Non-Farm Payroll Implications for Community Banks

As Mark Twain said, it is difficult to make predictions, particularly about the future. However, there are a substantial number of concrete and high probability events that we think we can prognosticate about the next couple of years that will have significant impacts on community banking.

The October payroll gains at 531k were the largest for three months, the prior two months were revised up by 235k, and the unemployment rate dropped to 4.6%. This development is a meaningful transition from post-Delta and augurs for even higher job growth in the next few months. The new Infrastructure Investment and Jobs Act combined with the potential Build Back Better Act will only add to this wage growth and pressure. With these developments, we will see a Federal Reserve trying to catch up on monetary policy and then a change in the shape of the yield curve in 2022. This, in turn, will lead to some historically common banking behavior, and community banks need to position for this behavior as soon as possible to capitalize on business opportunities and avoid certain common risks.

Non-Farm Payroll Pressure – Job Well Done (Almost)

We believe that the Federal Reserve has accomplished its mandate on inflation goals – although the term “price stability” may be a misnomer with CPI expected to reach 6%, and the term “transitory” has now been redefined by central bankers instead of Webster. On the employment mandate, the economy is approaching pre-Covid levels. However, there are a few overlooked but revealing indicators that lead us to believe that the Fed has substantial work to do to raise interest rates earlier than expected in 2022.

Non-farm payrolls now stand 4.2M below pre-Covid levels. However, employment gains are being stymied by a lack of supply, not demand. This is an unusual phenomenon and is being misunderstood by some. In a typical recession, the Fed’s job is to attempt to create demand for employment through accommodative monetary policy. It is questionable how the Fed is geared to achieve its objective of full employment when there are 10M job openings, and workers are not willing to fill those positions. More stimulus will not persuade workers to take employment they deem unsatisfactory, except by increasing the supply-demand imbalance by driving wages up higher and leading to spiral inflation. The Fed is keenly aware that driving average hourly earnings higher (now at 4.9%) will lead to flashing red signs for inflation.

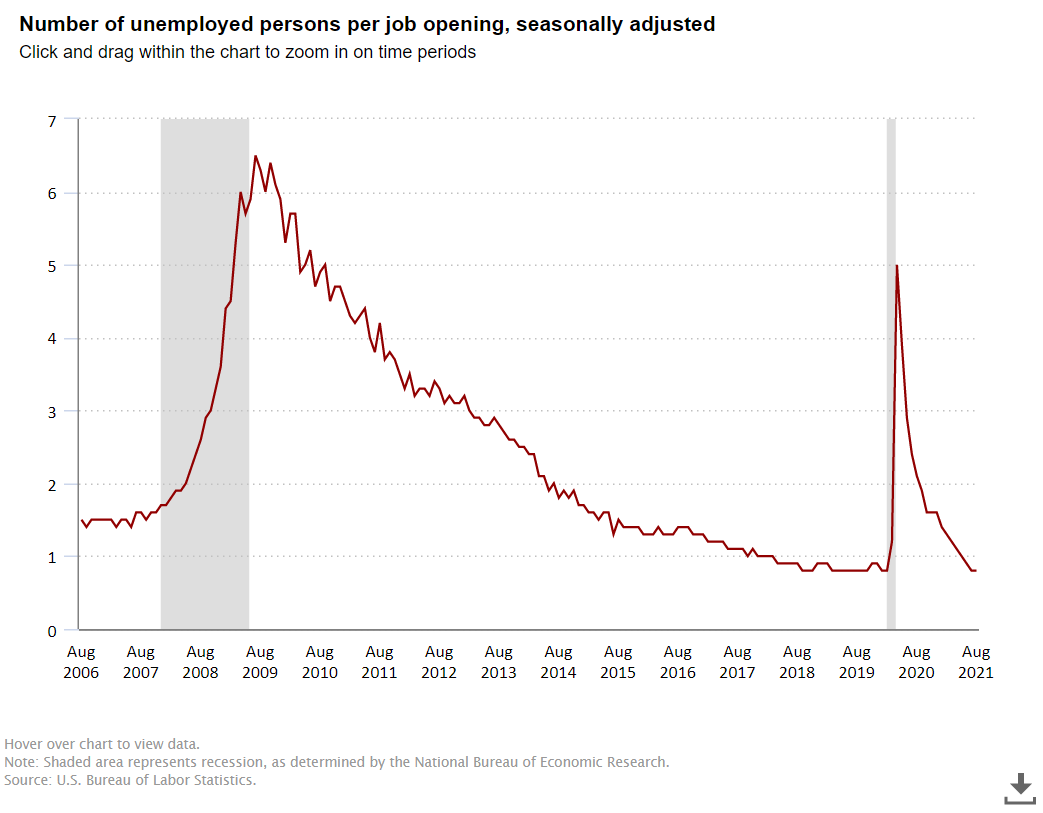

The graph below from the US Bureau of Labor Statistics shows the number of unemployed persons per available job – we have never had more job openings per available worker. Therefore, how does additional accommodative monetary policy motivate more workers to join the workforce?

What to Expect Next

There is a high probability that the Fed will start raising rates in 2022 at a faster pace than the market currently expects. Historically, every time the Fed started raising interest rates, the yield curve flattened. This phenomenon has been resolute through modern history. The graph below shows the difference between the two and ten-year rates in the blue line, the Fed Funds rate in the red line, and the blue triangles mark Fed tightening (or rising short-term rates). Over the last 30 years, the Federal Reserve has started four interest rate tightening cycles, and each cycle resulted in a flat yield curve. We expect the next Fed tightening to result in a similar shape of the curve.

A flat yield curve has major implications for banks. In anticipation of a flatter and higher yield curve in 2022, community banks may want to plan their strategy accordingly to maximize profit and reduce risks for that specific yield curve shape. Typically in a flat yield curve environment, the following strategies and considerations work best for community banks:

- Deposits decrease, and loan-to-deposit ratios increase.

- Banks become more liability-sensitive.

- Demand deposits gain value.

- Net interest margin (NIM) becomes constrained.

- Fee income becomes more germane.

- Relationship accounts become more profitable, and transaction business becomes less so.

- Banks need to emphasize and measure the ROE of a relationship vs. a single product.

- The lifetime value of a relationship becomes more important, and banks need to build products with higher switching costs.

- Borrowers demand longer fixed-rate loans, and community banks should be ready to accommodate that switch.

Conclusion

Some things are difficult to predict, but current developments herald a flattening and higher yield curve in 2022. As has happened four times over the last 30 years, certain strategies work better for community banks when the Fed starts raising rates. Now is the time for banks to consider their 2022 budgets and strategic planning, considering a changing economic environment and the commensurate strategies that have worked for community banks when the curve flattens.