How To Set Up For The Next PPP Round by January

The new split bipartisan Covid Relief Bill got traction yesterday and stands a good chance of getting approved in the next couple of weeks. Most versions of a new stimulus package contain the approval for the next draw of the Paycheck Protection Program (PPP). The SBA, in turn, is preparing to bring the program live around mid-January. While a new PPP program is much needed, banks will have a surmountable challenge once again rushing a process and program to market. To help banks, we break down the ten most important decisions makes the need to make in the next two weeks to be ready to put needed capital in the hands of our small business clients as soon as possible. In addition, we offer a free webinar (Register) for any bank still in need of a processing platform.

Go / No Go Plus Strategy: The first decision banks need to make is IF they will offer the next PPP draw. If so, will they offer the program themselves, or will they refer customers to another bank or fintech firm? Banks will have to decide if they have the resources, the expertise, the focus, and the desire to either service their existing customers or go offensive and take on new customers. If banks do decide to move forward, then it pays to determine what factor they want to optimize (below).

Customer/Prospect targets: While most banks will decide to provide PPP loans for their current customers, banks need to decide the definition of a “customer.” Does the definition mean just current PPP borrowers, just loan customers, just deposit customers or any customer of the bank? Further, if the owner is a customer, but their business is not, does that constitute a customer?

Technology Platform: Once a bank decides it will be in the PPP business and the size of the market, it will be going after, then it can seek a solution. A bank may choose to handle the process manually, quasi-manually by having backend automation but take applications manually, or it may opt for a complete end-to-end solution. Banks that are looking to utilize a third-party platform need to be looking at options immediately as approval may take several weeks.

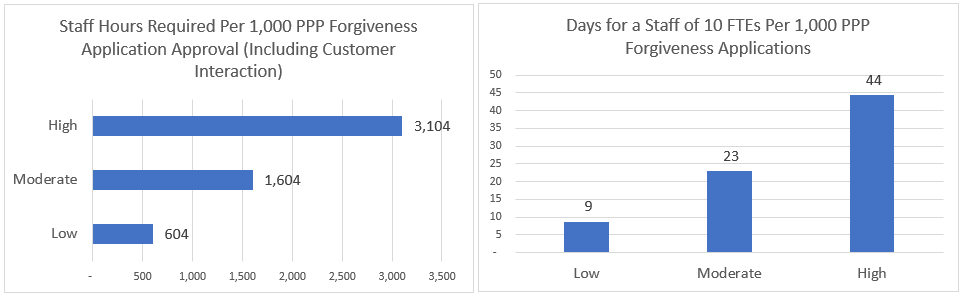

Personnel: Once the bank has an idea of the market, the process, and the technology, it next has to decide on the number of required personnel and if they are going to outsource all or part of the effort. A PPP origination program takes as little as ten employees and as many as 100. Usually, the rule of thumb is it takes approximately 30 underwriters, customer service, and support personnel for every billion dollars. Once the size of the required workforce is determined, banks need to figure out if it wants to outsource all or part of the process. Like last time, many banks will look to outsource packaging (confirming basic calculations, documentation, and eligibility) while keeping underwriting review and customer service in-house.

Minimums: Banks can help manage the volume by creating a minimum loan amount. Like last time, the average PPP loan is expected to be north of $110,000 without a minimum. Similar to last time, the breakeven, depending on the efficiency of the bank, was between a $5,000 and $10,000 loan size. If a bank puts a $10,000 minimum loan size, it will save approximately 10% of the volume. While no bank wants to restrict capital, if a bank is crunched for resources, it is better to let a more efficient platform handle the smaller loans so that it can do the greatest good with the scarce resources it does have.

Eligibility: One major lesson learned from the last round of PPP origination was the need to better qualify the borrower in terms of eligibility. Banks will need to decide what level of non-eligibility it can handle when choosing a system or designing a process. The next round contains more needs tests, such as the verification of a revenue drop, so banks should be prepared to do more testing, not less. Requiring a NAICS code check, revenue drop verification, non-1099 employee validation, check of good standing, and other safeguards should be built in upfront of any process.

Fraud Detection & Know Your Customer Requirements: Even banks that only underwrote existing customers suffered greater than expected fraud. It is rumored that some underwriters experienced levels of 10% to 15% fraud. This next round of PPP will likely require banks to become more diligent in detecting not just eligibility but to do a better job at validating the employees, making sure employees are not double-counted in other business, and that the borrower is a legitimate business. Any process or platform banks design should make sure they are increasing their due diligence when it comes to risk. Unfortunately, while we have been processing loans and forgiveness, the bad guys have had ample time to consider how to beat the system.

Duel Forgiveness and Origination Processing: Unlike last time, banks will have to conduct both the forgiveness and origination effort simultaneously. This adds another level of complexity, and banks should think through how they are going to handle both efforts, particularly when it comes to customer service. Banks may want to assign dedicated teams or have just parts of the team to be dedicated to each channel.

Automation & Core Connection: Banks will need to decide upfront on how vital things like E-tran automation is or connections to the core is to the effort. Last time, most banks didn’t have a choice. Now, banks may want to pick the partner or design their internal process in order to maximize efficiency. Underwriting, data validation, submitting loans to the SBA, processing e-signed documents, and booking the loans on the core system are all areas that took the most resources that banks need to pay special attention to when designing their process.

Marketing and Marketing Automation: Another major lesson learned during both PPP origination and forgiveness is the importance of messaging and marketing during the process. Banks now have a better idea of what is required and can help choose a system or process that either contains marketing, notifications and reporting built-in or can interface with the bank’s current system.

Putting This Into Action

Similar to both origination and forgiveness, we make our platform available to any bank that wants to leverage our efforts and technology for use in their own market. We have partnered once again with SmartBiz and just released the beta version of the next iteration of PPP origination that also comes with an automated forgiveness application. If you are interested in learning more, you can review the website HERE and/or sign up for a webinar that we will have on:

Thursday at 3 pm ET – REGISTER

If you already have a platform or plan to do this on your own, then stay tuned as we are in the process of collecting more data and more insight to help you process your applications. Like last time, we also plan to establish a live chat room so that all banks can share ideas and help solve joint problems together. Having real-time communication with banks across the nation, big and small, was critical to our effort and we look to expand it next year.