Use These Banking Tactics to Leverage the Big, Beautiful Bill

On July 4th, the President signed into law his expansive policy and economic package that will bring sweeping changes to banking and America’s finances. In this article, we breakdown not only where the Big, Beautiful Bill (HR 1) helps and hurts banking, but we provide strategies on how to take the best advantage of these generational legislative changes.

Executive Summary

If you don’t have time for the details, here is the rapid assessment for banks below. First, here are the positives of the Bill, in order of impact:

- Tax Relief: Lower net taxes for individuals, small businesses and corporations will increase cash flow, lower the probability of default, and increase loan demand. Look for credit to improve 5% to 20% depending on the sector and absent of higher interest rates. We break down the detailed impact on sector impact later in the article.

- Less Regulation: Consumer-facing and public banks should face lower regulatory friction and lighter reporting burdens such as those related to sustainability (ESG), and diversity programs (DEI). This will result in more innovation and lower cost but could come at the expense of trust and cultural impact. Look for M&A and new banks to get approved faster.

- Deposits: So-called “Trump accounts” will be created by banks and investment firms to hold the one-time $1k from the Federal Government and receiving tax-advantage savings from parents and employers. This three-year program we expect to generate $17B+ in investment activity and $3B in demand deposits.

- Fiscal Stability: Clarity on debt‑ceiling averts liquidity‑shock scenarios reducing the headline risk and cash flow interruption of future budget battles.

Of course, there are some steep negatives to include:

- Higher Rates: Look for materially increased fiscal deficits, forcing more Treasury supply into the market. This will likely place upward pressure on rates, increasing funding costs at banks, increasing probabilities of default, raising loss given defaults, and impacting mark-to-market by the present value of 10-15 basis points per annum minimum.

- Trust and Social Impact: The relaxing of regulation will increase the number of bad actors on the fringes of banking potentially eroding trust. Look for states to fill some of the enforcement gaps making it more complex for some banks. Many green and sustainability programs are rescinded including HUD’s grant/loan program for multifamily efficiency that was popular with bank financing.

- Operation Changes: Banks will have to make certain operational changes such as the 1098 IRS filing for the new auto loan interest deduction. Banks will have to have these forms out by 1/31/26 for interest paid in 2025.

Big, Beautiful Bill Financial Advisory

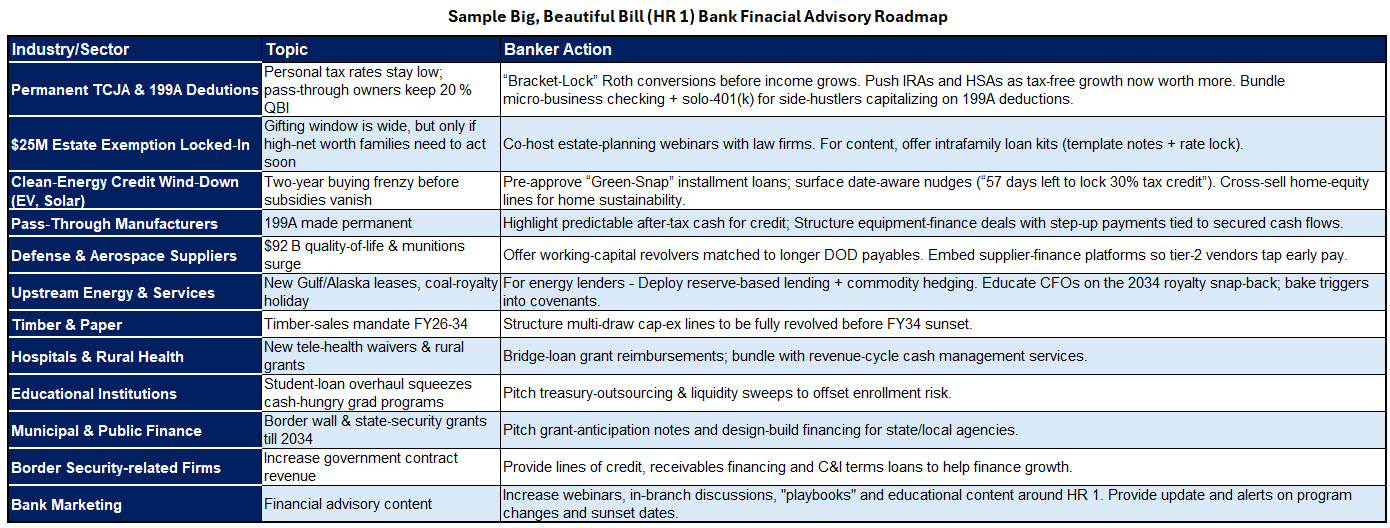

The Big, Beautiful Bill provides the ideal backdrop for banks to provide thought leadership and advisory support to their retail, small business and corporate clients.

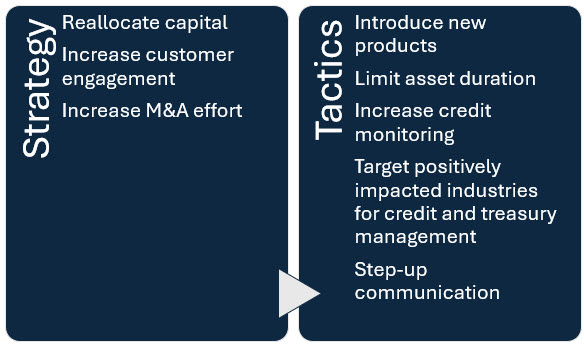

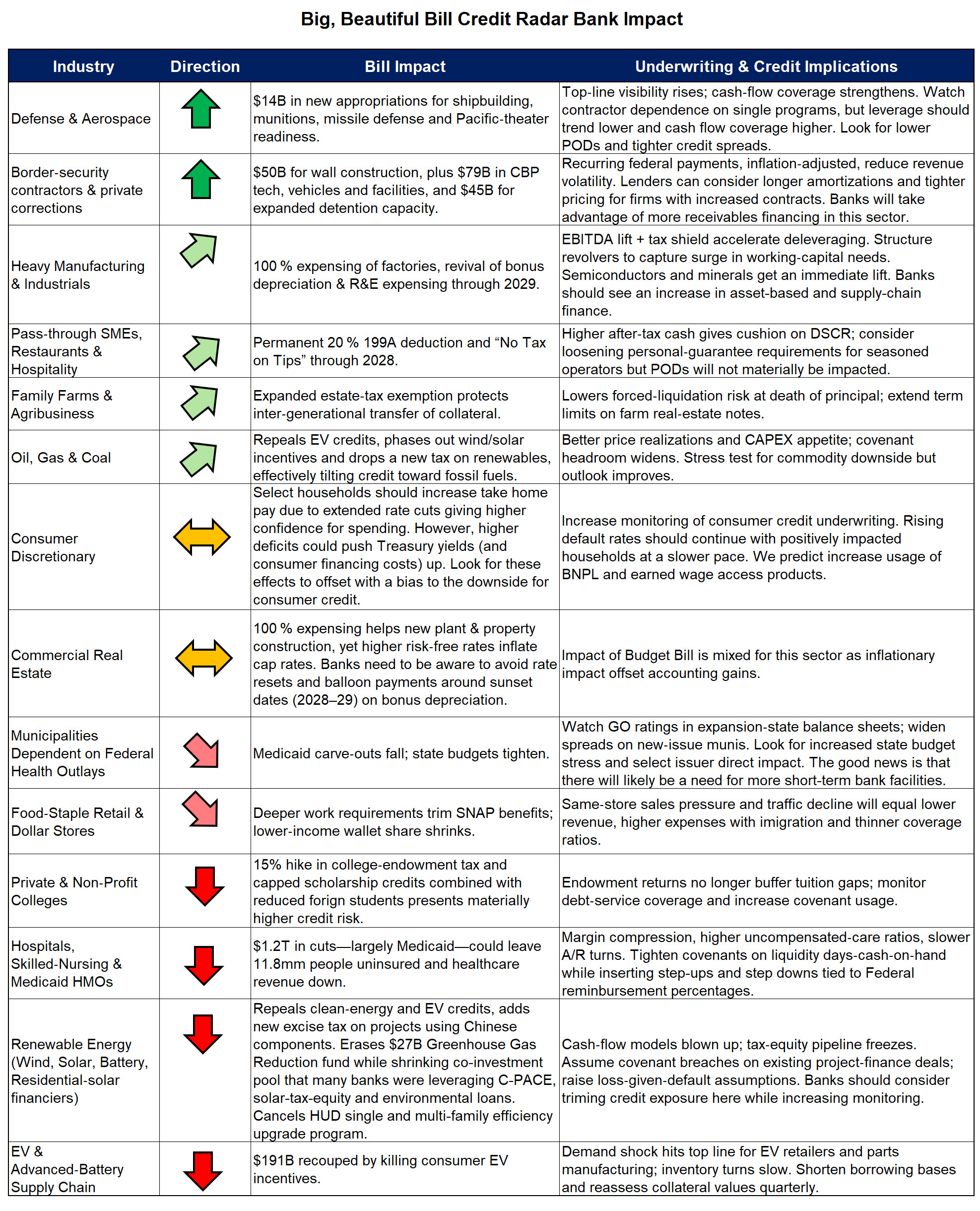

First and foremost, action items include getting clarity on the bank’s credit position and becoming defensive on certain healthcare, retail, private college and renewable energy sectors. Conversely, banks may want to consider expanding credit to select aerospace, defense, border security firms, and US-based manufacturing.

Once decided how the bank wants to reallocate its capital, banks should design a financial advisory, sales and marketing plan to execute its defensive and offensive positioning. This means talking to clients both about how credit availability may be increasing or decreasing but also about the potential resources available to the customer.

Below is a sample roadmap that a diversified bank may want to execute in terms of advisory and marketing content.

Large, diversified banks are best positioned to benefit significantly: higher profitability, enhanced service offerings, and reduced regulatory stress. Small and community banks might gain operational freedom but face heightened competition and greater credit-risk exposure in struggling communities. While larger banks are in a position to leverage the complete Bill, community banks will need to choose their leverage points.

In either case, all banks should consider increasing their customer outreach and communication in order to take a leadership role in their financial advisory positioning.

Permanent Tax Cuts & Financial Flexibility

Primarily, the Bill extends the 2017 Tax Cuts and Jobs Act, which were set to expire in 2025, including corporate rate cuts for banks, and reinstates full, immediate expensing for capital investments. The Bill keeps the lower tax brackets, larger standard deductions, more generous child tax credit and the higher estate/gift tax exemption. The Bill also offers a variety of other relief points that has the net effect of lowering taxes including:

- Raising the state-and-local tax (SALT) deduction cap from $10,000 to $40,000 which will have an immediate positive impact on those living in high-tax states such as CA and NY.

- Provides a $6,000 per person “bonus” to seniors to offset all or a portion of Social Security taxes.

- Tax breaks for tip income and overtime pay positively impacting hospitality workers.

- Permeance for the larger deductions for 199A pass-through entities such as contractors, freelancers, and gig workers.

- Puts in a tiered gains-exclusion schedule offering lower tax rates for business sales creating more liquidity for business exits, venture capital, family offices and SBIC funds.

Impact: For some consumers and selected businesses, cash flow will improve. Look for more activity around HELOCs, card usage and C&I. Many of the Bill’s changes will stimulate trust, wealth, and private banking groups at banks for advisory services and investment services. The timing of many wealth transfer triggers will need to be revised.

Higher Interest Rates

The Bill increases the debt ceiling by $5 trillion while adding approximately $4 trillion to the national debt over a decade. There is no way to sugar coat the fact that this legislation puts the US Dollar (and our credit rating) at risk while being inflationary.

Impact: Could lead to long-term economic volatility, rising interest rates, and tighter monetary policy—negatively affecting lending margins and credit availability. Banks and financial institutions benefit from improved profitability and reduced tax burdens, freeing up capital for expansion, lending, and investment.

Less Regulation

In addition to slashing the CFPB’s budget by half, the Bill shuts down the $350mm modernization investment budget at the SEC.

The Bill also incorporates deregulation efforts like the Reins Act and the SEC Regulatory Accountability Act, mandating cost-benefit analysis, and potentially tightening rulemaking.

Impact: Reduces compliance burdens and simplifies rules, especially benefiting smaller banks. Look for slower rule making and less enforcement. Long term risk of consumer harm headlines or state AG activism may fill the void adding complexity to a bank’s compliance fabric.

The Social Impact of the Big, Beautiful Bill

One of the largest impacts of the Bill is on social programs, particularly Medicaid, as it cuts $1T from the program according to the Congressional Budget Office. A new 80 hour per month working requirement, eligibility redetermination every six months (vs. 12) and limitation of states contributions is projected to reduce healthcare coverage to about 7.8mm Americans.

Cuts to the Supplemental Nutritional Assistance Program (SNAP aka food stamps), are projected to impact 40mm low-income Americans and reduce household revenue by $146 per month.

The combination of these cuts will put great economic stress on the lowest-earning households and increase state and local burdens in every community that banks serve.

On the plus side, the establishment of a new savings account with a one-time deposit of $1,000 for children born in 2025 through 2028 will be tax-advantaged and boost deposits at banks. Parents can then contribute up to $5k per year and employers can contribute up to $2,500 both tax-free. While the 529 college savings plan allows for higher limits and better tax advantages, this savings account product will have a material impact. Estimated total investment we estimate at $15B over three years with approximately $3B ending up in bank deposits.

Impact: Deep reductions in Medicaid, SNAP, and other social programs reduce lower-income consumer’s spending capacity potentially increasing non-performing loans and requiring more credit availability.

Other Lending Programs

Student loan lenders and borrowers will undergo a major impact. Legislation expands Pell Grant availability, but new limits reduce how much it can be borrowed. As a result, funding costs will increase, placing more stress on these households, while banks will have the opportunity to increase private funding.

- Caps unsubsidized student loans at $20,500 per year and $100,000 lifetime, for graduate students

- Caps borrowing for professional degrees, such as those for doctors and lawyers, at $50,000 per year and $200,000 lifetime.

- Adds a lifetime borrowing limit for all federal student loans of $257,500.

- Caps parent borrowing through the federal Parent PLUS loan program at $20,000 per year per student and $65,000 lifetime.

- Eliminates grad PLUS loans. These allow grad students to borrow up to their entire cost of attendance minus any federal aid.

- Starting in mid-2026, there will be just two repayment plan choices for new federal student loan borrowers: They could enroll in either a standard repayment plan with fixed payments or an income-based repayment plan known as the Repayment Assistance Plan, or RAP.

Then there is the auto loan interest deduction that should fuel new auto loan growth. Certain households may deduct up to $10,000 of annual interest on loans for new, US-assembled cars for loans made from 2025 through 2028. Deduction’s value starts to fall for individuals whose annual income exceeds $100,000; the threshold is $200,000 for married couples filing a joint tax return. This provision creates an operational burden for banks as it will require banks to file an IRS 1098 interest deduction form by January 31, 2026 for interest paid in 2025. Banks will need to work with their core system to facilitate this form production. One issue is that this provision sunsets in 2028 so there is a limited time to make back the ROI on this investment.

Credit Impact of the Big, Beautiful Bill

From a credit perspective for banks, there are some clear winners and losers. Below is our analysis, sector-by-sector, on how this Bill will impact lending, underwriting and credit.

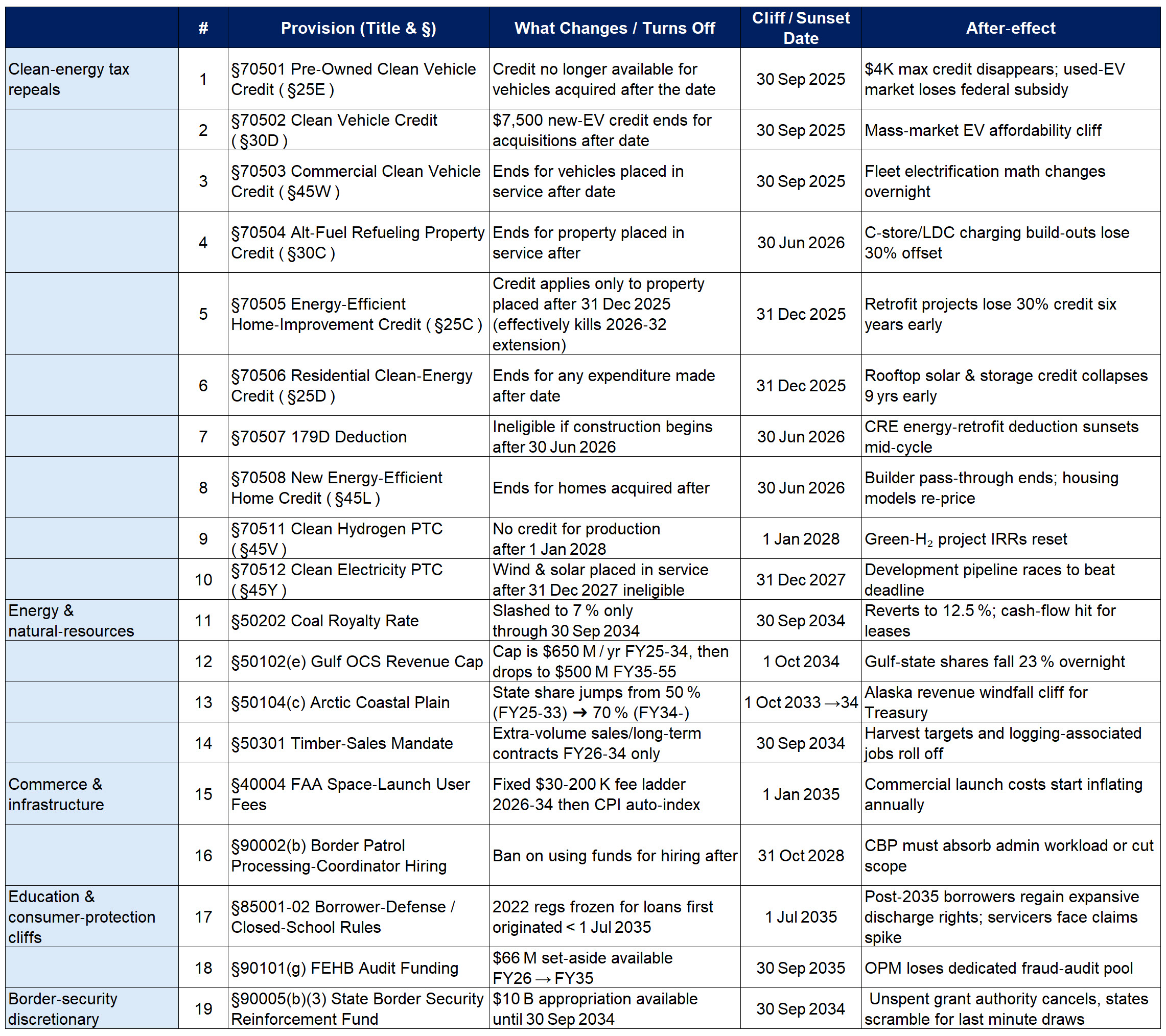

Sunset Dates and Policy Cliffs

One aspect of the Big, Beautiful Bill is that many of the programs are not permanent, enactment timing is staggered, and program cancellation dates vary. This creates complexity when structuring loans and introducing new products.

Below is a master cheat‑sheet of every explicit sunset or policy cliff baked into the 1,600‑page package pertinent to banks. Use it to see exactly when there are program changes or impact to credit, fee, or rate so you can prepare balance‑sheet models, client outreach or legislative strategy before the edge arrives.

Why this matters: Each cliff above represents a binary policy change—tax equity deals priced today, lease bids, or operating budgets can collapse (or balloon) the day after. Keep these dates pinned to your strategic calendar.

Putting This Information into Action

The Big, Beautiful Bill offers banks powerful short-term financial gains and regulatory relief, but it also introduces long-term risks tied to federal debt, potential economic downturns, credit, and reduced consumer health/trust could adversely affect lending quality and bank performance over time.

Banks should consider increasing resources in those areas that benefit from the Bill while figuring out how best to support those areas where Federal funding is reduced. In all cases, banks need to put forth a material effort to gather deposits around the Bill while increasing the monitoring of credit to the at-risk areas.