Faster Payments – FedNow is About to Change the Game for Banks

Next week, FedNow goes live, ushering in the next era of faster payments. Some 57 financial institutions will start with FedNow, including about 42 banks (plus a handful of core systems providers and fintechs). FedNow joins The Clearing House, which has offered real-time payments (RTP®) for the last five years. Banks are about to win back payment flow from non-banks, and in this article, we break down how this will happen and what it means for your bank.

To get our nomenclature correct, for the sake of this article, we will collectively call RTP and FedNow’s Instant Payments “Faster Payments.”

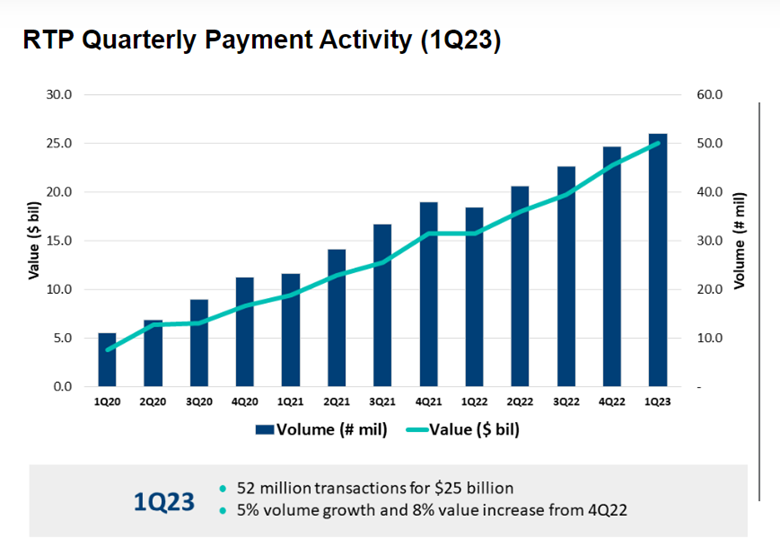

The State of Faster Payments

The RTP network currently has approximately 351 participating banks, 23 technology providers, and a handful of correspondent banks that can facilitate payments and settlement. At the end of the first quarter, the current volume included 52M transactions for over $25B. This is over 50% annual volume growth from the same period last year, and traction is likely to accelerate. For context, according to The Clearing House, senders can reach 65% of U.S. bank accounts using RTP.

Now add to that FedNow, where 57 institutions are going live in the first round, and over 100 institutions should be live within the next 60 days. Since FedNow runs on the Fed’s Fedline, which has more than 10,000 institutions on it, we expect penetration to reach more than 3,000 banks over the next 18 to 24 months. About 92%+ of U.S. bank accounts will be able to be reached by at least one of these networks.

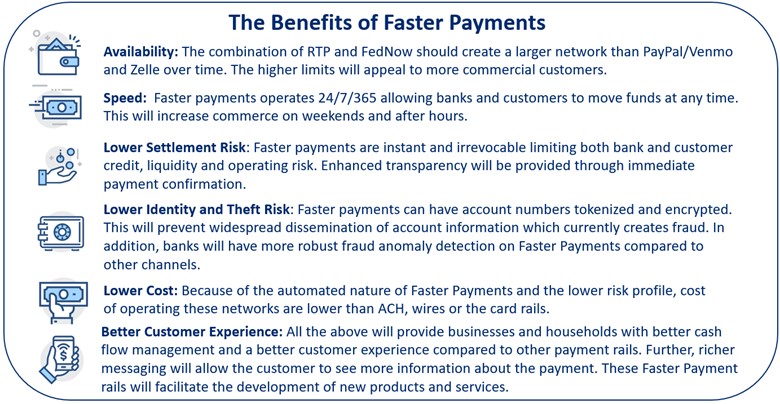

Like the RTP network, FedNow offers 24/7/365 payment flow to facilitate the instant movement of money between financial institutions. These payments are instantly either rejected or confirmed. Hence, the sender immediately confirms their payment status, an attribute not present in today’s payment rails, such as ACH or wires. With real-time payments, there is no limitation by processing schedules, enabling better control over when payments are made and received.

Both rails will be based on the ISO 20022 standard, a dramatic step forward for banking (See our article HERE). This will allow a richer message than any other payment rail so that senders can attach documents and data within the payment message.

While there are slight differences in operations, the only material difference is that The Clearing House supports transactions up to $1M, while FedNow currently goes to a $500k limit.

The combination of RTP and FedNow will allow providers, such as correspondent banks, to offer both rails to provide a more expansive network reach and redundancy. Community bank customers will only have to agree to an irrevocable instant payment, and payment providers will route the payment to the fastest, cheapest, and most stable network.

Request for Payment is the Game Changer

If your question is – “Why should my bank care about faster payments?” – here are the reasons:

FedNow will Explode Liquidity: First, there is a confluence of events over the next six months. FedNow alone will usher in much deeper, faster payment availability, and each enabled bank will be marketing it to their clients, many of whom will be asking your bank if you offer the service. The large number of banks that are expected to join FedNow will deepen liquidity while, in the process, increasing the number of payments, which in turn will increase deposits at each enabled bank.

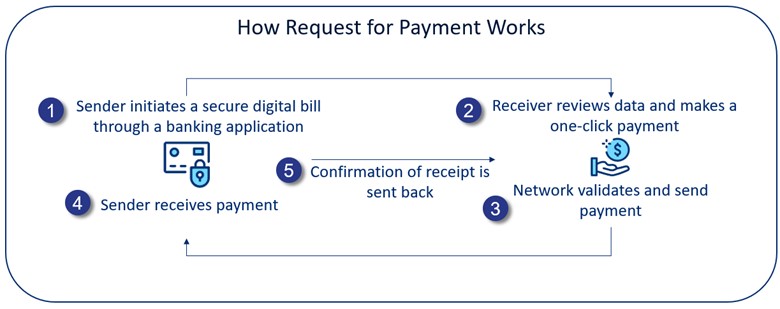

Request for Payment: Then there is a Request for Payment (RFP). The Clearing House currently offers this, and FedNow will soon offer this feature. The critical part here is that while banks like Citi, BNY Mellon, JP Morgan Chase, and PNC offer this now, an array of other large banks will be coming on, such as Bank of America and Wells, which will explode the usage (because more customers will be RFP enabled).

RFP allows billers such as insurance companies, utilities, municipalities, manufacturers, and small businesses to request payment while attaching a document and/or the data of a bill, invoice, or statement to the payment message.

Request For Payment can be made on a one-to-one basis or a one-to-many. This will significantly enhance payment convenience, scale, and capabilities for business-to-consumer (B2C), government-to-consumer (G2C), business-to-government (B2G), and business-to-business (B2B) payments.

Not only will the bill and the payment request be in one place, but receivers will be able to make a payment with a single click instead of going into their banking application and sending a payment or setting the account up in a bill pay application. Further, many banks are now working on the ability to embed that RFP message right into accounting and enterprise resource planning (ERP) systems, such as SAP and Oracle, making it even easier for commercial customers to make payments.

Costs will be dramatically reduced as businesses and governments no longer must send bills, invoices, and remittance notices separately, follow up with a reminder and then reconcile the process. RFP will increase efficiency for all parties.

Safety, Control, Scheduling & Recurring Payments

Another game-changing aspect of faster payments for commercial or retail customers is the ability to control payments. Payments can be scheduled and recurring. Money will come in faster to customers, while outgoing payments can be delayed until their due date, increasing cash flow.

An instant payment receipt will also aid in account efficiency, making the reconciliation process practically non-existent and greater transparency. The digitized and standard nature of the message makes integration into accounts payable, accounts receivable, ERP, and accounting software easier.

Faster payment networks are one of the only payment networks outside of some of the card rails that allow for the tokenization of account numbers. Look for this to become the new standard as encrypted hashed account numbers stand in for real account numbers reducing the potential for theft and fraud.

Get Set for Faster Payment Innovation

Finally, consider all the new products that will now be derived from this payment platform. Banks with trust or escrow capabilities will see an explosion of uses. Home closings can take place on weekends. Virtual lockboxes become more popular. Payroll can move to daily payment. Micro-payments and tipping get digitized. Loan disbursements happen instantly. Pay-on-delivery and request-for-donation become common. Machine learning financial management tools become more meaningful with increased payment data contained in the messages.

The list of new products and services goes on. Whole new customer segments open up for banks, and product penetration deepens.

The potential for new products and new customer segments is limited only by the creativity of banks.

Putting This Into Action

Faster payments will be the final blow for checks. Check usage will decrease, fraud will continue to increase for checks, and the per-unit cost of checks will make the payment channel unsustainable. Faster payments will also cannibalize cards, ACH, and wire volumes. Banks with faster payment capabilities will be able to grow their market share while increasing customer retention.

Faster payments will explode during the next year through RTP and FedNow. In the U.S., Faster Payments only make up less than 1% of all payments. In Europe, where Faster Payments have been around longer (since 2008), that number is 15% and should move to 25% by the end of the year. More and more U.S. customers will be not only requesting it but choosing their bank based on faster payment capabilities. Banks committed to treasury management or building deposits should now start the conversation with potential providers.

Any bank looking to build deposits and serious about offering competitive treasury management services will need to be on at least one of the faster payment networks, if not both. Banks can get some of these services from their core provider, correspondent bank, or fintech provider. Banks can even combine providers so that they receive through one and send through several. Banks can also leverage providers’ APIs and white label a payment platform to compete with card processing companies.

To learn more about faster payments, including a deeper dive into the risks, cost, workflow, strategy, and tactics, click below to find out more and register to attend our upcoming webinar on August 17.