How PPPFA Will Impact PPP Staffing and Your Bank’s Forgiveness Workflow

True to form, last Friday, President Trump signed into law a Paycheck Protection Program (PPP) change giving us yet a new acronym and the need to scramble to figure out how to amend our respective Forgiveness program to accommodate. The good news is that the new law, the Paycheck Protection Program Flexibility Act (“PPPFA”), addresses many concerns of our small business customers. Since these changes now radically offer both production workflow and profitability, in these changes, we highlight the impact of PPPFA and discuss some ways to optimize the process.

For starters, PPPFA will change the application, so any bank that sent out the old application will have to resend the application out and message accordingly to avoid confusion.

Lower Payroll Expense Thresholds and Longer Covered Period

Now that the amount needed to spend on payroll was lowered from 75% to 60% and that PPPFA extends the period from eight weeks to 24 weeks, banks can expect the following impact:

Technology Platform: Banks will need to make sure they have use of their technology platform for a year or more as some borrowers will wait until the end of the year to file for forgiveness which means a bank will have to process by February of 2021 and may not hear back and complete the Forgiveness process until May of 2021. This not only drives up the cost for some banks as now they must license their technology platform for longer, but the bank now must do a higher level of due diligence to ensure the platform continues to be supported.

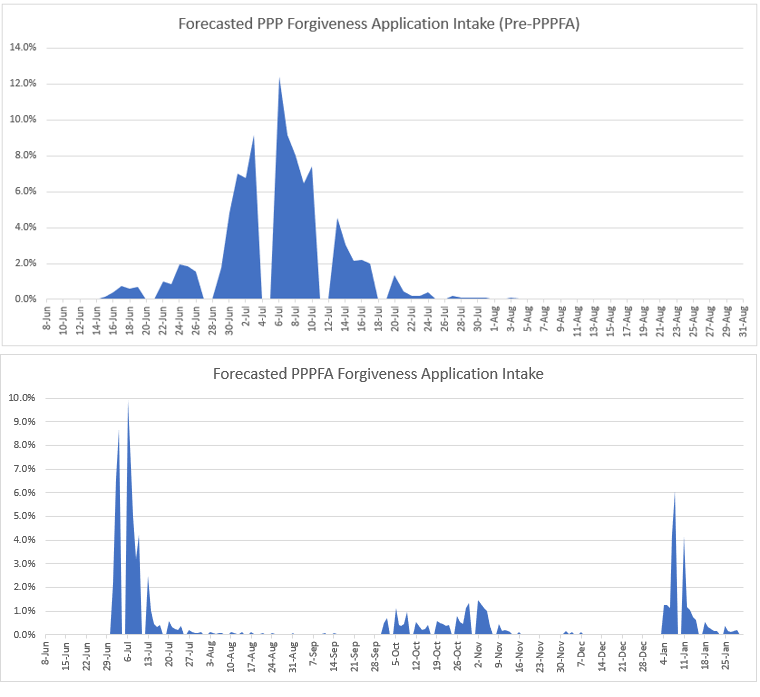

Staffing: The longer period for processing means less of a staffing spike for banks and a lower need to outsource a solution. In some respects, this is good news as banks were being forced to go to outside parties to handle the massive influx of Forgiveness applications that were originally forecasted in July. Now, given PPPFA, our staffing model indicates that the applications come back in essentially three waves. One, the bulk of customers that remain on the eight-week track, a second wave that opts for the 24-week track and a third wave that opts or the 24-week track but needs to wait to file their fourth quarter 941 Form in January. As such, staffing requirements shift from the top graph to the bottom below.

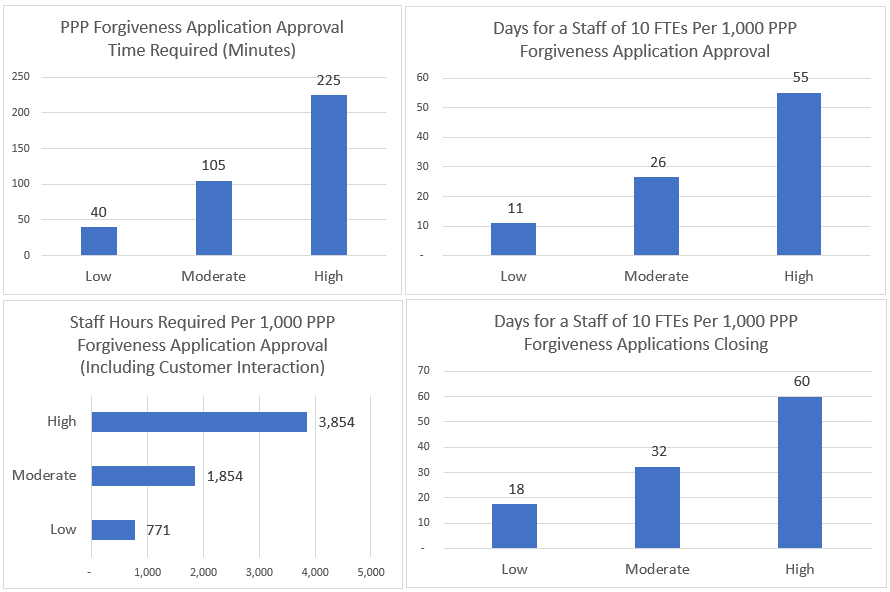

The culmination of all these changes means a more complicated review process plus more work amending loan systems. These changes essentially add about 40 FTE days to the average bank’s process, further increasing cost. Our updated staffing model is below for banks that plan to do a Low, Moderate or High Level of due diligence (explained in our original model introduction HERE)

Probability of Forgiveness: While the first two items drive up the cost of the bank, the good news is that the PPPFA changes will dramatically increase the probability of forgiveness to above 90% of all outstanding applications. This will have a positive impact on the bank’s PPP effort and marginally help reduce staff from our original model.

Deferral Period Extended

What was a fixed six-month deferral time is now a variable time to when the SBA remits to the lender the amount of forgiveness. At its maximum, this could be May of 2021. Prior to PPPFA, the average PPP loan was set to move out of deferral in October 2020. Now, October becomes the best case for banks, and the average is now projected to be closer to December. The toughest part about this change is that banks will need a programmatic way of making this change on their core system or risk having to make this change on a case-by-case basis.

Re-Documentation of Existing PPP Loans

Perhaps the most troubling aspect for banks is the extension of maturity from two years to five years. While this largely impacts new PPP loans made after June 6, 2020, borrowers that do not achieve forgiveness now have the option to negotiate with the bank for an extension from five to ten years. While PPPFA is written so that the bank must agree, this will impact a material number of loans that cannot pay with the original two years. It is our guess that the SBA will want banks to extend the maturity to the maximum extent before it has to make good on the guarantee. As such, as it stands now, banks will likely be forced into granting almost 100% of those borrowers that request it. Bankers will now have to go in and regenerate and execute new loan documents as well as update both their loan and core systems. This aspect is going to take some very tricky messaging and operational flexibility.

Defaults and Workouts

The second derivative of PPPFA also means the banks will now have an increased time period to manage most of these loans. This increased time period increases the cumulative probability of default by a factor of ten. Many borrowers will simply go out of business during the life of PPP or wait until the deferral period ends, amortization starts, and then be forced into bankruptcy. This aspect alone significantly increases management time as banks will have to document the default, claim the SBA, review the handling of the loan, and conduct a special asset disposition.

Putting This Into Action

While these changes are mostly useful for the small business borrower, they come at a cost for the banks. Banks must now relook at their process and make changes to limit the additional time that will be required for review and management and further look for ways to increase efficiency. In upcoming articles we will look which department in the bank is best suited to take responsibility, how to set your ratios to speed the application review process, how to tier your review process for maximum efficiency, how to manage variances to make your review process more efficient, workflow improvements to decrease processing time and how this PPPFA changes quantitatively impact profitability.

Until then, be sure to send a message out this week to your PPP borrowers, letting them know how your bank will be handling the changes and keeping them educated so that they can maximize their forgiveness amount.