Lessons We Learned From Hedged Loan Modifications

Since March of this year, many community banks have been working to provide cash flow relief to customers who have sound business models but require some temporary payment restructuring caused by business disruption as a result of the Covid-19 pandemic. CenterState has been involved in those same restructurings both as a lender and as a hedge provider under the ARC program. We have learned some valuable lessons that we would like to share.

Basic Considerations

The general credit considerations have been shared before and continue to be applicable for hedged loans that require restructuring. The essential playbook is as follows:

- Identify: Identify borrowers who have sound business models but whose cash flow from operations is impaired because of temporary revenue challenges caused by the coronavirus.

- Liquidity: Analyze the borrower’s position for liquidity. Some borrowers requesting relief have sufficient liquidity to withstand zero or negative EBITDA for months. Lenders want to provide assistance for those that cannot immediately tap other sources of liquidity.

- Credit: Understand the structural weakness of the credit. For any cash flow relief provided, the lender will want some form of consideration, such as additional collateral, guarantees, covenants, or premium pricing.

- Structure: Structure relief that is long enough to provide a bridge to a permanent solution, but not longer than is reasonably required based on available information. For example, agreeing to an interest-only (IO) period of one month is not long enough to bridge many borrowers over the effects of the coronavirus and will require multiple modifications and negotiations. However, giving 12 months of relief may be too long given the expected temporary consequence of this health concern (based on current medical information and past pandemic experiences).

- Agree: Negotiate a form of relief that helps the borrower survive temporary cash flow disruption and still protects the bank’s capital.

For hedged loans, the same forms of cash flow relief are available to borrowers as with non-hedged loans. The following options are available:

- Forbear: Defer principal payments (create IO payment periods),

- Reduce Interest: Reduce the credit spread of the loan thereby lowering interest payments,

- Defer: Defer principal and interest payments, or

- Forgive: Last resort – forgive interest or principal payments.

Hedged Loan Considerations

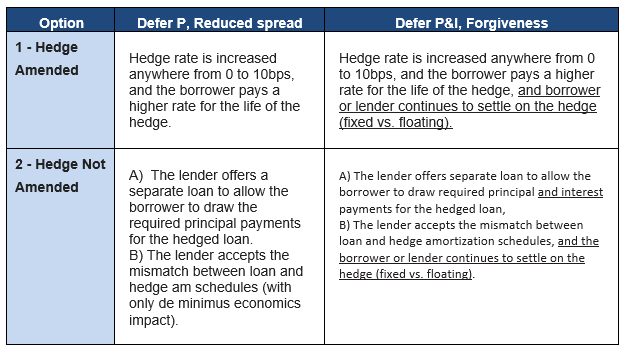

With a hedged loan, lenders have an additional consideration – how to handle the hedge in conjunction with the loan. Community banks should be focused on the best loan outcome, and the hedging strategy should follow. The primary focus should be principal at risk on the loan, and the hedge is flexible to reflect the desired outcome. Through the ARC program, as with many hedge programs, so long as periodic hedge settlements are made to the upstream counterparty, the lender can negotiate any form of modification. The initial decision for a hedged loan undergoing modification is whether or not to modify the hedge. The possible choices for a lender using a hedging program are shown in the table below.

So far, approximately 40% of the hedged loan restructurings have been done through an amendment to the hedge, and the remaining 60% of the loans have been restructured without amending the hedge. The average cash flow relief period is three months (but we have seen as little as two months and as long as 12 months). We have not yet worked on restructurings where principal or interest has been forgiven. Where the hedge is not amended, approximately 80% of the restructuring involved the lender offering a separate loan to allow the borrower to continue to make payments under the hedged loan, drawing those funds from a side note. In the remaining 20% of the cases, the lender and borrower acknowledge that there will be a small mismatch in the amortization schedule between the hedge and the loan – with very little economic impact on either party.

Implications for Banks

Through the ARC program, as with most hedge programs, as long as the hedge provider continues to receive periodic hedge settlement payments (either from the borrower or the lender) and collateral securing the hedged exposure is adequate, it is the lender that controls the restructuring strategy. The hedge provider may make recommendations on best practices, market convention, or economic value – it is the lender’s capital at risk, and the lender has ultimate control of the borrower relationship. The only difference in the ARC program is that the derivative, and any credit adjustment caused by stress on the borrower, resides with the hedge provider instead of on the bank’s balance sheet.