Here is Our Bank Government Shutdown Playbook

Unfortunately, disruptions from a federal government shutdown are all too familiar to the American population. More unfortunately, this one is different from all that have come before. This shutdown will test both Democrats and Republican’s resolve like never before. As such, this shutdown could go past the 35-day record during the first Trump presidency. Banks are positioned to play an even more important role this time around. In this article, we breakdown how banks can help their customers and increase their brand in the community.

Government Shutdown Background

A government shutdown is primarily a failure of the legislative/appropriations process, but it produces ripple effects across the economy, public services, and the financial system. The Congressional Office of Budget Management places the cost of the 2019 shutdown as shaving off $3B from the economy. Since 1976, we have had 20 government shutdowns lasting an average of 8 days.

The 2025 version has the Administration planning (or bluffing) to use the shutdown to punish its enemies and cut government overhead. This shutdown seems to have more vitriol than in the past.

On the surface, lawmakers on both side of the aisle are deadlocked as Democrats refuse to vote on a bill that wouldn’t extend health care subsidies set to expire at the end of the year. Republicans, for their part, won’t negotiate or vote on Democrats’ alternative legislation.

The Administration has halted tens of billions of dollars, almost all of which are to blue states to include disaster preparedness funds to California and the $18B for the New York Subway and Hudson Tunnel projects, all of which were Congressionally approved.

Instead of furloughing federal employees and giving them past earned wages when the government opens back up, common in past shutdowns, the Administration has threatened to fire them.

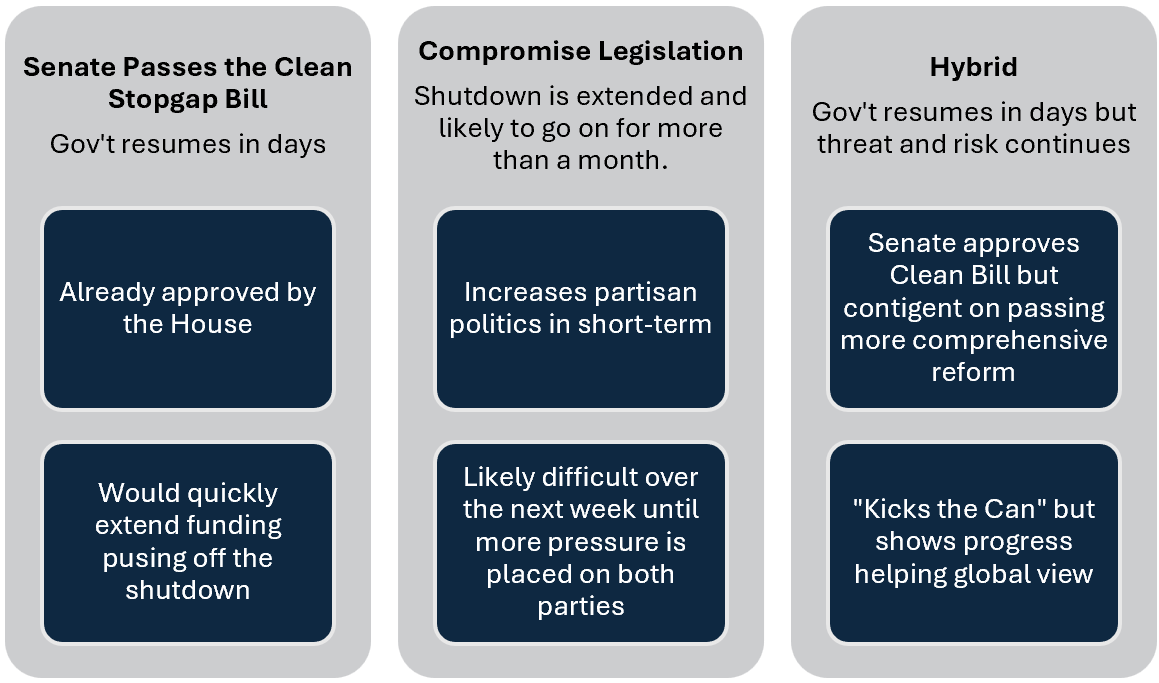

At this point, we need to think in terms of probabilities, and we see the following potential paths:

The bottom line is that this shutdown is poised to create even more disruption and chaos for households, small businesses and commercial firms than at any time in the past. Banks can help.

To see where banks can step in, it’s useful to understand what breaks (or slows) in a shutdown, and what core financial functions remain working.

The Role of Banks in a Shutdown – What gets disrupted

- Many federal agencies and discretionary programs pause or run at minimal “essential” staffing.

- Agencies that require yearly appropriations (e.g. SBA, noncore regulatory functions, some lending programs) may suspend operations.

- Approvals, certifications, or guaranty functions tied to federal agencies may be delayed. For example, SBA loan closings may pause.

- Consumer-facing regulatory oversight, enforcement, or data releases may slow or be interrupted. Some market regulators furlough many staff.

- Public confidence can decline; consumer and business sentiment may weaken.

- Workers and contractors may miss paychecks or face delayed payments, hurting liquidity.

What continues (or must continue)

In a shutdown, banking regulators (FDIC, Federal Reserve, OCC) are less impacted because their funding is not directly tied to the annual appropriations process. Essential services and “mandatory spending” (e.g. Social Security, Medicare) typically continue. Some regulatory agencies can function even during a shutdown if their funding is structured independently of annual appropriations.

Thus, banks have a fundamental continuity, even as other parts of the financial and governmental ecosystem falter or slow. That gives them a unique opening to take initiative.

Risks and Constraints for Banks

Before diving into opportunities, it’s important to acknowledge the constraints and risks.

Credit and Liquidity Risk: If large segments of government workers or contractors miss paychecks, they may fail to meet loan payments, overdrafts, credit obligations. Small and mid-sized businesses may not get leases paid, invoices processed, or service work reimbursed. This raises credit risk both for these individual entities but also systemically. Loan pricing will increase, and loan supply will start to be constrained as lower and more uncertain cash flow ripples through the economy.

Market & Economic Risk: The longer the shutdown goes the more it impacts not just on the domestic economy but on the global economy. One of the biggest impacts will be the shutdown of critical data providers to capital markets to include the Bureau of Labor Statistics, Bureau of Economic Analysis, and the Census Bureau. A lack of data to the Federal Reserve will have an impact on Federal Open Market Committee’s decision to lower rates.

In addition, many private sector reports will be slowed or their accuracy impacted. Less data means less confidence. Less confidence in the U.S. Dollar and U.S. Treasuries mean higher relative borrowing cost for the U.S. which raises interest rates and supports inflation.

Lower wealth and greater uncertainty also impact consumption. We forecast a 0.1% reduction to GDP for each week the shutdown continues, a number that will increase 0.025% for each succeeding week.

Cost of Funds: Fewer buyers for U.S. Treasuries could increase bank’s cost of funding or at least dampen the reduction from Fed cuts. Uncertainty also makes the equity markets more volatile which, in turn, makes the credit markets more volatile. This increase in volatility means increased risk which impacts bank margins. While normally, margins compress 25% of the Fed Fund reductions due to quickly resetting loans and slower rate setting deposits, higher credit costs increase faster than rising interest rates usually resulting in just a 15% to 20% benefit in Fed Funds target interest rate cuts.

Operational Strain: The bank might see spikes in requests for commercial and consumer loan forbearance, delays, and customer inquiries. If banks extend significant short-term assistance (e.g. zero-interest advances, fee waivers), those come at cost and must be carefully managed requiring higher operational costs. Further, operations such as stress testing that rely on government data could be impacted.

Revenue Generation: Product revenue could be impacted. Government programs, such as federal flood insurance will be more difficult to obtain thereby slowing down the closing of mortgages. SBA loans will likely not be processed, and Community Development Financial Institution (CDFI) Programs will likely be frozen.

Regulatory Uncertainty or Slowness: The Securities and Exchange Commission will likely cease operations during the shutdown impacting public banks looking to raise capital. Some regulatory approvals, modifications, or supervisory guidance from prudential regulators might get delayed during a shutdown. While bank prudential regulators are not shut down, many of their support mechanisms are slowing decisions.

Reputational Risk and Moral Hazard: There’s the risk of not doing enough for the customer or being seen as intervening improperly creating a further moral hazard.

One action item here is to be aware of the strain the government shutdown is placing on the bank to better manage capital allocation and programs. Any initiative to support customers during these strained times must be calibrated, risk-managed, and aligned with the bank’s financial health and risk appetite.

Leading Through A Government Shutdown

The silver lining here is that negative sentiment is on the rise and retail, and commercial customers will seek more guidance than usual. Banks are positioned to fill that leadership and insight gap.

Here are several domains where banks can step in, potentially providing leadership:

- Direct Support Programs for Impacted Customers

Paycheck Advance / Bridge Loans: Banks can offer short-term, low-cost, or zero-interest loans or advances to federal workers or contractors who are furloughed, to help them meet basic obligations like rent, utilities, and payments. (USAA is doing something like this: offering interest-free loans of up to $6,000 for military members if paychecks are delayed).

Fee Waivers / Refunds / Grace Periods: Suspend or reverse overdraft fees, late payment penalties, credit card interest surcharges, etc., for customers facing hardship. In past shutdowns, some banks have reversed or refunded fees for impacted federal workers.

Loan Modification / Payment Deferrals: Allow borrowers impacted by the shutdown to defer certain payments or renegotiate terms for a brief period without penalty.

Dedicated Communication and Outreach: Proactively identify customers likely to be impacted (e.g. those with direct deposit from federal agencies) and reach out with offers or information.

By doing these action items, a bank can strengthen brand trust and customer loyalty, while helping maintain community stability.

- Partnerships and Coordination

Banks can take this opportunity to strengthen partnerships to further ingrain themselves and support their respective communities.

Work with Local Governments, Nonprofits and Industry Associations: Banks can provide thought leadership around the shutdown and its impact on the economy to a variety of trade groups and non-profit associations. Banks can partner with community organizations to co-sponsor relief funds, matching grants, or emergency assistance programs. Banks can lead or participate in industry-wide relief frameworks or codes of conduct for handling customer distress during shutdowns, making sure there’s fairness and coordination rather than ad-hoc, inconsistent responses.

Provide Liquidity or Payment Support to Affected Sectors: In some cases, banks could step in to guarantee lines of credit or provide working capital to contractors or local businesses who depend on government contracting and are facing cash flow disruption.

- Public Leadership, Advocacy & Thought Leadership

Public Voice / Policy Advocacy: Banks and bank associations can emphasize the importance of predictable government funding and push for reforms in how essential services are funded or how shutdowns impact financial stability. This can elevate the bank’s reputation as a systemic stakeholder. J.P. Morgan Chase was quick to do this HERE.

Transparency and Guidance: Provide clear public communication to customers. Helping the public understand what parts of government services are affected, what it means for customers that rely on federal cash flow, what the bank will do, and what customers should anticipate, will help reduce uncertainty.

Data and Analytics: Banks can use their data to model the macroeconomic and credit impacts of a shutdown, share findings with policymakers, regulators, and the public to help drive smarter solutions. Different industries will have different impacts and banks can provide thought leadership to promote the bank withing an industry.

Stress-Testing and Systemic Resilience

A government shutdown could create credit or liquidity shocks. Banks can ensure robust contingency plans, liquidity buffers, and internal scenario analysis for shutdown risks. This helps their own resilience and can be a model for peers.

It may be important for banks to engage their regulators making sure they are keeping critical oversight. This is less critical if this shutdown gets resolved but should it go over 30 days, greater uncertainty is likely to ensue. Additional communication could be important.

The Opportunity & Strategic Value

Why should a bank consider doing more than just a wait-and-see posture? The answer is better brand recognition, trust building and improved risk management. More communication leads to more conversations which helps banks gather market intelligence. Holding town halls, for example, not only helps the bank’s brand but helps gather needed data about how different industries and households are being impacted.

By increasing the bank’s brand and thought leadership position, cumulative lifetime value often increases, and customer acquisition costs can decrease. This will pay dividends well into the future.

By being proactive, banks also build credibility with regulators, which can translate to smoother relationships in supervision, policymaking, or trust during future crises.

Finally, one indirect benefit is the role that banks play providing liquidity, credit relief and confidence to their respective communities. Helping customers maintain liquidity and preventing a cascade of defaults benefits not just the bank, but the broader financial ecosystem. A more stable environment is better for all market participants.

Key Principles and Guardrails for Responsible Leadership

To execute well, banks should adhere to some guiding principles:

Targeted Assistance, Not Universal Bailouts: Assistance should focus on those demonstrably impacted (e.g. federal workers, contractors, SBA) and not be open-ended to avoid moral hazard. Relief should be temporary and with a clear sunset, to avoid lingering underwriting distortions.

Clear Eligibility Criteria & Credit Assessment: Even in relief mode, suitability assessments and modified underwriting are needed to avoid abuse or losses. Banks need to be careful of being adversely selected and only getting of the riskiest of the impacted households and companies.

Monitoring and Feedback Loops: Banks should track and report relief program usage, outreach programs, shutdown related delinquencies/defaults, and outcomes so it can not only monitor but report to the market. This will help banks also understand the operational strain and cost.

Illustrative Example & Precedents

The USAA case is a concrete example of a bank that takes a proactive position with its Government Shutdown Program. The bank makes interest-free loans up to $6,000 for expected federal paycheck delays to military members.

During prior shutdowns, banks like Bank of America, Wells Fargo, and Capital One have offered forgiveness of late fees, suspension of penalties, and payment deferrals for affected federal employees and small business clients.

These precedents show that relief is feasible and can be scaled in a targeted way.

Putting This into Action

In a government shutdown, many public functions slow or stop, creating strain on households, contractors, and markets. Volatility will increase.

Given the level of partisan politics and the potential balance of the midterm elections, this shutdown could be the longest in history. The time to prepare is now and we would not necessarily assume that shutdown will go away.

October 15th is a demarcation and will be the first missed federal worker paycheck. The impact of the shutdown will get very real after. Should employees be let go instead of furloughed, look for the economic fallout of this shutdown get further exacerbated.

Banks maintain core functionality in the economy and thus have a rare position of continuity and trust. By stepping into that breach, offering temporary relief programs, communicating clearly, coordinating with stakeholders, and thinking systemically, banks cannot just manage risk, but lead in a crisis. This leadership will payoff handsomely in the future.