Overcoming Lending Challenges for Community Banks

Covid-19 and the responses to the pandemic are exerting various pressures on community banks. How a community bank underwrites and books commercial credit through the end of 2020 will have a significant impact on the bank’s profits and credit quality through the entire next business cycle. In this article, we focus on four key steps of what banks can do to continue to add earning assets to their balance sheet.

The Challenges

Credit Stress

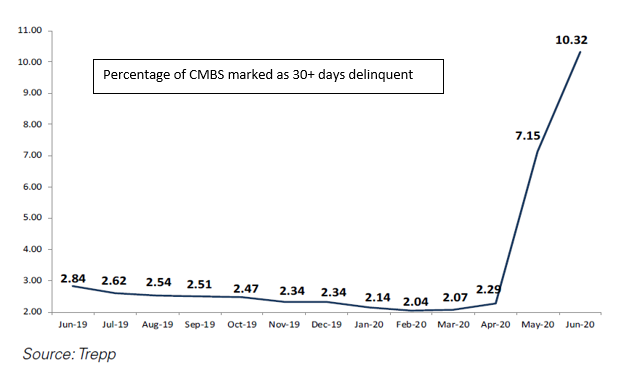

The recession is creating credit stress in various community bank lending markets. Perhaps the best harbinger of default rates is the commercial mortgage-backed securities (CMBS) market, where many borrowers were unable to obtain PPP loans. The graph below shows delinquency rates across all property types. Once government lending support wanes, the CMBS delinquency rates become a reflection of the broader economic credit environment.

Different property types are experiencing different stress levels. For example, retail and lodging have seen the highest increase in non-performance, followed by office and multifamily. Industrial property performance has held up so far.

Interest Rates – Shape and Level

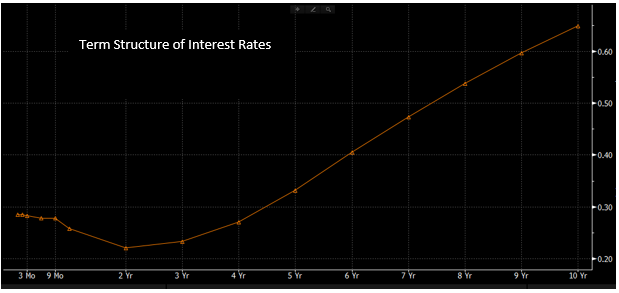

The Federal Reserve response has lowered interest rates by approximately 120 basis points and flattened the yield curve. The graph below shows the inter-bank rates from 1-month to 10-years. Longer-term rates from 2 to 4 years are lower than adjustable rates, and a 5-year rate is only 5bps higher than adjustable rates. The 10-year rate is only 40bps higher than adjustable rates. The shape of the yield curve is a significant obstacle for community banks in generating interest income and creates tough choices for banks on how best to manage their balance sheets — extending balance sheet duration caries all of the attendant gap risks without any of the rewards.

Commercial Loan Spreads

Bank margins are under pressure from the shape of the yield curve and the cost of credit deterioration, but loan yields are not helping. In Q1 2020, the banking industry’s net interest margin (NIM) fell by 9 bps to 3.14% quarter-over-quarter. Yields on total loans decreased by 21 bps to 5.08% (cost of interest-bearing deposits decreased by 18 bps). Industry-wide, for high-quality commercial loans, spreads increased only five bps early in Q2 (latest available data). Our own research shows that community banks are able to generate 40 to 50 bps additional spread on high-quality commercial loans, but this is dependent on loan size, loan category (owner-occupied commercial real estate excluded), and geography. In summary, the potential increase in credit spread (if any) is dwarfed by the higher cost of credit deterioration and yield curve compression.

Possible Solutions

We see several possible strategies to help community banks survive and flourish until the Covid-19 crises subsides, possibly in late 2021.

Develop sources of fee income: In a flat and low-interest rate environment, fee income help banks retain profitability. The greatest source of non-interest income for community banks is hedging income, international services, and SBA lending.

Choose the best credit quality in your market: As in previous recessions, the difference in credit quality based on category and stability of cash flow has diverged. While delinquencies for lodging have increased by over ten-fold, delinquencies in industrial have decreased by 24%. Choosing superior credit quality in a downturn protects the bank and helps long-term profitability.

Lock your best clients: Since every bank is now focused on quality borrowers, competition has increased as quality is now much easier to detect. Once the bank has chosen the best credit quality customers, make sure those customers do not flee to a competitor in the next economic upturn. This is easier said than done, but it starts by getting smart about pricing and understanding, to the best you can, the future of credit. Several banks, we know have instituted a 4.0% floor on their loans. Ironically, now that these loans are a matter of public record and any bank that uses S&P Global, Corelogic, is tied into county records or has one of several other services now has competitor loan information at their fingertips. Bank that utilize floors, or fixed rates without material prepayment provisions are asking for their loan to be refinanced away.

Consider the need for hedging solutions: When the yield curve is low and flat, banks must be vigilant to make every basis point count and avoid unnecessary risks. When the future is less predictable, taking risks without compensation becomes even less desirable. Many community banks have turned to loan hedging to reduce interest rate risk, increase fee income, and retain their best customers for longer periods. It is critical for banks to address borrower needs for longer-term funding – because, typically, it is the bank’s best customers that demand longer

commitment terms.

With banks set to have a record number of assets not paying interest (either delinquent or in forbearance), banks need to find quality assets to help mitigate this risk. This means protecting existing borrowers, going after quality credits that can survive the downturn, and structuring loans in such a way as to reduce both credit and interest rate risk.