Preparing For Inflation’s Impact on Credit

Some economists, Fed officials, and pundits are making the argument that while inflation may run hot for the next year or so, the risks of long-term high inflation is not pronounced and inflation will be capped at around 3% in the near future, and the probability of runaway inflation is next to nil. This is not a useful analysis for bankers because bankers must underwrite to the probability of outcomes and not to a singular or most likely outcome. The possibility of increasing inflation is real, and the threat that inflation presents to a bank’s balance sheet must be addressed at the inception of the underwriting process. Last week’s PPI increased 1.0% for the month of March alone.

Future Path of Inflation

Despite assurances that inflation will not be a problem – when many trillions of dollars of monetary stimulus from the Federal Reserve meet many trillions of dollars of fiscal stimulus from Congress, one cannot dismiss the possibility of serious inflation threats. Of course, most of the economists and pundits who write about inflation today were not around in the 1960s and 1970s to witness the phenomenon first hand.

One of the biggest rebuttals to runaway inflation is that the Federal Reserve has the tools and motivation to curtail inflation if required. Overlooked is the fact that the Federal Reserve couldn’t control inflation on the way up and tried, and failed, to bring inflation to 2% over the last ten years. Why believe that the Fed will be any more effective in controlling inflation the next time?

Further, the assumption is that there will be motivation to control inflation. The Federal Reserve and Congress may not only tolerate inflation but seek it. The fastest way for the government to shrink the mountain of debt weighing down the U.S. economy is to promote inflation. The vast majority of government interest payments are fixed in nominal terms, and inflation makes the existing debt less burdensome in real terms. Assuming a 30-year bond, raising the long-term inflation target from the current 2% to a still-modest 4% would reduce the debt by 39.6% over the life of the instrument, and raising the long-term inflation target to 6% would reduce debt by 62.4% over the life of the instrument. The U.S. has used inflation this way before. The average inflation rate from 1946 to 1955 was increased to 4.2%, reducing the debt/GDP ratio by almost 40% within a decade.

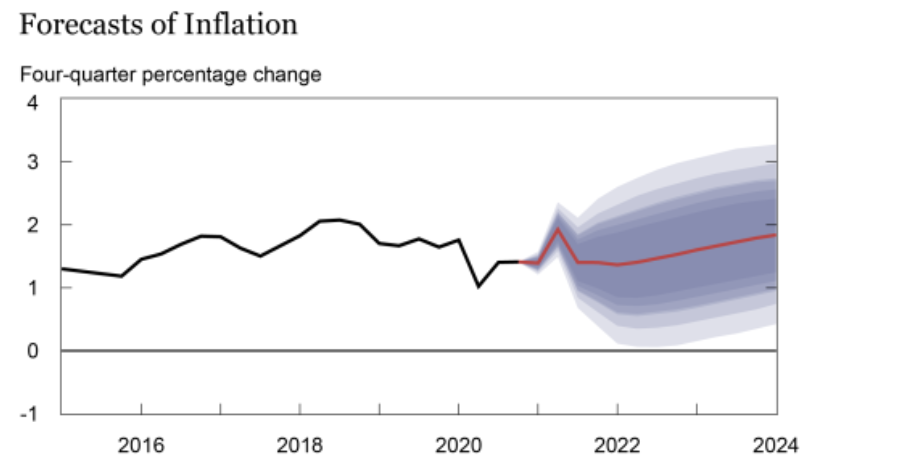

One of the best indicators on the future path of inflation is presented in the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model (we won’t get hung up on the fancy name). The beauty of the model is that it predicts the distribution around the predicted path of inflation. As shown below, the model predicts 2% inflation but with substantial volatility (distribution) around that prediction. The uncertainty for inflation forecasts remains large, and the possibility of inflation approaching 4% is not zero.

Why Inflation Matters To Banks

There are two main risks from inflation for commercial loans. First is DSCR deterioration, and second is repricing risk that leads to DSCR deterioration and lack of equity.

DSCR Deterioration

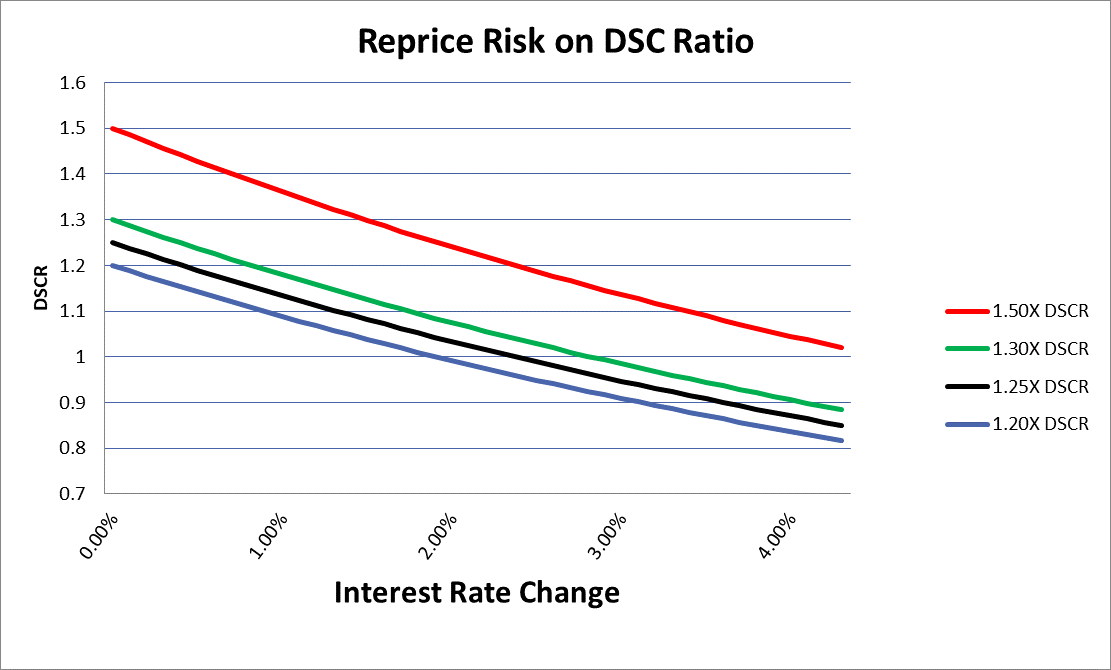

DSCR deterioration is the result of increasing interest rates caused by a rise in real interest rates or a rise in inflation. The borrower’s loan costs increase, and the ability to service the loan declines unless revenues are correlated to interest rates. Unfortunately, most real estate investment businesses, multifamily properties, and many owner-occupied businesses do not demonstrate any positive correlation between interest rates and revenue, EBITDA, or net operating income (NOI). When interest rates increase, the ability to service debt declines. In today’s lending market, borrowers are starting from historically low-interest rates, making the probability of DSCR deterioration all the more likely.

The average community bank’s DSCR for the commercial loan portfolio is close to 1.25X. The graph below shows DSCR sensitivity with increasing interest rates. A 148 basis point increase in rates decreases a loan’s DSCR from 1.25X to 1.00X.

Repricing Risk

The average community bank real estate loan amortization term is almost 25 years. Because the amortization is almost always mortgage-style, very little of the loan is repaid in the first few years. The table below shows the percentage of the loan repaid each year on a 25-year amortization period. With little equity increase in the collateral from the borrower’s cash flow, a repricing of the loan at a higher rate not only negatively impacts the DSCR but also jeopardizes the secondary source of repayment.

Application

Community banks underwriting commercial loans today must stress test the DSCR and equity in the collateral assuming non-benign inflation. Inflation at 4% per annum should be the standard and not the stress case. The average bankable commercial loan has little DSCR cushion to absorb higher interest rates and not enough equity cushion to save the loan with any decrease in asset value of the collateral. The conclusion is that the banks should prioritize credit overpricing.