Asset-Liability Management: What if the Fed Hikes?

Last year’s worries of deterioration in labor-market conditions have evaporated and the Fed is still harboring concerns about elevated inflation risks. Many banks budgeted some six rate cuts in their 2024 asset-liability plans last year that never materialized. Going forward, the major unknown is the new administration’s policies that all skew to higher inflation (from labor reduction, higher deficits, less regulation, to tariffs).

Banks should now be using probabilistic modeling (more about this here) to consider the higher probability that interest rates in the near future are expected to rise rather than fall. While there is uncertainty in the magnitude of new administration’s policy changes, the direction of those policies is largely self-evident: most of the stated policies are inflationary. Therefore, we should expect higher economic activity, tighter labor supply, more fiscal stimulus, and the resultant pickup in inflation (from a level that is already above the Fed’s stated 2.0% goal). How should community banks think about their balance sheets, product offerings, and client demand in this pivot?

How Forecasts Get It Wrong

Currently, the futures market is pricing in just one quarter point Fed Funds cut in 2025 (in July). This serves as the basis for many bank’s 2025 asset-liability plans. Unfortunately, the conviction of the market is not strong and volatility skew (more on this below) is pointing to higher rates around the forecasted mean.

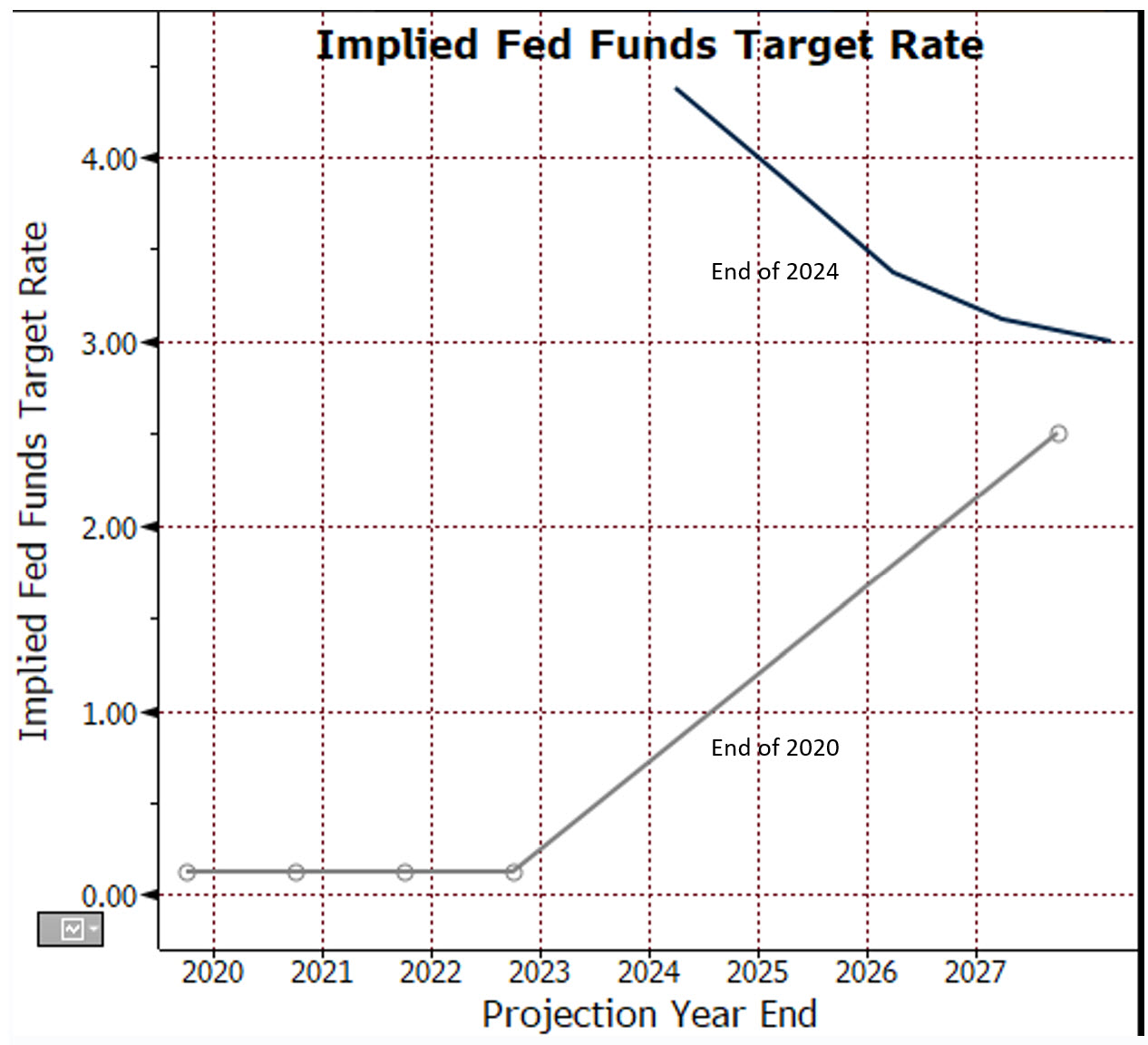

The graph below compares the December 2020 and the December 2024 FOMC DOT plots. These lines represent the FOMC average members’ outlook for the path of interest rates based on expected future economic conditions. Comparing the Fed members’ expectation at the end of 2020 to the actual realized interest rates in 2023, the FOMC was off by about 5.00%. Not a ringing endorsement for the Fed’s crystal ball, but not unexpected given the uncertainty of economic, geopolitical, and pandemic developments. The FOMC members could not see the future in 2020, and they are unable to see the future now.

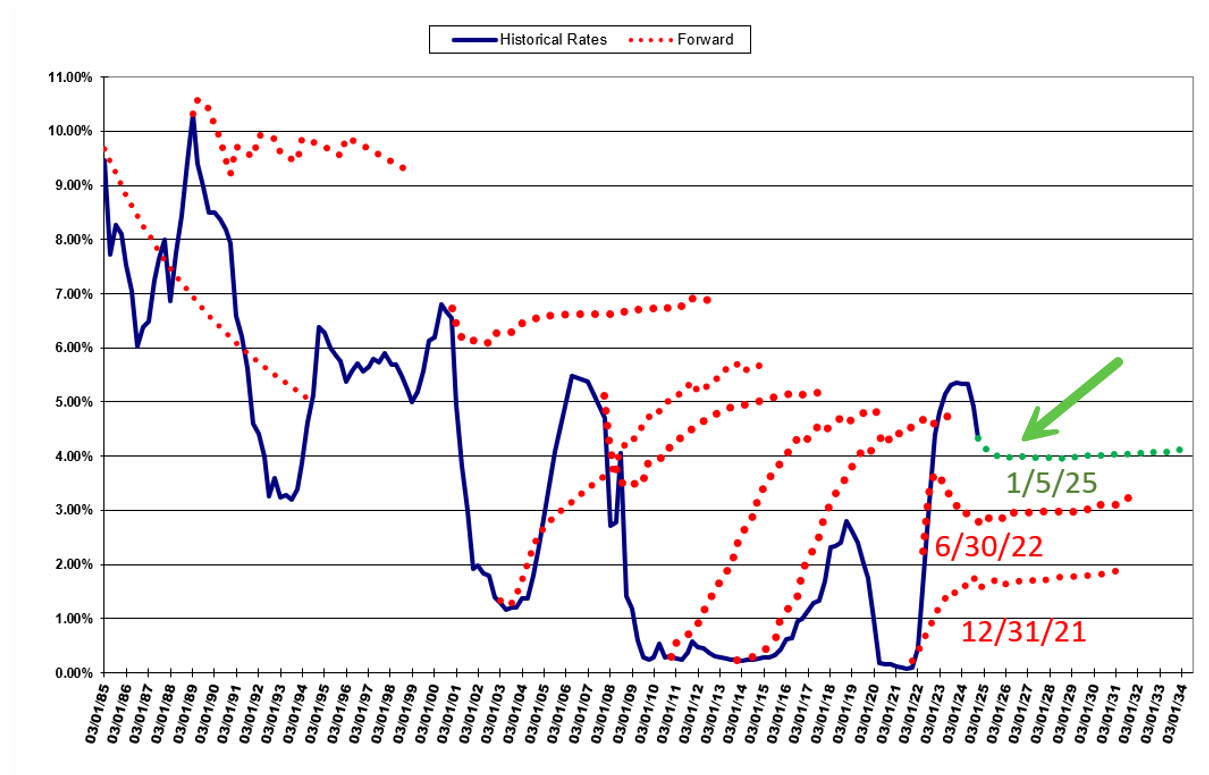

The graph below shows in the blue line where short-term rates have been since 1985 to the present. In the dotted red line are forward rates for specific periods and the dotted green line is the most recent forward curve on the graph. The current forward curve is almost a straight line. As shown in the graph where the blue and red lines diverge, the market does a markedly poor job of predicting future interest rates. However, during inflection points, the forward rates were especially off from the blue line. Historically, these inflection points represent recessions, runaway inflation, and abrupt changes in public policies (as currently expected with the new administration).

Common Sense and Skew in Asset-Liability Management

Normally, politicians, especially populists, have a penchant for fiscal expansion. The new administration’s agenda is highly pro-business, and fully throttle inflationary. This leaves the FOMC with two options: one, allow deficits, spending, tariffs, and tightening labor supply increase inflation and tolerate above the 2.0% target, or two, stop cutting rates earlier than the market expects and start raising them at the first sign or rekindled inflation. The FOMC’s decision path is simple to predict and will follow option two. The FOMC has stated that persistent high inflation is a challenge to their credibility of the dual mandate, and, further, politicians recognize that high inflation is an erosion of living standards.

A probability skew refers to the unevenness in outcomes across future events. In probabilistic modeling, when bankers attribute weight to potential future path of interest rates, the probability skew makes certain outcomes more likely. This probability skew reflects the market’s perception that certain results (higher interest rates) are more likely than other results (lower interest rates). It is how the market views the potential for outcomes around the mean in one direction versus the other. Right now, markets are, and should be, expecting higher probability that the US economy, with the stated agenda of the new administration, will result in higher inflation, and thus, higher interest rates over the course of the next few years.

Community Bank Posture

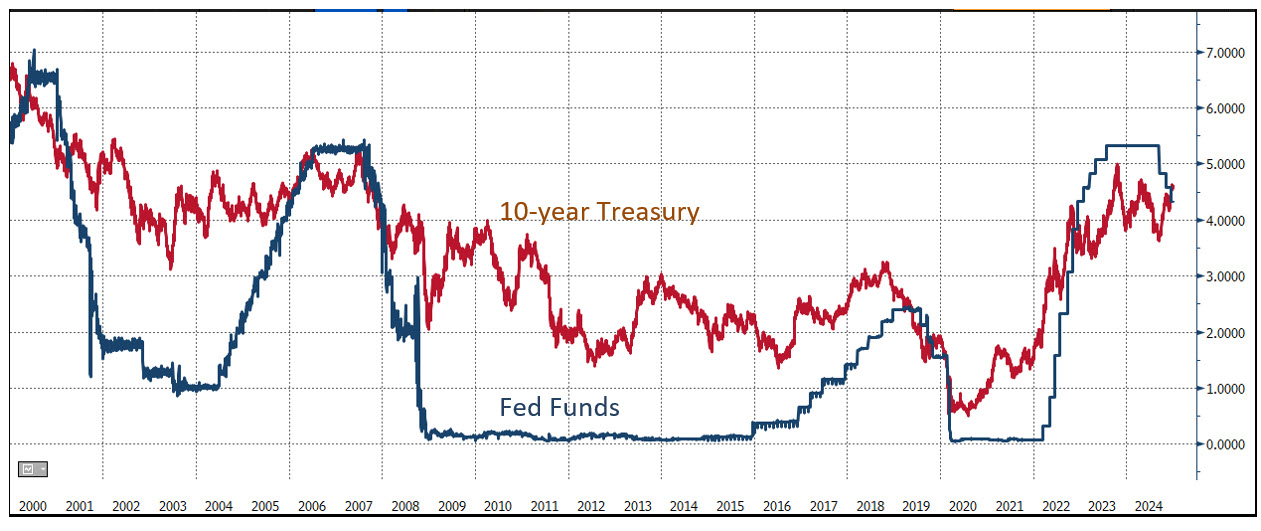

Predicting the asset-liability future is hard, but giving good advice to clients is what bankers must do daily. Based on the current information, bankers should be positioning their bank’s balance sheet, and helping clients navigate, a higher probability of a rising interest rate environment for the next few years. Interest rates are comparable to historical averages that prevailed before the great financial crises. But borrowers may be biased to compare current interest rates to lower rates seen a few months ago, or during the pandemic. Below is a graph showing short-term rates and 10-year Treasury yield from 2000 to the present.

Community bankers should be listening to their customers and delivering the best products possible based on customer demand. Community bankers should stand ready to deliver long-term fixed-rate loans, short-term fixed-rate loans, or floaters as customer demand warrants. Bankers also need to address the forward curve and discuss the implications with their clients – we need to satisfy the client’s needs and figure out a way of addressing our asset-liability needs separately. We will see more clients wanting to protect their businesses with fixed-rate, longer term loans to stabilize their debt service ratios.

Action Items

There should, and will be, substantial concern by asset-liability management committees about what interest rates will be do in the future. Those concerns are well founded, and banks should be considering all their options for assets and liabilities. A similar playbook that applied during the last rate hiking cycle will prevail in the next hiking cycle. While forward interest rates are a poor predictor of the future, banks must manage their balance sheet using a probability weighted outcome for future interest rates. Taking interest rate risk is almost always a poor decision. Banks should match asset and liability duration. What became clear in the last hiking cycle is that deposit duration is shorter than many banks expected and the benefit of stable, low cost, and long-term deposits is paramount. We also witnessed that in a rising rate environment, asset duration extends and liability duration contracts. Using probability weighted outcomes with a commonsense probability skew will help community banks position for higher performance.