It Is When, Not If Your Commercial Bank Will Offer Digital Disbursements

While the eulogy for checks has already been written and cash is starting its demise, the pallbearers are now in place. By our estimation, 14% of banks offer this service and they are starting to reap material rewards. Bank of America, which has offered the product since 2014 is one of the largest beneficiaries and has gathered hundreds of millions in deposit as a result. The rise of real-time processing will only accelerate this move. In this article, we take a look at the benefits and the options for community banks.

What Are Digital Disbursements?

Digital disbursements is the platform banks can provide their commercial treasury customers to make payments or request payments to and from customers or vendors digitally, via ACH, real-time clearing or push-to-card instead of issuing a check. This is a person-to-person (P2P) application like Zelle or Venmo restructured for organizations such as small businesses, middle-market companies, larger corporations, non-profits and municipalities. Payments are routed from one company to many customers securely and directly to the payee’s bank account or prepaid card using either their mobile number or email address as an identifier.

The product has the following advantages to community banks compared to disbursements using paper checks:

- Cost Reductions: End-to-end disbursement costs are reduced from an average of $1.70 per item to approximately $0.37. Since canceling and reissuing checks go by way of the tail fin, secondary processing cost is dramatically reduced. This is to say nothing of escheatment management which is probably one of the worst time sucks in banking. For payees, production of payments can occur in a fraction of the time and postage costs are eliminated.

- Customer Experience: Payments arrive faster, with more accuracy and with a better, easier to understand accounting trail. As a result, electronic disbursements provide a better customer experience compared to paper checks.

- Core Product: Electronic disbursements, combined with electronic accounts payable, invoicing, electronic receivables, sub-account management, and payroll cards form the cornerstones of the treasury management platform that all commercial-oriented banks will compete on in the future.

- Marketing: Payers can include and manage an interactive message/promotions along with the payment.

- Privacy: Cash recipients do not have to disclose their account number, address or other bits of personal information. Once registered, recipients are alerted via text or email, thus privacy is increased.

- Security: Check forging, fraudulent deposits and ID theft gets dramatically reduced.

- Control: Banks and payers have better control disbursement helping liquidity management.

- Trendy: Application is both mobile and environmentally friendly, two important trends that play well with consumers.

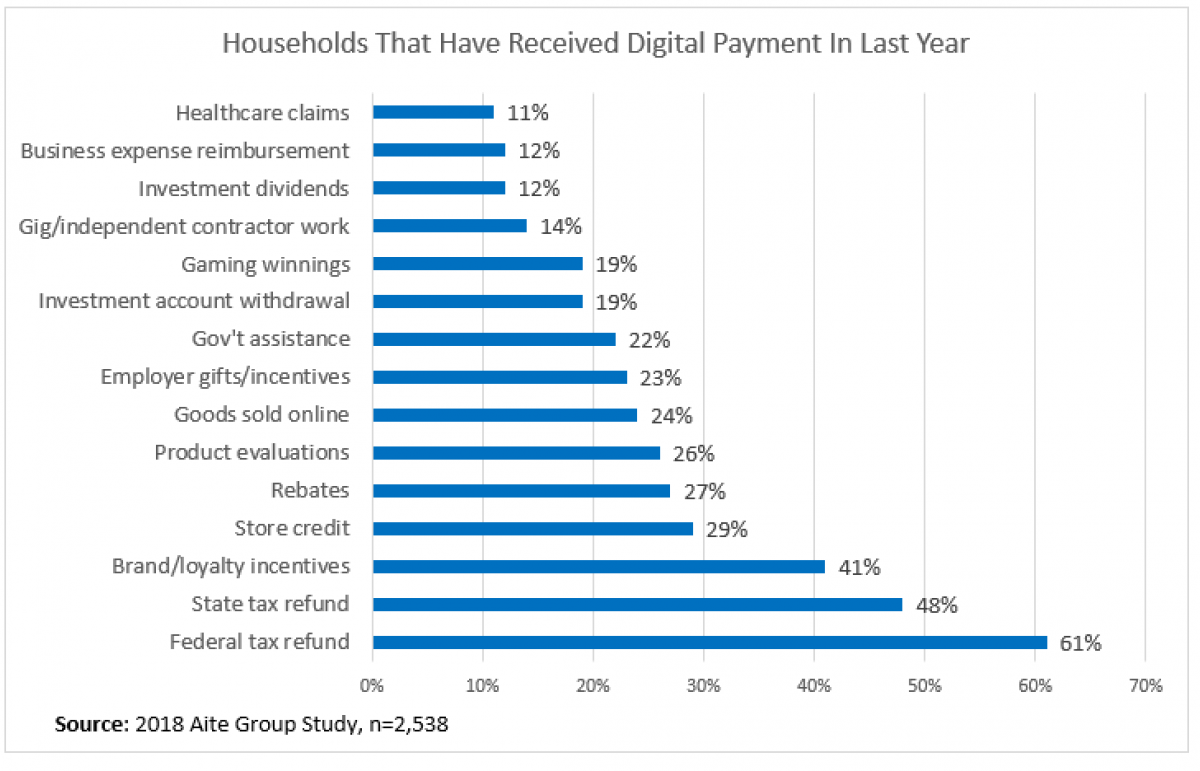

Organizations that particularly benefit from digital disbursements are those that send rebates, refunds and claims payments on a regular basis. Hospitals, municipalities, insurance companies, utilities, product manufacturers/distributors, auto dealers, law firms, companies with gig workers and others have all been early adopters and can recognize immediate and substantial benefits. The product solves many challenges facing bankers, payers, and payees and will soon be commonplace.

Community Bank Options

Options now abound for banks to achieve a turn-key solution. Almost all the core systems offer a product and there is now a myriad of fintech payments companies offering robust capabilities. Integration costs run around $70k, takes about three months to implement and transaction costs are around $0.45 or less depending on volume. Given the benefits, particularly the cost of checks, this is an easy decision for most banks.

As this product becomes mainstream, the cost for processing paper checks will increase on the margin as check volume drops and fixed costs will compose a larger percentage of incremental processing. This will make handling paper checks more and more cost prohibited for banks (and payees). The end result will be that community banks will either have to capitulate or cease servicing their business customers with check disbursement.