Using The French Defense in Deposit Management

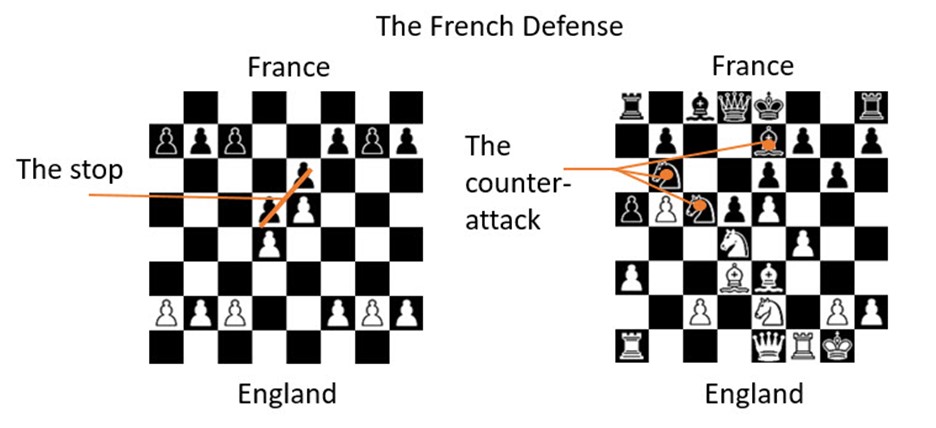

It was the famous England vs. France chess match back in 1834, where the French opened with a simple yet potent attack. England came out, moving a pawn to the center of the board. The French stopped the pawn’s advance and used the combination of their bishop, rook, and knights to counterattack England’s exposed players. The set of moves has become known as the “French Defense” or “The French” and is one of chess’s most famous opening moves. The objective of the French is to signal to your opponent that aggression will be met with aggression while opening up the center of the board. Banks can use the French Defense in deposit management.

The French Deposit Management Defense

The French Deposit Defense stops a bank from executing a deposit promotion in a local market. Let’s say Bank A comes out with a 2.00% money market account, which is substantially above the current market average of 25 basis points (current money market promotions HERE).

At this point, Bank B can choose to ignore it and risk losing rate-sensitive customers (which isn’t bad) or match it, which drives up its cost of funds while making the deposit base more sensitive to higher rates. Most banks would do one of these tactics.

However, second-order thinking asks, “How can I not only stop the deposit aggression but better my bank’s position in the process?” The answer is the French Deposit Defense and it is one of many tactics in a seasoned banker’s deposit management playbook.

Here, Bank B stops the advance by countering with a message of service. First, it reinforces its training to its employees with a message that underscores the problem of marketing with rates. Next, Bank B sends a message to its customers and potential customers that while a high money market rate might seem nice, it is inconsistent with building quality relationships based on trust. After all, service is more important than rate. Bank B highlights its mobile capabilities, its bundled products, its cash management capabilities, and its commitment to the customer’s dreams. The intent is to make clear that your bank is about service and building a bank that will be around for the long run through multiple generations.

After the initial move, Bank B has served to slow Bank A’s advance while using the event to differentiate itself strategically.

The Counterattack

Now, Bank B uses its bishops, knights, and rooks for enhanced deposit management. While there are many variations, one counter is to find a product or service to issue a press release around while instituting a social media and digital marketing campaign. The goal is to find a product or solution bundle that delivers service. The CEO of Bank B works a quote in there that while it could pay a high money market rate, it chooses to invest in products and services that deliver value. If Bank A is paying a high deposit rate to just new customers (likely), so much the better, as Bank B can highlight the fact that it doesn’t believe that paying new customers a higher rate than your existing customers is the recipe for building trust.

Here, this effort highlights Bank B’s service and commitment to the long-term relationship but helps indirectly highlight Bank A’s money market rate. This will likely drive more rate-sensitive customers to Bank A while speeding up the cannibalization of their existing deposit base. The net result should leave Bank A with a higher cost of funds and a more rate-sensitive deposit base – the exact opposite of where you want to be in a rising rate environment.

The Coup de Grâce

As a final blow, Bank B’s CEO then calls up the CEO of Bank A and offers to move over $100k of deposits because that 2% money market is too good to pass up. The worst case is that Bank B gets a decent yielding money market investment, and the most probable case is that Bank A thinks twice about continuing the high-price deposit tactic.

Putting This Deposit Management Defense Into Action

Once you know this tactic, the French Deposit Defense is simple to put into action as all it takes is a little marketing with some pre-planning for creating a press release template, digital ad creation, and an email campaign. Having this collateral ready to go combined with some talking points are clear next steps.

A successful strategy in deposit management, like chess, requires a long game that looks many moves ahead. Like chess, deposit value creation often means controlling the center of the board. It is no surprise that national banks like Wells Fargo and Bank of America firmly control their deposit market from the center and not from the fringes. Banks that market from the fringes – with new customer promotions, with “specials,” or with promotions to targeted geographies – end up weaking their center position.

That said, many community banks have also created strong deposit value attribution by having a clearly defined strategy in their core deposit products and then letting other banks react to it. There is nothing wrong with having the lowest deposit rates in the market so long as you have given your customers some other non-price reason to bank with you. For some banks it is superior service, others it is specialty products and others it is pure brand.

Bankers need to understand what builds deposit value and how their competition will react. Banks can come ahead by focusing on service and using their competition to help define their brand better. Given the potential for rising rates and greater demand for deposits, extending your foundation of low-rate sensitive deposits is one of the most innovative ways to create franchise value and checkmating your competition.