What The Presidential Election Might Mean for Interest Rates

Current congressional and presidential polls are showing a close election this November. The elections are still three months out, with plenty of time for unexpected events to develop. However, we would like to identify one important macroeconomic variable that will affect the banking industry regardless of the makeup of the legislative and executive branches of the US government. Regardless of who wins, our national debt will continue to increase, and community banks should be prepared for its consequences.

Long-Term Budget Projections

The US is currently the 7th most indebted country in the world as measured by debt to GDP – only Sudan, Japan, Singapore, Greece, Italy and Bahrain have a higher debt to GDP ratio. While the US dollar is the de facto world reserve currency, our country’s debt issue is only expected to deteriorate.

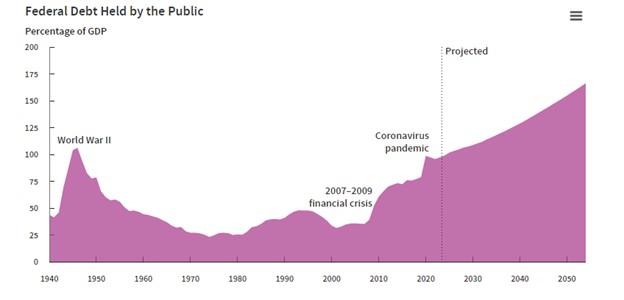

The Congressional Budget Office (CBO) publishes the most comprehensive and objective outlook on the federal budget. The latest outlook (here) is a detailed view of the federal budget, projected deficits, and accumulated debt. In short, CBO projects that in 2029 the US debt, as a percentage of GDP, will exceed its previous high (from WWII), and will sour to 166% of GDP in 2054, and continue to increase thereafter. The graph below shows these projections.

Source: Congressional Budget Office March 20, 2024

Bankers are typically staunch fiscal conservatives and rational financial actors. Almost all bankers that we speak with are advocates of government fiscal responsibility, especially during economic growth periods. Unfortunately, politicians do not get elected to practice discipline, and whether they are Democrats or Republicans, the result has been continued spendthrift policies. We do not believe this behavior will change as fiscal austerity is not an electable platform for any party.

The underlying reasons to expect increased deficits are unequivocally persuasive, and can be summarized as follows:

- Government outlays are expected to continue to increase as “mandatory spending” (Social Security and health care programs) increase as a percentage of GDP. This is primarily caused by the aging of the population.

- Government outlays for interest payments grow as debt rises. Interest outlays to service debt is projected to exceed all discretionary outlays by 2044, and to exceed all spending on Social Security by 2051. We can forget about the federal reserve printing money to remove public debt, as the last few years have shown that Modern Monetary Theory, not paradoxically, leads to unwanted and pernicious inflation.

- Projected government revenues do not grow as fast as outlays. From 2024 to 2054, total revenues as a percentage of GDP grow by an average of only 1.3 percentage points annually. CBO cannot predict the possibility of increase in taxes, but most agree that higher taxes (regardless of how they are applied and distributed) is not a winning political message.

- Finally, CBO’s message is that real potential GDP will slow from an average rate of 2.1% per year, to only 1.6% per year after 2045. This is caused by slowing growth of the labor force and slower labor force productivity. Again, US demographic changes are the primary culprits in diminishing revenue projections.

Relationship Between Debt, Interest Rates, and Economy

There has been ongoing debate among economists about the impact of expanding government debt on interest rates, consumption, asset value and other potentially adverse effects. Over the last four decades, sufficient empirical evidence and economic theory has surfaced that government debt does have an impact on the real economy, interest rates, consumption and asset values.

As government debt increases, most economists (CBO publications included) believe that general interest rates on Treasury Department-issued debt increases. Further, orthodox economic understanding is that as federal debt grows, general interest rates in the economy rise. As federal borrowings increase, those borrowings crowd out (reduce) capital available for private investments. A smaller supply (of private capital) increases required return on capital and interest rates. A working paper by CBO (here) studied the relationship between rising federal debt and interest rates. The paper concludes that each percentage-point increase in debt-to-GDP increases interest rates by two to three basis points.

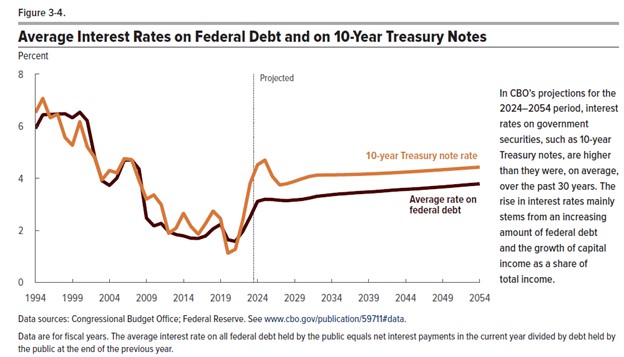

CBO’s projections for average interest rates on all government securities and the ten-year Treasury note is shown in the graph below. The graph shows that the ten-year Treasury is expected to average a yield of 4.2% from now until 2054. These projections on interest rates appear less than the projected two to three basis points increase for each percentage-point increase in debt-to-GDP. We would expect 10-year Treasury note rate to approach 6.00% within the next 10 to 20 years, vs. the 4.4% projected by CBO.

How Community Banks May Respond to the Presidential Election

First, bankers must distinguish the short-term interest rate cycle currently projected by the Federal Reserve from the long-term trend of higher government debt and the resulting increase in interest rates. Our discussion below focuses on 10 year (and longer trends) and not on the FOMC’s next few meetings.

We expect that changes in interest rates will have the following effects on community bank business:

- Higher interest rates and future recessions will create higher stress on borrowers as the ability to lower real interest rates below zero becomes problematic for the Fed when exercising monetary policy to achieve maximum employment. Risk management (credit, interest rate, and liquidity) will become more important for community banks as the amplitude of shocks increases.

- Higher interest rates may help bank margins. However, banks with more asset sensitivity are more likely to thrive.

- Higher interest rates motivate more borrowers to extend their loan terms and fix their interest payments, the exact opposite of the results that community banks may want.

- Liquidity in the market will decrease, deposit betas are likely to increase, and the possibility of surge balances will diminish. Community banks should focus efforts on deposit management and prudently manage migration from DDA to term deposits.

- Competition for higher quality credits will intensify. Higher interest rates create more challenges for business models and increase the possibility of bankruptcy. The ability to predict and measure risk-adjusted return on equity will be paramount for bank survival.

- Fund transfer pricing will become more important for community banks to measure the profitability of the major revenue drivers at banks (deposit gathering and asset origination).

- Competitors will continue to increase product stickiness to avoid losing relationship accounts. Banks will always poach clients, but higher interest rates create a stronger case that banks are in the business of keeping, not making, loans.

- Community banks will need to focus on managing risk and retaining profitable relationships as the margin for error decreases with lower liquidity and higher P & I payments for borrowers.

Conclusion

Not everyone has a ten or 20-year time horizon, but some macroeconomic changes are so pervasive and profound that they cannot be ignored. Community bankers who properly position their business model for the consequences of rising government debt and its inevitable effect on the economy are much more likely to thrive and outperform.