How Commercial Prepayment Speeds Are Making Your Margins Worse [Get Our Model]

There has been substantial research on how prepayment speeds of residential mortgages affect the profitability of individual loans and portfolios. Because of the homogenous nature of residential mortgages, many firms have developed highly predictive models to calculate prepayment speeds based on past behavior, portfolio makeup, and macroeconomic variables. However, very little research is available on prepayment speeds of commercial mortgages – this is understandable because of the uniqueness of each commercial loan. Even sophisticated loan risk-adjusted return on capital (RAROC) models often do not incorporate the value of prepayment speeds in calculating return on equity (ROE) or net present value (NPV) of income.

We developed a model that shows the NPV of income for commercial loans based on assumed prepayment speeds. The results of our research surprised us – while we expected to see higher commercial loan profitability for lower prepayment speeds, the tremendous value that lenders give away by not managing prepayments on commercial loans are startling, and all community bank lenders need to understand this critical value driver.

Four Reasons for Prepayment Provisions

We have written extensively on the value of prepayment provisions in commercial loans for community banks. There are four main reasons that prepayment provisions make loans more profitable for lenders:

- Decrease the value of the option held by the borrower to prepay the credit.

- Increase the lifetime value of the relationship.

- Increase cross-sell and upsell opportunities.

- Reduce negative selection bias in an economic downturn.

In previous blogs, we also quantified the NIM and ROE benefit associated with each of the four reasons above. However, we never measured the present value of income for loan portfolios using different prepayment speeds. We developed a model that allows us to change assumptions on two identical loans but with varying speeds of prepayment.

In our model, we vary prepayment speeds based on CPR (conditional prepayment rate). CPR is the portion of a loan or pool of loans that pays principal ahead of the loan’s preset amortization schedule. These calculations are vital and have been modeled for mortgage-backed securities for decades. However, very few bankers pay attention to CPR for commercial loans.

Our Model

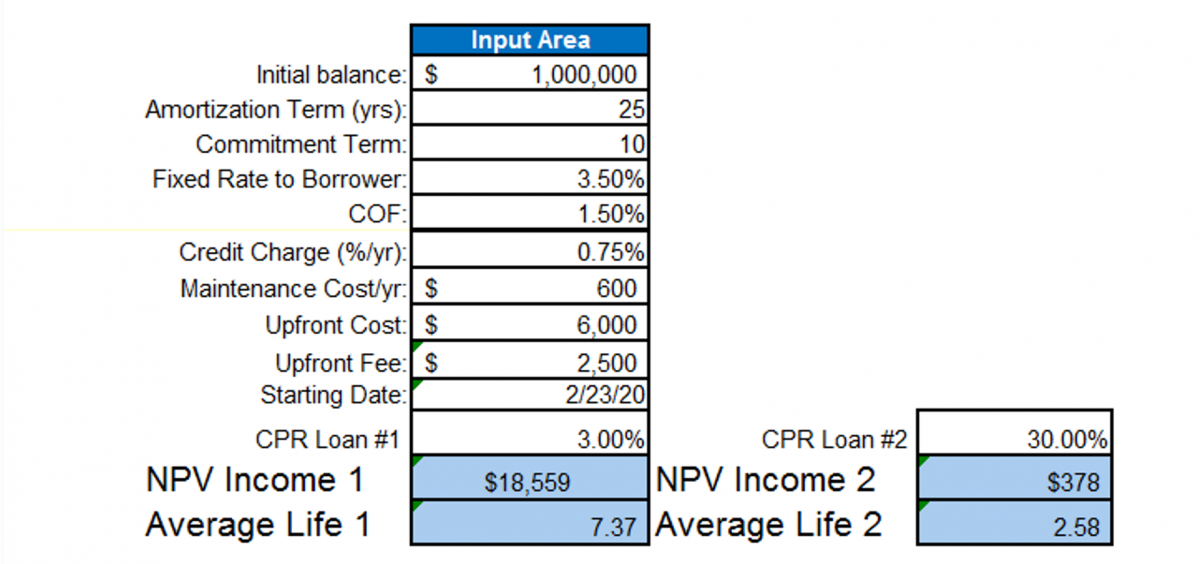

Our model allows us to input parameters of a commercial loan such as loan amount, amortization, interest rate, COF, upfront fees, annual maintenance costs, credit charge, and loan origination costs. We can then make different assumptions on prepayment speeds as measured by CPR and value two outputs: NPV of income and the average life of the loan (or portfolio). The inputs and outputs appear in the table below.

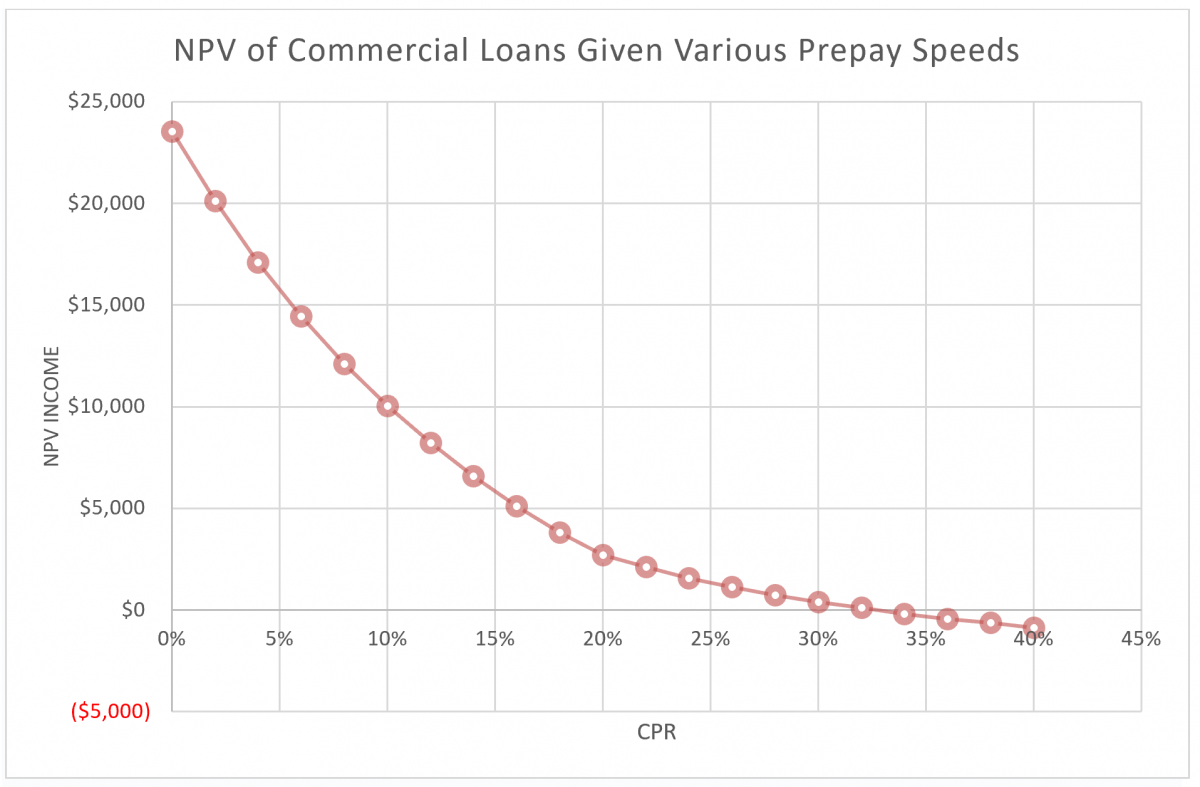

We ran this model on an average loan shown in the table above. We performed a sensitivity analysis to understand how CPR affects loan profitability as measured by NPV of income. The output of the relationship appears in the chart below. It is astonishing to see the impact of higher prepayment speeds on decreased loan profitability. We talk to many bankers that complain bitterly about the adverse effects of commercial loan prepayments on their P&L. These bankers intuitively understand how the cost of loan replacement decreases the bank’s profitability. Seeing the math underlying the intuition is very enlightening.

The chart above shows that the NPV of income falls dramatically as CPR increases. A profitable $1mm commercial loan at 0% CPR becomes barely profitable at 20% CPR and shows a negative NPV of income when CPR reaches 33%. Many community banks have an average CPR on commercial loans of between 20% and 30%. This high CPR is a major cause of decreased profitability for many lenders. The reason that NPV of income (and ROE) are so sensitive to prepayment speeds is that commercial loans have thin profit margins after accounting for ongoing costs such as funding, credit charges, and loan maintenance costs, but most importantly, commercial loans have high upfront origination costs. That sales process averages about 33 months and comes at a cost of time, marketing and sales expense. Without the time necessary to earn that thin margin, a bank cannot recoup its cost of originating the credit. It is only with relatively long and stable periods of earned margin does the commercial loan becomes profitable. This behavior is especially pertinent for smaller credits – and the average commercial loan at a typical community bank is between $250k and $500k at inception.

Key Lessons

We believe that there are two important lessons from our research for community bankers. First, bankers need to understand how their loans prepay and take this into account for pricing decisions. We are not aware of loan models that predict prepayment speeds, so bankers cannot rely on any out-of-the-box solution to accomplish this task. At the same institution, there are categories of loans that will have very low CPRs (below 5% and some even under 3%), and other commercial loan categories may have CPRs above 20%, 30%, and in some cases, even above 40%. Bankers need to understand how their loans behave to make proper pricing and relationship decisions. What may look like a desirable credit may not be so profitable after considering the anticipated prepayment speed (and vice versa).

Second, bankers must strive to decrease CPR on commercial loans to increase profitability. Most loans can be made more profitable with a longer stream of income. Again, most loan pricing models do not track, predict, or measure prepayment speeds, and community bankers are left to their intuition to try to maximize profits.

We have simplified our internal model and have reduced it to an Excel worksheet in case you would like to use it for your own loan portfolio. Our model can be found HERE.

Conclusion

Next time we compete for a commercial loan against an insurance company, or another bank using a hedging program (which decreases CPR on commercial loans to around 2-3%) we need to realize that that competitor may not have a lower cost of funding, or is buying market share, or acting irrationally in pricing the credit, but may merely be reflecting the profit associated with strong prepayment provisions that translate to lower CPR and higher profitability.