Loan Prepayment Speeds and Community Bank Profitability

When pricing and structuring commercial loans, few community bankers consider factors that affect commercial loan prepayment speeds. Further, even many sophisticated loan pricing models do a poor job of modeling commercial prepayment speeds. But loan prepayment speed is a major factor influencing a bank’s profitability and, in this article, we will outline why this is so, and the considerations community bankers must address to manage loan prepayment speeds. We note that national and super-regional banks use historical analysis, sophisticated quantitative modeling, and other predictive analytics to increase loan retention (decrease loan prepayments), which is a significant driver of their commercial loan portfolio profitability.

Relationship Between Prepayment Speeds and Profitability

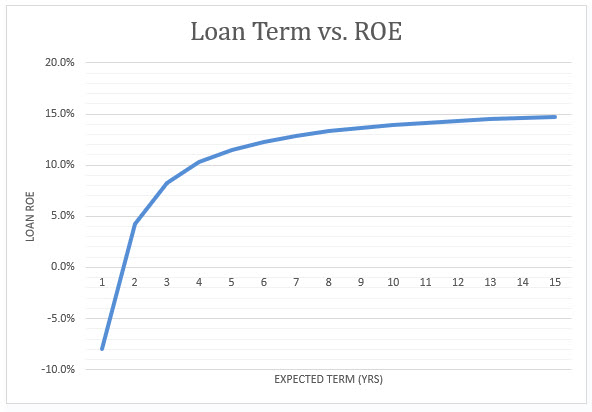

As an introduction, we would like to restate our core loan profitability principle – banks are in the business of keeping loans, not making loans. Making a loan is expensive when considering the cost of sourcing, underwriting, approving, documenting, and funding a commercial loan compared to the expected profit margin of that loan. A commercial loan’s profitability profile is shown in the graph below. The average commercial loan will not generate profitability for a bank in the first year or two. But that same loan, over time, can produce substantial return for the bank.

The graph below demonstrates the relationship between term and ROE. The graph shows the ROE of a $500k term loan, 20-year am, priced at current average commercial loan spread of 2.50%.

Below is a list of factors that explain the relationship between commercial loan prepayment speeds and bank profitability.

- Thin credit margins and high origination cost result in longer seasoning time to turn the average loan ROE positive for a bank.

- Lower prepayment speeds also lead to more cross-sell and upsell opportunities for bank. To obtain those cross-sell and upsell opportunities, the bank needs time to establish a trusted relationship, understand the client’s needs, and, most importantly, stay connected to the customer while the business grows, and banking needs expand.

- Principal reduction drives credit quality and, in turn, ROE. As a loan seasons, the borrower continues to make principal payments increasing the equity in the collateral.

- Lower prepayment speeds dampen competition for loan origination. Consider two banks with a $1Bn commercial loan portfolio (same credit quality, overhead and maintenance costs, etc.) with only one material difference – because of loan prepayment speeds, portfolio one has an average loan life of 8 years and portfolio two has an average loan life of 2.3 years (about average for a community bank). To grow its loan balance by 5% in a year (a reasonable target), the bank with portfolio one must originate only about $80-$100mm in new loans to offset prepayments and amortization and achieve $50mm in loan balance increases. But the bank with portfolio two must originate about $410-$430mm in new loans to offset prepayments and amortization and achieve the desired $50mm increase in loan balances. The bank with faster loan prepayment speeds will require more lenders, underwriters, and loan processors to retain and grow its loan base, and new production will more likely be thinner priced because a larger portion of new bookings originated in competition with incumbent lenders. This bank will necessarily demonstrate a higher efficiency ratio for the same growth rate.

Factors Driving Prepayment Speeds

The problems that community banks face trying to predict prepayment speeds are that there are dozens of factors influencing commercial loan prepayments, some of the factors are financial and some personal/business driven, some of the factors are interrelated (correlated), and some factors are probabilistic instead of deterministic (they do not lend themselves to direct outputs). The germane input factors that influence prepayment speeds are the following:

- Loan contractual maturity – longer loans will prepay slower than shorter term loans.

- Loan size – all else equal, larger loans will prepay faster than smaller loans.

- Non-economic/personal factors.

- Vintage and business cycle will influence prepayments.

- The shape of the yield curve will favor certain term structures to prepay faster or slower.

- The strength and enforceability of the prepayment provision is one of the most important determinants of prepayment speeds.

- Loan category will affect prepayment speeds.

- Debt service coverage and LTV influence prepayment speeds. Lower credit quality loans will exhibit lower prepayment speeds.

- The index used to price the loan also has a bearing on prepayment speeds.

Conclusion and Applicability

Community banks must consider products, clients, loan structures, and strategies that lower prepayment speeds and lengthen the expected life of the client relationship with the bank. There are many ways to do this – including, commercial loan prepayment provisions, assignable and assumable loan structures, better treasury management products and selecting true relationships over transactions. We will publish a future article explaining the interrelationship between factors driving prepayment speeds and loan profitability and highlight certain strategies that community banks can use to increase profitability without having to pass any costs or additional fees to commercial borrowers.