How Community Banks are Developing Lending Opportunities

The future path of the economy is currently unpredictable. Still, the majority of banks have now eliminated two possible scenarios: 1) Best case scenario – that nothing will change from February 2020; and 2) Worst case scenario – that the pandemic will not end in the foreseeable future and banks should avoid loans and invest in riskless securities. If your bank falls in that middle ground, then you are strategizing on how to identify the right mix of lending and credit quality, how to retain relationship accounts, and how to keep your bank’s balance sheet safe. We agree with John Galbraith, who said that economic forecasting exists to make astrology look respectable. We may have little vision into the future; however, some potent conditions exist today that bankers should be observing and managing their loan portfolio accordingly.

Borrower Demand For Certainty

Current low interest rates at the long end of the curve are motivating borrowers to extend the duration of their liabilities. The graph below shows the 10-year hedge rate from 1987 to today. Interest rates for long-term liabilities have never been lower, and A-credit quality borrowers will want to lock long-term financing to the greatest extent possible. Community banks must design a platform and create products to take advantage of this demand in the market, mainly because retaining A-credit quality borrowers in today’s credit environment is paramount.

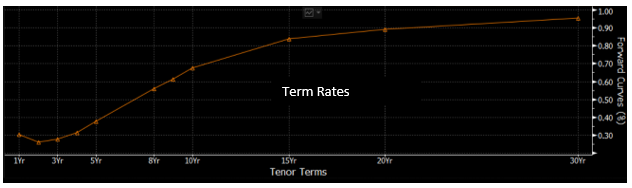

The demand for long-term certainty is even more pronounced because of the shape of the yield curve. Below is a graph showing interest rates from one to 30 years. The entire yield curve differential is less than 60 basis points, and the differential between 5-year rates and 10-year rates is only 30 basis points.

Community bankers should now be considering how to safeguard their loan portfolio and how to develop lending products that work best in a flat yield curve environment. While historically, the five-year fixed-rate term loan has been the dominant loan structure for community banks, this product is likely only to work today for borrowers with no alternatives. Conversely, A-quality borrowers will have ample choice to obtain longer-term commitments from various competing lenders.

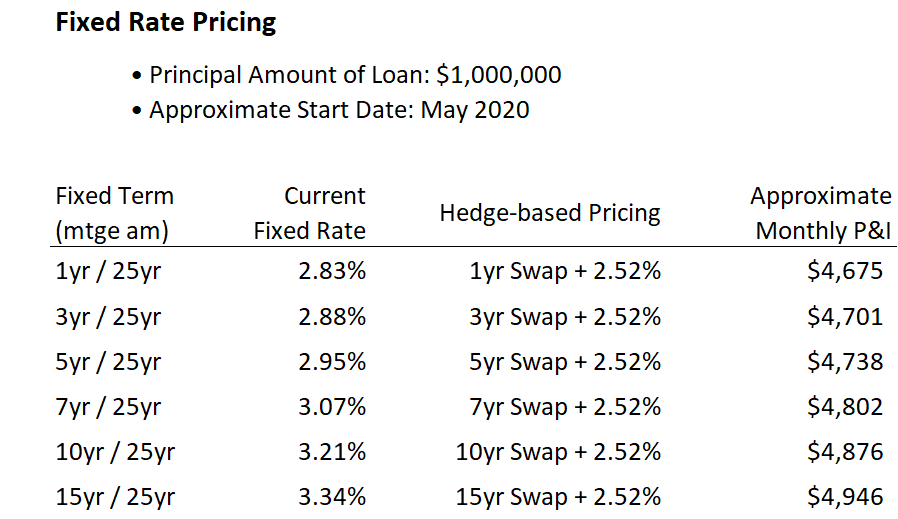

S&P Global tracks average loan spreads across the banking industry. A-rated credit quality spread in March 2020 (the last reported month) was 2.00% and is an increase of 5bps from one year ago. We track spreads for community bank loans, and the average spread for A and B-rated credit quality, post Covid19, is 2.52%. Below is a copy of a borrower pitch from a bank showing various term options at 2.52% over the cost of funds.

The average A-credit quality borrower would be compelled to consider term commitments beyond five years, given the small market pricing premiums. The difference between five and ten-year rates is only 26 basis points and the difference in monthly payments on a million-dollar loan is only $138.

Banks that can offer competitively priced commercial loans for fixed-rate terms in the ten to the 20-year range will have a competitive advantage for three significant reasons. First, these banks will be able to differentiate their product from most competitors. Second, these banks will be able to attract and retain A-quality credit borrowers. Third, the long-term commitment allows banks to keep customers longer, thereby increasing profitability and switching customers from transactions to relationships.

Differentiation

Almost all lenders in the market are readily offering commercial fixed-rate loans for up to 3 years. But fewer banks are able to offer 10, 15, or 20-year fixed-rate commercial loans. Being able to compete against fewer lenders is a tremendous advantage for community banks. In today’s market, winning a commercial loan on the shorter end of the curve requires concession on pricing or credit structure – neither is a good option in this credit environment. In a flat yield curve, being able to offer a longer fixed-rate commitment at similar costs is a significant competitive advantage.

Enhance Credit Quality

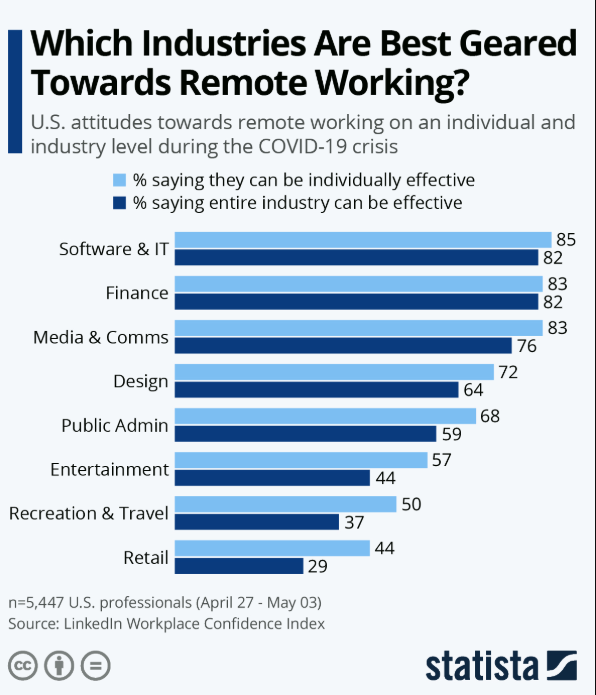

In a challenging credit environment, banks are especially motivated to retain and attract top credit quality customers. Banks must identify industries and categories where they believe credit will outperform the average. For example, below is a list published by Statista, showing sectors that are best positioned for remote work during Covid19. Within those favorable industries, community banks must then underwrite individual borrowers that represent acceptable credit risk.

After identifying superior credit opportunities, banks should attempt to lock in these customers for as long a period as possible to prevent losing these clients when the credit environment improves, and competition again becomes less rational.

Relationship Banking

Most community banks value relationship banking over transactional banking. Community banks can foster relationship business through products, geography, service level, or expertise. Shorter-term loans have higher prepayment speeds and lower expected lifetime value. Shorter credit commitments create transactional expectations from the borrower – every few years, the borrower and the banker expect the community bank to compete for the borrower’s business. Each competitive situation potentially requires the bank to again compete on price or credit structure. However, a 10, 15, or even 20-year fixed-rate commitment has a much longer expected loan life and higher lifetime value of the relationship and eliminates repetitive competitive situations. The longer life also allows the bank to cross-sell more products and further solidify the customer relationship.

Conclusion

If your bank has decided not to close shop and will continue to make loans, then this challenging credit environment demands that the bank: first, identify safer borrowers; second, retain those borrowers for longer periods; and third, embrace a strategy and a platform that works with the flat and low yield curve.