The State of Liquidity & Regulation in Banking

While banking returned to some semblance of normal, many banks continued under short-selling pressure. In this article, we recap the latest data on deposits and banking in order to give you an updated picture.

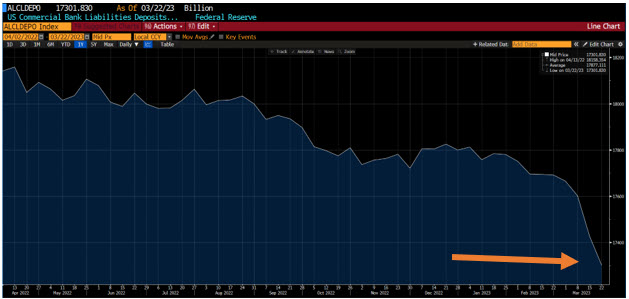

Deposit Balances

The Fed’s H.8 report, published last Friday, provides an interesting snapshot of the banking system’s assets and liabilities through March 22. In contrast to the previous week, small bank deposit balances remained stable, while large bank (top 25) balances declined by $96B, possibly indicating a shift to MMFs. Deposit outflows for the prior week were revised upwards to show a combined decline of $64B, including $185B from community banks—the Fed included a notice with the release stating that data for the week ending March 15 were revised to account for a change in how FDIC bridge banks were incorporated into the community bank data.

Additionally, as evidenced by the H.4.1 data on Fed borrowing and FHLB issuance volumes, aggregate bank borrowing significantly slowed during the week ending March 22. Cash balances had increased by $468B the week prior, as banks took precautionary measures to bolster liquidity, but were subsequently reduced in the week through March 22.

Bank Borrowings

According to the Fed’s H.4.1 data, Bank Term Funding Program (BTFP) borrowing increased by $10.7B to $64.4B, while discount window borrowing fell by $22.1B, resulting in a net decrease of $11.4B in borrowing from these facilities during the week. This, combined with a reduction in FHLB net issuance and slower money market fund (MMF) inflows, points to the fact that the rate of deposit outflows is decelerating, and much of the borrowing observed two weeks prior was taken as a precaution.

Bank’s Balance Sheets

Interestingly, even as borrowing slowed substantially and banks required less liquidity, banks continued to offload securities. This may have been a strategic move in light of falling yields and the need for banks to add liquidity to their balance sheet. As an estimate, it looks like banks sold approximately $37B in securities.

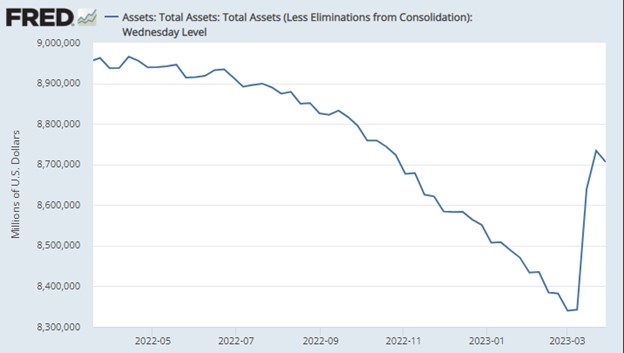

It is also interesting to point out the step back in quantitative tightening with these added liquidity programs and usage (below).

Lending

Although we only have quarterly lagged data on credit conditions, it is worth noting that more timely H.8 data show that loan growth has already significantly slowed since the beginning of the year across all categories. Notably, loan growth has decelerated considerably for commercial and industrial loans as well as real estate, and it is declining for consumer and other loan categories (*includes loans to private credit, insurance, and foreign entities, among others), with the most dramatic decreases occurring at the largest banks.

Regulation

Last Thursday, the Biden administration released their “Fact Sheet” that called on banking regulators to enforce stricter regulations on mid-sized banks, which can be implemented without congressional support. The White House suggested that banks with assets ranging from $100B to $250B should more closely align with Too-Big-To-Fail Banks, maintain higher liquid assets, increase their capital, undergo annual supervisory capital stress tests, and develop “living wills” outlining their potential wind-down process.

These measures can be executed under existing laws, eliminating the need for congressional approval. The White House’s proposals support the Federal Reserve and other banking regulators’ ongoing efforts to enhance oversight, particularly for mid-sized banks. The Administration also urged Congress to mandate the inclusion of clawback language for bank executive pay.

The Biden administration also recommended that regulators reduce the transition period between regulatory bank categories, increase bank supervision, increase long-term debt capital qualifications, and ensure the cost of replenishing the Deposit Insurance Fund (DIF) is not borne by community banks.

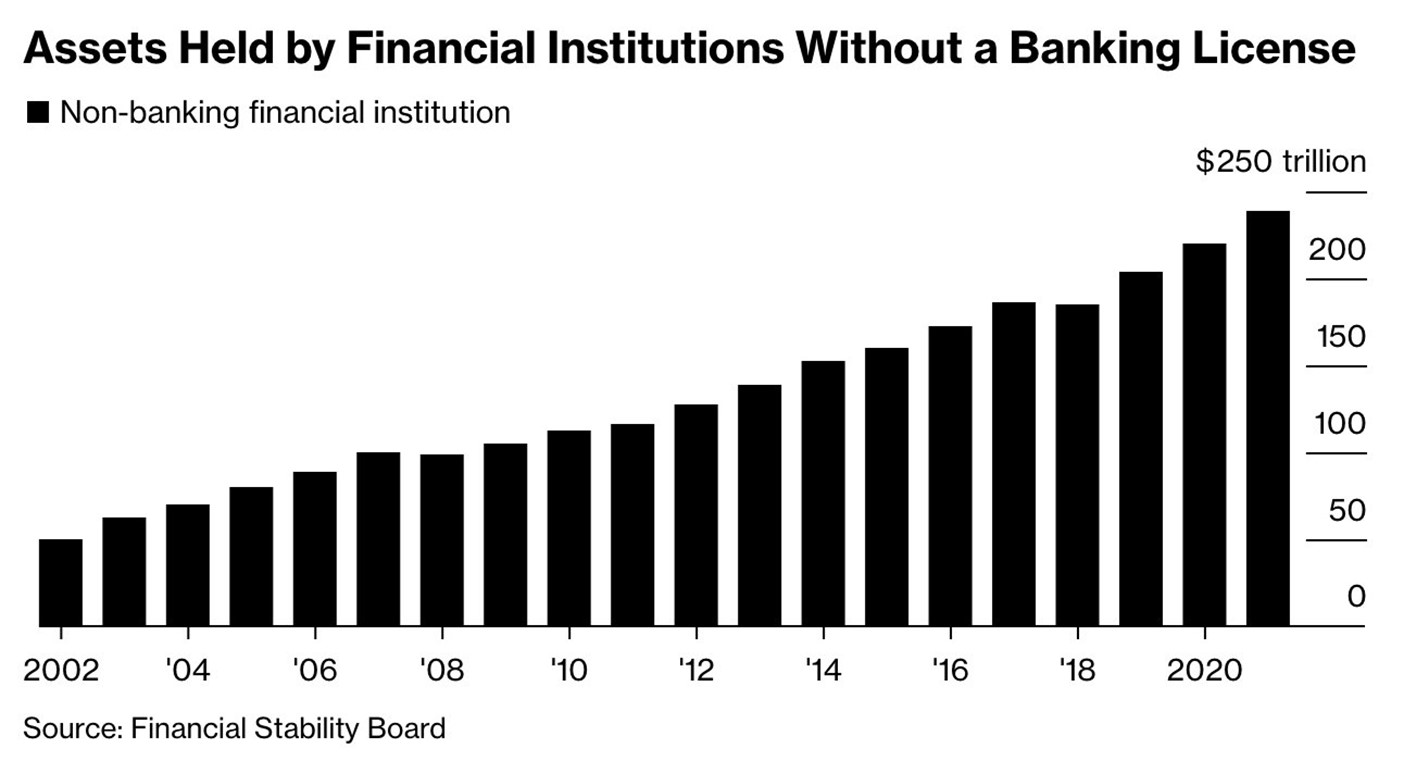

The proposed regulations will impact about 30 banks, and the concepts will filter down to larger community banks between $50B and $100B. The move will increase the cost of compliance and the cost of capital. The move also doesn’t address the systemic risk of balances held outside the banking system at non-banks (below).

While senior administration officials have been in close contact with regulators regarding the proposed changes, the timeline for any actions will be determined by the independent agencies themselves.