Loan Floors and the Zero Interest Rate Environment

We are working with numerous community bankers to develop strategies for instituting floors on commercial loans. The idea of protecting floating or adjustable rate assets is not new to community bankers, but the current interest in this concept is spurred by specific and unusual communications and market developments that are worth analyzing. In this blog, we will discuss the reasons for the current banking industry’s interest in floors on earning assets and the possibility of interest rates heading to zero. In our next blog, we will outline specific strategies that we recommend to community banks in dealing with adjustable-rate loans and how to consider the feasibility of using floors in commercial loans, and the cost/benefit analysis for various strategies.

What is ZIRP

After the Great Recession, many central banks turned to unconventional monetary means to stimulate their economies. The European Union member nations and Japan decided to employ zero interest rate policy (ZIRP) to combat deflation and promote economic recovery. Although for Japan, ZIRP was not a new policy after two decades of slow growth. EU and Japanese central banks continued past ZIRP and took orchestrated steps to achieve negative interest rates. By contrast, the United States and the UK the central banks lowered interest rates to near zero but not negative.

Unfortunately, for various reasons, ZIRP has been unable to stimulate economic growth and increase inflation in both the Japanese and the EU economies. The primary benefit of ZIRP is that near-zero interest rates lower the cost of borrowing, which can help spur spending on business capital, investments and household expenditures. However, ZIRP has been widely criticized and deemed generally unsuccessful in Japan in the EU. The downside of ZIRP is well documented. The risks to the Federal Reserve and the US economy of lowering rates to zero now include the following:

- It penalizes savers by lowering the return on safe deposits,

- It reduces a central bank’s ammunition if and when the economy falls into the next recession,

- It would encourage large-scale capital flight to other countries where returns are higher (this is currently the situation in Japan), and;

- It would reduce the supply of credit in the economy, as the banking system would be handicapped by an inability to earn an acceptable spread on loans (this is currently the situation in both Japan and Europe).

The conclusion by most economists and pundits is that the Federal Reserve will resist, absent a severe shock, cutting interest rates to zero. In fact, many Federal Reserve members are on the record that the current monetary policy is already doing too much today to distort the economy.

Loud Voice for ZIRP

There is one thunderous voice for ZIRP and that is the president of the United States. The President has repeatedly attacked the Fed for not doing enough to support his growth agenda, arguing for rates to be cut to zero or even negative, and calling Fed officials “boneheads” for not cutting rates to zero.

The President’s argument for more monetary stimulus is two-fold: first, it would offset the ZIRP pursued by other central banks and boost economic growth (unfortunately, it is the same monetary strategy that is not working in those other countries), and second, it would allow the federal government to refinance its outstanding debt at lower rates. Again, unfortunately, the federal government debt is not callable (like a residential mortgage) and cannot be paid off with lower coupons bonds. The fixed interest rate on existing debt is set for many years, and only new debt can be issued at lower coupons.

The US consumer and corporation have been benefiting from very low-interest rates for over a decade, and the liquidity in the market has led to additional stock buybacks. Additional liquidity from the tax cuts led to even more buybacks. So it is puzzling why additional cash via even lower rates would result in anything other than more buybacks.

So is the President’s strategy anything but of background noise that should be discounted? The market believes that to be the case.

Market Expectation

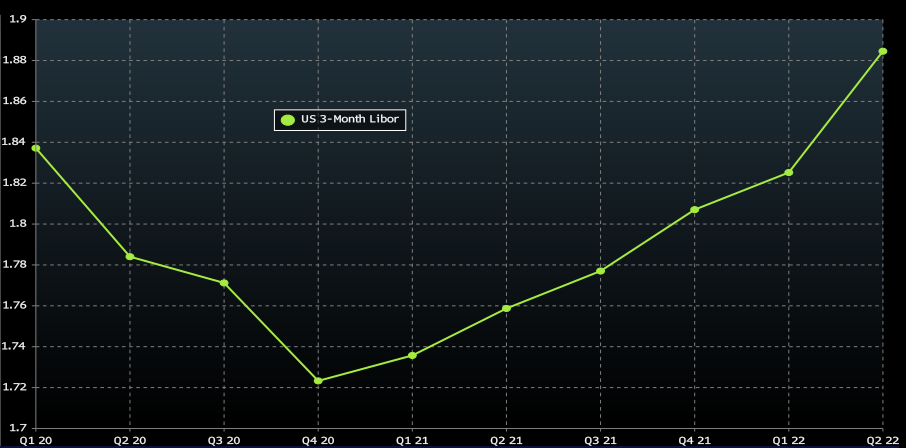

We can look at economic prediction and market pricing of interest rates to discern the probability of ZIRP in the US. The graph below shows the average of 40 economists’ forecast for short-term rates (3-month LIBOR) for the next ten quarters. The economists do not forecast zero interest rates but do forecast approximately a 12bps decrease. A similar muted outlook holds for the 10-year Treasury rate.

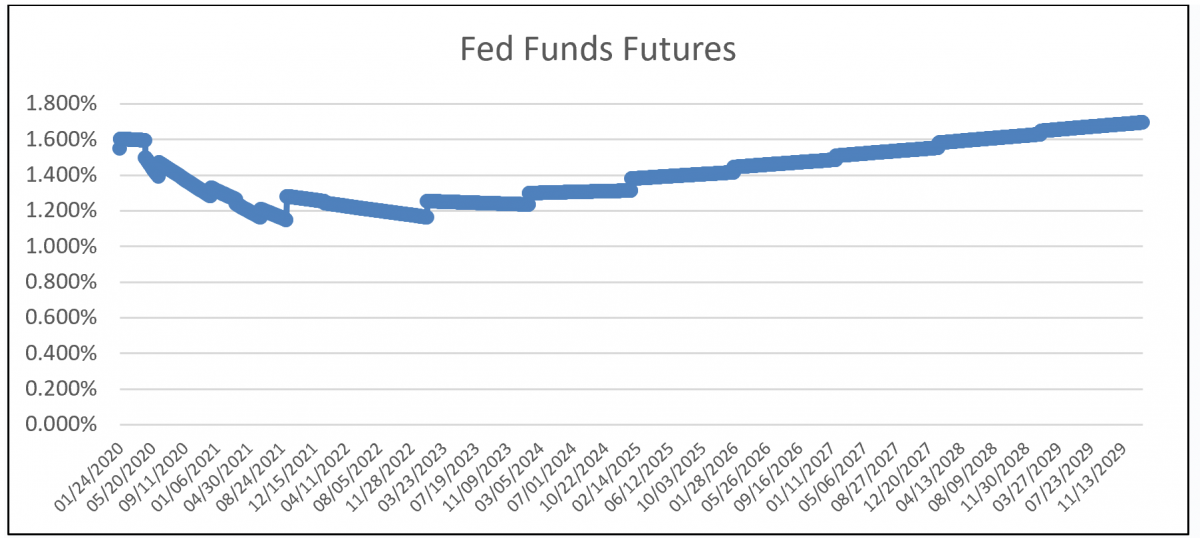

We also look at Fed Fund futures, one of the most liquid markets in the world, to discern the market’s expectation of future interest rates. The graph below shows the market’s expectation of Fed Funds for the next ten years. Again, the conclusion is that ZIRP is not an expected outcome. The base case for the market is one or two rate cuts over the next two years and then increasing interest rates.

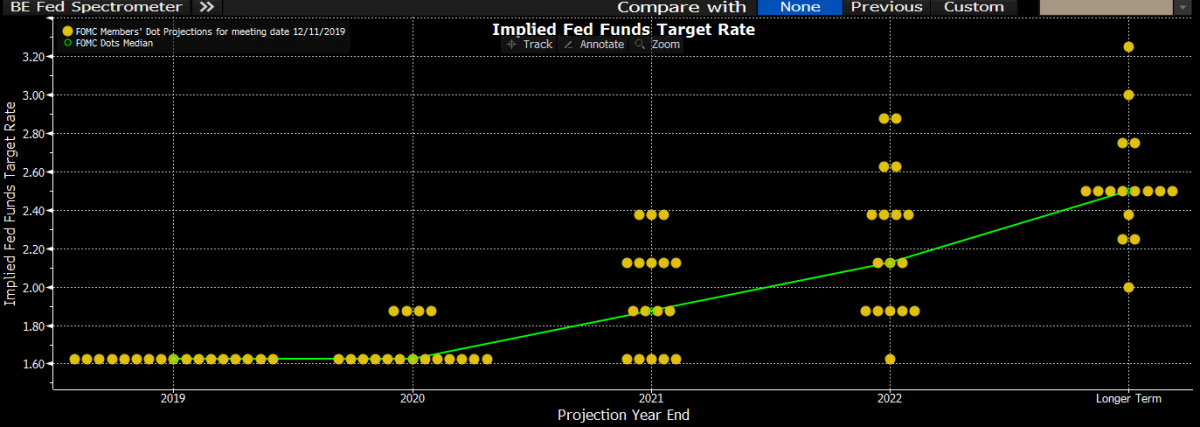

Finally, we can observe the expected path of future rates directly from the monetary policy decision-makers. The DOT plot from the last FOMC meeting appears below, showing that none of the members expect to lower interest rates over the next two years.

Expectation versus Risk

Despite the questionable efficacy of ZIRP, the discount of the loud voice advocating for ZIRP, and the market’s expectation for no ZIRP, there is still a possibility that interest rates will decrease in the future and still a possibility, however remote, that interest rates to go to zero or even below zero in the US. Banks that buy floors do not do so with the expectation that the floor pays out, but instead floors act as a catastrophic insurance policy. So how should banks assess the cost/benefit buying or structuring protection from decreasing interest rates? In next week’s article, we will outline specific strategies that other banks have deployed, and we will assess the cost/benefit of buying interest rate floors and compare that cost to various alternatives in structuring loans to provide the best yield for community banks.