3Q Loan Pricing Insights

Over a thousand community banks work with us in various capacities across the country. We observe and measure commercial loan pricing (on average we see over a hundred commercial loans per week). Our bank customers range in size from under $100mm to over $10B in assets. We see pricing on commercial loans as small as $200k and as large as $100mm. Our customer banks win loan business, and in certain cases they do not, based on pricing, structure, and product offering. In this article, we will share germane loan pricing insights on commercial pricing trends, credit structures, and return calculations.

Themes and Loan Pricing Insights

This year, the average commercial loan size in our ARC program is $3.05mm and the range is $200k to $26mm. Over the years, the average credit spread is relatively steady at 2.41% over SOFR. The average loan term is 9.1 years (skewed higher by long-term CRE loans). The average amortization is 22 years. A graph below demonstrates the trend in credit spread (average, high and low).

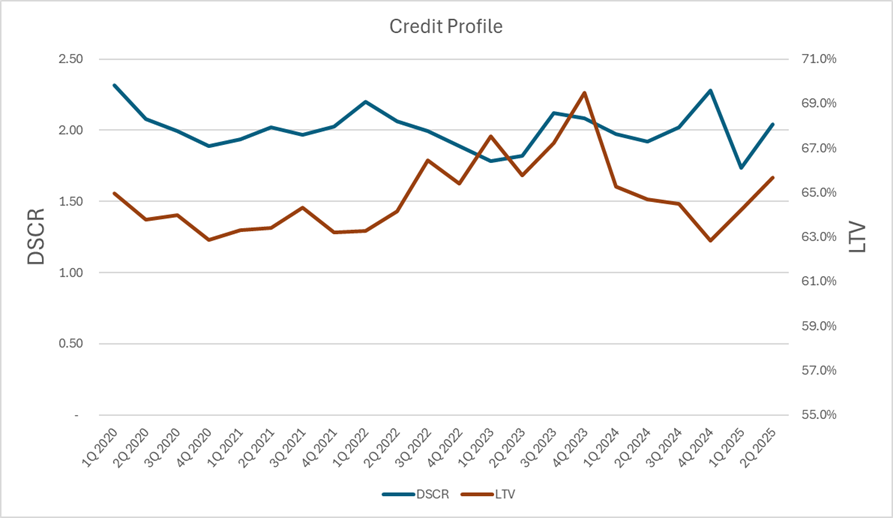

The credit profile of this same group of commercial loans (DSCR and LTV) appears in the graph below. The average DSCR is 2.01X and the average LTV is 64.9%. There is an observable correlation between loan size, credit quality, term, and the credit spread. Longer term deals, higher credit quality, and larger loan size all tend to price at a narrower credit spread.

ROE Explanation

There are some interesting takeaways from this observed data. First, the loans in this data set demonstrate larger size – on average they are almost ten times larger than the average community bank loan size. Second, they are longer term relationship credits – bank and borrower commit to longer terms with strong prepayment provisions. Third, the credit quality is superior to the average credit.

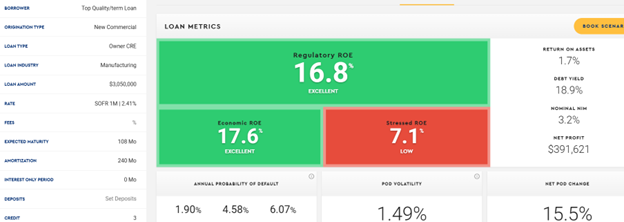

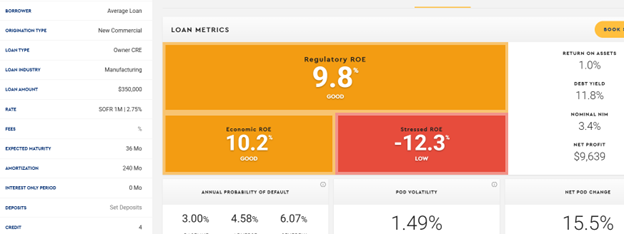

The market (in a broad sense) prices to risk-adjusted return on capital (RAROC), and not on credit spread. So how do these loans price on a RAROC basis (you can get our model for free HERE)? We priced the average loan for a community bank ($350k, 3yr term, 1.25 DSCR, and 75% LTV, 2.75% credit spread) and the average loan we observed in our ARC program as described above. We excluded any fee income, cross-sell or upsell opportunities.

The first screenshot below shows the larger loan with a tighter credit spread of 2.41%. Despite the thinner pricing, because of the loan size, credit quality, and commitment term, the economic ROE is 17.6%. The second output below shows the RAROC output for an average loan size of $350k, 3yr term, and a general industry average credit spread of 2.75% over SOFR. The economic ROE is 10.2%, which coincidentally is remarkably close to the average industry ROE. Despite the credit spread advantage, the smaller, shorter, less credit-worthy loan results in lower return on equity and lower stressed ROE (the ROE expected in a credit downturn).

While not every loan originated at a community bank can be $3mm, with long term commitment, and stellar credit quality, to achieve top performance one of our most critical loan pricing insights is that banks must spend resources seeking such credits and price them accordingly. The regulatory and economic ROEs shown in the screenshot above do not incorporate crucial contributors to ROE such as fee income, deposits, and other cross-sell businesses. However, the results build an important directional opportunity for community banks.

Conclusion

Our industry suffers from severe opaqueness where a small number of relationships generate the bulk of the profits, most relationships are breakeven, and a few relationships detract from ROE with negative contribution to overhead. Banks report and gauge performance based on the sum total of individual accounts, but within that average there is tremendous opportunity for bankers to improve performance by allocating resources to retaining and attracting top accounts, migrating mediocre accounts to profitability, and understanding the cost of doing business with negative ROE clients.

If you need a profitability model to help with the pricing of loans, deposits and relationship, check out Loan Command by signing up today.