Stress Testing The Severity of Coronavirus

The Coronavirus is simultaneously disrupting supply and demand in the world economy. The shock to the economy will have a profound effect on the US economy, and community banks will not be immune from this disruption. It appears that a global recession is inevitable, but the full extent of damage to the banking industry is unclear. However, there are some troubling signs that many banks may be unprepared for the severity and length of this recession and the extent of credit losses. Community bankers may want to look at the Federal Reserve Board’s definition of stress test under CCAR (Comprehensive Capital Analysis Review). While this stress testing does not apply to community banks, the severity of the stress test may give some guidance to potential credit losses for all banks.

Rapidly Changing Information

There are two annual letters to shareholders that we read because they are well written and offer an unbiased view of the state of the economy. These two letters to shareholders are written by Jamie Dimon, from JPMorgan Chase, and Warren Buffet, from Berkshire Hathaway. This year, the letter from Buffet was published on February 22, 2020, and was written before that date. The date of the writing of Buffet’s report missed the Coronavirus story and, therefore, did not mention the virus once. On the other hand, Dimon’s letter was published on April 6, 2020, and focuses sharply on the possible effect of the virus on the banking industry. Dimon cites the virus on 15 occasions in his letter and concludes that the future holds a bad recession that will include financial stress similar to the global financial crisis of 2008. Further, the letter implies that the impact on the economy will be more severe than the stress test under CCAR.

Stress Test Under CCAR

The Federal Reserve Board runs hypothetical scenarios for stress test exercises to ensure that large banks have adequate capital and processes so that they can continue lending to households and businesses, even during a severe recession. However, it appears that the effect of the Coronavirus will be more extreme than the 2020 stress test exercise. The stress test framework includes two hypothetical scenarios: baseline and severely adverse. While the largest banks are expected to pass the severely adverse test in 2020 (results of the test are to be released by June 30, 2020), the level of severity of the stress test appears to be milder than current conditions and those that we expect shortly. While this exercise is reserved for banks over $100Bn in assets (34 of the largest banks in the country), it is a test that serves as a yardstick for all banks.

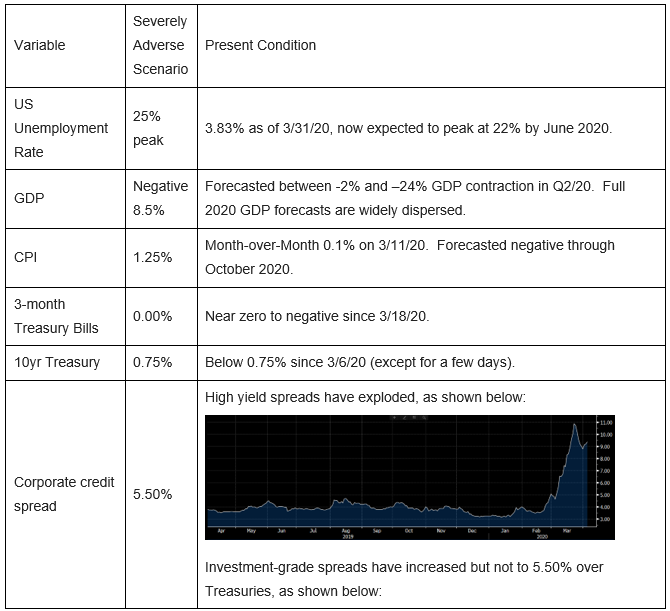

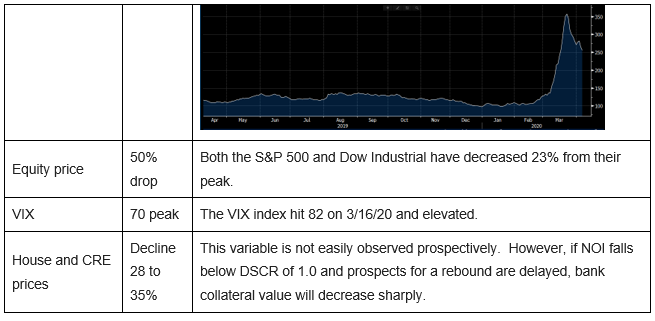

The severely adverse scenario describes a hypothetical set of conditions designed to assess the strength of the bank. The severely adverse scenario is defined by certain variables that include six measures of economic activity and prices, four aggregate measures of asset prices or financial conditions, and six measures of interest rates.

The severely adverse scenario outlined by the Federal Reserve Board is characterized by a severe global recession accompanied by a period of heightened stress in commercial real estate and corporate debt markets. It appears that we have already reached the severely adverse scenario within two months of the Coronavirus fight, as outlined in the table below.

Conclusion

We are not predicting the evolution of the economy in the near term future. However, it appears that the current consensus forecast for the economy and the existing economic variables are direr than the CCAR severely adverse scenario. This bodes poorly for some banks that do not have the capital buffers and reserves to survive such a stressful business climate. Perhaps the biggest independent variable to banks’ survival is the quantity and quality of cash flow supporting loan repayment. Even if we assume that cap rates do not increase (a big assumption indeed), curtailed NOI for an extended period will cause panic by borrowers and bankruptcies or restructures. The optimistic or positive scenario is that residential and commercial real estate prices decline over longer periods of stress, and a “V-shaped” or relatively rapid recovery will mitigate credit stress for community banks. The self-imposed shutdown of the economy may be just the prescription needed to shorten the period of recovery after the forthcoming recession.