How The Election Will Impact Your Bank’s Budget and Strategic Plan

Since the election falls right in the middle of bank’s budgeting and planning cycles, it is worth spending some time looking at potential outcomes. With a little more than two weeks before the election, the current polls and betting odds favor a Democratic Administration and both houses of Congress. According to FiveThirtyEight, Biden has a +10.5% lead, up from +7.6% two weeks ago. The polling also shows a 96% House retention and a 73% chance of winning the Senate. We look at the probability of the polls being wrong and what a “Blue Wave” outcome could mean for banks.

Could The Polls Be Wrong?

Like last time we wrote this piece, the polls could be wrong. This time in 2016, Hilary Clinton had a similar lead in the polls. However, short of some type of fraud or tampering, it is not likely the polls are that wrong this time for a couple of reasons.

First, polling and statistical projections of polls have improved because of 2016 and have proven more accurate in recent elections. Part of this equation is projecting undecided voters. Back in 2016, there was a record 15% of Americans reporting to be “Undecided” two weeks before the election. Today, that number is 3% or the lowest level since Franklin Roosevelt was elected. Another factor is record early voting. As of today, the US Election Projects estimated that 22mm votes have already been cast, 10x more than this time last election. Statistically, polling error is reduced the more mail-in ballots are submitted early.

Because of these factors, the odds now favor a Democratic regime for the next four years. Let’s look at how that might impact your bank.

The Impact of Administrative and Congressional Democratic Control – Interest Rates

The three major considerations for banks are interest rates, policy, and financial regulatory environment.

Democratic control would first and foremost likely lead to more front-loaded stimulus. From a balance sheet perspective, the Committee for a Responsible Federal Budget calculates the impact of the current Administration’s stimulus package would increase the national debt by $4.95T over the next 10-years, while a Democratic Administration would add $5.6T.

The latency of that stimulus is also interesting as the current Democratic plan calls for more spending on infrastructure and education, which is usually two of the faster paths to get money in the hands of workers outside of direct stimulus payments. Further, complete Democratic control would likely create more alignment with government departments helping to speed fiscal pump-priming to its source.

A large historic deficit will force the Treasury to have longer-dated issuance, which will push rates higher to entice buyers to soak up the supply.

As such, we see lower rates in 2021 by about 15 basis points as the pandemic goes on longer than expected (stemming from problems getting the majority of the population vaccinated) plus the impact of the current credit shock. For 2022 and beyond, we see higher rates by some 50 to 150 basis points as inflation and economic growth create less money supply and more capital demand.

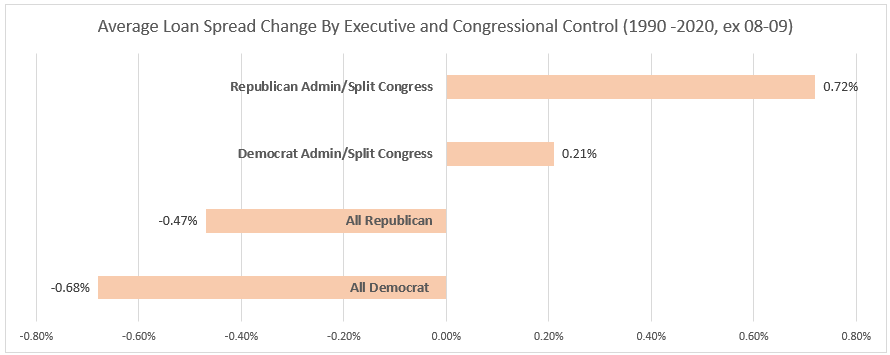

The Irony of Credit Spreads

If you ask most bankers, a common refrain is that they are distrusting of what a Democratic President and Democratic Congress would do to bank performance. This historical record shows that this anxiety may be misplaced. The single most significant factor on bank performance is the value of a bank’s loans, and in political eras where a single party controls both the White House and Congress, loans increase in value. In fact, when there is Democratic control, the loan portfolio tends to increase in value an average of approximately 68 basis points per year, or more than any other Executive and Legislative branch regime structure. For clarity, we are not implying a cause and effect here, only that there is a correlation.

We also do not want to imply that loans are poised to tighten another 68 basis points, as loan spreads are back to their historic tight levels in multiple sectors to include commercial real estate loans for multifamily, industrial, medical, owner-occupied office, and single-family rental. That said, loan spreads could grind tighter both due to the reduced number of quality borrowers and the reduced number of investment alternatives.

Policy & Regulation

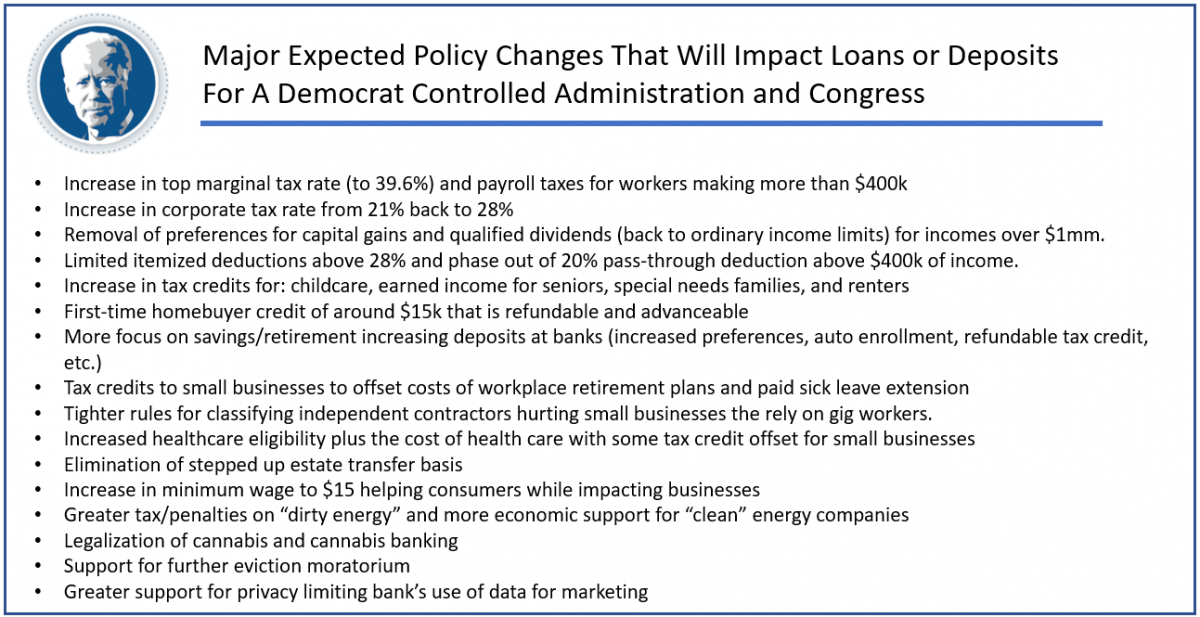

While there will likely be many policy changes starting next year, by far, the largest one impacting bank performance will be a change in the corporate tax structure.

Taxes: A Democratic power structure would likely raise the top marginal corporate tax bracket up to 28% from its current 21% that was the result of the Tax Cuts and Jobs Act of 2018. In addition to hurting the earnings at banks and increasing the cost of capital, borrowers will also suffer some impact, thereby reducing available free cash flow coverage. Depreciation schedules are also likely to change, impacting the more capital intensive industries and companies.

For banks, higher taxes are offset by benefiting real estate owners and investors, which make up a considerable portion of community bank exposure. This is a material driver of tighter credit spreads and is a plus for commercial real estate loan valuations.

Of course, tax changes are never easy and likely take two to three years to enact.

Antitrust: An all-Democratic structure would likely mean more of a focus on antitrust, which would benefit the middle market corporates and small businesses. As a result, we look for slight credit tightening in technology, transportation, media, and infrastructure.

Industry Impact: With more household middle and low-income tax relief and stimulus spending, we see an increase in deposits and a benefit to our customer base in areas of materials, construction, equipment manufacturing media, clean energy, municipals, cannabis, and consumer discretionary lines.

Sectors that could be impacted include dirty energy lines, healthcare, tobacco, drug companies, and businesses with a large percentage of their workforce at minimum wage.

Then there are various industries, such as housing, financials, utilities, gaming, and agriculture, where it is too early to tell how a Democratic slate would impact performance.

Putting This Into Action

While a Blue Wave isn’t a forgone conclusion, it is highly probable. Historically, community banks are positioned to be net beneficiaries on a relative basis, but many will feel some impact. While it is too early to execute on a capital reallocation process, it is not too early to do some planning and have that conversation of how your bank might adjust.

Because margins are currently so thin and credit volatility relatively high, capital allocation decisions have never been more important.

There will be clear winners and losers. Specific industries, such as clean energy, are likely going to clear winners, and it would benefit banks to start planning now to be able to capture quality relationships.

More importantly, the tax impact conversation alone needs to take place at a minimum as it will impact the expected relationship profitability hurdle for every bank in the country. If you are booking ten-year loans, for example, you may want to start using a higher tax rate to take into account a future marginal tax increase. Depending on what your view is, that could have a material impact on your loan pricing.