Licking Your Online Applications

Here is the funny thing about the tongue-brain connection – your brain can project, with a very high degree of certainty, what it will feel like if you lick any given object such as your desk, your shirt, car hood, a stucco wall, computer keyboard – you name it. This is despite the fact that you are likely to have zero experience in licking any of those objects in the past. The wiring in your brain is designed to project forward that tongue-licking feeling based on other sensory input, and it does it with amazing accuracy. Unfortunately, it is not the same for creating digital applications, and many banks are running themselves right into problems without even knowing about it.

The Problem – Getting Tongue Tied

Moving deposits, loans, and fee lines of business online have been a priority for most banks. The problem is that many banks looked for the best solution for a single product set and not project forward what they are going to need in the future. Unlike understanding what it is going to feel like to lick something, many banks cannot internalize the problem well enough to project what it will feel like in the future to be a fully digital-capable bank.

Let’s start with the assumption that customers do not want to fill out forms if they can avoid it. To the extent, your bank can populate forms with existing information or information that you can pull from a third-party source such as QualiFile/ChexSystems, Lexis-Nexis, IDology, Acxiom, Plaid, Follow The Frog or others, the better, and safer the experience is for all. The easier that you make account opening, then the probability of opening that next product increases.

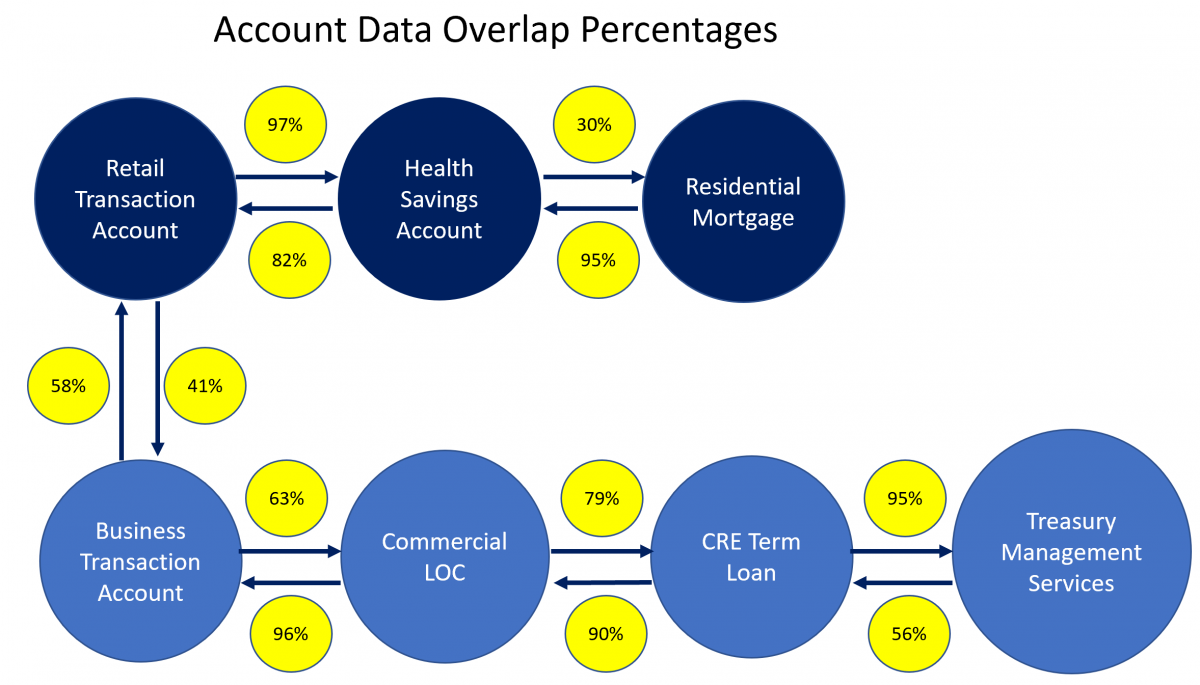

With this premise in mind, as you can see below, there is a material overlap of required and desired data for most bank products. In our example of common bank products below, the worst case is that you likely already have about 30% of the data you need to open that next account and in some cases almost 100%. If you are going to open a line of credit for a customer, then you better at least try to open a transactional account at the same time since you have almost all the information required.

Now, let’s take a look at an all-too-common example – Usually, a bank starts with wanting to open retail deposits online and in the branch. They find a vendor and then roll the product out.

The problem comes about when the bank wants to introduce the next online application. If you just rolled retail deposits out, you are likely going to want to tackle commercial deposits for partnerships next so that businesses can open an account for both the business and the owners? However, many online account vendors can’t handle commercial accounts. So then, what is a bank to do? Take customers through an entirely different process for what is essentially the same product?

If you have chosen a quality vendor, then they can likely handle retail, sole proprietorships, and partnership deposits, but what about an account with the same primary holder but with different beneficiaries? What about corporations, S-corps, health savings accounts, or trust. One day soon, you will need all those online and be able to support various channels such as online, mobile, branch, call center, voice, and personal devices.

Then there is the question about what to do about loans. Opening a deposit account at the same time as you take a mortgage application has been one of the most proven ways to generate deposits. You essentially have all the information you need in a mortgage application to cover a transaction account, so why not combine them and save the customer time, while boosting your bank’s profitability?

In a similar vein, banks should strive to achieve a transaction account, line of credit, and commercial real estate financing for all qualified business accounts as it not only increases profitability but dramatically reduces credit risk for the bank by being able to monitor cash flow. A bank should make it as easy as possible to open all those accounts at once.

The Solution – The Dynamic Application with Standardized Underlying Processes

The solution is to plan and choose a partner or partners to handle all your needs now and in the future on a single workflow framework and platform. The ultimate goal is to be able to both a single and then incremental dynamic application that meets the customer’s needs. For example, if a small business wants a transaction account, savings, money market, and line of credit facility, they should be able to get it with one application. If the customer then wants an additional transactional account, receivable financing, and real estate financing, they should be able to achieve that with the minimum fields possible.

To drive this point home, consider if done correctly, that secondary, incremental application for the transaction account, receivables financing, and real estate financing would take the verification of about 14 fields and the input of approximately 12 new line items. This can be done in less than 10 minutes online or mobile. Compare this to the customer walking to another bank and spending more than 90 minutes getting the same set of facilities. The digital bank should be able to not only win this business every time but do so at a cheaper cost and lower risk – which also might translate into better customer pricing.

The next best case is to be able to take the customer through multiple applications but has all the fields populated to save them time. This also takes some pre-planning and, while not ideal, since you have to bring the customer through the entire application process in a linear fashion, at least you save the customer time by pre-populating fields. Using this methodology, the customer could complete the incremental application in approximately 35 minutes.

Making The Investment In the Future

Here, a bank has a decision to make – many banks have chosen their vendor based on their ease of install. However, creating dynamic applications will take a little more work upfront as the bank has to think through the process of the customer journey. However, while this will likely take you an extra 240 hours of time and development effort and an additional $50k in development cost, this pales in comparison to having to redo your application process in the future or making the customer go through entirely different processes for each product.

Before You Do Anything, Get Your Underlying Processes Right

Contained within a deposit or loan application are a half-dozen sub-processes that banks need to further consider. Banks are going to need a single electronic signature platform, identity verification, payments platform, data structure, and possibly access controls. A bank should choose these solutions first since these processes will be used for more than just account opening.

Where to store all this data is also a challenge to think through. For example, to open an account through your mobile channel, you will want to capture the device profile for security reasons. Where are you going to store that? Most community banks only read and write to their core system. The worst case is that many cores cannot handle this number of structured and unstructured data fields. Even if your bank’s core system can handle it, it will likely be expensive, slow, and inefficient. Far better to write the data to a data warehouse or third-party application such as Salesforce or other open customer relationship management system (we call it the “Customer Core”).

For example, identity verification will likely be used in the branch, call center, chatbot, and third-party applications. As such, figure out your identity process first and then seek digital account opening vendors that can accommodate. This not only ensures a consistent experience across customer journeys but has the huge advantage or scaling your investment as well as creating a single process to train your employees on.

Putting This Into Action

While every bank has a “digital transformation” initiative, it pays to think through the future of what your bank might want to do over the next five years. Building the foundation now with the right design, partners and platforms will pay off immensely in the future. While you may not be as accurate as if you licked the application process, at least trying to see where you might go will get you close enough to declare success both now and in the future.