How Federal Debt May Impact Banking

The Federal debt is already impacting banking. Cyclical economic changes are driven by business cycles. These changes may occur swiftly, such as interest rate changes, inflation changes, or unemployment rate changes. Cyclical changes and their impact on the economy dominate the news and the attention of corporate boardrooms because they are immediate and need to be addressed in real-time.

Secular changes occur over many business cycles, tend to be slow-moving, and are more difficult to manage with business strategy. Because secular changes occur over decades, many management teams miss the telltale signs of significant secular disruptions—think of a frog boiling slowly in a pot, not appreciating the changes in the water temperature over a longer period. However, because bank capital has an average expected life of 15 to 20 years, bank managers must gauge and react to secular changes that will impact their business model.

We believe that one of the most significant and disruptive secular changes in the banking industry in the next ten to 20 years will be the growing size of federal debt as a percentage of GDP.

Why The Growing Federal Debt Matters

While there is some debate in academic circles if higher federal deficits lead to long-term changes in a developed economy (such as higher interest rates or higher inflation), most economists believe that higher deficits cause interest rates to rise, and a currency to appreciate. The relationship between federal deficits and interest rates may depend on many complex factors, such as: whether tax rate changes, money supply changes, government spending changes, or political and economic stability worldwide accompany the deficits. However, the common thinking is that increasing federal government debt leads to higher interest rates over longer periods.

Furthermore, high federal government debt does not just lead to higher interest rates but also poses economic, national security, and social challenges. What is most troubling is that the growth in the federal debt is not the result of one administration or one set of policy decisions, but rather, a reflection of our political system (politicians that focus on reduced government spending are less electable – regardless of the party), and the aging demographics in the country is shifting policy to higher government spending and a lower tax base.

These changes associated with higher government budgetary spending will have direct and consequential effects on the banking industry.

The Nation’s Fiscal Health

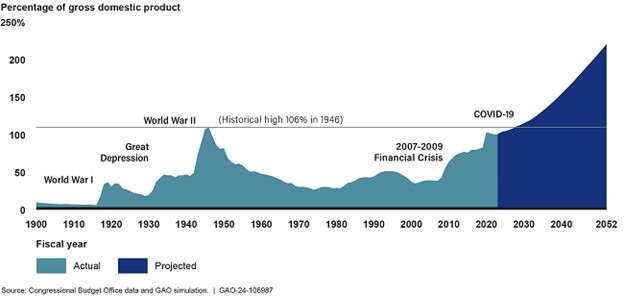

Historically, congress and various administrations have not made the difficult budgetary and policy decisions to reduce the federal deficit or curtail the growth of the federal debt as a percentage of GDP. The graph below shows the debt held by the public (not monetized on the Fed’s balance sheet) as a percentage of GDP, both actual and projected to 2052.

By 2028, debt as a percentage of GDP will reach a historical high of 106% and will reach 200% by 2050. Unlike previous spikes in debt levels, the projected debt increases are being driven by financing gaps in Medicare and Social Security, and the rapid aging of the US population drives demand for both.

Why Bankers Should Care

As debt is projected to grow twice as fast as the US economy by the Government Accountability Office, it seems unlikely that policy or budgetary changes will markedly alter this expected trajectory. All else equal, growing debt increases interest rates, dampens personal finances, lowers average wages, and increases the cost of borrowing money. Further, rising debt increases the chances of fiscal crisis, decreases confidence in risk-taking, and, most importantly for banks, higher debt increases the volatility of asset prices, and personal and business cash flow. As interest rates remain higher, and the federal government is constrained in smoothing out business cycles, recessions become more severe and last longer.

Bankers may not see the impact of the growing federal debt burden on their business model year to year, but over longer periods, these changes are poised to alter the way community banks do business, manage risk, and target clients.

Federal Debt – Impact Banking

The path of the federal debt is already changing economic and public dynamics. With time, these changes will only amplify. An aging population, higher federal debt as a percentage of GDP, and higher interest rates will change the way community banks view risk, manage relationships, use technology, and generate revenue. We think that community bankers should consider the following four business model changes because of higher national debt:

- Less risk-taking and a smaller pool of entrepreneurs will decrease the demand for small business loans. While the US is, and will remain, the center of innovation and risk-taking, the economy will transition to fewer small businesses and more larger enterprises. Community banks’ focus on business banking must adapt to offer more sophisticated products to larger business clients.

- As interest rates rise and remain higher, the value of deposits will grow. Community banks must deliver best-of-class treasury management products to capture this valuable banking product.

- Risk management will become even more important because the higher absolute value of interest rates causes more asset price variability. Proportional interest rate changes between 10% and 15% (a 50-percentage point increase in absolute level) result in more collateral devaluation than an equal 50 percentage point increase from 4% to 6%.

- As risk management becomes more prominent, technology and data mining become an indispensable tool. Human-driven risk management will be aided by more upfront risk assessment (AI underwriting, risk-adjusted return on capital (RAROC) measurements, and other predictive analytics) and technology-intensive ongoing risk monitoring.