Talking to Borrowers About Interest Rates in 2026

To be a better trusted advisor to your commercial borrowers, one important topic is interest rates in 2026. We recently wrote an article about how the Federal Reserve’s next interest rate move may be up and not down (here). The aim of that article was not to take a alternative view for contrarian-sake but to analyze nine sound reasons why market conditions may evolve to cause the Fed to take a long-term pause, or even hike, in 2026. The upshot of that article is that no one can predict the market for interest rates, as hard as they try. But it is a question often posed by borrowers: “where do you think interest rates are heading?” We recently heard a lender at a bank field that question exquisitely, and we would like to share his answer in this article.

Being a Trusted Advisors for Interest Rates in 2026

We have collaborated with this banker a number of times and his method has been crafted over many years. His reasoning is sound and his answers are well practiced. However, he has added some additional depth to his answers that resulting in providing valuable insight about interest rates in 2026. The banker’s method is summarized as follows:

- He acknowledges that he does not have a crystal ball and cannot predict interest rates. But he knows that his clients are looking for some insight.

- He then references five general areas that borrowers and lenders can consult to predict future interest rates: 1) the FOMC dot plot, 2) composite economic forecasts, 3) public and private modeling, 4) historical context, and 5) the futures market. He then suggests that these five predictors are, on average, wrong. If anyone could predict future interest rates, they would not be sharing their insight for free – and if they could do it consistently, they would not need to work.

- He points out that the timing of economic cycles are difficult to predict, but there are important longer-term trends that should be considered, and he identified three current ones as follows:

- Kevin Warsh’s nomination to succeed Jerome Powell as Chair of the Federal Reserve may have a serious long-term impact on interest rates. While at any one time there are 12 voting members of the Federal Reserve, the Chair (appointed for four years) has influence to unify the board’s voices. During his tenure as a Fed Governor from 2006 to 2011, Kevin Warsh was an unwavering inflation hawk. Other than recent statements coinciding with his new job interview, he has not signaled any departure from his long-held beliefs.

- AI may be a productivity miracle, but in the short-run AI may be fueling inflation, and in the long-term it may support a non-inflationary boom. Its rapid adoption will change how our economy grows, how inflation behaves and the long-term demand for labor.

- The US administration has signaled its intent to run the economy hot leading to the November 2026 midterm elections. The belief is that a high-pressure economy can win the electorate. The strategy can be achieved through expected additional tax cuts through tax refunds and investment incentives, and aggressive deregulation. However, a blockbuster 2026 may lead to overheating, inflation and volatility.

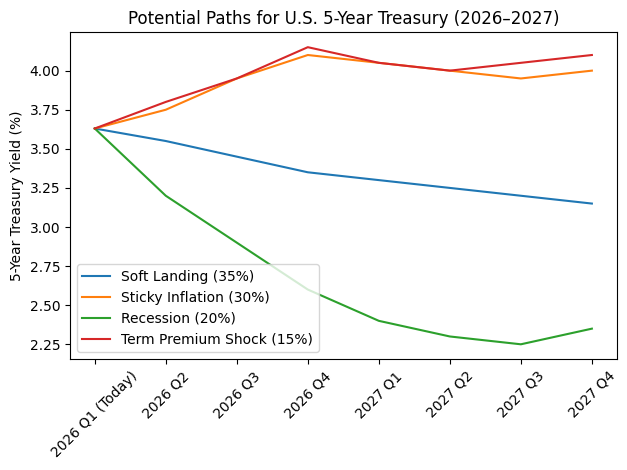

- The lender explains the probabilistic potential paths of interest rates and may show the borrower the current market scenarios and weightings using the graph below.

- The lender then turns the discussion to the more predictable – the borrower’s personal and business goals. Attempting to predict interest rates is inherently speculative and borrowers are better served by grounding decisions in business fundamentals. The lender explains that analyzing the borrower’s banking needs and aligning those with the bank’s products is much easier. The lender asks the borrower about the following:

- Holding period: What is the expected ownership or investment horizon? Financing maturity should broadly match the expected hold period.

- Rate sensitivity: How exposed is the project or business NOI/EBITDA to interest rate movements? If free cash flow are not interest-rate sensitive, then fixed-rate financing offers superior protection for the borrower.

- Financing friction costs: How expensive and time consuming are all-in entry and exit costs? This includes appraisals, prepayment penalties, underwriting complexity, business switching costs, collateral substitutions, and business flexibility. More expense should lead borrowers to prefer long-term credit facilities with stable payments.

- Portfolio strategy: What is the borrower’s total debt roll duration? Borrowers with multiple assets and credit facilities should structure debt strategically to improve flexibility and reduce long-term costs. This involves laddering maturities across different portions of the yield curve and diversify collateral structures.

- Lender’s natural habitat: What is the lender’s preferred and best priced structure? Here the lender explains how the borrower can get a best priced deal from the bank based on the bank’s target lending asset, prepayment structure, and commitment term. Different lending institutions will be more aggressive and active for different banking needs.

The lender explains that borrowers can meaningfully reduce long-term financing costs by focusing on factors they can predict—business cash flows, hold periods, operational needs—rather than playing the rate-forecasting game.

Conclusion and Implementation

Good lenders function as trusted advisors who understand their clients’ wants and needs, and how to help them get there. While lenders do not know where interest rates in 2026 will go from here, they can analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future.

We believe that banks should hold formal training sessions to instill the principles that the bank wants for their lending staff. Rather than guess about the future path of interest rates, bankers can be more effective as trusted advisors focusing on their client’s business needs. We believe that lenders can maximize value by analyzing the borrower’s balance sheet, cash flow, and liquidity positions and offering products that can help borrowers reduce business risk and increase profitability.