Should Your Bank Have A Workplace Vaccine Policy?

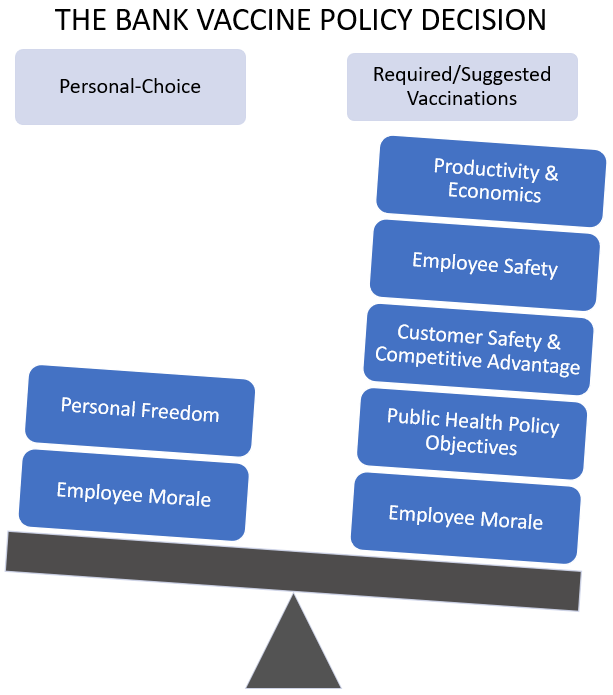

With FDA approval and the first shipments of the COVID-19 vaccine start to hit our communities this week, the question comes up over should banks have a policy around if the vaccine should be mandated, recommended, supported, and acknowledged in the workplace? On the one hand, taking a proactive stance supporting workplace vaccination could be the fastest way to normalcy and safety. On the other hand, requiring a vaccine to return could be rife with liability and employee morale issues. This isn’t an easy decision, but our position is that doing nothing will likely result in your bank’s worst possible outcome.

The Background

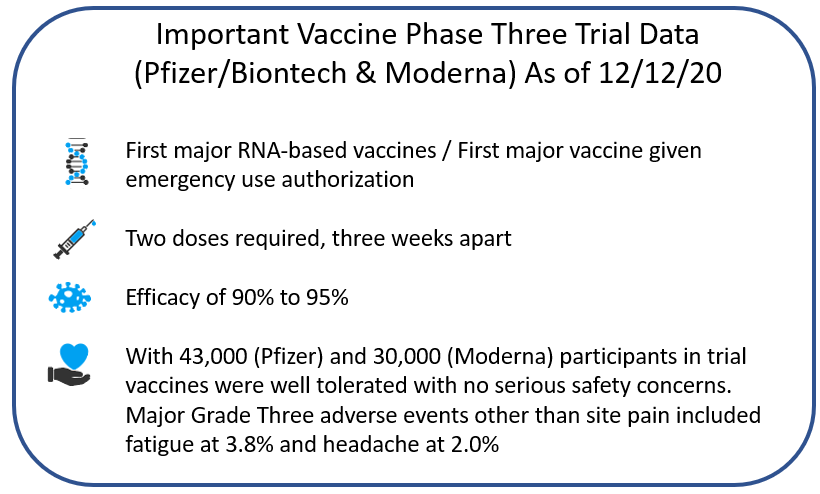

Most of our public and workplace health policy to this point during the pandemic was predicated on the arrival of a vaccine in 2021. At present, the first bank employees are set to get the vaccine starting in March, with most of the industry being slated for the June to September time frame. From recent surveys and our estimation, it can be forecasted that a low of 30% and a high of 70% of the employees (Median 55%) will opt to get the vaccine. In support of this, a September poll by the Pew Research Center found that 49% of respondents “definitely or probably would not get vaccinated at this time.” The Lancet found that only 50%-59.9% of U.S. respondents agree that “vaccines are safe.”

While there are lots of important decisions bank executives make every day, few have an impact on life and death. This one does, which is why it is so important to get it right. Deciding if to have a vaccination policy and what it contains is likely the single most important decisions banks will have to make in their careers.

Mandated Vaccination Policy

Given the above fact set, an argument can be made that banks can require vaccines before returning to the office or branch because the virus is easily transmitted in the workplace. As long as exceptions are made for religious and medical reasons (to include generalized anxiety) under the Disabilities Act, employers have the legal right to require vaccines with the justification that non-vaccinated employees put other employees, customers, and the general public at risk.

While no authority has yet to issue guidance over vaccine policies, it could be coming shortly. The U.S. Centers for Disease Control and Prevention and the Equal Employment Opportunity Commission (EEOC) have both issued guidance determining that COVID-19 meets the “direct threat” definition allowing employers to take reasonable actions such as requiring masks, asking health screening questions, and taking temperatures. It is possible that both these authorities could issue stronger pro-vaccine guidance providing banks with legal cover.

For banks thinking about mandating at least part of their workforce to be vaccinated, any such plan would need to include a prioritization in which to do that. Bankers that are required to be on-site, are at risk for health reasons, AND are customer-facing would likely have the highest priority, while non-at-risk employees that can continue to work from home will have the lowest priority.

Of course, should an employee be mandated to get a vaccine without clear guidance from local or federal health officials, and something goes wrong with an employee vaccination, the Bank could be held liable. Mandating vaccinations also come with the risk of how to handle those employees that seek exemptions. Banks can request information and documentation from the employee to support the exception request, but it’s a thin line of how much information and evidence a bank can ask for. Regardless of what the exception policy is, it will need a process to handle and manage exceptions as well as maintaining evidence that it does not practice “immunity discrimination.”

The Personal-Choice Policy

On the other side of the argument is the “personal-choice” position that Facebook and many banks are taking. Here, they are leaving it up to each employee. While this seems like the path of least resistance, should the vaccines maintain its efficacy and safety record, then the bank slows the full return to the office as employees can always argue that they don’t feel comfortable coming back into the office.

If a mandatory vaccination policy is not imposed, the bank opens itself up for liability in that it has failed to provide a safe and healthy work environment that is both expected by employees and required by law under the Occupational Safety and Health Act (OSHA) or under local public health guidance.

Then there is the practical risk of a personal-choice policy. A recent survey by Blind of Amazon, Google, Facebook, and Apple showed that a majority of employees would not return to the office without a mandatory vaccination plan. Further, a large majority of employees from these companies also said they would get vaccinated if their employers asked them to. This brings up the ethical question is, why won’t a bank proactively support the most considerable health care and public policy initiative of our time? If a bank chooses not to at least support a vaccination effort, does it owe its employees and the public a reason why?

Employee Morale – The No Win Position

No matter which direction your bank chooses to go, the bank is going to be at a disadvantage when it comes to morale. Choose the mandatory vaccine policy path, and your employees think – “How dare my bank tell me what to do with my body.” On the other hand, choose the personal-choice path, and your employees think – “Is my employer trying to kill me? Do they not care about my safety?”

While mandatory vaccination programs are present in all 50 states, all required vaccines went through the standard pathway of approval. No state has ever required an experimental vaccine that has been approved under emergency use authorization (EUA).

That said, the U.S. has never faced a graver threat. At more than 3,000 deaths per day this month, the virus has again become the leading cause of death in the U.S., surpassing heart disease and cancer. When the horrible events of 9/11 occurred, we lost almost 3,000 Americans that day – the nation stopped and quickly mobilized against a common enemy. Now, we lose 3,000 Americans per day, and we struggle with a simple mask policy. When the enemy is us, mobilization and enforcing public health policy is more difficult. Banks now must weigh personal freedom against the potential death of employees or their family members.

Hybrid

Then there are the banks that plan on being flexible as to their location. Some banks may demand vaccinations for their customer-facing personnel but not for office workers. Others may leave it up to the location manager or just choose to vaccinate their on-site employees and let remote workers make their own decision.

As we talk with banks, the most common approach is to start with personal choice and consider a mandated vaccine position once greater data is obtained, and more vaccine choices are available.

Protocols Should Continue

It remains unclear if the vaccine prevents the transmission of the disease, and it is still undetermined how mutations impact the efficacy of the vaccine. Finally, it is worth noting that, at present, employees will need two to four doses per year, depending on the vaccine. Given the data so far, it appears that some vaccine recipients could be exposed to reinfection five to six months after the last vaccination dosage. If nothing else for contract tracing purposes, banks would be wise to record and understand which employees have current vaccinations.

Until we get above the 70% vaccination threshold with current effectiveness AND banks institute a methodology for tracking vaccination employees, masks; sanitization; frequent handwashing; contract tracing; limiting travel; reducing office density; improving ventilation, and social distancing will likely be the norm for years to come until herd immunity is achieved.

Other Considerations

There are several other considerations that banks should think about when creating a policy around returning to work and the vaccine.

Headline Risk: The media will attach, and social media will fuel any problems with the vaccine. We have already seen headlines of palsy, malformed body parts, and stories of being doubled over in pain because of the vaccine. While many of these stories have been debunked, there will undoubtedly be real problems. Give 300 million dosages of anything, say milk, and some will have an allergic reaction.

Despite all the testing, there are still many unknowns for how large parts of our population will react. The key for banks is to have a methodology established to be able to rate the risk of each of these headlines – are problems statistically valid, are they from reliable sources, and what is the data around the problem. By having a framework, banks will be able to better react to new information as it arises.

Establishing Bank Vaccination Sites: It is currently anticipated that banks will be able to set up their own on-site COVID-19 vaccination sites by late 2021. This is a time when it is anticipated that supplies of the vaccine will plentiful, and more staff will be back in the office. The challenge will be is that banks will likely have to make this decision by March of 2021 to obtain the vaccine in 2021, the required supplies to administer, and the vendor to administer.

For banks looking to budget this process, the cost of the vaccine will be paid for either by the Federal Government or through insurance as mandated by the Coronavirus Aid, Relief and Economic Security (CARES) Act. In addition, banks are budgeting between $8.50 and $50 per employee to cover the cost of administration should it be required.

At this point, some banks are planning on excess branch and parking lot space to make vaccination programs available not just to employees but also to customers and the community. Banks can use their inherent trust to help the public health effort.

Wellness Programs and Incentives: Just as most banks include the flu shot as part of a wellness program, the Covid-19 vaccine should also be included. If banks are uncomfortable mandating the vaccine, then offering a carrot or added incentive to obtain the immunization may prompt some employees that are having trouble deciding. The reality is that Corona Virus outbreaks currently cost banks tens of thousands of dollars, if not more, between lost productivity, pandemic response overhead management, and health safety expenses. This creates a strong and clear economic catalyst for banks to mandate or “highly suggest” vaccination in addition to a moral and public health policy obligation.

Marketing: Since banks have a particularly strong stake in a successful vaccination program, most banks will, at a minimum, have a vaccine marketing program built into their return to work effort. The basis of this marketing program will be to help distribute credible and supported information in a timely matter about the vaccine and its related issues. Budgeting this expense now and deciding on the rough type of information that will be disseminated and frequency would be the core of an initial vaccine marketing plan.

Customers – the competitive advantage: Then, there is the issue with customers. Some of the bank customers, such as those in the healthcare field and those with large manufacturing facilities, will likely require vaccinations before coming on site. Bankers that have the vaccine may have a distinct sales advantage over competition that doesn’t. This also means having a standard way to not only capture vaccination evidence but easily displaying that for travel or sales calls.

Having an office or branch vaccinated will likely turn into a competitive advantage for some banks. Having a staff that is Covid-free with a 94% confidence sends a message of safety and trust.

Technology: Has the bank already invested in Covid-19 management apps, and will the platform handle some of the above issues as it relates to vaccinations? Most likely, yes. If a bank has not invested in this technology to date, will it do so now? Popular Covid-19 management platforms such as those from Salesforce, Service Now, Safe Site Check-In, and many others can help a bank manage its workforce efficiently and more safely than just trying to handle the effort in on-prem databases or Excel spreadsheets.

Putting This Into Action

Having a safe and effective vaccine is the first step to saving hundreds of thousands of lives in the United States alone and put our economy on the path to returning to normal. While banks don’t need a vaccine policy per se, we believe every bank needs to take a proactive stance on the vaccine and have a clear return to work policy that specifies pandemic protocols, return to work metrics, and the ability to track and manage employees that obtain the vaccine.

While having a plan of action around the vaccine may seem obvious, most companies have put off the decision. Now, with both the vaccine and 2021 upon us, banks can no longer wait and at least must start creating this plan so that it can improve both its strategy and tactics with each new data point that comes in the future.

Banks will likely want to start with a personal-choice stance for the first several months and then offer an incentive for the vaccine once the risks are better known. Over time, banks may need to consider incorporating mandatory vaccination as a pre-condition to returning to work in some offices and positions.

Bank can do their part to improve public health by maintaining their efforts to decrease virus transmission and promote the vaccine, assuming it remains at its current safe level.

No matter which policy the bank decides to go with, choosing either a personal choice position or a mandated vaccine ensure either morale or safety will be optimized. For banks that choose to do nothing and remain silent, they will end up with the worst of all worlds. Employees will not have the leadership required to move employees in either direction, AND they will not understand or be able to manage the risk in either direction. Banks that choose this path either proactively or by default will find that they will end up with the lowest morale AND the highest infection rates compared to the industry.

This is the single most important decision banks will be making in 2021 and likely in the history of the bank. Having a vaccine position and plan must be every bank’s priority in 2021. Not doing anything is abdicating authority. This is the time where leadership counts.