Preparing For Rising Rates in 2022

There appears to be some complacency regarding the Federal Reserve’s monetary policies in 2021 and 2022. The ten-year Treasury, around 1.35%, may be sending a short-term signal on liquidity versus a long-term prediction on inflation. Community bankers need to factor in the high probability (50% to 75%) that tapering will start in 2021 and not end until well into 2023. Short-term interest rates will rise before the end of 2022 and may revert to their 6% mean by 2024. We present five compelling arguments why the Federal Reserve is already behind the curve in monetary policy normalization, and bankers should take notice.

Pent Up Demand

First, because none of us have direct experience with a pandemic-induced recession, there is a tendency by market participants to view this recession through the prism of previously experienced recessions. However, a pandemic-induced recession is an abrupt and massive labor supply shock and service/product demand shock. It is the most costly and abrupt disruption to an economy. It can also end as quickly as it began if progress is made to end the pandemic. We are now witnessing an abrupt turn to a more hawkish tone of the Federal Reserve as substantial progress is made against Covid-19 with the better-than-expected distribution and uptake of highly effective vaccines. Economic activity and employment indicators will strengthen rapidly as the economy moves to a faster and wider reopening.

Inflation

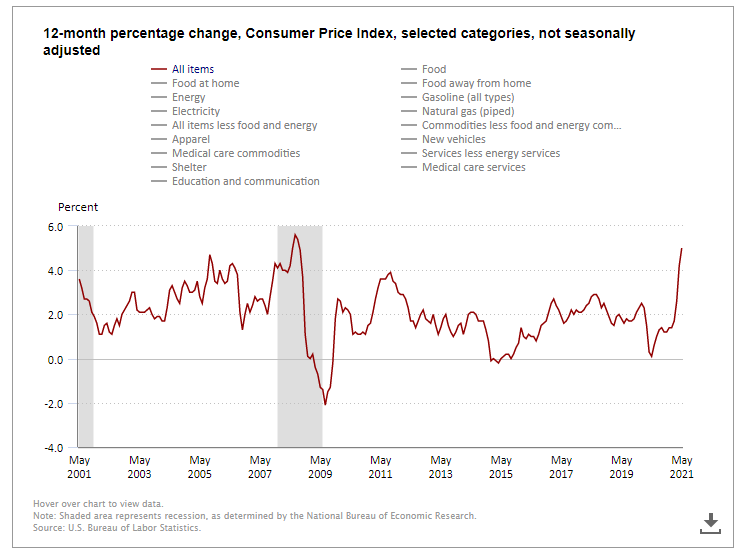

Second, Federal Reserve Chairman Jerome Powell has repeatedly stated that controlling inflation expectations is key to achieving the central bank’s twin goals of price stability and maximum employment. It is unclear how the Fed can manage inflation expectations or even if the Fed measures those expectations correctly. The graph below from the Bureau of Labor Statistics shows the CPI reading in May at the highest level in 13 years.

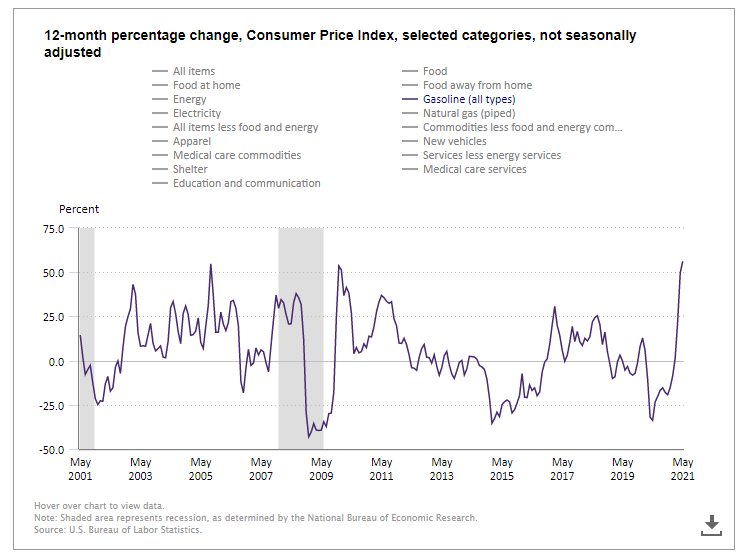

However, consumers’ expectations of inflation vary widely, depending on their age, gender, and income level, and are not sensitive to what the central bank does or says. The big focus for most consumers is how much they pay for gasoline and food. Filling the gas tank is a frequent occurrence (so consumers can compare price changes readily), the price is clearly marked (both on signs and on the credit card receipt), and there are few substitute products (if you need to drive to work, the car cannot run on a different fuel). The graph below shows that the recent rise in gasoline prices is the highest in more than 20 years.

The rise in gasoline prices causes consumers’ attitudes to change and is causing the central bank to shift its focus in trying to stop inflation concerns from spiraling out of control. The risk of inflation expectations becoming unanchored is now looking very real. With the CPI surging at the fastest rate since 2008, the transitory inflation thesis is now questioned with the sustained increase in gas and food prices.

Employment

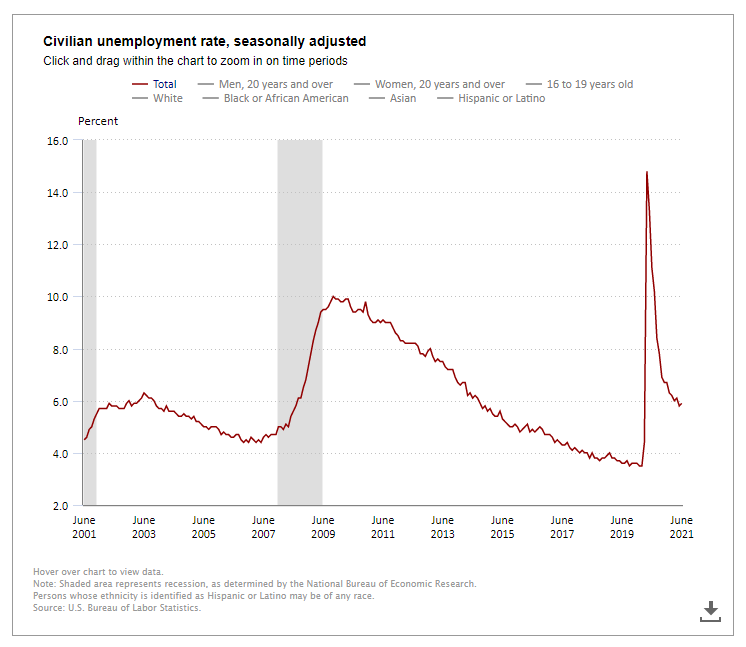

Third, full employment can be achieved quickly at this stage if the economy keeps adding almost 900,000 jobs per month as it did in June. The unemployment rate is shown in the graph below. Labor data is now showing pockets of overheating. The Federal Reserve will want to see the unemployment rate fall to 4%. However, it is likely that the pandemic will trigger a broad reconsideration of work-life balance with some workers. Augmented jobless benefits will end in early September, promoting even greater matching of employers and workers. In fact, the incentive to delay job-finding may be waning well before September as the administration has clarified that recipients need to take a suitable offered job or lose benefits. The private sector is now projecting the unemployment rate to land below 4.0% before the end of 2022.

Fed Member Expectations

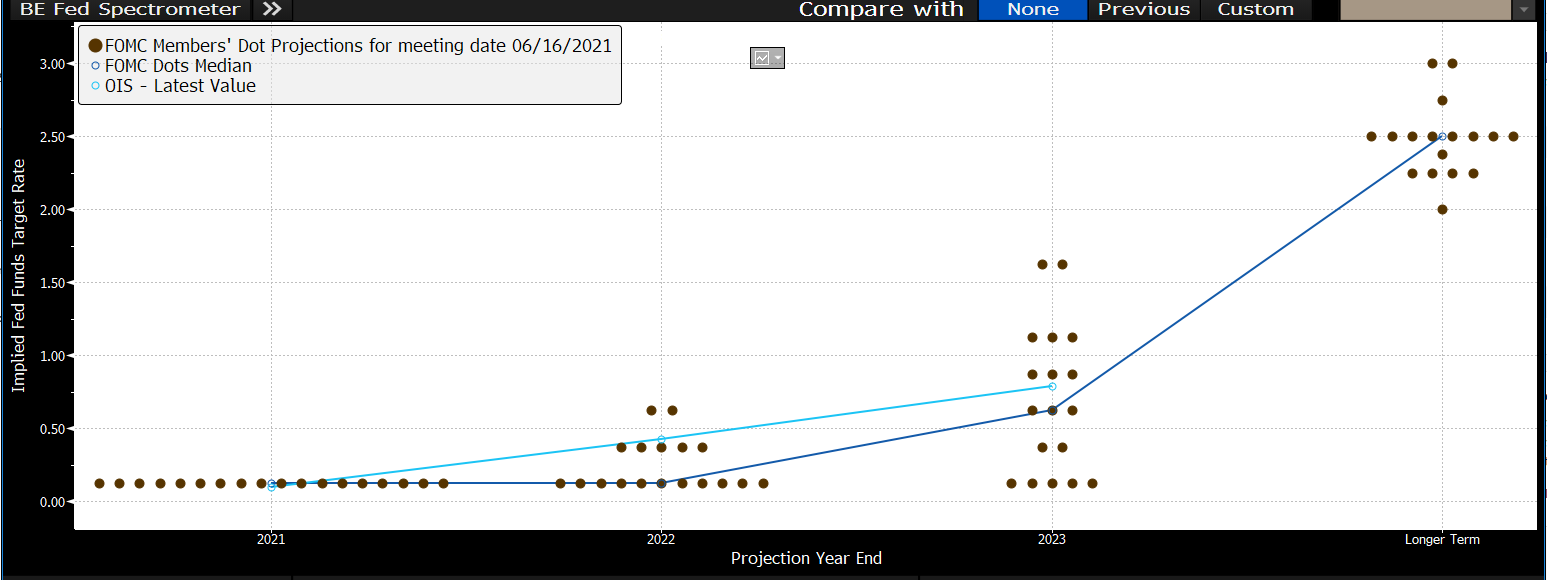

Four, the Federal Reserve is starting to recognize that it may have been too slow to react to the economic developments in the economy. At its June 15-16 meeting, the Fed signaled it would raise interest rates by 50bps in 2023, but seven of the 18 policymakers indicated an increase in 2022, up from four members at the March meeting. The International Monetary Fund believes that the Federal Reserve will need to begin raising interest rates in 2022 as increased government spending keeps inflation above its long-run average target. The IMF staff stated as follows: “Managing this transition — from providing reassurance that monetary policy will continue to deliver powerful support to the economy to preparing for an eventual scaling back of asset purchases and a withdrawal of monetary accommodation — will require deft communications; under a potentially tight timeline.” In the near future, we may see more Federal Reserve members shifting their rate view to a more hawkish stance.

Five, the market has already started pricing in the high probability of interest rate increases in 2022. The DOT plot below shows the Federal Reserves’ interest rate expectation, with seven members expecting a rate increase in 2022. However, the light blue line in the graph below shows the market’s interest rate expectation – pricing 1.5 rate hikes in 2022.

Conclusion

While we have yet to achieve a post-pandemic equilibrium, that goal may be closer than some bankers expect. If the economy keeps adding almost 900,000 jobs per month and permanent disruption in employee sentiment about work-life balance, we may only be a few months away from the unemployment rate approaching 4% and the Fed policymakers declaring a non-preemptive tightening policy. When the Fed tightens, they are likely to do so quickly at first and then on a steady basis until inflation is under control. At the same time, the Fed will reverse much of the pandemic’s stimulus, and liquidity will drain from the system.

Community banks should be modeling a decrease in liquidity and an increase in balance sheet stress-testing (assets and liabilities) for a more normal interest rate environment within the next 12 to 18 months as the pandemic-induced recession recovers more fully. That likely means a substantially higher cost of funds, greater deposit sensitivity, and a shift in deposit mix from non-interest bearing to interest bearing. On the asset side, it is highly probable that a +300 basis point rate shock will not be enough. The sharp rise in rates will likely cause havoc on the valuation of assets on every bank’s balance sheet while creating credit risk problems.

Our industry got lucky during the pandemic thanks to stimulus programs. Now it is time to play defense.