New PPP Borrower Data That Will Surprise You

Recent survey data from borrowers that took a Paycheck Protection Program (PPP) loan was surprising as more borrowers than we first expected will be using the EZ Form and fewer borrowers than expected will be using the 24-week covered period. In this article, we breakdown some of this data and then discuss how it might impact your PPP Forgiveness Process in the coming months.

PPP Survey Data

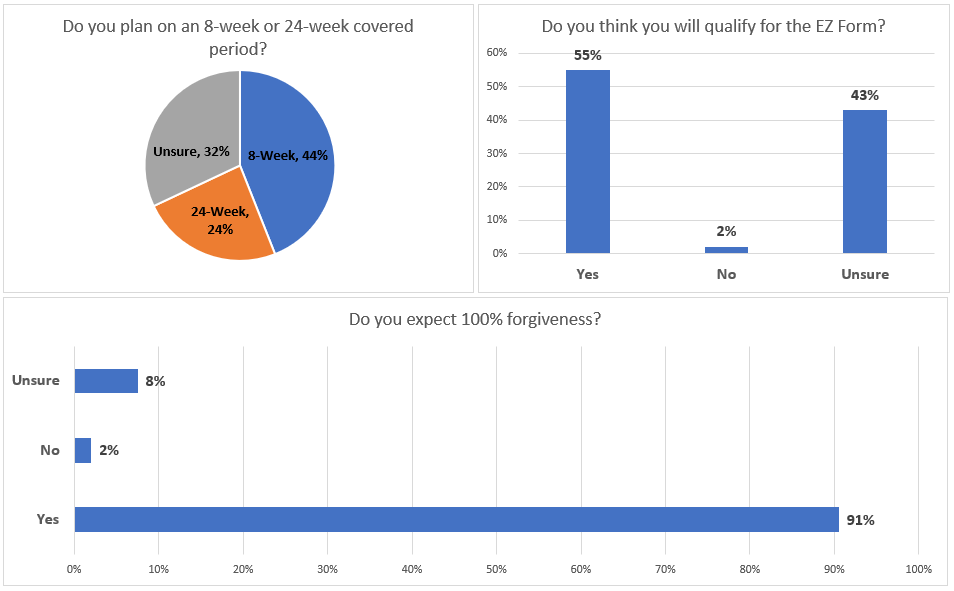

Using survey data collected last week and outlined in the graphs below, 44% of borrowers will be utilizing the eight-week covered period, while 32% remain unsure. Both of those are much larger numbers than originally forecasted and not only speaks to the fact that more applications will come in sooner than we last forecasted, but it is the single most commonly asked question and an area where a large number of PPP borrowers need more help.

91% of borrowers expect to receive forgiveness, which, combined with the 8% that is unsure, helps validate our original forecast of 94% will receive full forgiveness.

The other surprising piece of data from the survey is that 55% of borrowers expect to utilize the EZ Form, with 43% unsure. Again, both those numbers are higher than expected, and help around the use of the SBA’s 3508EZ Form is now trending as the second most common question asked of bankers.

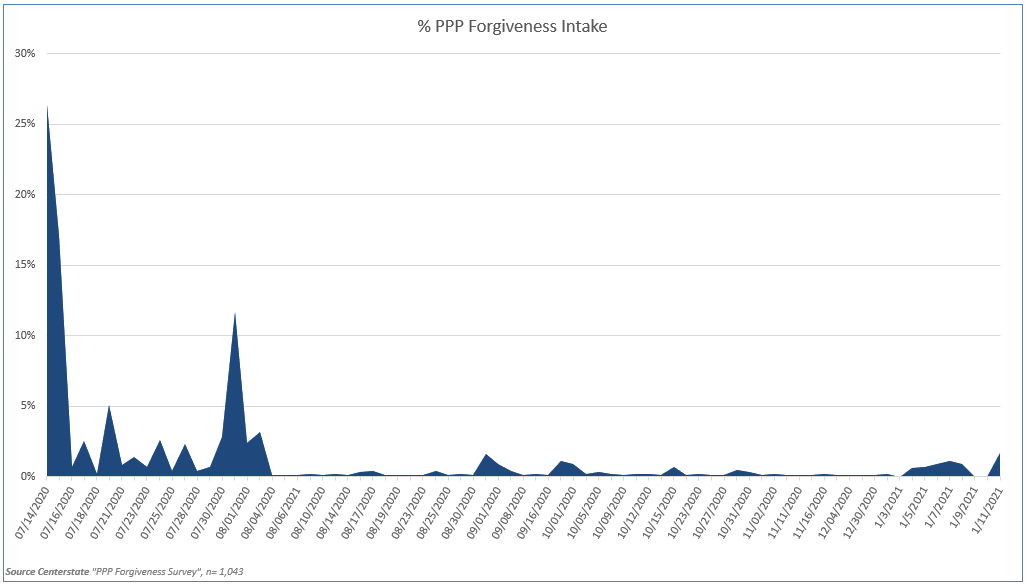

Utilizing the above data, we have updated our intake model (below), which drives our staffing model and get the below profile. As can be seen, the net result is more applications are expected to come in earlier, so we revert back to our original expectation of a July rush as opposed to our last model that had application filing coming in three distinct waves. Now, more than 70% of applicants will file forgiveness in the first 30 days the application process is open.

The downside for banks is the PPP Forgiveness effort will be more concentrated and will likely result in more of a need for outsourced help. For us, because of the huge need to get the process correct upfront, the plan is to test our process with a small diversified sample of customers in order to prepare for the initial wave of submission.

The Need For More Education

The other item that the survey surfaced was the need for greater borrower education. PPP and the PPP Flexibility Act created deep confusion. Many borrowers said they don’t have the time or focus on reading, various websites, and need to rely on their banker. This could place a steep burden on bankers during the process, which is why we have decided to put more resources into PPP education in order to educate our borrowers ahead of time.

Specifically, here are the top 10 questions that PPP borrowers have at this point in the cycle:

- What are the pros and cons of an 8-week vs. 24-week covered period?

- What is the EZ form, and how do you qualify?

- Is there a completed sample form that borrowers can review?

- What is the latest list of required documents, and is the IRS 941 required?

- If I opt for the 24-week period and I can support 100% of forgiveness before, can I file before the end of the period?

- What are the deadlines for filing, and how long will it take to know if my loan is forgiven?

- What are some tips on how to receive 100% forgiveness?

- Who can I call if I have questions regarding the application?

- If I don’t get 100% forgiveness, is there an appeal process?

- How can I get additional capital?

The Need For More Capital

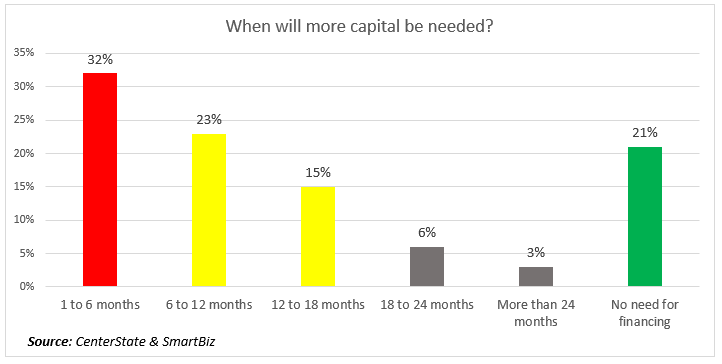

The survey data also indicates that borrowers need more help than just PPP. An estimated 55% of PPP borrowers will need additional capital in the next 12 months with the bulk of those needing capital in the next six months. This is, in part, why we have the view that banks will have to transition into SBA 7 (a) lending quickly.

Prioritizing Applications

The other interesting question that comes up is those customers that are asking for a “fast track” application process. Most of these customers have an outstanding event such as a merger, sale, partnership buyout, or similar and have a need to settle the PPP obligation as quickly as possible. The request begs the question of if banks will employ any prioritization to forgiveness applications?

While most banks will handle the process on a first-come, first-serve basis, for banks creating different channels, it begs the question of how you allocate personnel to affect throughput. While applications might be handled in the order they were received, by applying specific resources to each channel, banks will be able to impact speed.

All this adds up to another level of complexity. Banks that agree to prioritize larger loan amounts, more profitable customers, or customers with a greater need will be forced into creating a separate channel. Alternatively, banks that have multiple channels will need metrics and cross-trained personnel, in order to manage resources to ensure the speed, is roughly the same for each channel.

Back-End Workflow

The other vexing problem for banks is how to handle the back-end workflow. Structuring an appeals process should the borrower not achieve full forgiveness is just an example. How many times should a bank go back and forth before a final decision is rendered?

Should forgiveness not be achieved, should a bank automatically extend the maturity to five years, does it need to conduct some type of underwriting or need assessment, and what is the most efficient way to handle the redocumentation of the loan?

To solve the above, most banks are gravitating around an average of three material interactions with the customer to attempt to achieve forgiveness and then finalizing the decision unless new information comes to light. With regard to extension, most banks are recording the need for an extension and then automatically generating the loan amendment with an electronic signature.

Putting This Into Action

As most banks prepare to go live, banks will need to finalize their education process, test their process, and prepare for faster filing than previously surmised. We recommend processing a diverse group of applications to start and then reviewing the entire process to see where it can automate and streamline. Since there is not the pressure and the rush as with origination, both banks and borrowers have time to get the process right. PPP forgiveness is no small undertaking for most banks and it critical that banks continue to refine their process up to the last minute in order to optimize resources.