What President Trump 2.0 Might Mean For Inflation and Interest Rates

The Trump administration’s impact on the US economy has been thoroughly analyzed and will continue to be debated (and closely watched) for its entire four-year term. Economic scenarios may unfold in a myriad of unexpected ways. However, one result of the administrations stated policies will be highly likely – we estimate at least a 90% chance – that is, higher inflation, resulting in higher interest rates. Community banks should now consider how the immediate changes in interest rates and inflation expectations will influence borrower demand for debt, credit quality, ALCO, risk management, and deposit costs. The first Trump presidential term did not have a marked impact on inflation, but Trump 2.0 is highly likely to reignite inflation, resulting in higher interest rates. Trump 2.0 may also change the independence of the Federal Reserve – further risking higher inflation and higher interest rates.

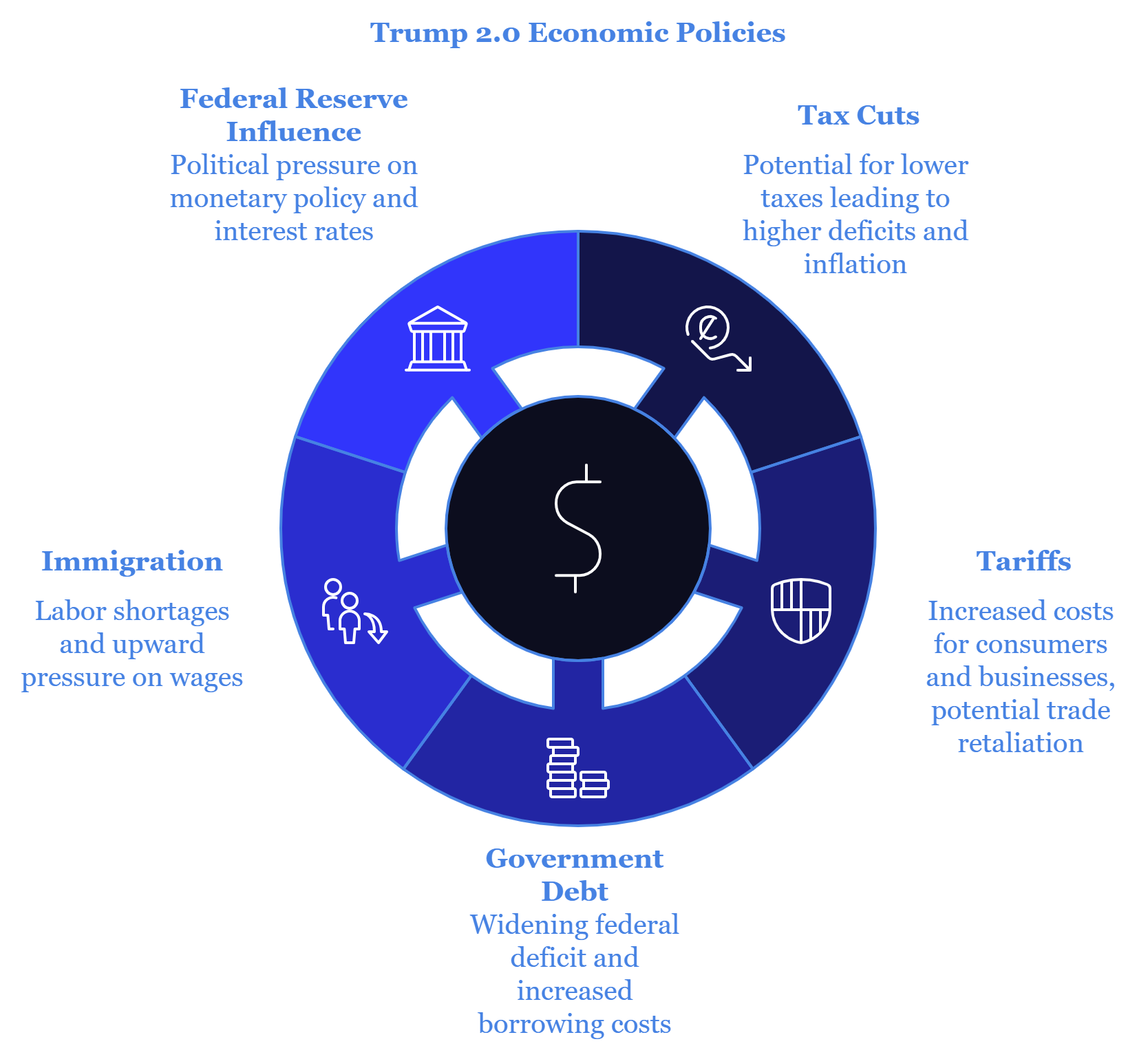

Trump’s Stated Policies

Trump is notorious for his unpredictability and has used stated policies as bargaining tools to negotiate more favorable deals or terms. However, there are five primary Trump-stated policies which taken together are extremely inflationary. Even if Trump is unwilling or unable to enact his full stated agenda, just a few of these five policies is highly likely to stoke inflation and result in higher interest rates.

1) Tax Cuts

During the second Trump term, the former president wants to extend the 2017 tax cuts that are set to expire in 2025. He has also stated exempting taxes on tipped income and some Social Security benefits. We do not know the ultimate size and shape of the new administration’s tax framework, but we should expect some tax cuts at a minimum. Many are debating the impact of these cuts on the economy, but there is little debate that lower taxes and higher deficits will lead to higher inflationary pressure and higher interest rates.

2) Tariffs

Despite some rebuttals, most all economists agree that tariffs raise costs for consumers and businesses. Tariffs will have an even higher inflationary impact if trading partners retaliate with tariffs on US exports. Trump has proposed adding 10% to 100% tariffs on imports (from all countries, but higher levels for Chinese goods).

3) Government Debt

Trump’s overall economic platform has not called for reduced government spending or decreased spending on entitlement programs. The federal deficit would be expected to widen and add to the government’s borrowing costs. Higher debt burden is always inflationary in the long run – even for the world’s reserve currency.

4) Immigration

Trump has called for mass deportation of illegal immigrants. Whatever shape and size this policy takes, removing a source of US labor is inflationary. Further, any policy to limit legal immigration would also put upward pressure on labor costs and stoke inflation.

5) The Federal Reserve

The largest unknown is how Trump 2.0 will influence the Federal Reserve. While the Fed is an independent body from the executive branch, allowing it to make unpopular decisions when necessary to curb inflation, Trump has routinely suggested that the president should have influence on monetary policy. In his first term Trump urged the Fed to cut interest rates more aggressively. Unfortunately, a mistake in monetary policy (lowering interest rates during inflationary periods) requires policy overreaction in the future to bring inflation and employment into equilibrium. Political influence over the Fed would be an unwelcome economic development, but even legal battles over that possibility would hamper the Fed’s ability to control inflation – most presidents would welcome lower rates, but inflation may be the undesired result.

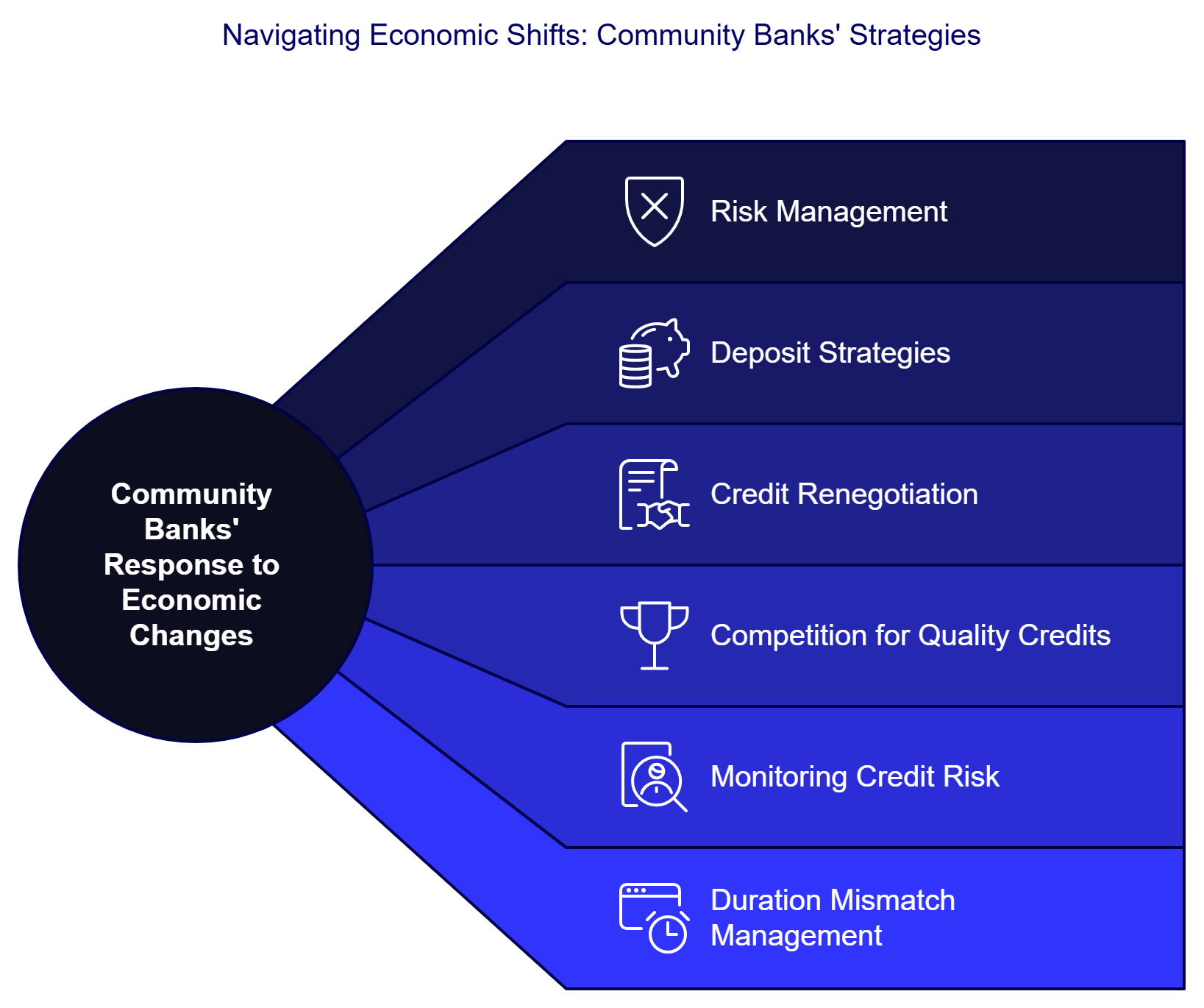

How Community Banks May Respond to Trump 2.0

The market currently expects only three more 25 basis point cuts for this easing cycle. We then see a high probability that the Fed starts a new hiking cycle in mid to late 2025 as Trump policies stoke higher inflation. Community banks need to be prepared for such a high probability outcome and should consider the following:

- More borrowers may be at risk of servicing higher cost debt. Banks should protect their source of repayment with lower risk credit structure (longer fixed rate debt with faster amortization periods).

- Deposit costs will once again be rising. Term deposits will again put pressure on demand deposit account funding.

- Existing borrowers will be looking to renegotiate the terms of their credit to lock-in funding costs.

- Competition for higher quality credits will intensify.

- The major banks will attempt to push borrowers into 10-year fixed-rate products using derivatives to lock relationships.

- Community banks should closely monitor credit risk as cost of funding debt may increase. Credit facilities with repricing or maturities in 2025 through 2027 should be proactively managed through refinancing options.

- Community banks will be well served to consider options to manage duration mismatch. Such solutions include broker deposits, match funding through advances or interest rate hedging platforms that can allow banks to extend loan duration without taking on interest rate risk.

Conclusion

This presidential result has one high probability impact on the economy – higher inflation and higher interest rates. Community banks need to examine their balance sheets and business models considering this change in the market’s expectation of future interest rates based on more inflation and fiscal stimulus. This could be an opportune time for community banks to differentiate their loan and deposit products to take advantage in a possible abrupt change in market expectations. In our next article we will highlight how our bank is using our hedging platform to protect our balance sheet, and our customers, from the possibility of higher inflation and higher interest rates.