Are Credit Tenant Loans Profitable?

A credit tenant loan (CTL) is typically structured as a loan secured by the real estate pledged as collateral, with or without personal borrower guarantees, and, most importantly, the obligation of a credit-rated tenant of that real estate to pay rent. These loans have both bond and loan qualities. They are like a bond in that the credit-rated tenant has an obligation to pay rent and this is typically a senior obligation of the tenant. The CTL also has qualities of a commercial mortgage with senior borrower obligations and real estate collateral. Unfortunately, banks that do not often compete for CTLs tend to misprice these credits by a wide margin.

Example of a Credit Tenant Loan

A community bank that we work with was lamenting that the competition was undercutting pricing on a CTL by about 10 to 20bps (depending on the term shown). Our bank was pricing the $2mm term loan at SOFR + 2.15%, with the borrower having the option to fix that rate anywhere from 5 to 10 years using the ARC program. The bank would also earn 25bps hedge fee equal to about $27k to $40k (depending on term). The loan would cashflow over 1.25X and be within 75% LTV. The borrower would agree to a bad-boy guaranty. However, in this case, the credit tenant was Starbucks Corporation which is an investment rated entity (BBB+, Baa1) and issues fixed-rate, unsecured debt at 4.65% (equivalent to SOFR + 20bps).

Neither our community bank nor the competitor was properly analyzing this credit opportunity. The CTL is usually less risky than a comparable commercial mortgage and, therefore, priced accordingly. Community banks have historically shied away from CTL financing for the following three reasons: lower loan yield, longer-term, and lack of personal guaranties. But we feel that CTLs offer community banks profitable lending opportunities.

General Credit Considerations For Credit Tenant Loans

CTLs are structured to be safer than a traditional commercial mortgage or an unsecured bond with similar credit ratings because the lender benefits from both the credit profile of the rated tenant and the real estate collateral. There are three key elements of analyzing a CTL: credit risk assessment of the tenant, lease structure review, and property risk consideration. Most community banks are well-positioned to analyze all three elements.

There are five key aspects of CTLs that make them especially attractive to community banks.

- Improved credit quality – CLTs typically benefit from a lower risk of tenant default. In our example, the tenant (Starbucks Corporation) is an investment grade credit with a one-year probability of default of 0.0115% as calculated by Bloomberg default grade scale. This default rate is an order of 100 times smaller than the average NOOCRE credit. The credit default market requires only 94.5bps per annum fee for default protection.

- Better stress testing – The quality of cash flow to service debt must be measured at inception and in down-case scenarios. By definition, tenants of CTLs are publicly reviewed, and banks can analyze financial performance and estimated future cash flow. For Starbucks Corporation, as an example, banks can review various sources for three years of forecasted revenue, forecasted gross margins, and forecasted EBITDA. Banks can then stress test based on perceived threats to the business model. A CTL allows a bank to choose businesses that demonstrate financial stability and quality of cash flow. The graph below demonstrates Starbucks Corporation’s historical share price, credit default premium, and 1-year probability of default in the market for the last five years.

- Better loan structures – Many CTLs are not typically supported by personal guarantees, but the common LTVs (75%) result in better debt yield than average commercial mortgage loans. Further, the longer-term leases allow banks to amortize a larger portion of the loan based on 10 to 20-year terms. In fact, many CTLs are fully amortizing and benefit from no balloon payments. Longer-term loans offer a benefit to both the borrower and the bank as the principal on the CTL amortizes, the equity value of the collateral increases. Therefore, while the visibility horizon on the tenant’s credit profile decreases with time, the equity buildup in the real estate collateral offsets the risk of the loan.

- Quality and frequency of borrower/tenant information – During recessions and sudden shocks, it is crucial for banks to get frequent financial reporting and updates. CTLs allow lenders to access quarterly public data and, in many instances, daily credit data in the form of the tenant’s credit default swaps or bond pricing. By contrast, most commercial mortgage borrowers provide annual financial reporting with long delays.

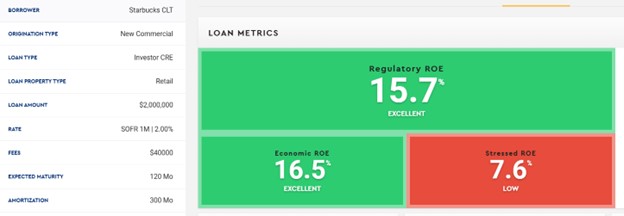

- Pricing – For assorted reasons (liquidity, loan size, agency risk) CTLs are much richer priced for the level of credit risk than equivalent corporate bonds. In our example, the bank can win this loan at approximately SOFR + 2.00%, while the bond market is pricing the tenant’s unsecured debt obligation at SOFR + 20bps. The CLT benefits from real estate collateral, and possibility of future business with this borrower and potentially cross-sell opportunities. CLTs create an opportunity for community banks to lock in top-quality credit assets, that if properly structured with a prepayment provision, will stay on the books for 10, 15, or 20 years yielding above-average returns with minimal credit risk and the upside of additional business with the borrower. Community banks have an added advantage in sourcing CTL opportunities between $1 and $5mm in size where larger banks would prefer opportunities above $10mm. At smaller loan sizes, local equity investors would prefer a local lender with an intimate understanding of the market. We ran our loan through Loan Command, our risk-adjusted return on capital (RAROC) model (below), and the regulatory ROE is 15.7% (an acceptable return for a standalone credit with no additional assumed cross-sell opportunities).

Conclusion

CTLs offer community banks a unique opportunity to originate long-term profitable and low risk loans. These credit tenant loans, in addition to being profitable on a standalone basis, also add some level of diversification to the lending portfolio. Credit tenants tend to be less susceptible to regional downturns and credit shocks that hit particular industries such as hospitality or energy.

We encourage lenders to approach their CFOs to compare the yield and ROE on these loans versus buying the underlying tenant’s bond or credit default swap. In most cases, these CTL opportunities generate superior risk-adjusted returns and potential for additional business with the borrower.