Two Deposit Strategies That Tested the Best

Bank deposits are evaluated by the investment market and industry analysts on how non-correlated they are to interest rates. We are concerned with growing beta as it is an indication of poor deposit management and/or a challenging interest rate environment. In this article, we evaluate and test four deposit strategies to see which performs the best.

Deposit Strategies Background

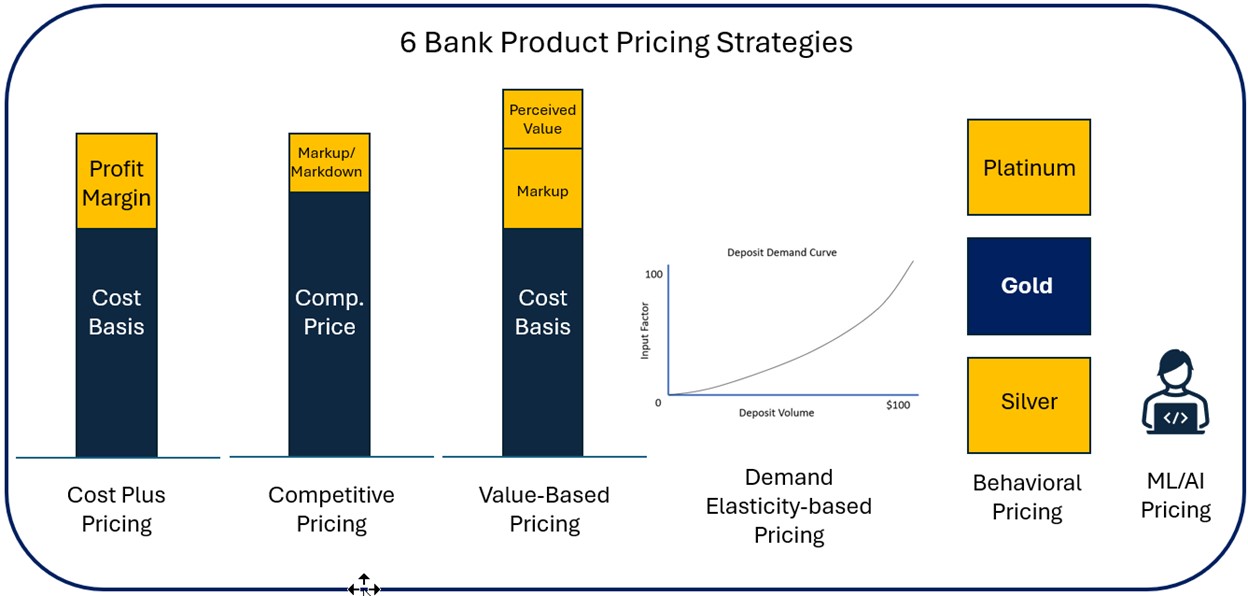

We have discussed the various pricing positions a bank could take when pricing all products, particularly deposits (HERE). A bank can price according to cost, competition, value, elasticity, customer behavior or using machine learning (below). In this article, we will be looking at tactics that span multiple strategies particularly value, elasticity, behavioral and machine learning.

It is common for a bank to have an 80% beta or be 80% correlated to interest rates. The more interest-bearing accounts a bank has, for example, the more correlated to interest rates they are. The same goes for the rate on those accounts. The more high-yield accounts a bank has, the higher the beta. The more a bank prices deposits to the competition, and the competition uses interest rates to price, the more correlated a bank is to interest rates.

This Common Tactics Hurts Deposit Performance

However, a bank approaches a beta of “one” largely because they de facto index their deposits to the Fed Funds target. When the Federal Reserve moves rates up or down, banks usually follow immediate suit and move their rates up and down.

Why do this?

If you strip away the noise, the argument usually comes down to – because it is easier for the bank. This is true. Moving rates in lockstep with the Fed makes it so a bank does not have to conduct any quantitative analysis on deposit pricing and makes it, so rate movement is easily explained to their customers. Few customers complain after a bank moves rates up because the Fed moves rates up. Society is conditioned that way.

While easy, this is not the best way. What other industry abdicates pricing authority when they don’t have to? Why ignore supply and demand when pricing? Why ignore your customer’s behavior and the ability to build a value proposition?

There are better ways to price deposits.

Deposit Pricing Strategies to Consider

Below, we look at, and compare, four pricing deposit pricing strategies.

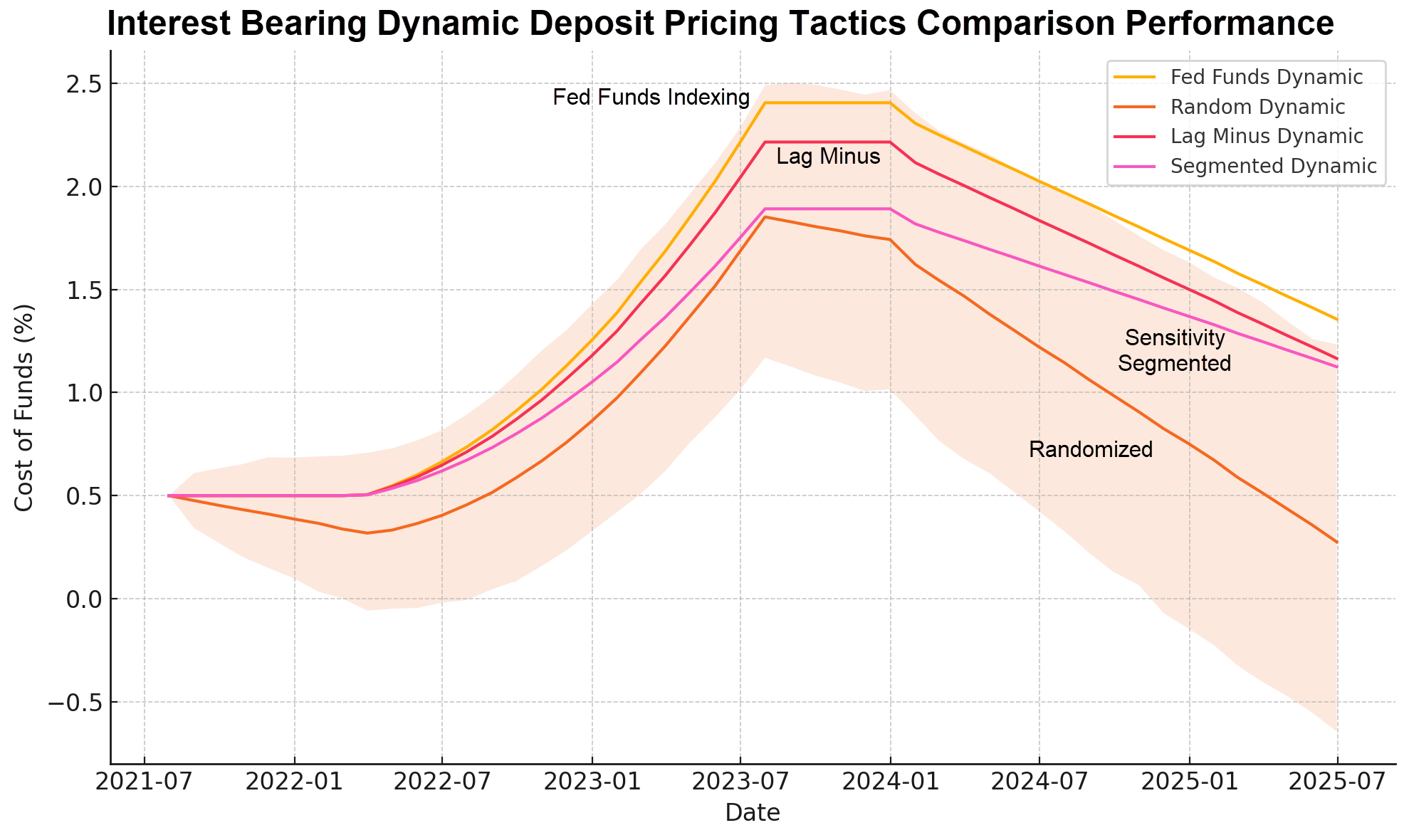

As a base line, we will include the common practice of Fed Funds indexing to include either explicit indexing or implicit indexing where a bank moves in the direction, timing, and amount of the Federal Reserve. As the target Fed Funds rate was increased after the pandemic and peaked in August of 2023, then decreased starting in Sept. 2024, this is the path that most top quartile (in deposit performance) banks followed.

Let’s break down the pros and cons of this methodology.

Pros:

- Easy to communicate and justify to customers (“We moved rates because the Fed did.”) Aligns with headline news coverage, so that customers are primed for changes.

- Can signal responsiveness and transparency.

Cons:

- Fed Funds is not the actual funding cost of large banks or the marginal funding rate in wholesale markets, SOFR is closer.

- Separates pricing strategy from true funding supply and demand factors. Often leads to overpaying when market rates drop.

Best used for: Of all the deposit strategies available, indexing is best used when the importance of deposit performance is not an issue. Either a bank’s margins are so great that the difference in deposit performance is a rounding error, or if your business model is such where you don’t need performance value to drive earnings, indexing is the easiest to implement and manage. This methodology is also better for customer optics than balance sheet optimization.

What is Dynamic Pricing?

Instead of moving rates when the Fed moves, oftentimes some banks will move rates for other supply or demand reasons such as we indicated back in April when the tariff fear gripped the nation and the markets started to dislocate (HERE). We set forth the argument that because the depositors were more defensive, short-term rates fell, and the market expected rates to drop further, it was a good time to move rates down. This is a form of dynamic pricing.

Should a bank need funds, it can raise its rates to attract more money.

Any time you move pricing outside of when a stated index moves, that is a form of dynamic pricing and is a methodology to better align cost with revenue and better align liquidity and interest rate risk management with the financial position of the bank.

As can be seen from the other methodologies we tested, moving rates dynamically are almost always better (95% of the time statistically) than indexing rates.

What is Lag Minus Pricing?

“Lag Minus” pricing is a common dynamic pricing methodology where a bank follows the Fed but makes a series of micro adjustments along the way to manage supply and demand. Lag Minus also means when the Fed does move rates, there is a one-to-two-month lag when rates rise and an immediate move when rates drop.

In general, you are not doing a whole lot of analytics but trying to gain an extra advantage by adjusting pricing each month and trying to build in a savings (the “minus” part) to rate movement. Thus, when it looks like the tariff crisis will be solved and rates spike to 10 basis points as was common, a bank may decide to raise its rates five basis points.

Let’s summarize the pros and cons.

Pros:

- Gives banks the ability to use timing and deposit spread pricing to best match its asset-liability and profitability goals while getting better performance than rate indexing.

- Is a simple pricing methodology to execute and keeps close enough to market rate movement to provide a level of transparency.

Cons:

- Limits the ability for the bank to optimize pricing to meet supply and demand.

- May generate customer complaints from more rate-sensitive customers.

Best Used For: Lag Minus pricing is best used as a next step for banks on the path to segmenting their customer base based on rate sensitivity. This methodology reduces funding cost and sensitivity quickly.

What is Randomize Pricing?

When teaching new bankers about deposit management, one of the first stops is to show them the performance of a randomized pricing methodology. This is more of an intellectual exercise than a true enterprise-wide methodology, but the tactic serves as a useful tool at times.

Randomized pricing is also an analytics-light methodology that any bank can do and means literally that the bank creates a random price for products and clients in the general direction of the rate movement. Should market rates of interest spike 25 basis points for the month up or down, the bank assigns a random increase or reduction to each product or customer from 0 to 25 basis points. The bank consistently varies pricing each month so that the customer gets use to various price changes and finds it harder to compare the bank with the competition.

What happens when you randomize pricing is that you teach and train every customer and every employee not to be rate sensitive. The downside is that you can no longer control supply pricing which can lead to suboptimal outcomes. As such, you will never attract the rate sensitive customer as they would never stay or be attracted to your bank in the first place.

The upside is that once you have non-rate sensitive customers, you can offer lower rates on a consistent basis. It is for this reason that this tactic usually outperforms all others on a consistent basis.

Let’s summarize the pros and cons.

Pros:

- Reduces customer anchoring to rate cycles and encourages loyalty to value, not price. Avoids building a “rate reflex” in your base and employees.

- Makes it harder for rate shoppers to arbitrage you.

Cons:

- Undermines predictability, especially in business/commercial relationships.

- Risks mismatching pricing to market conditions and liquidity needs. This tactic is also hard to defend internally, especially with Treasury, ALM, and pricing committees.

Best Used For: Only viable when paired with strong brand, value-based messaging, and differentiated offerings. This methodology is best used as a thought experiment to train bankers away from always offering rate. It is also an ideal methodology to use when you need to reset training for a product or for a segment of a bank’s customer base.

What is Sensitivity Segmented?

Of all the deposit strategies available, perhaps the best methodology to deploy in this age of machine learning is dynamic personalized pricing down to the product (for retail customers) or customer level (for commercial customers). To pull this off, customers, or customer segments are scored and then optimized as to rate depending on the bank’s deposit and profitability need.

This methodology produces lower pricing that traditional indexing but gives banks the ability to better optimize demand generation based on the bank’s funding or profitability need.

The pros and cons.

Pros:

- Provide banks with the best control over pricing and balance management given various supply and demand conditions.

- The best methodology is to handle a variety of goals that may change over time.

Cons:

- Segmenting a customer base and assigning pricing is analytically complex.

- The methodology lacks a level of transparency. Banks may need to still discuss with customers why they are not getting the best rate, which may also raise some compliance concerns.

Best Used For: Customizing product and pricing offerings to commercial customers while managing pricing at the product and state region level allows banks the most pricing flexibility to accomplish a variety of goals while beating most other pricing tactics.

Putting This into Action – Deposit Conference

Deposit strategies vary and matter when it comes to deposit performance. Just reacting to the Fed doesn’t give banks the flexibility they need to properly manage their cost of funds and beta. To grow deposits at the least cost while delivering the best performance relative to SOFR, a bank must decide how closely to tie its deposit pricing to market benchmarks. A good first step is to start by moving rates down prior to when the Fed moves rates down and up with a delay after the Fed hikes rates.

Then consider moving rates any time interest rates vary more than 40 basis points in a month which is approximately one standard deviation of rate movement. This will make the bank more reactive to interest rate movement and best aligned with managing profitability and spread targets.

From there, given the rise of generative AI opening access to the business line use of machine learning, bankers should explore moving to more bespoke pricing based on the funding supply and pricing demand of each customer.

In the future, we will be going deeper into our pricing model and how it applies to any bank’s deposit base. To learn more about deposit pricing in an interactive setting, be sure to attend the industry’s only deposit conference.

To find out more about our deposit conference go HERE or the button below.