Should Community Banks Consider Credit Tenant Loans

A credit tenant loan (CTL) is a loan secured by the real estate pledged as collateral and the obligation of a credit-rated tenant of that real estate. These loans are a cross between a bond (because the tenant’s obligation to pay rent is a senior obligation of a creditworthy obligor) and a commercial mortgage (because of the real estate collateral). The CTL is usually less risky than a comparable commercial mortgage and, therefore, priced accordingly. The CTL is also structured for a longer-term and does not rely on personal guarantees. Community banks have historically shied away from CTL financing for the following three reasons: lower loan yield, longer-term, and lack of personal guaranties. But we feel that CTL offers community banks substantial lending opportunities, especially in an unsettled Covid-19 credit market. We recently came across a CTL opportunity that we will use to highlight why CTLs are good lending opportunities for some community banks.

General Credit Considerations

CTLs are structured to be safer than a traditional commercial mortgage or an unsecured bond with similar credit ratings because the lender benefits from both the credit profile and the real estate collateral. There are three key elements of analyzing a CTL: credit risk assessment of the tenant, lease structure review, and property risk consideration. Most community banks are well-positioned to analyze all three elements of a CTL.

There are five key aspects of CTLs that make them especially attractive to community banks during Covid-19 stress.

Managing credit through the business cycle: Any bank can perform reasonably well during up-years. But the best banks maintain performance during down years and sudden shocks, such as Covid-19. A CTL allows a bank to choose businesses that demonstrate financial stability and quality of cash flow. Banks have the ability to source CTLs where the lease is to a riskier retailer (such as Sears) or where the lease is to a less risky medical provider (such as DaVita Inc.). Both tenants may present bankable deals but with much different LTVs and different pricing. In challenging credit environments, CTLs offer community banks an opportunity to increase loan credit quality.

Stress testing credits: The quality of cash flow to service debt must be measured at inception and in down-case scenarios. By definition, tenants of CTLs are publicly reviewed, and banks can analyze financial performance and estimated future cash flow. For DaVita Inc., as an example, banks have the ability to review various sources for three years of forecasted revenue, forecasted gross margins, and forecasted EBITDA. Banks can then stress test based on perceived threats to the business model. For DaVita Inc., banks also benefit from seeing where the market is pricing default risk in live time. The company’s credit default swap costs (currently 90bps per annum) is shown in the graph below. The financial insight into the credit tenant is a tremendous benefit to lenders in the current sudden shock credit environment.

Loan structures:

- Leverage – CTLs are not supported by personal guarantees, but the common LTVs (commonly up to 75%) result in better debt yield than average commercial mortgage loans. This is especially important during Covid-19, when commercial property cap rates have risen on average by 1% but are still elevated by historical averages. Today, we see banks that are still willing to lend on commercial real estate at 80% or even 85% LTVs and accept sub 6% debt yield. CTLs offer a much safer option.

- Balloon payments – Banks wanting to avoid troubled debt restructure by minimizing balloon payments during the early years of an amortizing commercial loan. CTLs are structured on 20 to 30-year amortizations with 10 to 30-year terms. Many CTLs are fully amortizing and benefiting from no balloon payments. Longer-term loans offer a benefit to both the borrower and the bank as the principal on the CTL amortizes, the equity value of the collateral increases. Therefore, while the visibility horizon on the tenant’s credit profile decreases with time, the equity buildup offsets the risk of the loan.

- Cash flow – Typically, CLTs are structured to provide rental payments to result in a DSCR of 1.0X to 1.25X. However, banks can choose tenants that demonstrate highly stable cash flows by analyzing the critical nature of the property for the tenant. For example, banks may choose financing of corporate headquarters, or critical distribution facilities, or relocation of existing centers to better geographic locations. This leads to the increased likelihood that the rent is paid, even in stressed credit event scenarios.

Quality and Frequency of Credit Data: During recessions and sudden shocks, it is crucial for banks to get frequent financial reporting and updates. CTLs allow lenders to access quarterly public data and, in many instances, daily credit data in the form of the tenant’s credit default swaps or bond pricing. By contrast, most commercial mortgage borrowers provide annual financial reporting with long delays.

Pricing: Prior to Covid-19, CTLs with high-grade tenants (like DaVita, Inc., which is rated BB by S&P) and sound collateral were priced at LIBOR plus 1.65% to 1.85%. During this pandemic, we see these same credit quality CTLs priced at an average of 50bps higher spreads. This creates an opportunity for community banks to lock in higher-yielding, top-quality credit assets, that if properly structured with a prepayment provision, those loans will stay on the books for 10, 15, or 20 years yielding above-average returns with minimal credit risk. Community banks have an added advantage in sourcing CTL opportunities between $1 and $5mm in size. At those loan sizes, local equity investors would prefer a local lender with an intimate understanding of the market, and larger banks pay less attention to these loans.

Our Bank’s Opportunity

Our bank was looking at the following lease abstract:

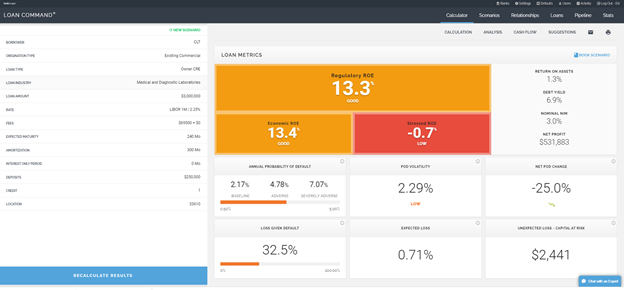

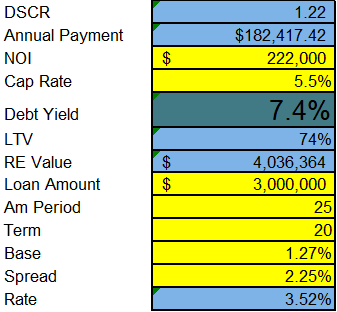

Our bank submitted a term-sheet and won the loan (against one other community bank and one regional bank). The loan was structured as follows: $3mm, 74% LTV, 25 due 20, 1.22X DSCR, and 7.4% debt yield. The pricing was set at LIBOR plus 2.25%. We offered the borrower a 20-year fixed rate using the ARC program, which eliminated interest rate risk, balloon risk, and generated $69.5k in upfront hedge fees for the bank. The summary of the loan and credit parameters appear below.

Using this structure and pricing, we won a high-quality loan with acceptable returns, added some low-cost deposits, and won a new customer for the bank. Our Loan Command output appears below and shows a 13.3% risk-adjusted return on equity and a 1.3% return on assets.