What Does a Hawkish Fed Pause Means for Banks?

For the first time in ten meetings and the first time in 15 months, the Federal Reserve left its fed funds rate unchanged at 5.00–5.25%. However, far from settling future interest rate moves, the “Fed Pause” creates several perplexing future monetary scenarios. While the Fed did pause, it increased its terminal rate forecast by another 50 basis points. Despite the pause, the Fed also forecasts higher interest rates for longer. And despite the pause, the Fed forecasts higher inflation, a lower unemployment rate, and higher GDP. This is an odd stance for the Fed, whose self-proclaimed job number one is to temper inflation. The Fed now faces the challenge of explaining two contradictory policies: leaving rates unchanged and indicating two more increases later this year.

Context of the Fed Pause

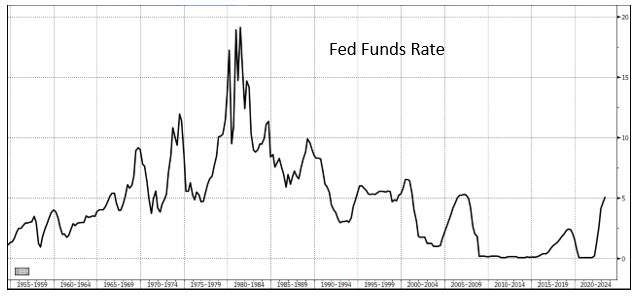

As the graph below demonstrates, the Fed has increased interest rates in this tightening cycle faster than at any point in the last 47 years. Therefore, while the Fed paused, the message delivered was more hawkish than the pause itself would suggest. The tone of the Fed is also hawkish in an attempt to cool a resilient economy. The futures market forecasts one additional hike in 2023, but more importantly, no interest rate decreases this year.

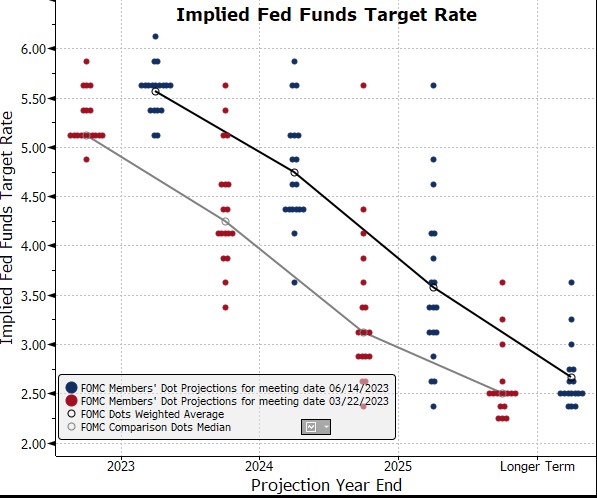

The Fed’s Dot Plot now shows a 5.625% terminal fed funds rate in 2023 and a 4.75% rate at the end of 2024. In the last three months, the Fed has adjusted its short-term interest rate projections higher by 50 basis points. The graph below compares the Fed’s March and June projections (red and blue lines, respectively) and clearly demonstrates a Fed leaning more forcefully into hawkish forward guidance.

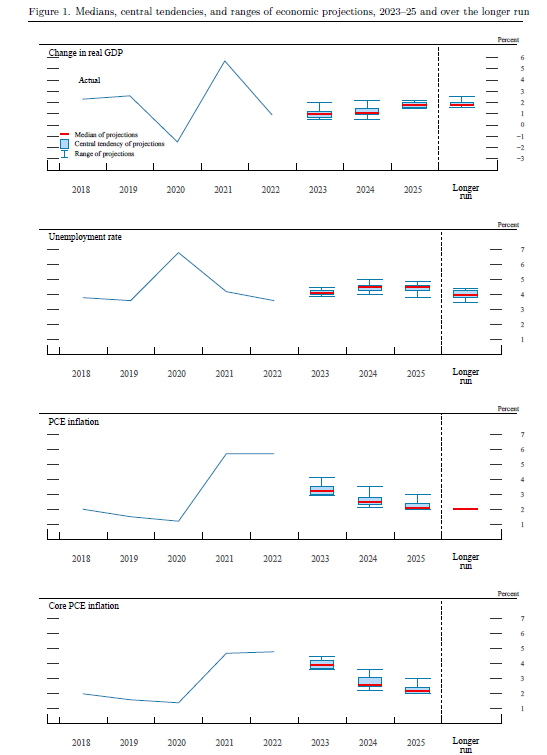

Equally important are the Fed’s 2023, 2024, and 2025 projections for inflation, GDP, and unemployment – all pointing to a hotter economy for a longer period. The projections (below) for the next three years all demonstrate a revised March to June, higher GDP (by 0.6%), lower unemployment rate (by 0.4%), and higher core PCE inflation (by 0.3%).

Our Interpretation

Fed officials believe they have done most of the work necessary to calm inflation but may need to fine-tune short-term rates at the July meeting and perhaps one more time this year. This pause may provide the committee with the most options necessary to cease raising rates or to follow on with some additional tightening depending on economic developments. Unsurprisingly, this Fed would like to avoid a second mistake of being caught offside on inflation after calling inflation transitory just 15 months ago. This pause and hawkish stance allows the Fed to up their views on inflation this year and to forecast more sanguine data for the next three years.

What perplexes us is that the Fed is not projecting core PCE inflation to hit its 2.0% target level for the next three years. This means that the target inflation rate is flexible over time, or yet again, the Fed will need to revise its projected interest rate policy to be more restrictive, as it has done so for the last 12 months.

The Fed’s monetary policy is dependent on the interaction of three variables: 1) velocity of movement (how quickly interest rates rise), 2) absolute interest rate level, and 3) duration of monetary restriction (how long interest rates stay at restrictive levels). The Fed has achieved the fastest velocity of monetary restriction in a generation. We believe the Fed is close to its desired interest rate level (give or take a few more increases). However, the duration of the monetary restriction depends on the inflation trajectory, which is the most open variable for the Fed at this juncture.

While the markets had strong expectations of rate cutting by the end of this year, this is no longer the Fed’s base case, and it is no longer the market’s expectation. Even if inflation slows this year, interest rate cuts are beyond the expectation horizon and should not be factored in until a more substantial possibility of a recession arises.

Key Takeaways of the Fed Pause for Community Banks

While pausing interest rate hikes and signaling further potential increases gives the Fed some flexibility on future policy, the Fed’s first halt in 15 months is unlikely to result in interest rate cuts soon. A pause of rate increases will not lead to a shortening of the duration of monetary restriction until a recession is forecasted on the horizon – this is not the base case for the Fed or the market, generally. As we wrote in other blogs (here), the banking industry should be prepared for continued funding pressure, rising deposit betas, and pressure on NIM.