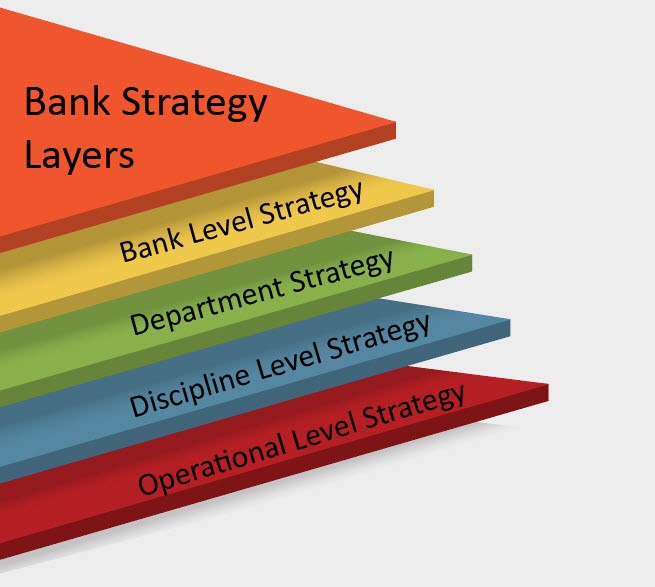

Improving Strategic Planning – The Four Layers of Bank Strategy

A good bank strategy is a multi-layered cube. In this article, we present the four horizontal layers and then follow this article up with the vertical layers to round out the construction of the basic framework that can be used to set any bank’s strategic planning. The reality is that many banks fail to plan their strategic plan and, as a result, end up creating more silos and less cohesive execution. In this article, we provide a successful and proven framework that breaks down into the four layers of bank strategy that allows banks to start from a vision and produce the tactical tentacles that make execution easier.

Bank Strategy – The Goal of Alpha

Last month we discussed how to set risk as a guide rail during the strategic planning process (HERE) and presented 35 common strategic planning initiatives for next year as an example of what banks are working on. Now, we delve deeper into the bank strategic planning process and discuss some organizational aspects of planning that can optimize the planning workflow.

Every bank strategic plan starts with a vision and articulation of what makes the bank competitively different so that it generates both a return above its cost of capital and “alpha,” or the difference from the average industry performance. Taking a long-term horizon, preferably ten years or more, bankers need to proactively decide what businesses they want to be in, through what channels, and in what competitive position to achieve an above average, long-term return.

Within the bank strategy layer, management should focus on the two to five things that will separate the bank from its competitors, resulting in an above-average return. In this layer, management might outline new markets, types of products, channels, customer segments, cultural elements, or service levels that will bring an above-average return to the bank’s stakeholders, including customers, employees, shareholders, vendors, and regulators.

Department Strategy

Once the bank has an overarching vision, each department should take that vision and articulate what that vision means for the department. Commercial, Retail, Mortgage, Wealth, and other departments define the bank’s vision by adding more detail. This part of the plan can be more limited in time horizon so long as the department strategy takes the long-term bank strategy into account and breaks down the milestones into achievable goals.

For example, a bank strategy might employ technology to reduce the cost and speed of transactions while going after markets with above-average profitability. Commercial Banking may name what industries the bank should have a leadership position in and what generic technology the bank will employ (e.g., an automated loan processing platform) to accomplish the bank-wide plan.

Below is a diagram that expands on each layer and highlights the Retail business line. In each case, every department, discipline, and operational unit produce their own set of prioritized goals, initiatives, and objectives.

Discipline Level Strategy

To prevent banks from operating in silos, an effective strategic plan should have a layer of “discipline strategy” articulating the bank and department strategy across functional lines. Each department might have groups such as management, compliance, technology, strategic planning, and similar within them. There needs to be a coordinated strategy across the discipline for each department.

For example, management may articulate a bank strategy to improve operational efficiency. Credit, a discipline layer, will detail how it will leverage data and machine learning to make faster and more accurate credit decisions. Meanwhile, Commercial, a department layer, will create a plan for how faster and more accurate credit decisions for its commercial loans will be used to gain an advantage in the commercial marketplace.

The critical thing to note here is that staff can be members of both departments and disciplines. An employee can have their primary responsibility either in a department or in a discipline and can have a dotted reporting line to the other. This organizational structure, along with cross-training and frequent employee movement, are key to breaking down silos. Having “embedded” marketing employees in Commercial, for example, not only allows more specialization and product knowledge but helps create the connection to marry Marketing’s strategic plan with Commercials.

Operational Level Strategy

Like a military operation, an operational strategy then takes the department strategy, filters it through the discipline level strategy, and lays a strategic path on a grassroots level. This is the last mile connection from the regional, branch, or product level to the customer. This part of the strategic plan lays the framework and the starting point for the tactical aspects of strategy, as this layer provides the practical framework for execution.

For example, from the department and discipline layer, we have speed and segmentation as a directive using a cloud-based loan processing platform targeted at specific segments like health care. The operational level now talks about the particular segments of healthcare, any particular geographies, the priority of introductions, plus the marketing, training, and support required.

The diagram above shows the expansion of the operational layer for the Retail Department.

Strategic Planning into Action

These horizontal layers of the strategic bank cube are the foundation of building a long-term, fully articulated strategy. For larger banks, the substance of these layers will be detailed, while for smaller banks, the departmental, discipline, and operational layers of the plan will be more straightforward.

Plans fail or are delayed in execution not because they are too complex but often because they are too simple. Thinking about your strategic plan in these four layers helps management and business line owners better connect vision with execution and provides a framework for taking into account all stakeholders. This methodology also has the byproduct of being more encompassing, therefore, requiring input from a wide range of employees, shareholders, vendors, regulators, and customers. The net result is a well-thought-out framework that helps move the organization away from silos and provides for more coordinated action.