How Banks Are Paid For Interest Rate Risk

We have written numerous blogs about why banks should reconsider the risk-for-yield business model when it comes to credit or interest rate risk. The return on equity (ROE) in risk-for-yield businesses is low, and the business outcomes during downturns are adverse. Instead, banks should construct an advisory business where taking risk may be just one element in delivering a customer-centric solution. However, historically almost all commercial banks could make easy money by taking advantage of the interest rate carry trade. In the interest rate carry trade, banks borrow short and lend long. This carry trade is a prime example of taking risk for yield. The carry trade may work with an upwardly sloping yield curve, but today it could be a disastrous strategy for banks.

Interest Rate Risk

During a majority of the time, longer terms carry higher interest rates. Over the last 20 years, on average, the ten-year US interest rate was 1.33% higher than the two-year US interest rate. But this is not the case today – the yield curve is flat and banks are not being compensated for taking interest rate risk on their balance sheet. This is especially the case for commercial loans.

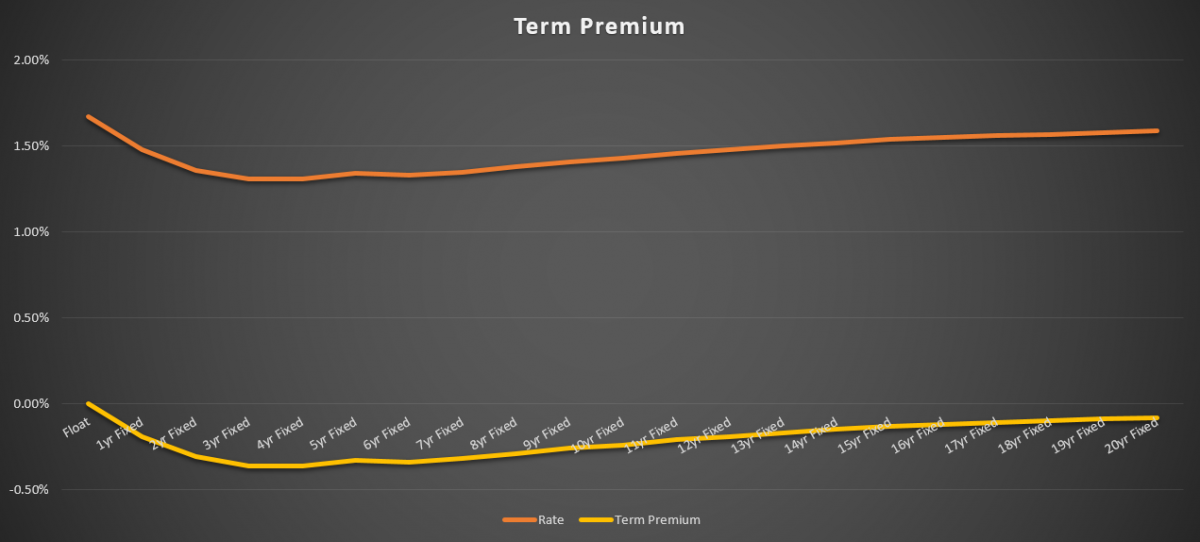

Consider the graph below that shows in the orange line the prevailing interest rates from floating to 20-year fixed. The yield curve is slightly downward sloping. Banks that lend long-term fixed are obtaining lower immediate yield than if they lend on a floating rate. The yellow line represents the premium (currently a discount) that banks receive to lend for term on a fixed rate – now that premium is negative across the entire curve out to 20 years (and also to 30 years).

This graph shows that banks are recognizing a lower yield to originate a 20-year fixed rate than a floating rate. Banks should especially avoid the three to ten year part of the curve because that is where the negative premium is highest, between 21 and 36bps. Even booking 20-year fixed-rate loans on the balance sheet yields a negative 8bps premium to floating rates. Banks cannot make a positive premium even on a 30-year fixed rate.

However, the above graph does not tell the entire story. In the course of making fixed-rate loans banks often give up the option of loan prepayment to the borrower. Typically, borrowers can prepay the loan any time, and banks can call the loan only upon a credit event. Further, many community banks do not include prepayment provisions in commercial loans, or they do not enforce them rigorously. The result is that the borrower’s option of repayment reduces the value of the loan to the bank (if rates rise, the borrower will keep the loan and if rates fall, the borrower will prepay the loan to refinance at a lower rate).

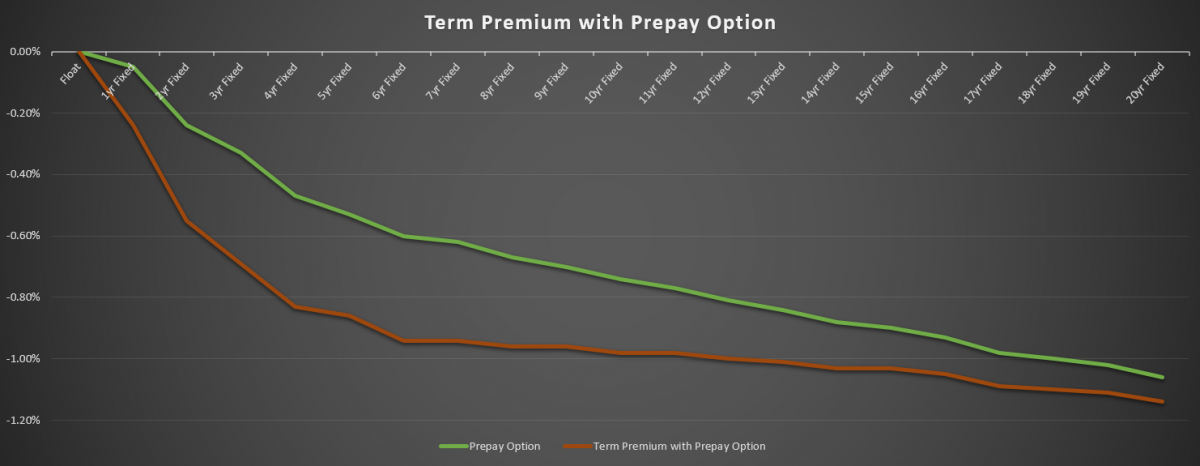

The value of that prepayment option (also known as negative convexity) can be quantified and equated to yield based on a loan rate. The green line in the graph below shows the value of the prepayment option on various fixed-rate terms assuming no prepayment protection. The red line shows the term premium (from the graph above) plus the value of the prepayment option. The red line is the sum of the term premium (discount in this environment) and the negative convexity of the prepayable loan.

The graph shows that a bank booking a five year fixed rate loan without prepayment protection is expected to yield 86bps lower return than a similar floating-rate loan. The decreased yield on a 10-year fixed-rate loan is 98bps, and on a 20-year fixed-rate loan, the decreased yield is 114bps.

Some bankers will argue that they are able to obtain higher yields on longer fixed-rate loans than on comparable floating loans, or shorter-term loans, and we do not doubt that. Borrowers value the certainty of longer-fixed rates in today’s environment. However, borrowers are paying a higher yield on longer-term fixed rate because of factors other than the shape of the yield curve (liquidity risk, marketing costs, but not term premium).

Implication for Banks

If there was a time to extend asset duration for banks for yield premium, it would NOT be now. With the present shape of the yield curve, banks are compressing expected loan yield by extending duration. Further, without including and enforcing prepayment protection in commercial loans, the expected yield on a ten-year fixed-rate loan is 98bps lower than a comparable floating-rate loan. If a banker believes asset duration should be extended for asset-liability management needs, or protection is required from decreasing interest rates, the better solution is to purchase securities where the market will still reduce yield for longer duration, but the market will pay the bank a fair premium for optionality.