Bank Tools For Predicting the Future

Many bankers are struggling to analyze the current business environment and need help predicting the future. Community bankers are especially concerned about economic forecasts such as GDP, interest rates, inflation, consumer and business demand, and default rates. The difference between a good decision and a bad one may not lie in spreadsheets or economic charts – it may lie in understanding the psychology of one person. When one person is making decisions for most of the domestic market, and a good portion of the world market, it is the psychology behind the choice, not the economic theory, that shapes the outcome. In this article, we discuss the psychology of decision-making, the Dunning-Kruger effect, and the power of acknowledging “unknowns” in a rapidly shifting market. The key message is that economics will only get you a small portion of the way, and psychology holds a larger explanatory value.

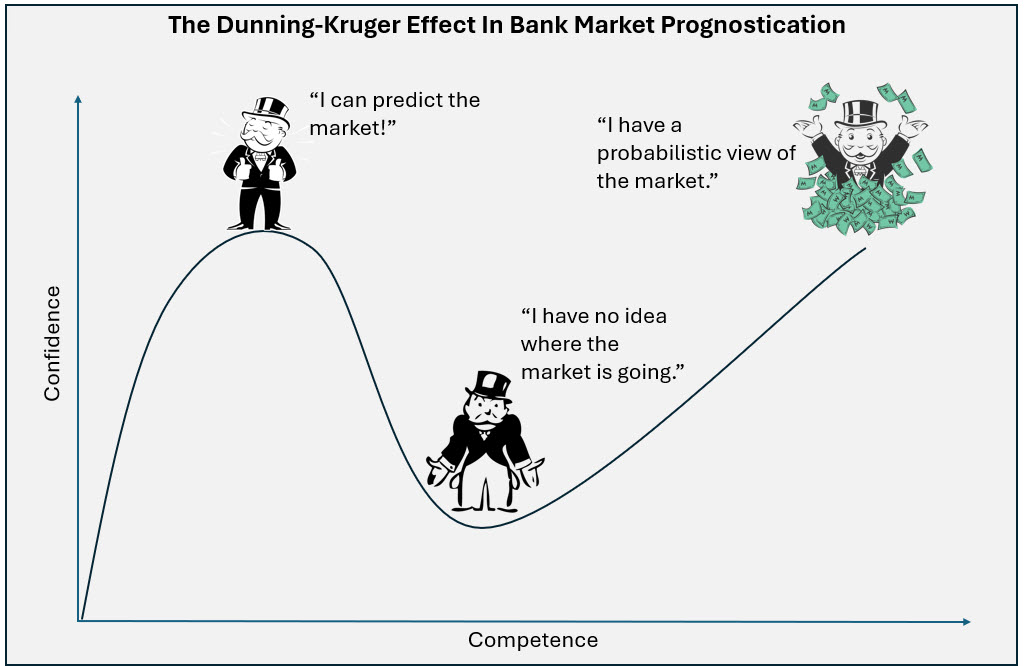

The Dunning-Kruger Effect: Risk in Predicting the Future for Banking Decisions

David Dunning and Justin Kruger coined a term every banker should know: the Dunning-Kruger effect. It refers to the cognitive bias where people overestimate their competence in areas where they lack experience or knowledge. In banking, this manifests clearly when executives, economists, pundits and analysts confidently assert that they understand market risks, interest rate trends, or business projections – when in reality, not only may they be out of their depth, but even the sole actor shaping the economy has no long-term plan or direction. In today’s environment, bankers must not only assess the numbers but consider the sole mind that may be reacting to those numbers and the options that he is most likely to take.

There are three foundational reasons why even well-informed bankers should be cautious about using numbers to predict the economy:

- No Expert Consensus Exists: Even the best economists rarely agree on short- or long-term interest rate forecasts. Those same economists are usually modest in their predictions—because they have seen how often they are wrong.

- Markets Are Always in Motion: Predictions change rapidly. What was “certain” a few months ago is now obsolete. The interest rate environment is currently violent in its gyrations.

- Time Horizons Do Not Match: Predicting the next three months is hard. Predicting the next 3 to 20 years is impossible. Yet many bankers, depositors, and borrowers have long-term financial goals. Decisions for long-term, made on short-term forecasts creates a planning mismatch that can be financially fatal.

If experts with reams of data and access to the highest decision maker cannot get it right, what should a community banker do? This is where psychological analysis can help, especially now that one person is formulating and implementing a large portion of business and trade policy.

The Known-Unknown Matrix: Clarity in Chaos

Bankers often deal with ambiguity – especially when managing their business and helping borrowers navigate uncertainty. One simple tool to make sense of complex decisions is the Known-Unknown Matrix, originally popularized by the Department of Defense and NASA.

The matrix breaks down knowledge into four categories:

Known-Knowns: Things we know and can prove.

Known-Unknowns: Things we know we do not know (like future interest rates, GDP, inflation, and recently, the actions of the government, particularly but not exclusively, the POTUS).

Unknown-Knowns: Things we know subconsciously or have forgotten.

Unknown-Unknowns: Risks or variables we are not even aware exist.

As always, the most critical risks are the “Known-Unknown” and “Unknown-Unknown” quadrants. Tariffs and other unilateral actions (such as executive orders) may change national and global economics. The best community bankers have recognized this and have hired advisors accordingly. In the current environment, we must assess the possible actions of the government, including the POTUS, and this may require a psychological analysis more than an economic analysis.

When One Person Is Making the Call, Bias Rules the Day

The current scope policy decisions seem to be primarily ruled by one individual and therefore, macroeconomic theory is much less relevant than in previous cycles. Psychology may drive decisions. Tariff battles followed by pauses, political volatility, inflation swings, and international conflicts have shattered the predictability once prized by the entire world, including financial institutions.

Economic models are useful, but they rely on stability and the emotional reaction of many participants (neutralizing irrational choices over the long run). In a world where policies shift overnight, those models quickly become irrelevant. Psychological models, explaining how one person may manage uncertainty, risk, and decision fatigue, become far more valuable to predict the future.

Predicting the Future Using Tools for Community Bankers

Here are five ways to apply psychological thinking in your community bank strategy and analysis for predicting the future:

- Conduct a “Premortem”: Before finalizing a strategy, walk through a scenario where everything goes wrong. Ask, “Why did this decision fails?” This premortem forces examination of blind spots.

- Look for Confirmation Bias: If your team is in total agreement, that is a red flag. Challenge your team to consider alternative strategies or delay decisions until more data is available.

- Use Individual Input: In loan committee and ALCO it may be appropriate to start discussions with individual polling where members submit survey responses to potential strategies first and after discussion. This avoids groupthink and encourages dissenting opinions, which often reveal hidden risks.

- Map Known-Unknowns: Make it a habit to list out “things we don’t know” about a deal, strategy, acquisition, etc.

- The Lens of Psychology: Analyze possible outcomes to government decisions through the lens of psychological gratification of this Administration as well as policy and economic implications. Consider the current POTUS personality has well-known personality traits and predilections as well as a set of well-known campaign promises. Consider assessing potential outcomes using game theory, taking into account personalities, uncertain environments, and unknown outcomes. Exploring these outcomes can reduce the bank’s risk and improve profitability. Assign probabilities of these market outcomes and develop strategies based on those outcomes.

Conclusion

Usually, predicting the future is an exercise in rationality. Economics assumes rational actors, but psychology knows better. Real people make emotional decisions, and they overestimate their skills, underestimate risk, and avoid uncomfortable truths. When most decisions are made by one person, recognizing that person’s tendencies are essential in trying to predict the future. When only one person is deciding, whether it is a business owner or a world leader, the quality and direction of that decision rests on psychology.