10 Big and Small Ideas From Gartner and Money 20/20 (2022) – Recap

Our teams just returned from back-to-back weeks at the Gartner Symposium in Orlando and Money 20/20 in Las Vegas. Gartner focused on technology infrastructure, while Money 20/20 was around fintech and payments. Every day we walked 8+ miles, talked to countless vendors, sat through PowerPoints, had our share of EDM piped into our ears, and ate a lot of dried-out chicken. Despite those challenges, we pulled out the top ten needle-moving ideas and ten smaller, exciting ideas to bring to your organization.

10. Small Idea – It’s Our Kid’s Technology

It was a sobering thought to realize that we are all really building most of this technology for our kids. Many of these problems are so complicated that if you are over 40, you will likely never see the full implementation of items like a central digital currency, the metaverse, a portable identity token, and seamless wearables payments.

While we have the technology to solve all of the above and more, there was a realization at both conferences that we are still decades away from developing a workable ecosystem and creating widespread adoption. Complicated technology sucks, but mortality sucks more.

10. Big Idea – Trends

While last year was dominated by crypto, this year, the themes were mainly around fraud and identity (both conferences). Almost every bank and brand we spoke with will increase their investment in these two areas for 2023. This was followed by a focus on banking-as-a-service, embedded finance, open banking, Web 3.0, cyber, infrastructure, and regulation. Most of the conversations at the conferences were around how to architect, execute, and attract/retain the required talent to pull these solutions off.

9. Small Idea – You Will Need a New Core Soon

Many of the new banking and payment technologies have now far eclipsed traditional cores’ capabilities. Create a smart contract that tracks rebates, wage garnishment or secures a bank’s collateral position from a future revenue stream, and a bank will need a new core construct to handle the complex accounting, contingencies, and ALCO calculations required. Do you need a product rolled out in six weeks? That will require a new core. If you think you have ten years on your current core, you don’t. It is closer to five. Banks are just starting to realize this.

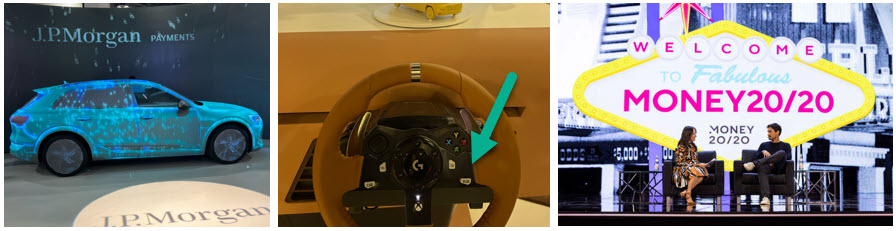

9. Big Idea – Consumer Preferences for Technology are Changing

AI, payments, data, and other aspects of innovation are dropping behind the scenes. Instead of shopping online and scrolling through a catalog of products, consumers would like to see something on Reels or Tik Tok and buy there. JP Morgan demoed their auto ecosystem that is embedded with payments at every turn. Their vision, while ridiculously executed, was at least thought-provoking. Their vision is that you will have a payment button on the steering wheel (below), and payment decisions will be pushed to your in-dash screen or brought to you via voice. You will drive, pay and bank all seamlessly without knowing you are “banking.” This is more than just embedded finance. For banks, this means creating products that accomplish a task and then integrating banking in the background. Instead of promoting a commercial lending product, a bank will roll out augmented reality that overlays maximum loan values and indicative rates on buildings to help potential buyers decide when they drive areas looking for locations.

8. Small Idea – Native Cloud Infrastructure

While this was a big idea from the past, there was still lots of energy around moving banks to a public, private, or hybrid native cloud construct in their architecture. We are still baffled why this is a debate, but it is. During the two weeks, there were over a hundred significant cyberattacks by nation-states on national and regional banks that you could watch unfold in near real-time (bel0w) at Gartner and Money 20/20. Each attack was from hundreds of thousands and even millions of locations. Any community bank that believes it can keep up and thwart millions of attacks per second is fooling itself. That’s just one example – load balancing, contingency planning, access management, and much more build an overwhelming case of why most bank uses cases should be moved from on-premises to the cloud. Further, applications should be built for the cloud.

8. Big Idea – Ecosystems and Platform Investments

There was a change in viewpoint among banks regarding the investment of time and money. Last year was still largely about investing resources in technology that solves particular problems (i.e., account opening, identification, rewards, student loans, etc.). This year, the focus was more on ecosystems and platforms. Investing in the Salesforce platform, marketplace, or network has provided banks with the greatest return. In short, banks have a new breed of customers (see Selling to Machines in Small Idea #4).

7. Small Idea – Policy and Regulations are Lagging But Are Going in Banking’s Favor

We heard from various policymakers and regulators that policy and regulation are at least two years behind the times (some say ten) and that we will see more movement over the next 18 months. This regulation looks more onerous for everyone but seems to be in most banks’ domain and skill sets. The CFPB announced a new regulatory framework putting Section 1033 (data privacy) at its center. The message continues to be precise – every bank will likely need to comply with some derivation of the GDPR standard, ala the California Consumer Protection Act (CCPA), as it gets adopted across the U.S.

7. Big Idea – Blurred Lines Between Online and Offline

As ecosystems come together, interoperability is starting to be realized. Here, banks have to change their thinking in their partners and architecture to handle identity, authorizations, fraud, payments, and banking services across platforms and connections. The future of banking is to allow things like account opening, payments, and credit to take place where the consumer or business is. This might be in a fleet vehicle offline and out of the area or on a wearable. Single sign-on, tokenized authorization that follows you, interoperable digital wallets, and experiences bridges will become the norm over the next three years.

6. Small Idea – Hyper personalization and One-to-one Marketing

While this trend has been significant for the last couple of years, we saw more and more banks (and brands) leveraging data to discover intent. Once the intent is discovered, banks and brands then deliver a micro-targeted promotion or process. We saw technology where the phone recognizes that it is in a farmer’s market and brings up the tap-to-pay app, complete with a discount for using the bank’s payment platform. We also saw this trend as Wells Fargo announced at Money 20/20 their partnership with Google’s virtual assistant. This assistant leverages every person’s transaction and balance stream to assist with financial improvement. While many bank virtual assistants are reactive to commands, this will be the first that is proactive.

6. Big Idea – P2P and B2C Tap-to-Pay

One of the most impressive leaps in technology and infrastructure over the past year has been the ability for near-field communication (NFC)-enabled devices to facilitate payments via a smartphone or wearable. While this has been resident for merchants for years, we are now seeing frictionless platforms where people can transfer funds between phones or in small-volume use cases. A small business at a farmer’s market can accept payments in the field for their business by having the phone or wearable near each other. P2P tap-to-pay takes out a swipe, a look-up, and a click vs. using Venmo and B2C tap-to-pay reduces the need for a separate point-of-sale terminal.

5. Small Idea – The Metaverse is Going to be Big

It might, but not for banks. Both conferences tried to convince everyone that the future runs through the metaverse. No one was buying it. Outside of gaming, most use cases fell flat, particularly those around virtual meetings and recreating virtual branches.

5. Big Idea – Building a New Digital Retail Brand is Fool’s Gold

The repositioning of Goldman Sach’s Marcus that was announced during these conferences had everyone talking. While no presenter touched on it, it was all digital bankers could talk about. To the many community banks and fintechs that have tried creating a digital bank (or are thinking about this), the strategy is misaligned to its core. To divert resources to stand up a new digital bank, that creates channel confusion, that goes after new customers at scale by using rate and/or credit will always be destined for failure. What invariably happens is that you roll out a very expensive platform to go after the least profitable customers while confusing your brand and your employees. It is a misalignment of strategy and tactics from the start. If Goldman, Chase, Moven, and Simple couldn’t do it, it is doubtful a community bank can. On the plus side, tech layoffs at Marcus, MX, and others have put a lot of talented bankers on the street that was running around getting jobs.

4. Small Idea – How Do I Sell to Machines?

Now that more banks and fintechs are scrambling to deliver embedded finance, there were several presentations and much talk about how you sell to a machine. That is, how do you get your bank’s products and technology into these networks and/or chosen by the machine? This likely requires a different business model, pricing structure, channel delivery, and marketing than most banks (and fintechs) understand. We will cover this in a future article, but selling to an ecosystem takes a whole new approach to product development and selling.

4. Big Idea – Get Ready for Consolidation

Higher rates and the potential for a looming recession had many neobanks and fintechs whistling in the dark. These economic macro trends and their impact on capital have put a terminal date on many of these companies. Banks have not lasted this long because of our excellent customer experience; we have lasted this long because of our cheap cost of funds and access to inexpensive capital. A balance sheet matters. This lesson continues to repeat itself.

On top of them, higher default rates are starting to appear to spell the end to many of these start-ups (see our comment about Marcus…). While a few of the larger players will survive (however, they will need larger bank partners), the next tier will be looking to consolidate or be driven into the hands of waiting banks. In most years, banks need fintechs more than fintechs need banks; by next year, it will be the opposite. You could feel the sentiment change.

3. Small Idea – Sustainable and Ethically-Focused Technology

A central theme at both conferences was leveraging technology to help the environment, social causes, governance, and human rights (including privacy). There were several presentations at each conference about utilizing the next wave of technology to reduce energy use and using technology to enable freedom. It was all somewhat vague, but we suspect this trend will continue.

3. Big Idea – Know Your Profitability

What was still missing at these conferences was any fundamental understanding of profitability. It is shocking how many vendors, speakers, and banks have no real feel for profitability when they are talking about products. The classic example is to listen to everyone talk about crypto for banks. Sure, customers might demand it, but how much will you make on it to offset the risk? The answer is between $25 to $75 per year per customer. Likely this is not an area most banks want to focus on.

2. Small Idea – AI For The Employee

More than any other year, there was a healthy dialogue about utilizing AI to help the employee. In years past, it has been all about helping the customer or the bank become more profitable. This year, the focus has been leveraging AI to reduce friction at work. That could be removing a mundane task such as fraud case management, or it could be a better employee onboarding experience.

2. Big Idea – How to Build Culture Using the Hybrid WFH Model

Both conferences talked in-depth about recruiting and retaining talent. The general theme was that banks need to leverage the hybrid work model and be able to build culture both in the office and remotely. Most work-from-home bankers leverage around eight tools to support culture, including – video conferencing, shared calendars, shared tasks and scheduling apps, visual collaboration tools, intranet, external shared file security accessible via mobile, and workforce management applications.

There was lots of talk and presentations about removing friction from the employee while allowing time to work on emerging technologies and work for a greater purpose. Establishing a rich skills growth program was also a common thread in order to better retain talent while training bankers on how to handle the future. The buzzword was helping bankers obtain better “digital dexterity.”

1. Small Idea – Composable Architecture

This was a big idea back in 2019 but has now gone beyond programmers and IT specialists. We have spoken at length about pulling functional layers away from your core, such as identity, payments, authorization, exception handling, user interfaces, etc., and using these composable processes across the enterprise. Now, the difference is these processes are being containerized and portable across the organization. These application building blocks are now being given the business line to assemble different products in a no or low-code environment.

This shift means three things for banks –

- The rate of product innovation will get faster;

- Bankers will learn to be more adept at using these composable building blocks when creating applications;

- And all bankers will only select vendors that utilize this type of architecture.

1.Big Idea – Building a Team

Ironically, the best idea at either tech conference wasn’t about technology at all. Coach Mike Krzyzewski (Coach K) talked at Gartner about how he builds championship basketball teams. It was a masterclass. He doesn’t coach a team; he builds a culture. He talked about taking “five fingers and turning them into a fist.” He builds his teams on (the fingers):

- Active communication;

- Trust;

- Care for each other;

- Collective responsibility;

- And, pride.

At the start of each season, he pulls his team together, including his Olympic Teams, and has each member set their own standards that the team lives up to. Coach K points out that rules are extraneous, and team members often try to further distance themselves from them. Standards, on the other hand, you own, become part of the culture, and members run to them. He ensures each team has self-created standards around integrity, respect, courage, duty, and trust and then lets them develop independently. His primary job is to recruit talent, put the culture in motion and then stand by to redirect members as needed. Coach K raised another interesting point – “many leaders will tell their team members to check their ego at the door – “there is no “I” in team,” they will say. I don’t believe it. We need your ego. You have an ego because you are great. Ego is pride. Ego just needs to be channeled and constrained within the standards.