Infrastructure Act Banking Impact

On Friday, Congress passed the $1.2T Infrastructure Investment and Jobs Act (the “Act” or “IIJA”) which goes to the President’s desk next week when Congress returns to become law and starts to go into effect January 1, 2022. IIJA targets our electricity grid, transportation infrastructure, the digital divide, and economic resiliency. In this article, we break down the 2,702-page Act and provide analysis from a banker’s perspective with the goal of helping banks better inform their budgets, strategies, and customer tactics in order to increase profitability.

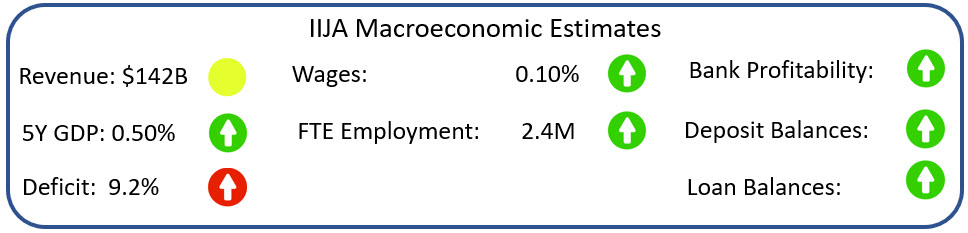

Infrastructure Act Macroeconomic Impact

While the impact is still being analyzed, we have reviewed the National Associations of Counties analysis (HERE), the Brookings Institute (HERE), Moody’s Analytics and the Reason Foundation (HERE), to inform our estimates to conclude that the Act will have the following preliminary macroeconomic impact on the U.S. economy:

The bipartisan IIJA will provide $973B over five years starting in 2022, including $550B for new investments in transportation, water clean-up, energy, environmental improvement, public lands, broadband, and resilience. While the Act will serve to drive both wages and prices up, more efficient infrastructure should increase productivity and lower prices in the long run.

About half the funds will come from the budget, while half will come from reallocating funds from existing programs such as delaying the Medicare Part D rebate or using unused 2020 Covid-19 relief funds. Some of the revenue will come from selling off part of the broadband spectrum, reinstating Superfund fees, extending Customs fees, selling Strategic gas reserves, and extending fees on Fannie Mae and Freddie Mac.

Approximately 45% of the funds will be distributed directly to counties, while most of the funds will be administered through existing government agencies.

Some of the Infrastructure Act Specifics

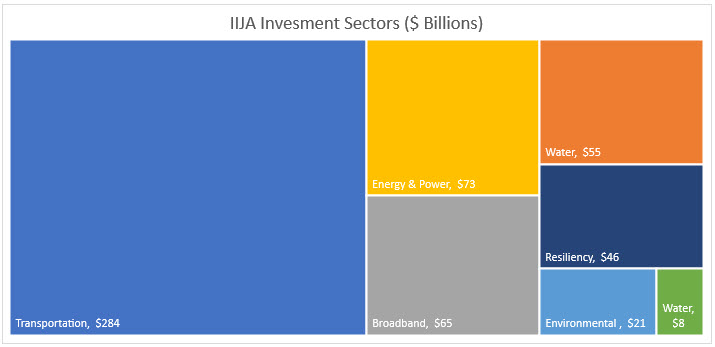

Below is a high-level graphical depiction of the Infrastructure Act’s outlays and a more detailed narrative breakdown of the major provisions in the IIJA that will have a positive impact on banking. Most of these provisions will serve to put more capital in our communities while driving the need for loans and banking products. In short, this is a stimulus program for banks as it provides capital and revenue to help companies grow that are in specific areas.

Roads and bridges: At the heart of the Act is approximately $110B of new investment in the Nation’s roads and bridges and other major transportation programs.

Amtrak: The beleaguered company gets the largest investment in its history since its founding at $66B to be used to improve high-speed rail availability, safety, and general modernization.

Broadband internet: The Act earmarks another $65B (on top of a similar inject within last year’s American Rescue Plan) to help ensure high-speed connectivity throughout the U.S. The focus will be on rural areas and includes a $30-per month subsidy for low-to-moderate-income households.

Electric grid: $65B will go to the upgrade of the U.S. electricity grid to include smarter distribution and management tech as well as greater high-availability coverage.

Water: The Act provides $55B for lead pipe abatement throughout the Nation.

Great rivers and lakes: $1B of the Act’s funding will go to cleaning up toxic spots along the Great Lakes region, while $47B will go for general water infrastructure improvements.

Public transit: The Act has the largest-ever outlay in public transit, to include $39B to modernize current infrastructure while improving public transit access for the elderly and people with disabilities.

Airports: The Act allocates $25B in capital to help modernize America’s airports.

Road safety: $11B of the Act’s funding will go to transportation safety programs, including a new program to help states and cities reduce car crashes and accidents involving car vs. pedestrians/cyclists.

Electric cars, buses, and ferries: This provision include $7.5B to install the first Federal electric vehicle charger network in addition to the purchase of electric busses and ferries.

Crypto: The Act requires cryptocurrency exchanges, such as Coinbase to report all trades. The additional reporting is expected to generate new tax revenue currently missed by the IRS.

Industries That Will Generate More Demand For Banking Products Due to the IIJA

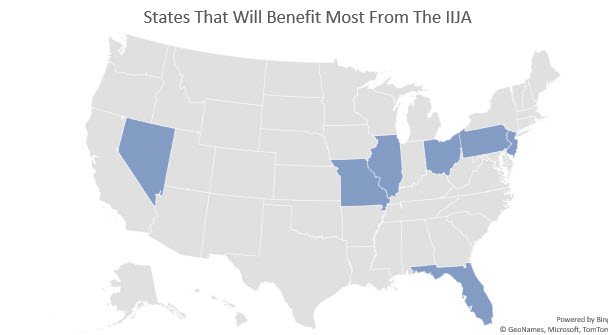

A number of specific industries benefit from the Act that will see an increase in loan demand and banking services starting in 2022. Companies within these industries will either receive direct grants or additional revenue, both of which will stimulate the need for additional debt that will be used for growth. As such, banks can start to educate their lenders to identify and market companies that will be the beneficiary of funds through Federal, state, and local distribution of funds.

Transportation Support: Companies that specialize in road, bridge, or public transportation repair or construction will be the largest recipients of the Act’s benefits. Banks should research any construction company that has worked on eliminating at-grade rail crossings in their community or has new ideas on how to reduce the threat of traffic to pedestrians since there are both grant and revenue programs for those specific efforts. Companies that provide road safety equipment such as signaling, barriers, cones, speed/traffic control/monitoring equipment, and similar will also benefit. In addition, companies that build or support public transportation vehicles, mainly electric, including buses, rail cars, and ferries, should see an increase in business.

Infrastructure: In addition to transportation-related construction companies, contractors, sub-contractors and equipment suppliers that handle major infrastructure projects at airports, electrical grid, port construction, and waterway infrastructure will see a boost. In addition to contractors, materials suppliers, particularly those in the steel, concrete, asphalt, rubber, and system controls.

Environment: Funds from the tax will be used to increase the clean-up superfund and brownfield sites, abandoned mines, old oil/gas wells, and water system lead pipe abatement. Companies that specialize in hazardous materials clean-up will benefit. Some examples include Glynn Environmental Coalition, Spaulding Decon, and Consolidated Environmental.

Green Tech & Sustainability: With almost $9B for environmental protection, $7B set aside to reduce carbon emissions, and $2B for charging, companies that focus on sustainability and green technology will see an increase in revenue. Almost every major city has a niche group of industries around this initiative, and banks can help these clients get the needed contracts and grants while helping them with debt capital. In addition, $3.5B is set aside to help homeowners and businesses better weatherize their locations to increase energy savings. These contractors are easy to find and support. Further, banks with sustainability marketing and branding will get a boost, as will loan and deposit production to these companies or developer initiatives.

Education: While the Build Back Better Act targets education there are some funds in the IIJA to assist rural schools.

Broadband & Telecommunications: Funding will be targeted to expand the use of high-speed internet to rural areas and low-income communities. Small broadband companies in rural areas will benefit from this funding allocation. Some examples include Zoom Telcom, Point Broadband, and Blue Stream Fiber.

Cybersecurity: The Act establishes a new cybersecurity grant program that targets helping municipalities upgrade their cyberdefense. Banks should find government-approved contractors in their area that could help with this effort.

Disaster Mitigation Initiatives: While largely undefined, the Act concept is to boost government agencies and companies that help mitigate risk during times of disaster. Companies that support first responders, emergency equipment manufacturers, communication companies, logistic companies, and similar will see a boost. Banks should research the Building Resilient Infrastructure and Communities (BRIC) program and see what companies are participating in their service area. In addition, counties and cities will be looking for low-interest loans from banks as part of the previously approved Safeguarding Tomorrow through Ongoing Risk Mitigation (STORM) Act that will be additionally funded through the IIHA.

Capital Markets & Municipal Lending: Municipalities throughout the Nation will have an increased need for grant anticipation loans plus will need both bankers and bond buyers handling additional debt. Because of the Act, private activity bonds will double to $30B.

Putting This IIJA Analysis in Motion

The historic size and focus of the Infrastructure Act provide banks with a rare opportunity to not only drive both loan and deposit growth but an opportunity to assist both existing and potential future customers in winning their share of contracts and grants. Banks should allocate more resources to banker education, sales, and marketing with the goal of taking advantage of these infrastructure initiatives. To this end, bankers can help their clients start to get approved at the Federal, state, and local level to be awarded some of these projects, can help their companies get an early jump on staffing in this tight labor market, and fill any gaps in equipment needs or M&A that may increase their chances of being awarded contracts.

Regardless, of the outcome, bankers should use the IIJA and Build Back Better Act as a catalyst to increase engagement with their customer base. Asking the question about each company’s plan to participate and then committing their plan into your customer relationship management system (CRM) at least shows that you are trying to add value at a minimum, while potentially uncovering lucrative business for them. Their answers will provide a path, or “playbook” to have further conversations and add further value.

Now that this act is passed, the attention should turn to the Build Back Better Act which will have about the same amount of stimulus and will be focused on some of the same industries as above, but with the added focus on healthcare, education, and housing. Where the IIJA is focused on creating jobs and fixing large problems in our economy, the Build Back Better Act will focus on fixing inequalities. The IIJA is a net plus for banking and the Build Back Better Act will be even more profitable since it will impact households and a more diversified array of companies that will be smaller in nature.

In addition to conducting their own research and working with their respective communities, banks can leverage third parties such as IBIS World, Vertical IQ, and D&B Hoovers to help delve more into industry specifics in order to develop a sales and marketing playbook on how to better take advantage of this historic program. Doing homework now on the details of the IIJA will place bankers in a true “trusted advisor” position as they can help their companies take advantage of the Act while driving profitable business for the bank.