Restructuring Commercial Loans Amidst The Coronavirus

The economic implications of coronavirus are expected to be widespread and are already causing some borrowers to be concerned about their ability to make loan payments. Many of our bank customers have used the ARC program to fix rates for borrowers while retaining a variable rate. Some of these borrowers in profoundly affected sectors, such as restaurants, hotels, and theaters, are now approaching the lending banks to discuss loan payment relief. CenterState Bank is ready to work with community banks to help provide cash flow relief to obligors who have used the ARC program and who have sound business models but require some temporary payment restructuring.

Lenders’ Considerations

We developed ideas and strategies in the great recession of 2008 to help creditworthy borrowers who needed cash flow relief and had hedged loans. The general playbook is as follows:

Step 1 – Triage Borrowers: While we discussed our framework at length (HERE), the goal is to identify borrowers who have sound business models but whose cash flow from operations is impaired because of temporary revenue challenges caused by the coronavirus.

Step 2 – Analyze Liquidity: Analyze the borrower’s position for liquidity. Some borrowers requesting relief have sufficient liquidity to withstand zero or negative EBITDA for months. Lenders want to provide relief for those that cannot immediately tap other sources of liquidity.

Step 3 – Target the Weakness: Understand the structural weakness of the credit. For any cash flow relief provided, the lender will want some form of consideration, such as additional collateral, guarantees, covenants, additional equity or premium pricing.

Step 4 – Bridge the Gap: Structure relief that is long enough to provide a bridge to a permanent solution, but not longer than is reasonably required based on available information. For example, agreeing to the interest-only (IO) for one month is not long enough to bridge many borrowers over the effects of the coronavirus, and will require multiple modifications and negotiations. However, giving 12 months of relief may be too long given the expected temporary consequence of this health concern (based on current medical information and past pandemic experiences). As previously discussed, banks should target a minimum of three months, consider out to six months (since that is usually the edge of what constitutes a “troubled debt restructure” (TDR)), and longer if the situation warrants (better to have a TDR than a default). Here, bankers have a variety of options to include 100% payment deferral, creating an interest-only period, restructuring the amortization of the loan, layering in another credit facility or calling an event of default. In exchange for some of these actions, bankers will be looking to increase their collateral position, getting additional guarantees and/or stronger covenants/reporting.

It also merits discussing government programs, particularly in cases where future risk cannot be reduced by gaining in your security position. Here, we anticipate a $1.5T package that will heavily favor Small Business Administration (SBA) lending. Here, banks can use a payment forbearance to buy more time to see where the Federal and state governments will assist.

Step 5 – Negotiate, Document, and Monitor: Negotiate a form of relief that helps the borrower survive temporary cash flow disruption and still protects the bank’s capital. Document this and increase monitoring and management to ensure the restructuring is sufficient.

Options Available For Hedged Loans

Hedged loans provide flexibility for lenders by offering various forms of cash flow relief to borrowers. Lenders may exercise any of the following options for borrowers who have hedged their loan:

- Create IO payment periods,

- Reduce credit spread on the loan (effectively lower interest payments), and

- Designate deferred payment periods.

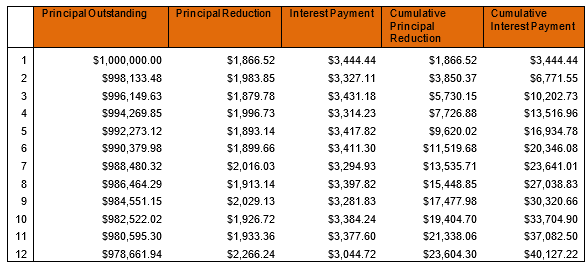

Each of the above options will most likely require that the bank designate the credit a troubled debt restructure, and each option may result in different economic impacts to the borrower and lender. Below is a typical loan amortization schedule showing monthly principal outstanding, principal reduction, and interest payment (on a 4.00% fixed rate). The last two columns also show the monthly cumulative principal and interest payments.

The first option allows the lender and borrower to negotiate an IO period. On a $1mm loan, each three-month IO period saves the borrower approximately $5.7k in cash. Under this option, the hedge provider amends the hedge to accommodate the change in principal reduction, and the cost to modify the hedge is included in the new fixed-rate to the borrower. The cost to amend the hedge is typically only a few basis points in interest payments for the life of the loan. We have seen this option used by banks for three to 12 months, with three to six months being most common. The advantage of this option is that the bank continues to earn the same interest rate on the loan, and additional options may be considered at the end of the initially negotiated IO period. The lender does not forgo any rights or income other than a reduction in the return of capital. The disadvantage is that the hedge does need to be amended to accommodate the IO periods restructured.

The second option allows the lender and borrower to negotiate a temporary reduction in the interest rate on the loan. On a $1mm loan, each three-month interest payment equals approximately $10.2k in cash. This is where substantial cash relief can be delivered to the borrower. However, most lenders prefer not to lead with this option because it reduces income to the bank. The advantage of this option is that it allows the hedge to be left untouched, and the borrower does not incur costs to amend the hedge.

The third option involves deferred interest and principal payments. On a $1mm loan, each three-month deferment of payments equals approximately $15.9k in cash. This option provides the highest amount of cash relief, and the bank may use “catch up” payments for later periods to compensate for deferred interest payments. The disadvantage of this option with a hedged loan is that the lender typically compensates the hedge provider for any hedge settlement costs (the difference between fixed and floating rate on the principal amount of the loan). However, as negotiated, the borrower may make that payment during the deferred period or after. We have seen this option used where the lender was commercially certain of a positive outcome in the credit, and the borrower required substantial cash flow relief.

Conclusion

This coronavirus will have a strong credit impact on some borrowers, but that impact will be temporary. Where borrowers require cash flow relief and the loan is hedged through the ARC program, CenterState is standing by to assist and advise our customers on the best way to help borrowers, and still protect the community bank.