During the last ten years of economic expansion, prudent bankers were planning for the next downturn. Everyone knew that the economic expansion would end, but no one could be sure when or how. Smart bankers managed their business by accepting that all expansions do eventually reverse. None of us can predict the future, but enterprising bankers were conducting business to craft better results for their banks by understanding that an economic pivot would come. We are again on the brink of another economic pivot. We note that the ten largest human airborne pandemics in the last two millenniums lasted between one and two years. We are most likely within a year or two from the next economic recovery. What should prudent bankers be concerned about for the next pivot? In our opinion, one of the most considerable risks for bankers is inflation.

Why Inflation

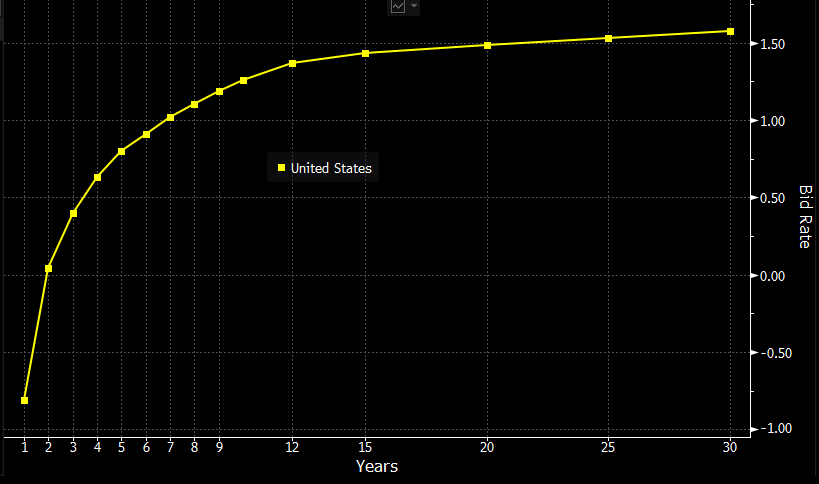

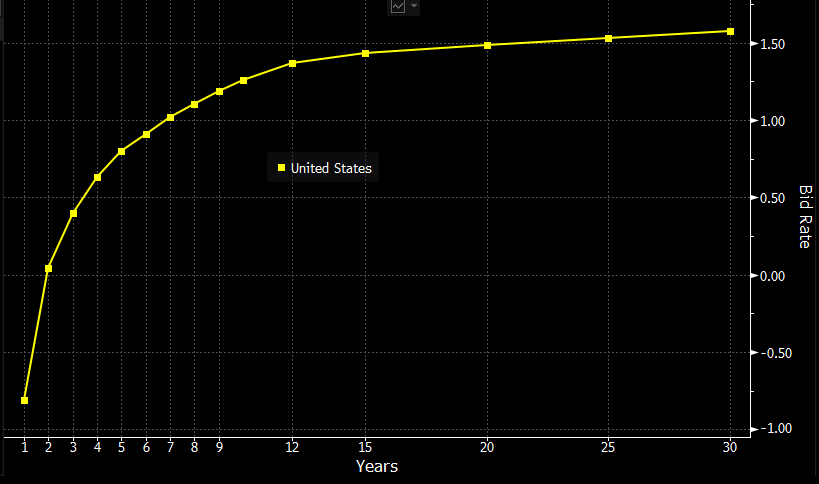

The “markets” currently do not view inflation as a risk – which is precisely why we feel it should be a concern for the economy and bankers. The graph below shows the current term inflation expectations. It shows that the market expects no inflation (in fact deflation) for the next year or two and very moderate inflation for the next 30 years.

However, the “market” is a poor predictor of the future. Humans who trade TIPS (Treasury Inflation-Protected Securities) have short memories and poor predictive abilities. There are several current developments that are paving the way for strong inflation pressures for the next decade.

The U.S. government (and governments around the world) and the Federal Reserve (and other central banks) are throwing everything they can at this downturn and will not stop until the economy improves. Even a U-shaped recovery that can happen in 2021 could have an enormous impact on inflation.

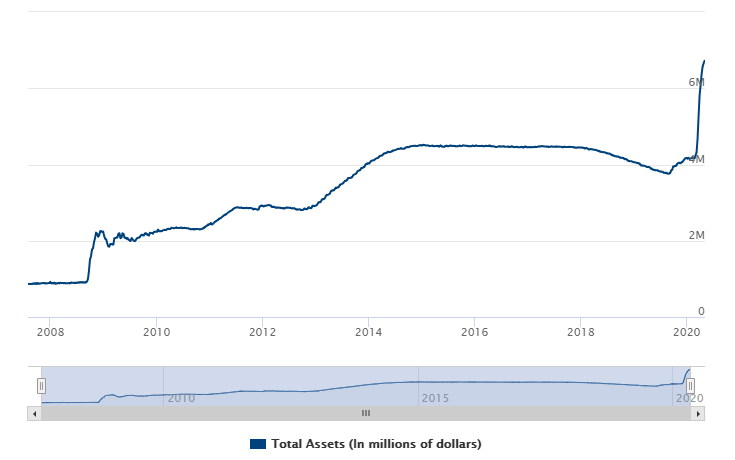

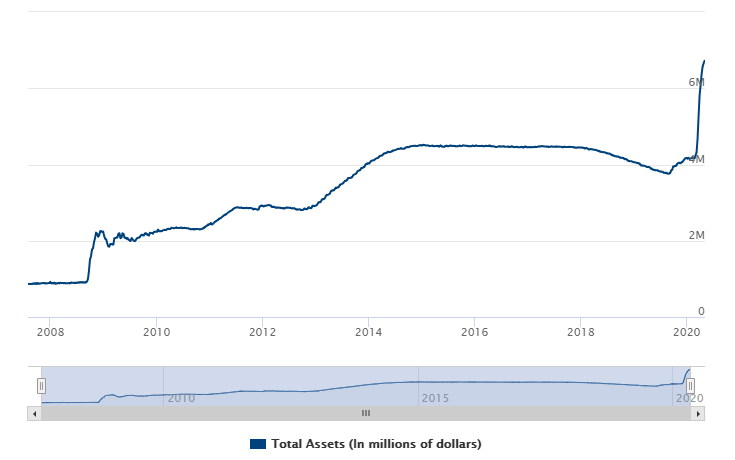

The graph below shows the total on-balance sheet assets of the Federal Reserve. The Fed’s balance sheet is approaching $7Tn and represents almost a doubling in size from the already elevated 2019 levels. This balance sheet ballooning is the result of asset purchases and is a prime example of a printing press that stokes inflation. The monetary expansion (that has not stopped from the last recession of 2008) is unprecedented. However, we have not seen runaway inflation between 2009 and 2019 – in fact, just the opposite, inflation remained tame during the entire expansionary period.

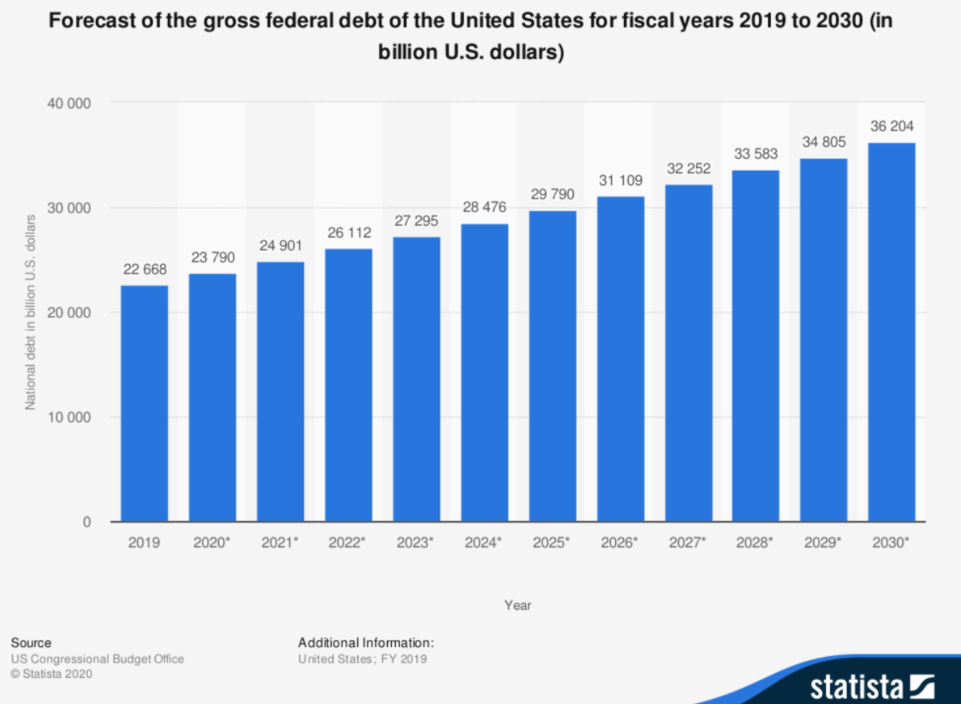

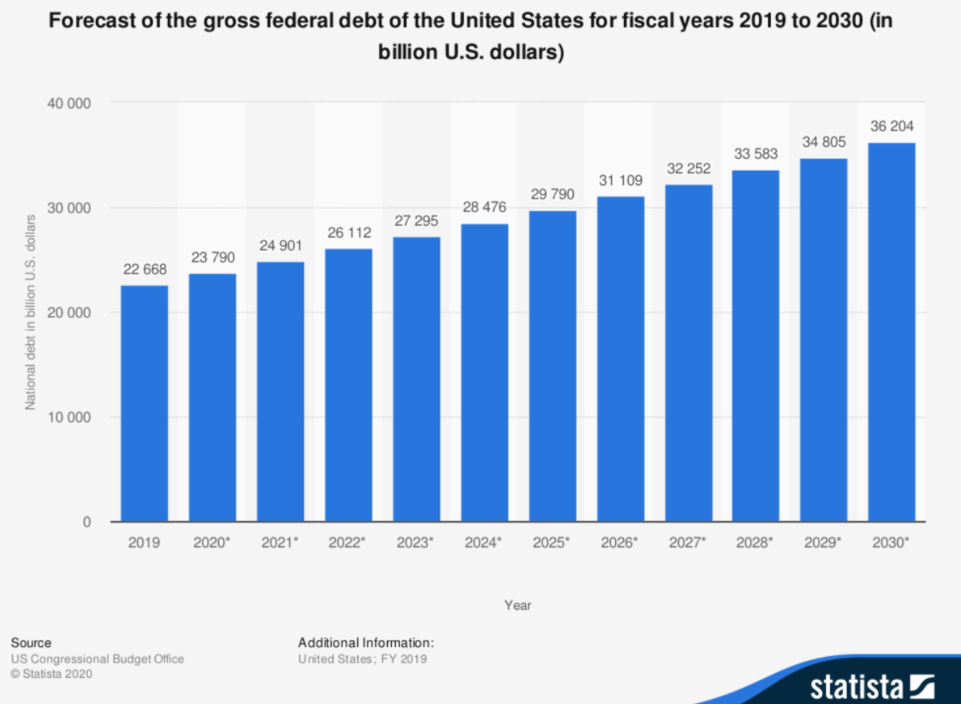

There are some substantial differences in 2020 that we did not see previously. This time, the fiscal response has also been highly inflationary. The U.S. Congress has spent almost $3Tn in just a few months to help counter the economic effects of the pandemic. There has been $500Bn in tax relief and $550Bn in credit enhancement thrown in for good measure. The graph below shows the forecasted federal debt through 2030. This amount of spending is highly inflationary, and these numbers do not even take into account state and local debt.

There are still other secular developments that will stoke inflationary pressures, including the following:

Policy: Public policy will see us shift many supply chains permanently away from cheaper China imports to more reliable, but expensive, domestic suppliers.

Workforce Flexibility: Because of the rising cost of healthcare in defending from the pandemic, many businesses that relied on gig employees will be forced to provide healthcare. These companies will be forced to re-designate their workforce from contract workers to employees.

Labor Cost: Many essential frontline employees during this pandemic are minimum wage workers whose plight and hazard risk may be a turning point for increasing minimum wage and providing better healthcare for all workers.

All of the above are real catalysts to higher inflation and higher interest rates. The U.S. Treasury will be servicing a massive public debt and will be competing with the private sector borrowing driving inflation and interest rates higher.

But will the Federal Reserve and future administrations halt any runaway inflation? This is really where the pivot to inflation is almost etched in stone. The U.S. economy has loaded up on debt over many years, and now the government bailouts are turning business and household debt into government debt. The Federal Reserve and Congress will not only tolerate inflation but will seek it.

The fastest way for the government to shrink the mountain of debt weighing down the U.S. economy is to promote inflation. The vast majority of government interest payments are fixed in nominal terms, and inflation makes the existing debt less burdensome in real terms. Assuming a 30-year bond, raising the long-term inflation target from the current 2% to a still-modest 4% would reduce the debt by 39.6% over the life of the instrument, and raising the long-term inflation target to 6% would reduce debt by 62.4% over the life of the instrument. The U.S. has used inflation this way before. The average inflation rate from 1946 to 1955 was increased to 4.2%, reducing the debt/GDP ratio by almost 40% within a decade.

Key Takeaways

Like chess players, prudent bankers are looking past the first move to see where and when the economy may pivot. The writing is on the wall – there are numerous economic and policy developments that will eventually rekindle inflation pressures. Most importantly, inflation will be an easy, perhaps only feasible option for the government to manage the federal, state, and local debt loads. A higher inflation target might very well be part of the policy strategy for getting debt reduced and the economy back on its feet. Bankers must be on the lookout to position their business for higher inflation and higher interest rates.

Tags:

Published: 05/21/20 by Chris Nichols