How to Reduce Risk and Turn Construction Lending Profitable

In today’s competitive commercial lending environment, banks must continually balance the risks and rewards of different loan structures. Nowhere is this tension more visible than in the decision to offer a standalone construction loan versus a construction-through-permanent (construction-to-perm or “single close”) loan. Though construction lending inherently involves elevated risk and complexity, banks that opt for the longer-term construction-through-perm structure enjoy greater profitability and lower long-term risk.

The Problem with Traditional Construction Lending

Construction lending is among the most challenging and least profitable credit products in a bank’s portfolio. According to industry data and loan pricing modeling, these loans carry significant disadvantages:

- High Risk Exposure: Construction loans involve three key types of risk: acquisition/permitting risk, construction risk, and lease-up/market risk. Banks often bear much of the risk but receive debt-level returns.

- Short Duration & High Costs: The typical construction loan lasts only 6 to 24 months. During this short life span, the loan demands intensive monitoring and administrative support, which can cost over $2,100 per month—two to ten times more than traditional commercial real estate loans of comparable size.

- Inefficient Capital Use: Because construction loans are drawn down over time, they often average only 50–60% utilization. This reduces interest income and further diminishes ROE.

- Negative Initial Returns: At origination, the ROE on a construction loan is negative due to high upfront costs. This is the case even with origination fees of up to 1.00%, depending on the loan size. Many banks fail to account for this in their pricing models, especially when they omit construction timelines.

- Competition for Term Takeout: After the construction period ends, national banks, insurance companies, and conduits often swoop in to offer long-term term loans, leaving the original construction lender with high-risk, low-return exposure and no long-term relationship benefits.

In summary, construction-only loans offer elevated risk with short-lived and uncertain rewards. For banks aiming to build shareholder value and maintain long-term relationships, this approach may be suboptimal.

Why Construction-Through-Perm Loans Are Superior

A construction-through-perm loan addresses the above challenges directly by bundling the initial construction loan with a long-term amortizing facility—often 5, 10, or even 20 years—executed at the outset as a single closing with either one or two notes. This strategy transforms a high-cost, high-risk transaction into a stable, long-term relationship. Here is why:

- Improved Risk Management

Combining a construction loan with a permanent takeout loan helps mitigate several types of risk:

Credit Risk: With a pre-established fixed-rate term loan, the borrower’s debt service coverage ratio (DSCR) is underwritten based on stabilized cash flow, making future defaults less likely.

Refinancing Risk: The borrower avoids the uncertainty and cost of refinancing after construction. This is particularly valuable during volatile or rising interest rate environments.

2. Stronger Profitability and ROE

Most importantly, risk-adjusted returns increase significantly when measured over the full duration of the construction-plus-perm term. While a standalone construction loan may yield a 3% risk-adjusted return or even a negative ROE, combining it with a 10-year permanent loan can drive the average return to 15–18%.

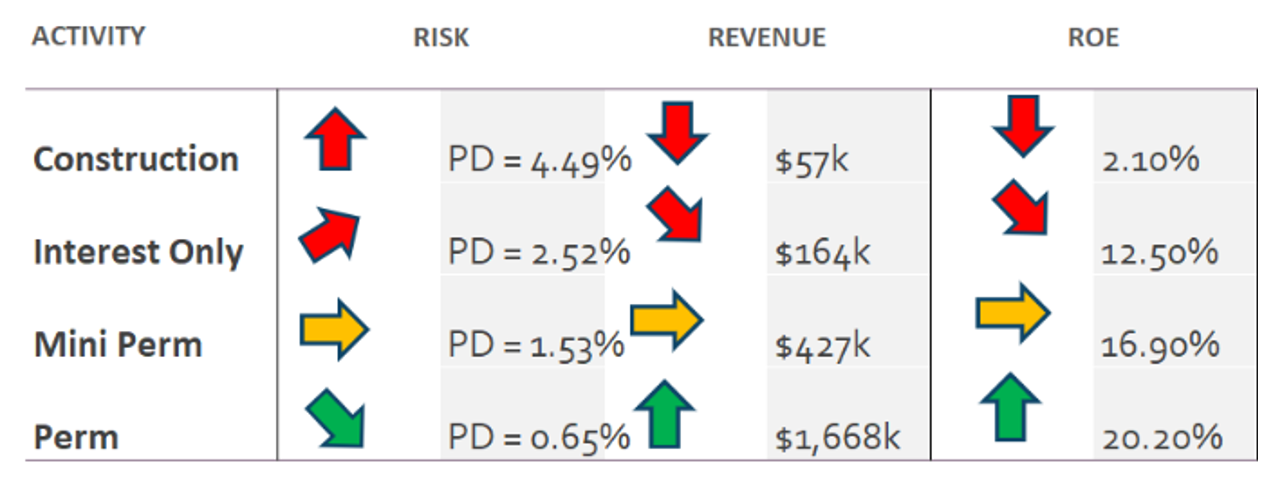

In comparing three options for a $2.1 million senior-secured construction loan for a four-unit industrial property, a bank considered four options as outlined below:

Option A: Construction loan (1-year)

Option B: Construction loan (1-year) + 1-year interest-only (IO) period

Option C: Construction loan (1-year) + 1-year IO period + 2-year mini-perm

Option D: Construction loan (1-year) + 1-year IO period + 10-year fully amortizing permanent takeout

The results based on a RAROC model were conclusive (see graph below). Option D not only yielded the highest revenue and highest ROE, but it also presented the lowest default risk.

This aligns with the principle of Customer Lifetime Value (CLV), which banks must consider by justifying the high acquisition and servicing costs of commercial customers. CLV increases directly with the duration and stability of the loan. Construction-only loans deliver low or even negative CLV, while construction-through-perm loans allow banks to extend the relationship, capture long-term interest income, and amortize acquisition costs over a longer horizon.

3. Reduced Competition and Stickier Customers

One of the greatest hidden costs of standalone construction loans is customer churn. After project completion, many borrowers shop for better long-term terms elsewhere. By embedding the term facility at closing, banks effectively remove the customer’s option to exit. Locking in the permanent loan at construction start ensures the bank retains the plum portion of the relationship—the long-term, low-maintenance, profitable term loan. An embedded prepayment structure discourages the borrower from replacing the term facility prematurely, thereby preserving the bank’s long-term revenue stream. Lastly, many large institutions (e.g., insurance companies, credit unions) avoid construction loans. By offering a comprehensive construction-through-perm product, community banks can carve out a valuable niche and even upcharge for the added value.

Creating a Win-Win Relationship With Construction Lending

Construction-through-perm loans are not just beneficial to banks – they may also be attractive to borrowers, which further reduces credit and relationship risk:

Rate certainty: The permanent loan rate is locked in at the start of the construction project, offering critical stability during uncertain economic periods.

One-time closing: Borrowers save significantly on legal, origination, and documentation costs by avoiding a second closing.

Relationship continuity: Borrowers appreciate dealing with one lender through both construction and long-term operations, rather than re-qualifying or negotiating new terms with a second institution.

Conclusion: Build Relationships

Some bankers may assume that shorter commitments reduce risk, but the construction-through-perm model proves that longer commitments can reduce total risk while boosting return – especially for senior secured, amortizing real estate-secured credits. The key lies in matching the loan structure to the borrower’s project timeline and market risks.

Construction loans, when viewed in isolation, are among the least attractive lending products a bank can offer. They are complex, expensive to administer, and fraught with risk. However, when paired with a pre-committed permanent loan, they become the gateway to long-lasting, profitable customer relationships. By embracing construction-through-perm structures, banks may reduce exposure to volatile lease-up or refinancing risk, improve ROE and CLV dramatically, secure long-term revenue through sticky borrower relationships, and differentiate themselves from competitors who avoid the construction phase altogether.