How Loan Term Drives Profitability

In a previous article (HERE), we discussed several factors that drive loan and bank profitability. We covered in detail how and why community banks can increase loan size to improve return on assets (ROA) /return on equity (ROE). In this article, we will consider how and why loan term is a significant driver of profitability for community banks and what community banks can do to improve performance.

Relationship Between Loan Term and Profitability

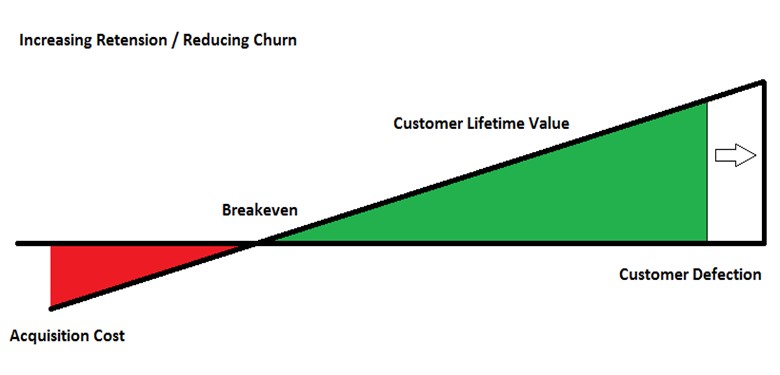

Four primary factors drive the relationship between loan term and ROA/ROE. The first factor is that commercial loan underwriting has a high upfront cost. The cost to source, underwrite, approve, document, and fund a loan is large compared to the expected profit margin of that loan. Because of thin margins and high origination cost, a loan ROE turns positive for a bank after substantial amount of seasoning. While the cost to book a loan is high, the ongoing maintenance cost is relatively low and as the loan continues to pay, the profitability to the bank increases. The graphic below demonstrates the negative return of a loan to a bank and how ongoing payments increase the ROA/ROE to the bank after a certain breakeven point. Bank performance is maximized by increasing loan retention and reducing customer defection.

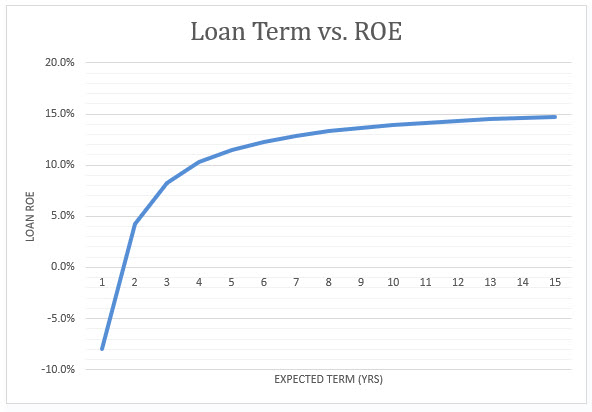

When we study the sensitivity of a single loan ROE by varying the loan term, we can see the stark effects of loan term on performance. Using an average community bank commercial loan, we can graph the relationship between term and ROE. The graph below shows the ROE of a $500k term loan, 20-year am, priced at current average commercial loan spread of 2.50%.

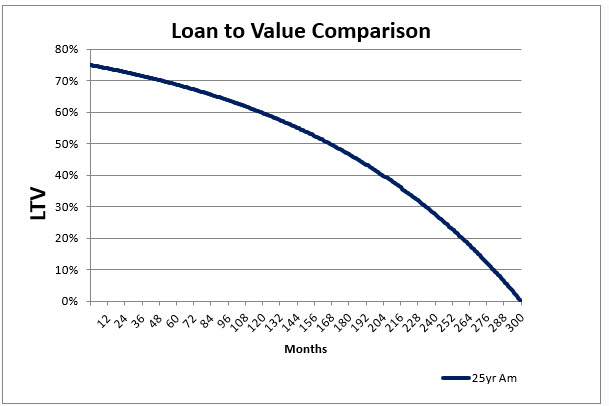

Principal reduction and credit quality is the second factor driving the relationship between loan term and ROA/ROE. As a loan seasons, the borrower continues to make principal payments increasing the equity in the collateral. The graph below demonstrates a 75% starting loan-to-value (LTV) and the LTV over a 25-year amortization period assuming no change in the collateral value. In the first year the borrower increases equity in the collateral (through principal payment) by less than 1%. In the second year that equity increase is only 2.11%. However, by year ten that equity increase is 15%, and by year 15 it is 28%. Mortgage style amortization results in little principal reduction in the first few years of the credit. Longer term loans increase collateral cushion and reduce credit risk.

Cross-sell and upsell opportunities is the third factor driving the relationship between loan term and ROA/ROE. Cross-sell and upsell, in the form of additional credit, deposit, or fee-based business increases bank performance. To obtain those cross-sell and upsell opportunities, the bank needs time to establish a trusted relationship, understand the client’s needs, and, most importantly, stay connected to the customer while the business grows, and banking needs expand. Longer loans create a longer runway for cross-sell opportunities and tend to establish longer customer relationships.

Prepayments is the fourth factor driving the relationship between loan term and ROA/ROE. Commercial loans do not tend to prepay equally over time. Borrowers accelerate prepayments and switch banks more readily as credit commitments approach 12 to 24 months to maturity. If the initial loan term is three years, a bank is again in competition with the market for that customer within one or two years of originating that three-year loan commitment – this is not enough time to generate to maximize ROA/ROE. Borrowers are much more reluctant to prepay a commercial loan with eight or 13 years remaining on a credit commitment priced at market rates (assuming two years into a ten or 15-year commitment). Borrowers value the long tail remaining on the credit facility and the burden of switching costs. Prepayment propensity for short-term commitments convert possible relationship clients into transaction clients – leading to high loan churn and it puts community banks in competition more often than necessary.

Conclusion

The rebuttal is always presented that short-term loan commitments protect the lender from adverse credit trends. We do not agree with that logic. When credits deteriorate, shorter-term commitments only help banks when another lender does not recognize that deterioration and is willing to refinance the ailing borrower. This strategy of expecting another bank to make a credit mistake to take out a problem loan does not work in the long term in a competitive market.

Community banks must create products and strategies that lengthen the expected life of the client relationship with the bank. There are many ways to do this – including, commercial loan prepayment provisions, assignable and assumable loan structures, better treasury management products and selecting true relationships over transactions. One good starting point is to reconsider reluctance to longer-term commitment terms. The average life of a five-year loan is only two to three years, and the average life of a three-year loan is only one or two years; this is not enough time for banks to optimize ROE.