Here is Our Digital Banking Platform Playbook

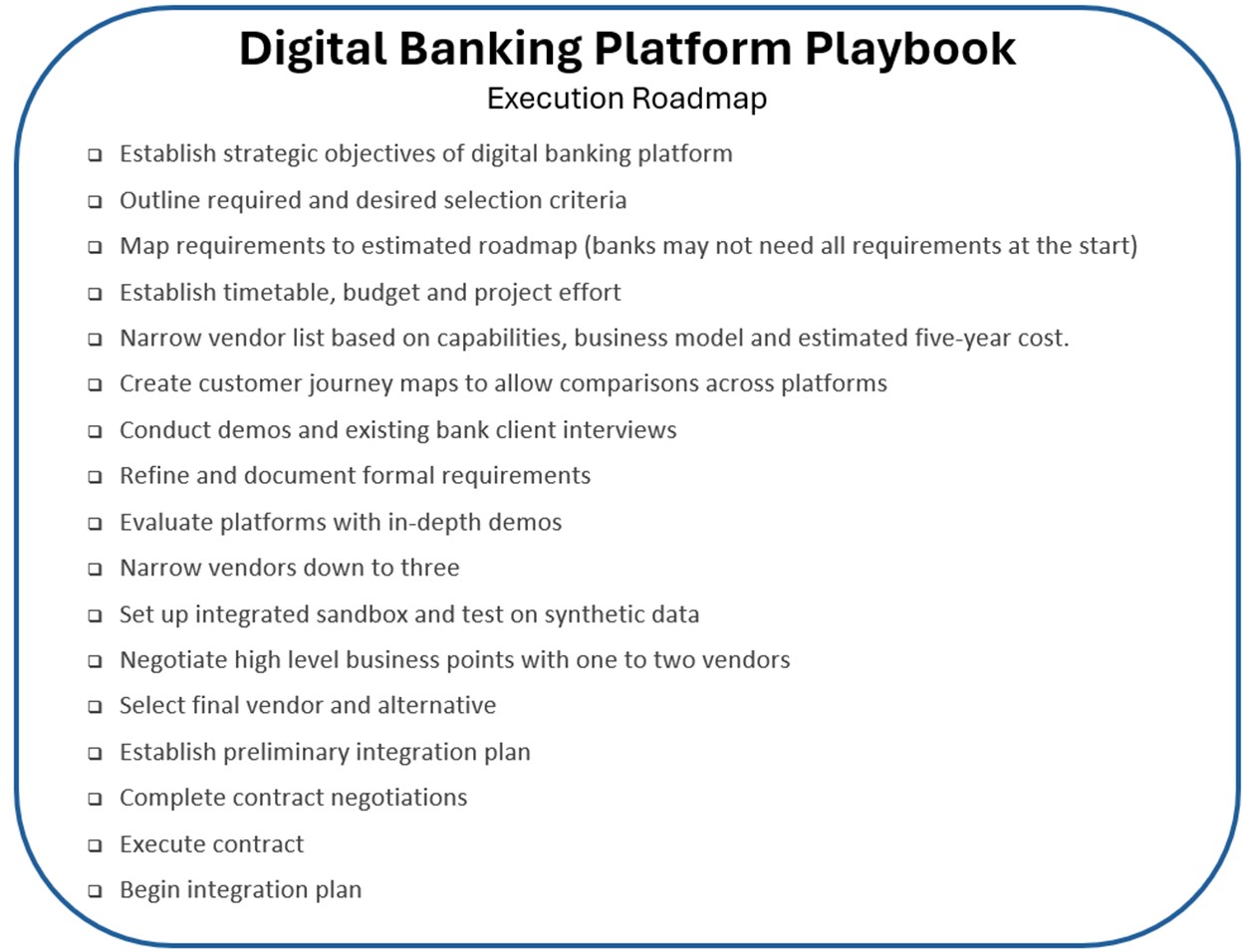

You might need a new digital banking platform. Chances are your bank chose your current digital platform because it was easy. Maybe your core vendor provided it, or perhaps you were sold a platform by a vendor you happened to meet at a conference. Likely, your vendor has little relationship to your strategic needs and future architecture. In this article, we uncover what a modern digital platform looks like, why your bank might need to plan to change over the next three years, and if you are going to change, we provide you with a “playbook” to assist in the effort.

The Problem with Most Digital Banking Platforms

The problem is architecture. Banks often lack a technology architecture plan and are channeled down dead-end streets. Part of this problem is deficiencies in vendor selection. Bankers don’t know what they don’t know, and few bankers outside of national and regional banks have experience with platform selection when it comes to digital banking platforms.

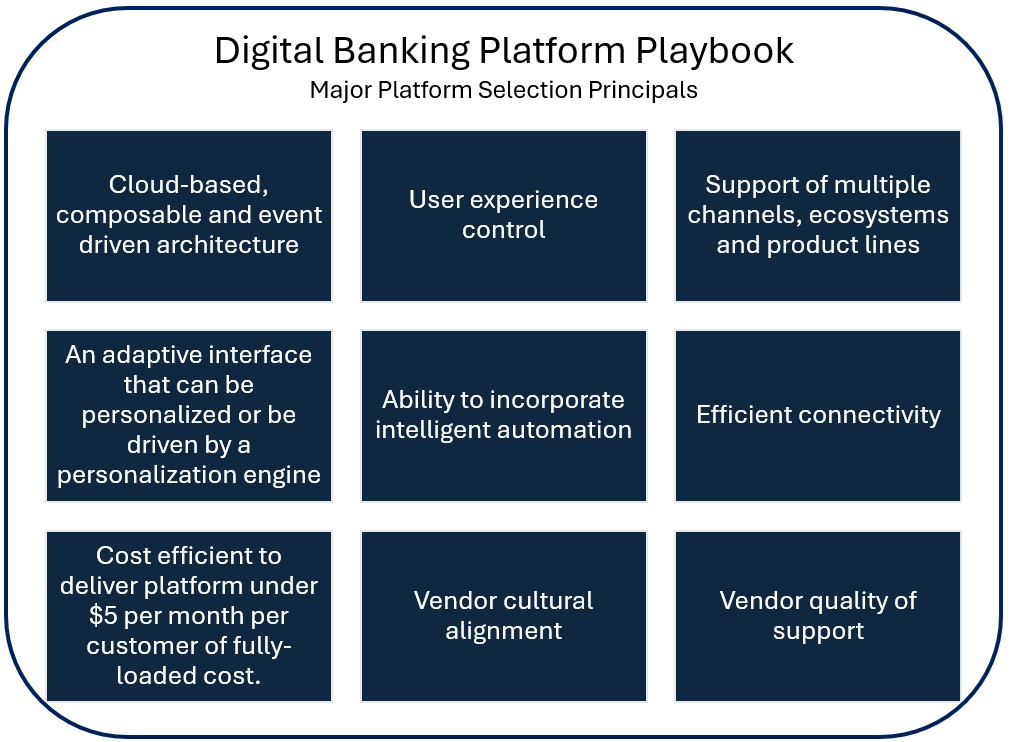

Over the last ten years, many banks have strived to create a more open and flexible environment in which to be able to introduce new products and control the customer experience. These concepts, combined with the traditional selection principals of vendor quality and cost, form the basis of our selection principal’s framework.

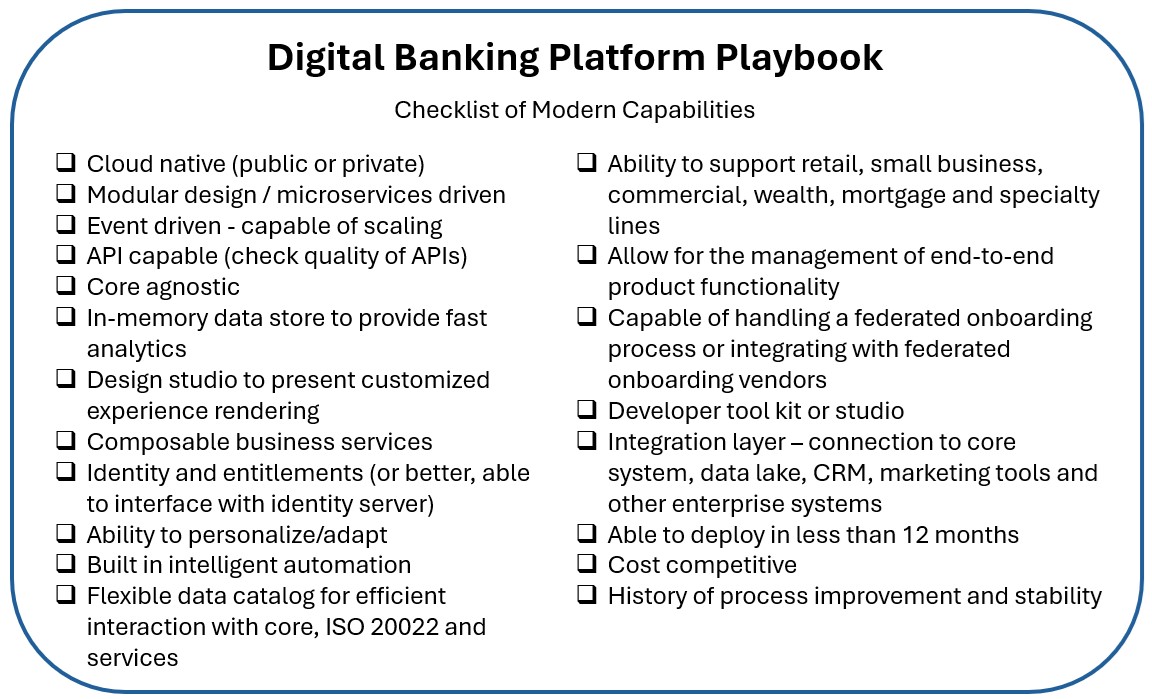

Most mobile and online banking platforms allow little innovation and customization. Many banking platforms were once state-of-the-art but purchased by core providers decades ago to fit the strategic needs of the core system and not the client banks. As such, banks often must have separate platforms for retail customers than they have for commercial customers. Unfortunately, small businesses often get stuck in the middle. Because banks usually must bring together different platforms, the customer experience suffers, and costs are increased for managing multiple platforms.

Another set of problems revolves around the lack of end-to-end functionality. Banks often must have separate account onboarding platforms or handle product onboarding (e.g., an existing customer needs to add treasury management), account maintenance, or data analytics in isolation or manually.

The other major issue is control. Most digital banking platforms require the vendor to handle changes. Creating a new product is difficult if the vendor doesn’t support the new product creation on your bank’s timeline. Modifications to handle the new product can be costly and take time. Many banks will be unable to handle the expected explosive growth in new product creation, such as what is currently happening with AI or payments.

Even slow changes, such as the recent integration of the ISO 20022 and FDX data standards, which has taken place over several years, are catching most digital banking platform providers off-guard and causing their banks to lag.

For the handful of traditional digital banking platforms that are adaptive, many banks have not developed the capabilities or the architecture to keep pace with client expectations and new business lines.

A bank needs the ability to change the customer experience beyond changing colors and the look and feel. The digital banking platform needs to be able to incorporate new business lines and processes, such as a payment hub, fraud controls, identity, data insights, or new product lines, such as earned wage access or custody. A digital banking platform needs to be able to foster omnichannel capabilities so that the customer can have a continuous experience no matter if the customer starts online, on mobile, or via an API.

When it comes to APIs, the digital banking application needs to be robust enough to be able to interface with not just the core but a variety of other vendors that may provide services now or in the future, such as an identity server to manage the customer’s identity.

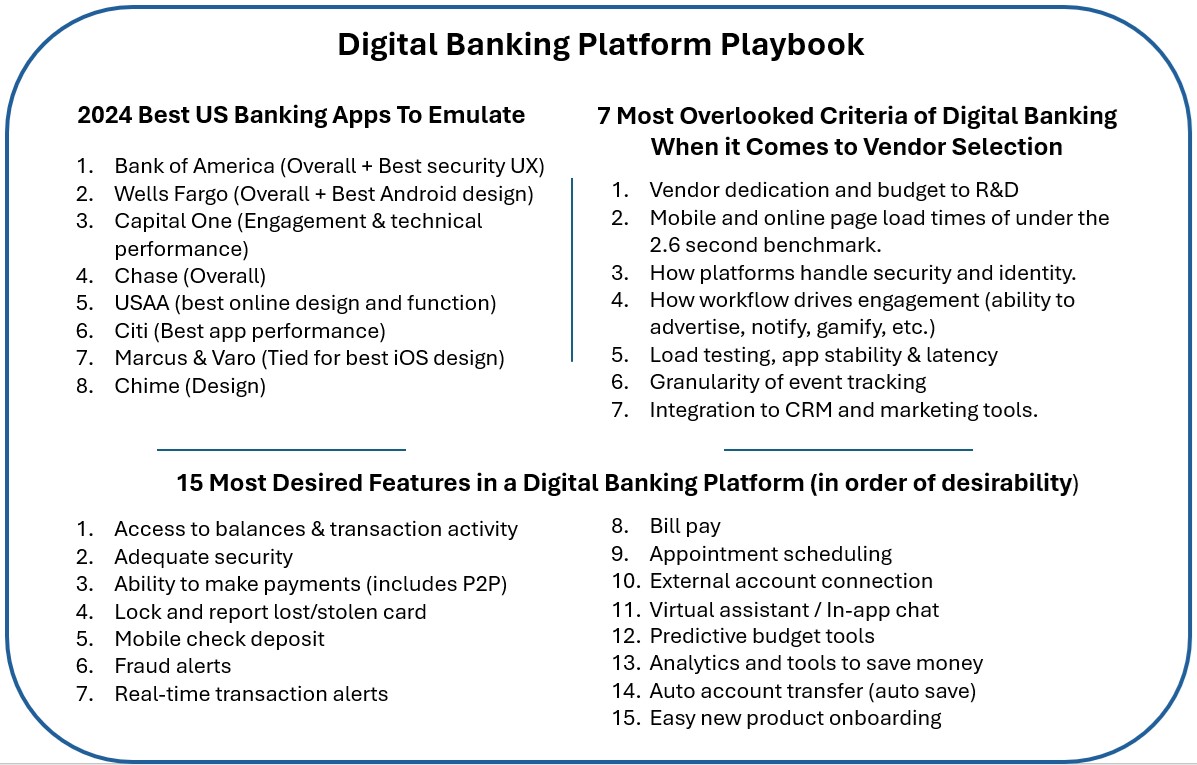

The below graphic is from our “Playbook” and is a summarized checklist of modern capabilities to consider when choosing a new digital banking provider.

The Objective of the Modern Digital Banking Platform

A modern digital banking platform should enable banks to manage the customer experience while orchestrating financial products/service delivery at will in a seamless and consistent experience. A platform should provide front-end development tools and standard business services to handle the middle and back-office workflow. In this manner, banks can manage composable experiences creating ecosystems (i.e., loans, payments, identity, banking-as-a-service, etc.) and product creation.

This will allow a bank to:

- Expand to new markets across geographies, customer segments, and industries.

- Allow for efficient rapid innovation and research & development.

- Present a cohesive ecosystem and product set to customers and employees.

The strategic objective is to choose a digital banking platform that helps management break down silos within the bank and support the generation of more top-line revenue while limiting operating costs. Identity, for instance, needs to be federated and abstracted from the core and then served through every product and service a bank has. The same goes for data, analytics, artificial intelligence (AI) and security.

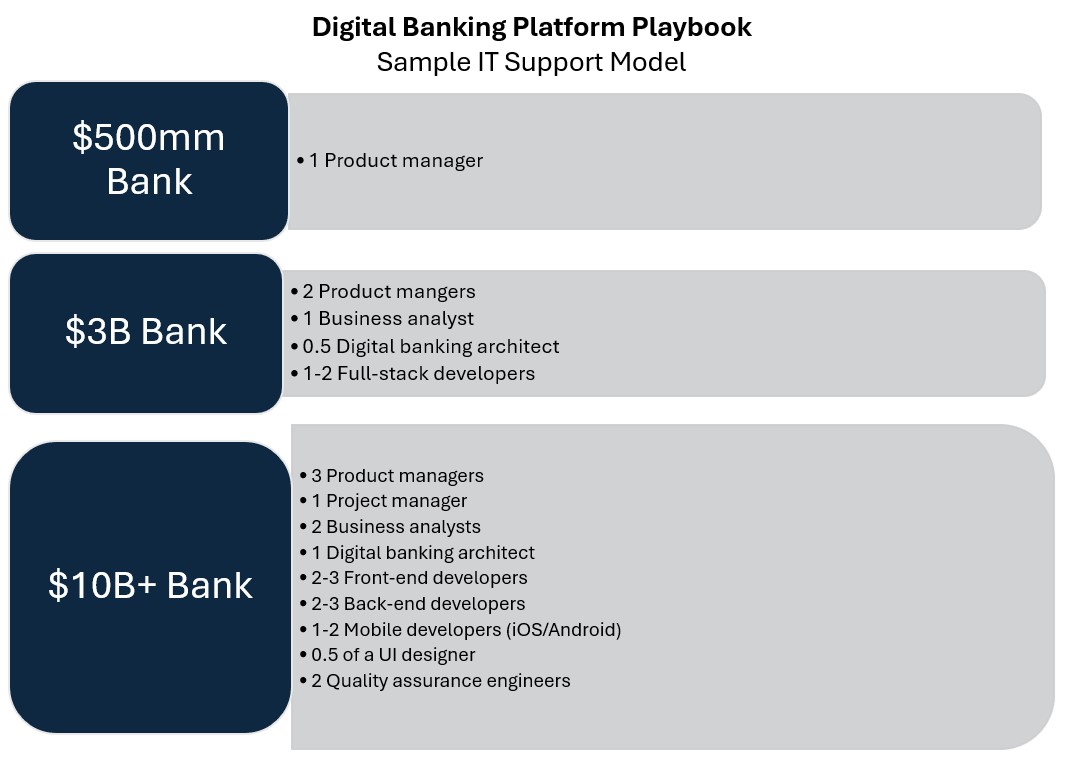

Cost is also a big consideration when choosing a digital banking platform. With most platforms costing seven figures, the key is to find a business model and capability set that meets the bank’s objectives. Here, it is critical to consider both the direct cost and indirect costs of the platform. While a bank will likely save on vendor costs with a modern digital banking platform, it will likely spend more on development (below).

Filtered Vendor Selection

We currently track more than 55 vendors offering banks digital banking platforms. Of these, we like a handful based on their ability to meet all or most of the requirements outlined in the Playbook above and the information we can obtain. The following vendors are not meant to be an exhaustive list, and suitability obviously depends on a bank’s strategic objectives and capabilities.