Use This Hack to Grow Commercial Bank Deposits

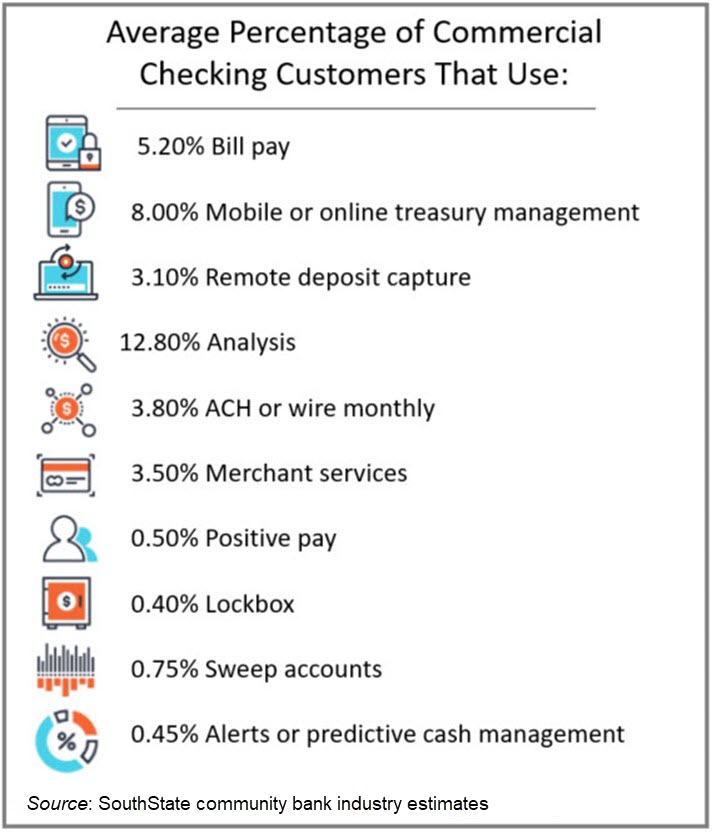

Seasoned bankers call it “The Distributor Tactic,” and it is a little-discussed technique used for ages in banking to speed up the sales cycle to land commercial bank deposits and treasury management accounts faster. The key to this tactic is to know that very few commercial checking customers utilize any medium or high-value treasury management services at banks (see below). These low penetration rates present an ideal situation to market your bank’s services and disrupt the competition. Most small business and commercial customers do things the old fashion way for no other reason other than they don’t know better. This article will highlight this never-before-published method and walk through the steps to land more customers faster.

Banking Services Are Underutilized

When a business opens or moves banks, they often agree to a basic account and usually don’t have a follow-up conversation with their banker about what products and services they should be using. Many commercial customers don’t know what they don’t know and have never been educated on faster payments, lockboxes, sweeps, alerts, or other treasury management services. Look at the product penetration below and see the tremendous opportunity that bankers have to return to their commercial customers and show them what products and services they should utilize as they grow. A banks increase cross-sell, commercial bank deposits grow.

Each one of these products helps reduce the customer’s cost and saves them time. For the bank, each product increases the customer’s lifetime, increases fees, and helps build deposit balances. Just as your bank likely hasn’t sat down annually with your commercial customers covering the above products and services, the good news is that your competition likely hasn’t either.

The Secret Hack to Commercial Bank Deposits

Here is the simple tactic – A bank or banker goes to a distributor and introduces themselves. We use “distributor” generically since this tactic originated back in the 80s (as near as we can tell) by bankers on the East Coast establishing relationships with beer distributors that service bars and restaurants. However, this could be any business that frequently sells products or services to your target prospects.

Once the banker establishes a relationship, the banker offers to pay for the data of the name of their customers that pay them with checks and the bank on which the checks are drawn. The bank is looking for businesses (not personal information) that still use checks.

For example, in any given metro area, alcohol and beverage distributors drive around making deliveries at restaurants, bars, gyms, grocery stores, convenience stores, coffee shops, and thousands of other places. Most of these non or small-sized franchise places pay on cash on delivery or last delivery net terms. When they drop off their delivery, they collect the checks for that delivery or at least the last delivery. This happens every day of every week with thousands of distributors throughout the metro area. In addition to beverage distributors, office supplies, uniforms, tools, repair services, and thousands of other businesses collect checks from their customers regularly. A bank that purchases this data on a per-account basis has critical information that can save months of time. A banker may offer $1 to $5 per account for this data and, in the process, be fully transparent that they want this data to market treasury management banking services, a product set that can only help their customer by lowering their cost, likely increasing credit and getting their customer more organized. To be clear, you are only asking for the name of the company and the bank on the check – nothing more.

Why The Data Is Important – Behavioral Selling

While seemingly innocuous data, knowing what businesses are using which banks give you three important strategic advantages. The first obvious one is that if this prospect is paying with a check (likely a handwritten check), then they are not using bill pay, ACH, or other lower-cost service. If that is the case, they are likely not using remote deposit capture (RDC), positive pay, and various other treasury management services. By positive selection, almost every name that the distributor gives you is a prospect that needs your banking services. These accounts are also positively selected as to higher-than-average balances for commercial bank deposits.

The second thing this data does is gives you the bank the check is drawn on so you can match them up with your competitive analysis to know what treasury management services the prospect bank offers. Every bank should have a list of their competing banks, their offered products, and typical pricing to be clear on how to position their bank when going head to head. If you pursue this tactic, one material byproduct from this effort is a steady stream of data from prospects, as most will willingly tell you what they like or don’t like about their present banking relationship. The trigger, and critical aspect of making this information flow, is knowing the prospect’s primary bank.

This is the third and most important aspect of this tactic – knowing the prospect’s bank makes it seem like you know your market cold and have deep insight into the prospect’s needs. Make a call pitching your banking services, and your conversion rate will likely be less than 7%. Call the prospect and let them know that they bank at ABC Bank and are spending too much time, money, and risk (always work risk in) by not utilizing bill pay, faster payments, ACH, etc., and your conversion rate will jump threefold or more.

By utilizing both the prospect’s name and their bank’s name within the same sentence, your success rate should jump regardless of marketing channel – direct mail, email, or hyper-personalized digital ad.

You name their college alma mater to get a conversation going for retail accounts. To get a conversation going for commercial accounts, you name their bank. These are simple psychological techniques that have been working for bankers for decades that many bankers have stopped using because they take hard work to put in motion.

While it is true there are other ways of finding this data, few ways are easier ways, plus this method has one other significant advantage – it often gets you talking to the CFO of the distributor, which also is a valuable prospect to sell them YOUR banking services. The fact that you can describe what you are doing and your products without any sales pressure on the distributor is another underutilized sales technique. As you describe your bank’s services, the distributor will compare their bank to yours.

Using This Commercial Bank Deposit Hack

Find a delivery person on the street and make an offer to test this technique out on a “beta” basis. Use the data and then record how it works. From there, you can formalize the methodology and then expand the program. Figure out the target businesses you want and then work backward to figure out what products and services they purchase from local suppliers that might sell you the data.

This tactic takes a minimum investment and only a little elbow grease to put this idea in motion. You only need to land ONE account to make this profitable, and often, you will find that you will land two or three accounts for every twenty names you get.

If you are looking for new techniques to land customers that utilize high-value products, this might be the technique for you. Give it a try, and let us know how it works in your area.