Addressing Bank Risk When Economic Uncertainty Is At All-time High

During first-quarter updates, many US banks amended their expectations because of economic uncertainty and a possible business downturn. How should community banks interpret the current economic uncertainty, the possible reset to the business environment, and how should managers address risks?

Economic Uncertainty

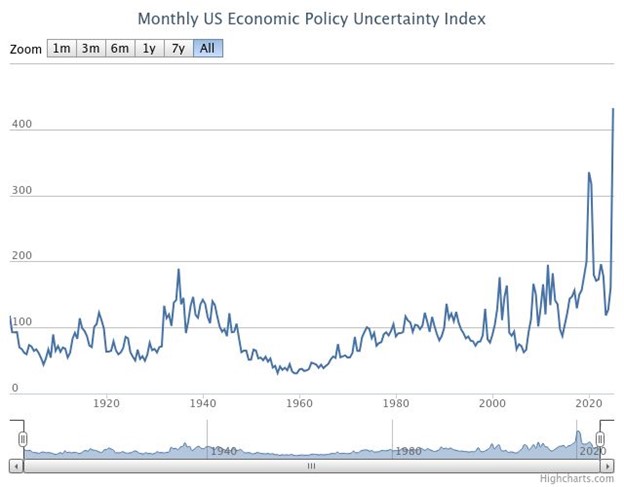

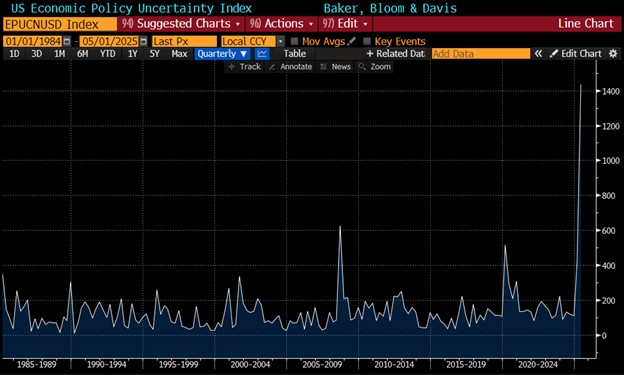

We considered two bellwether indices that measure policy-related economic uncertainty. The indices measure underlying components of uncertainty by searching publications for topic-specific indications of uncertainty, as well measuring the number of federal provisions set to expire and dispersion around economic forecasts. The US Economic Policy Uncertainty Index and the Baker, Bloom & Davis Uncertainty Index graphs appear below.

These two measures indicate that the current level of US economic uncertainty is higher than during the pandemic and the Great Financial Crisis by a factor of 2 to 3X. If one believes in the directional value (if not the absolute value) of these indices, then risk management lights should be blinking red at all community banks.

Uncertainty and Risk

Economic uncertainty affects community banks through several transmission mechanisms. Uncertainties for banks stem from the following:

- Economic Volatility: Fluctuations in economic indicators such as GDP growth, inflation, and employment rates.

- Interest Rate Changes: Changes in economic growth and inflation lead the FOMC to shift interest rates. In the current state of economic uncertainty, it is unclear how the FOMC will react to possible stagflation.

- Regulatory and Policy Shifts: Changes in financial regulations or bank government policies have been announced, however, their primary impact is on national banks which will make competition more intense for community banks.

- Geopolitical Events: Global economic activity, political instability, trade disputes, and global conflicts can disrupt financial markets and affect community banks’ clients with international exposure.

Community banks are likely witnessing greater credit risk, market risk (changes in interest rates, market prices of inputs, FX rates, and real estate values), liquidity risk, operational risk, and reputational risk (in a digital age, negative news about a bank can spread rapidly).

Interconnected Risks: The Role of Correlation

Financial risks are often interconnected, meaning that the occurrence of one risk can influence others. A positive correlation implies that risks move in the same direction, while a negative correlation indicates they move in opposite directions. Understanding these relationships is crucial for portfolio diversification and risk management. One simple example of risk correlation that is important for community banks to track is the relationship between probability of default (PD) and loss-given-default (LGD). The expected loss (EL) of a loan is the product of PD and LGD. For commercial loans the level of EL is explained by the following: a) state of the economy, b) state of a particular industry, and c) specific credit strength of the obligor and supporting parties.

What we witness during periods of uncertainty is the following:

- Increased correlation between PD and LGD. This is because collateral values are related to present value of discounted future cash flows (NOI or EBITDA), and it is this same cash flow that we measure for debt service coverage ratio to predict PD. This is the old underwriting adage that there are three predictors of credit risk – cash flow, cash flow, and cash flow.

- Relatively high standard deviations on PDs and LGDs. The expected PD and LGD during underwriting suffer from fat tails. When the economy turns, many industries suffer, and those obligors with minimum strength have much higher PDs and LGDs than originally calculated. PDs and LGDs must be stressed for the downside risk of a recession.

Strategies for Community Banks Amidst Economic Uncertainty

Community banks currently deploy many tools to manage various risks mentioned above to maintain stability and profitability. There are several key strategies for community banks during periods of heightened uncertainty as follows:

- Diversification: Spreading risk assets across various known sectors can reduce overall exposure. The emphasis is on known underwriting sectors and geographies without stretching into unknown asset classes or markets.

- Risk Assessment Models: Utilizing risk adjusted pricing with stressed PDs and LGDs is key to measuring fat tails and cross correlation to the same obligor.

- Stress Testing and Capital Adequacy: Simulating extreme market conditions to assess the bank’s resilience and the sufficient capital reserves to absorb potential losses.

- Hedging and Credit Risk Mitigation: Reducing duration mismatch for both the bank and the borrower is key to reducing interest rate risk. A bank’s funding tends to reprice over a short term and earning assets should match that repricing term. Many borrowers’ assets are long-term, and revenue tends to be interest rate insensitive, therefore, these borrowers are better insulated from risk with long-term and fixed-rate liabilities. Hedging instruments can help offset this apparent mismatch.

Conclusion

We would like to leave you with the following axioms of banking that summarize the best tenets during periods of uncertainty.

- Banks cannot speculate. With 8 to 10X leverage there is little room for error. A banker must be right 99 percent of the time to make the business model work. Therefore, bankers must now carefully consider why a lower margin may make sense for 2.0X DSCR, 50% LTV loan, versus the policy minimum 1.20X DSCR, 75% LTV loan.

- Do not borrow short to lend long. This is the cardinal sin in banking that has been propounded by Jamie Dimon and many other banking CEOs. We tend to quickly forget the many (and recently) failed banks that ran afoul of this axiom.

- Avoid directional bets on interest rates. Further, do not allow your borrowers to do the same. Evidence proves that humans are bad at predicting the future course of interest rates, and our borrowers are no exception. Question those borrower’s that express a desire to finance long-term assets with short-term repricing liabilities in the “hopes” that rates are lower soon – rates are just as likely to be higher as lower.

- Measure your bank’s products expected ROE/ROA. If your bank is not using a risk-adjusted return on capital model, such as Loan Command, to measure return on risky assets (such as commercial loans), ask your manager why. Is it too complex, too expensive, or too disruptive to existing business practices?