Managing CRE Risk – What Will Happen to Office Space?

Office lending for banks has been one of the better-performing sectors of commercial real estate (CRE) for banks for some time. Even during the pandemic, the credit on office loans is doing surprisingly well. The question arises, what happens in the future? Will it be business as usual post-pandemic? Will companies take more space to provide for social distancing, 25% of the space as they go mainly to remote workers or 50% of the space to handle a hybrid remote work culture? This article looks at various scenarios and forecasts the marginal stress that we believe is in store for many banks.

Current Performance

The latest Q3 2020 data from Costar suggests occupancy rates have only fallen by a point in the past year to 89.3%, and year-over-year national office rent growth decelerated to just 0.1%. The downside is that this performance is unevenly distributed. When looking at the largest 30 office metro markets, which account for 89% of the square footage inventory across the 390 metros that Costar tracks (95% by market value), we see that 28 of the 30 metro areas saw year-over-year rent growth deceleration in Q3 2020 versus Q3 2019. Eight of the 30 markets show negative year-over-year rent growth for an average of -1.3%, while 22 show positive year-over-year growth for an average of +1.5%.

Some markets, such as Houston, New York, and San Francisco, were already starting to experience deacceleration before the pandemic. Tech-heavy markets such as San Jose, Seattle, and Austin quickly adjusted to moving employees home and changing leases accordingly. It is not surprising that these markets are showing the most considerable growth weakness.

In many metro markets such as Seattle, Chicago, and New York, on about 10% to 20% of the office space is currently utilized. A recent poll of employers in these markets indicate 70% of Companies will look to take less space upon renewal, and many have already started to sublease their space. At present, in these markets, sublease space is up 20% and increasing.

The Lease Structure

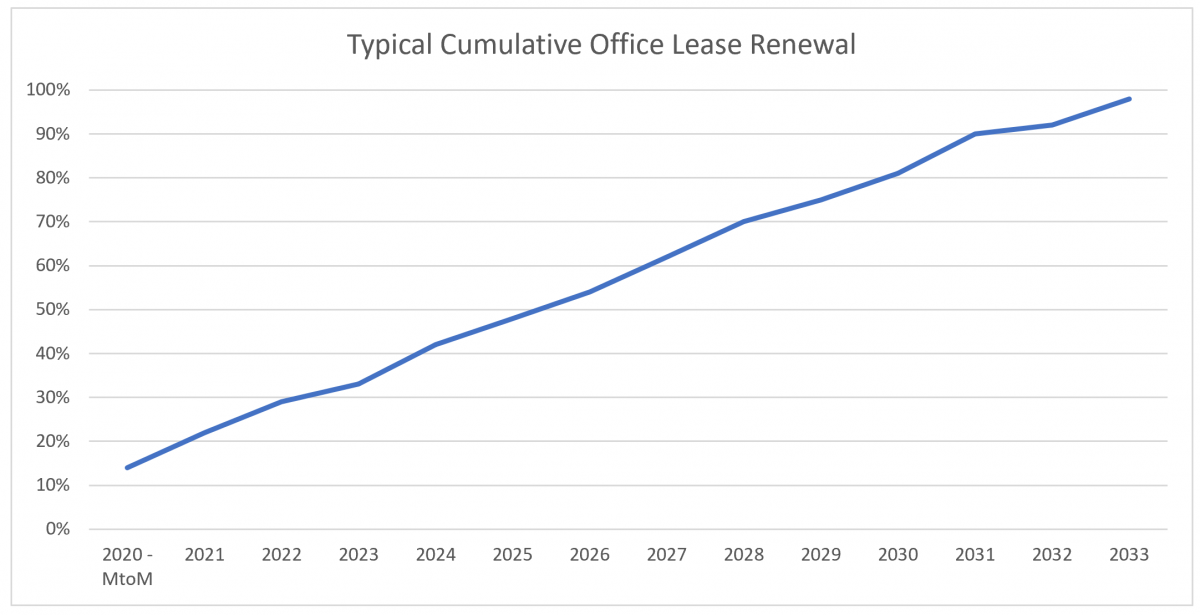

While lease structures vary from market to market, a bank usually strives to have the property manager have about 6% of their leases coming due in any given year and tries to limit month-to-month extensions to about 14% of the space. This structure has proven well in this market and is one reason while office has remained relatively stable. However, we point out that despite this optimal structure, a bank still has about 40% of the leases that drive collateral value coming due in the next three years (below). This pre-maturity lease expiration poses material refinancing risks for office loans for bank lenders.

Understanding lease expirations up to 2024 and earlier is a measure of quantifying near-term default risks as the office market will likely hit its low point in rents. Capturing lease expirations a year before and after loan maturity helps quantify the refinancing risks inherent in loans where property managers consider not only renewing leases and/or filling vacancies leading up to the loan’s likely balloon maturity but also underwriting future stabilized cash flows based on upcoming lease expirations.

At this point, it is worth stopping for a second to understand the true nature of lease risk as it pertains to CRE underwriting. We often hear in the market how the common lease structure lends itself to just a five our seven-year loan and that this is “safer” compared to a longer-term fixed-rate loan with a ten or 20-year maturity. While a bank would love to make a five-year loan on a property with 20-year leases, that is rarely the case. The reality is that there is only so much a property manager can do to manage the leases in the market, and a good property manager strives for diversity to present a lease structure similar to the one above.

However, in cases where you have 40% of the leases coming due in the next three years, it doesn’t much matter if you have a five or ten-year loan on the property as you will likely have the same outcome in both cases. If 40% of your leases reset substantially down by 30% compared to the original rental rates, you will have a restructuring in either case. In the case of a longer, ten-year loan, you may have less risk as you will have more flexibility to restructure the current terms before having an event of default.

The Structural Shift

We estimate that the average employer will save $11,000 per employee per year on rents, furnishings, supplies, insurance, utilities, maintenance, and support. A majority of employees at least would like the option to work from home, while productivity is often said to increase between 10% and 40% with savings on commute time at a minimum. A recent Microsoft survey found that 71% of managers and employees want to remain working from home post-pandemic.

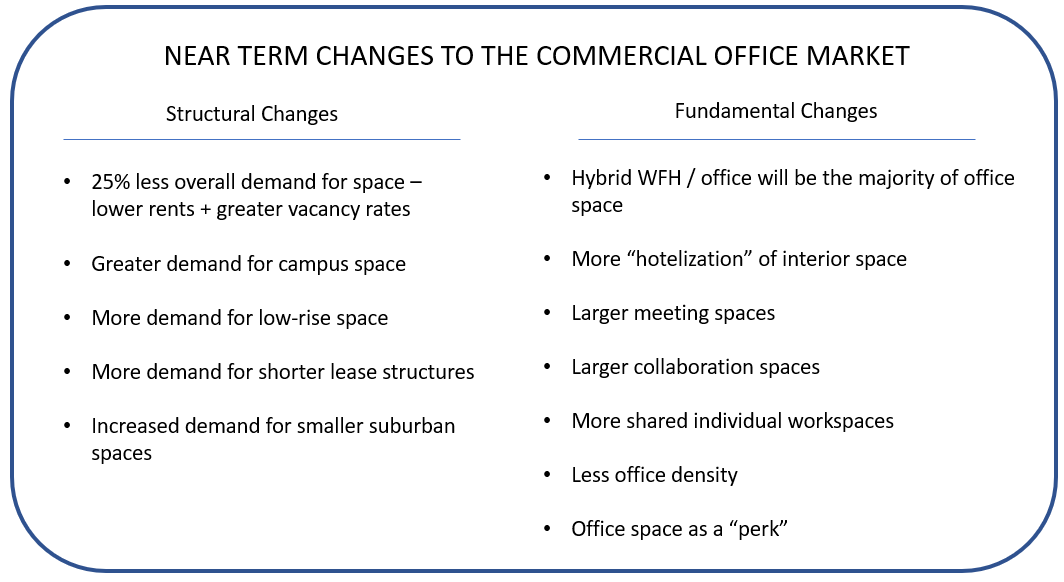

Given the experience over 2020, we predict that the office market will adjust over the next five-plus years to need approximately 25% less space as companies shift to a hybrid model, keeping some employees in the office while allowing others to work from home on a semi-permanent basis. Empirically, office net operating income growth lags GDP growth by about seven quarters, which would put the bottom in the back half of 2022. By then, we believe we will see vacancy rates peaking and effective net rents hitting their nadir.

One common structure that we see offices making is to have more executives in the office while middle and lower management primarily works from home. Offices would house workers that do not have the ability to work from home in addition to having shared space where staff could come in intermittently to collaborate on projects and to have meetings. This structure requires about 50% less space.

Thus, our predictions are that 15% of the companies will increase space, 40% of the companies will maintain their space, 30% of the companies will move to the hybrid model, taking about an average of about 40% less space and about 15% will materially reduce their space by more than 75%.

The Fundamental Shift

Ahead, we see not only lower space demands for the office sector, but a change in the product at least over the next several years until a vaccine and therapeutics become more widespread. Due to the need to reduce reliance on public transportation, there will be lower demand for interior metro space and relatively more robust demand in suburban and outer core space.

There will also be the “campusization” and “hotelization” of office space. Large and mid-sized employers will start looking for more campus-like settings where they can control ingress and egress to the property with single or multiple buildings that are low rise in nature in order to reduce elevator time and allow more stair usage. These campuses will have offices that are more spread out and include more outdoor space.

Alternatively, for businesses that are not large enough for campuses, look for smaller space in more suburban markets closer to where employees live. This will have the benefit of not only reducing commute time for employees and have cheaper rents than before but will also mitigate some of the pandemic operating risk for firms. An outbreak in one office will not impact the other offices, thereby allowing a shift in work to other offices without having to send the entire company to work from home when a new strain is discovered.

On the inside, workplaces will bring more comforts from home inside – More plants, more soft furniture, and larger collaboration spaces where employees can spread out instead of being jammed into a conference room. These offices will become destination spots with these open areas capable of hosting departmental meetings when the remote workers do get called back for meeting days. We look for less office density, and more spread out open floor plans as well as more individual offices than before.

Putting This Into Action

Banks need to adjust their office underwriting to reflect lower net operating income at office properties while preparing for some difficult negotiations during refinancing. Markets like Charlotte, Philadelphia, Miami, Phoenix, San Diego, Boston, Atlanta, Denver, Columbus, Minneapolis, Tampa, and Northern New Jersey are likely going to see the largest cooling off in late 2022 and early 2023 while markets like San Francisco, Orange County (CA), New York, Austin, Houston, San Jose Pittsburgh, Baltimore, and Seattle will likely reset down prior by late next year.

Whatever the case, banks need to tread, underwrite, and price carefully in the CRE office market as it runs the risk of undergoing some major structural changes to the determent of bank’s existing office loan portfolio.