The Bank Talent Acquisition Opportunity

Almost every bank has some form of “human capital management” in its top three challenges for the coming years. Attracting, acquiring, retaining, and training talent should be the cornerstone of any bank’s strategic effort as “people” indeed are our most valuable asset and far exceed the value of loans, deposits, and financial capital. This article looks at the fantastic opportunity in talent acquisition that is right in front of banks.

The Challenge

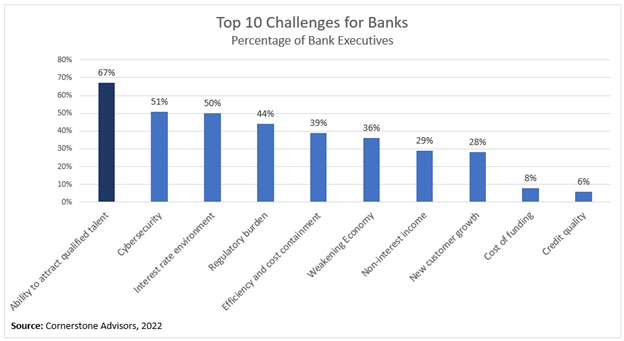

Talent acquisition remains a top priority among banking executives. A recent poll (below) found that 67% of bank executives listed attracting talent as a top challenge, making it the most significant perceived headwind in the industry.

The Talent Acquisition Opportunity

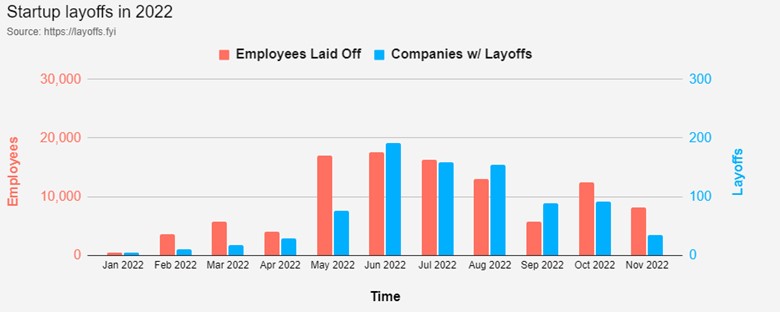

The Fed is raising rates to cool the economy, which means slowing the demand side of the equation down, which means the supply side slows down as well. With inflation as persistent as it is, and the lag between our unprecedented 3.75%+ increase in rates that have already taken place, economic slowing and more layoffs are only going to pick up steam.

No matter what happens in the future, there is an opportunity right in front of us that should continue. Look at the layoffs that have occurred in the last quarter:

- Twitter ordered a 50% staff reduction

- Chime is dropping 12% of its workforce

- Stripe is reducing 14%

- Chargebee laid off 10% of their staff

- Robinhood cut 9% of their employees

- Coinbase is laying off 18% of its workforce

- MX, Peloton, Netflix, Shopify, Gap, Wayfair, Carvana, and the list goes on.

This year, there has been more than 10,000 employees have hit the street which has been in neobanks and finance-related tech start-ups. Total tech layoffs, according to layoffs.fyi exceed 104,000 from over 750 companies.

It is horrible for these employees that must suffer emotional and economic hardship. Because of this experience, some of these employees will desire the stability of bank employment. All you must do is make a case for the bank and an offer.

Banks, with their increasing margins, are able to help these employees while dramatically helping themselves. For banks, this means access to top-tier software engineers, salespeople, recruiters, IT support staff, product managers, solutions architects, financial crimes staff, analysts, data scientists, and more.

Many of these employees that are on the streets were laid off for no other reason than they were assigned to a product that had to be discontinued. Some of these people may not be bankers, but that is a good thing as they can bring your bank new ideas and added skills.

How To Take Advantage of This Talent Acquisition Opportunity

Here is a compiled list of employees, their backgrounds, and their contact information from Stripe. The list provides the names, positions, background information, and contact information for hundreds of employees that have a background in payments and financial services. Most all these former employees are willing to work remotely.

It is no surprise that Huntington Bank was quick to start looking for talent among the Stripe’s former employees.

We have curated a list of some other financial-related and customer-experience impressive firms that banks would be smart to draw talent from:

Candidates from all the above companies can be found on LinkedIn and various job boards in addition to the curated list above. Talent abounds, and fintech’s loss can be your bank’s gain.

If you are looking for ways to build your human capital, the following year will present unprecedented talent acquisition opportunities for banks.