Loan Structures That Profit

In a competitive lending market, community banks are looking for an edge to win quality loans. On quality credits, many community banks are eliminating loan origination fees and prepayment provisions to differentiate from competition. Since it is easy for any bank to eliminate fees and prepayment provisions, that competitive advantage quickly becomes commonplace and no bank wins. However, we can prove that in many instances, a properly structured prepayment provision drives more value for community banks than increasing the loan coupon or charging loan origination fees. The key is being able to measure the tradeoff between how various loan structures drive risk-adjusted return on capital (RAROC). In this article, we will consider how community banks can best position and sell prepayment provisions to increase RAROC.

Our Analysis

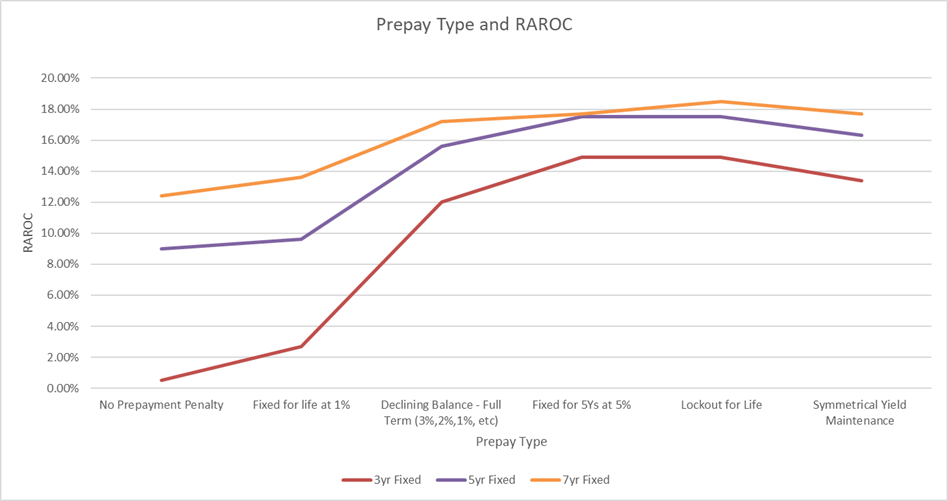

We used a RAROC model (Loan Command) with the benefit of a commercial loan prepayment model to structure an OOCRE loan and measured the impact of various prepayment provisions on the return on equity for that loan. We assumed a $1mm, new OOCRE loan origination, priced at a fixed rate (equivalent to a 2.50% credit spread) for three, five, and seven years. The LTV was 75%, and debt service coverage ratio (DSCR) was 1.30X, for a manufacturing business. The 2.50% credit spread is currently slightly above industry average for this type of credit and $1mm loan size is also slightly above average for community banks – but these loan parameters are easy to understand, replicate, and measure.

We analyzed the RAROC for each loan scenario varying only the prepayment provision. This in turn drove wide variance in the equity returns for the lender. A graph showing our results appears below.

Key takeaways from this bank’s analysis are as follows:

- As we vary the prepayment type, the stronger prepayment provisions increase RAROC return for lenders.

- The impact of prepayment provisions is more pronounced on shorter loans – meaning the prepayment provision on shorter loans vs. longer loans is a more important ROE driver for lenders.

- Different prepayment provisions (or lack thereof) vary the calculated RAROC up to 14.4 percentage points. This is a much higher RAROC sensitivity then we see for upfront fees or increased credit spreads.

- Not all prepayment provisions are equally acceptable in the market. Some prepayment provisions (such as lockout for life or fixed for 5 years at 5% of the principal amount may not be acceptable by most borrowers in the banking industry). Marketability or acceptance of a prepayment is a key factor in being able to sell the provision to a borrower.

- We assume that the contractual prepayment provisions are enforced. With the inclusion of carveouts and exceptions to the prepayment provision, returns approach the RAROC associated with no prepayment provision. We have not met a bank that does not waive a prepayment provision if the borrower refinances at the same bank – even at lower interest rates, which defeats the purpose of the provision.

4 Reasons for Prepay Provisions in Loan Structures

We continue to believe in the importance of prepayment provisions for maximizing lenders’ RAROC. There are four primary reasons why prepayment provisions increase profitability for banks. The four reasons are as follows:

- Decrease the value of the option held by the borrower to prepay the credit.

- Increase the lifetime value of the relationship.

- Increase cross-sell and upsell opportunities.

- Reduce negative selection bias in an economic downturn.

The competitive reality is that lenders and borrowers will heavily negotiate terms, conditions, and pricing for every competitive loan situation. Prepayment provisions are quite easy for borrowers to negotiate away for two reasons – first, other competitors are willing to concede them, and second, the provision is not internally compelling to the borrower. For a lender to successfully negotiate a prepayment provision (or any loan provision for that matter), the lender must convince the borrower that the competition will also insist on a similar provision or (but preferably “and”) that the provision is in the borrower’s interest. At SouthState Bank, the prepayment provision that we can most successfully sell is the symmetrical yield maintenance provision. Our bank struggles to enforce any other commercial loan prepayment provision.

Some community bankers may be thinking that prepayment provisions are simply off market where they compete. But we see the symmetrical yield maintenance provision deployed by small community banks to national banks, from commercial loans as small as $250k up to hundreds of million-dollar corporate deals, and contractual loan terms from 18 months to 20 years. What is important is to price the credit correctly and explain the benefit of the prepayment provision to the borrower. At SouthState Bank, we price loans with a symmetrical yield maintenance provision more aggressively understanding the RAROC benefit and position the loan for relationship credits that value collaborating with us for long periods. We explain the borrower’s advantage of collateral substitution and assumption that only the symmetrical yield maintenance provision can facilitate. The key is identifying the right borrowers, properly positioning, and structuring the loan, and explaining the provision to the borrower.

Conclusion and Applicability

While most banks measure and emphasize net interest margin and fee income, very few banks today are measuring the significant economic advantages of prepayment provisions within their loan structures. The right prepayment provision may increase the ROE by up to 14 percentage points. While obtaining a meaningful prepayment provision is not simple, with the right structure, explanation and with the right borrower, banks can increase their acceptance.