ISO 20022 For Banks – What You Need To Know

ISO 20022 is an international standard, a language for electronic data exchange between financial institutions, and was developed by the International Organization for Standardization (ISO). It’s a way for banks to speak with each other, and it started to be phased in during the first quarter of this year with the goal of a complete conversion by 2025. While this is mostly the domain of large banks, there are three reasons why your community bank should consider adopting this language to increase future bank performance. This article explains what ISO 20022 for banks is, how it is different, and what it can do for your bank.

The Context

Travel to Mexico and stay in a resort town; your English can get you around. You will run into problems and won’t be able to talk about specific topics; you may have to use your hands to communicate, and you will lose a large quantity of nuance, but you can survive. Travel outside the resort town or a major city in Mexico where less than 10% of the population speaks English, and you will get into trouble. Your productivity drops like a seventeen-year-old on Tik Tok and simple tasks become difficult. You will be stymied if you need to communicate quickly; their Spanish will be difficult to retain. You will quickly learn that while you might be able to order something in a restaurant after some difficulty, coordinating different professions to throw a birthday party becomes almost impossible.

Bank data is much the same. You can survive as long as you use the same ecosystem, such as your core system and digital banking platform. Go outside of that ecosystem, and the fidelity of your data becomes less and less until you get to the point where you can no longer communicate, and cross-functional tasks become impossible.

It would be easier if everyone and every platform spoke a common language. Enter ISO 20022.

ISO 20022 for Banks – What is it?

ISO 20022 is a methodology that defines the building blocks for creating a language that results in consistent message standards. The standard is composed of three elements:

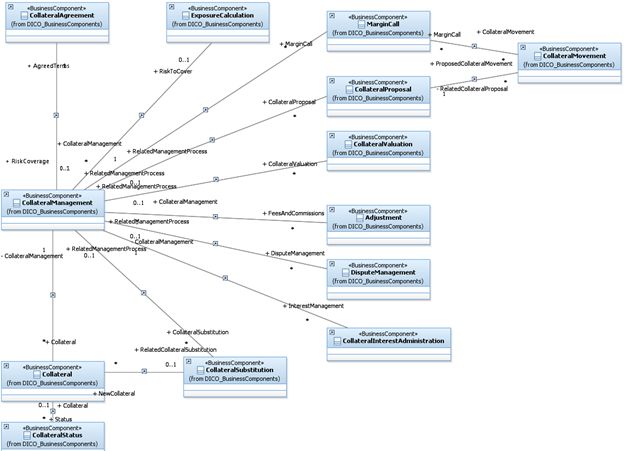

- The business model: The business model represents the concepts and processes that the messages will carry. For example, ISO 20022 defines the elements of a real-time payment, what constitutes a beneficial owner, or what happens during a transfer of securities for collateral (below).

- The Message Model: The message model defines how these business model elements are grouped into messages and the form these messages will take. This creates a standard set of business “objects” that are specific to banking. For example, ISO 20022 provides a set of messages (you can download HERE) to handle ATM transactions, fraud, account names, and time periods.

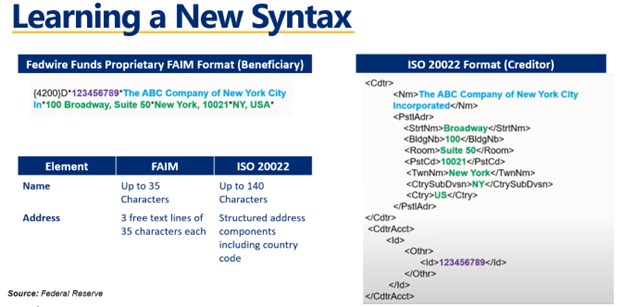

- The Syntax Model: The syntax model determines how the message model is represented in its specific form down to the field level. For example, the numerical address on your street is called “BldgNm,” and the city is called “TwnNm.”

Each of these models is developed using a specific methodology to ensure consistency and interoperability between the messages and the systems that use them. It is likely that your bank doesn’t have any definition for what constitutes a valid street address, and if it does, it is likely that you have 30 different ways to represent that address within different systems, such as three of the most common at banks:

- “Address Line 1” & “Address Line 2”

- “St Address,” “City,” “State,” “Zip Code”

- “St_Num,” “St_Name,” “Ste,” “City,” “ST,” “Zip”

Now, with ISO 20022, every bank and every banking system around the world should call the street name – <StrtNm> FOLLOWED BY (not before, which is how it is in 98% of banks currently) building number in the form of <BldgNb>.

Start to see the poetry of having a common financial services language.

ISO 20022 for Banks – Data Richness

What makes ISO 20022 unique is its ability to carry much richer data compared to older message standards. Fedwire, for example, uses the proprietary FAIM format and only allows limited fields and a small number of characters within each field. This makes it hard to not only include transaction data about a payment but often banks need to truncate the business name to adhere to the 35 characters of the name field.

With an ISO20022 message, banks can provide and receive detailed information about the transaction, like the purpose of the payment, full party details, and remittance information. It also provides more flexibility, as it can be easily updated to support new types of financial communications as they arise.

One major innovation is the ability to send an “information only” message to add more data to a transaction message. For example, a bank can now allow their commercial customers to append invoices, inventory lists, valuation data, or appraisal information to the payment counterparty. This allows an entirely new layer of transaction richness to take place and for banks to innovate on various products.

The Benefits of ISO 20022

To summarize, ISO 20022 is a standard for creating flexible, interoperable, and data-rich message standards that facilitate more effective communication between financial systems. The standard defines the protocol for creating electronic messages and covers a variety of transaction types, including payments, securities, trade services, cards, and foreign exchange.

Here are a few reasons why ISO 20022 is significant and why banks should care:

Global Standardization: ISO 20022 introduces a common international language for financial communications, making it easier for institutions in different countries to communicate with each other. Just having a common language for each counterparty is currently a challenge in dealing with various payment platforms. Now, this gets standardized under ISO 20022 (below). This can significantly reduce errors, improve speed, and lower costs. While your community bank may not do business with international banks, it likely might do business with Bank of America, Wells, or others that will likely be moving to the ISO 20022 standard by 2025.

Improved Data Quality: The ISO 20022 message formats are data-rich, allowing more information to be communicated per transaction. This leads to enhanced transparency and improved accuracy and facilitates compliance with regulatory reporting requirements.

Operational Efficiency: By using a common standard, banks can streamline their operations, reduce complexity, and simplify their infrastructure. Data will be able to be leveraged across products and silos and banking automation will become easier. This can result in significant cost savings and greater operational efficiency.

Enhanced Customer Experience: With its rich data capabilities, banks can offer better services to their customers. For instance, end-to-end tracking of payments becomes possible, increasing customer transparency.

Future-Proof: The ISO 20022 standard is designed to be flexible and adaptable to meet future needs. As technology and business practices evolve, the standard can be updated to accommodate these changes.

Interoperability: ISO 20022 supports different services and products, making working together easier for systems and solutions. This increased interoperability can drive innovation and open up new business opportunities.

Regulatory Compliance: Many regulators and market infrastructures around the world are moving towards ISO 20022, making it a requirement for participating in those markets. Banks that do not adopt the standard may find themselves unable to do business in certain markets.

Four Practical Reasons to Adopt the ISO 20022 Standard

While the above benefits may be enough catalysts to get your bank moving in the ISO 20022 direction, we want to make it even more concrete. Here are three of the top reasons to include an ISO20022 initiative in your strategic plan for 2024.

- Your Bank Needs a Single Data Model: No doubt you have heard that “data is the new oil”? Like oil, data needs to be refined, and as any data scientist will tell you, half the battle of data analysis is cleaning the data. Most of the cleaning must occur because banks do not have a single data model. Now, banks are being handed a gift that tells every bank exactly how to name/format fields and group messaging around products and functions. Even if banks never use the ISO20022 standard to communicate with other banks, having internal systems speaking the same language is well worth the effort. Your core system should be able to talk to your fraud platform, CRM system, and data warehouse, all in the same vocabulary. The smaller your bank, the more you should want to adopt the standard. The time to build to the standard is now when you have a limited number of systems. Waiting will compound your data and communication problems in the future.

- It’s all About Payments: The future of banking will revolve around payments, and sooner or later, your bank will play a role in the payment process. The Fed, NACHA, instant payments, SWIFT, card networks, and others are all moving to ISO20022. While your current vendor may be able to translate those messages into their current proprietary format, the question is, why would you want that? You would be defeating all the benefits of the ISO 20022 movement. It will be far better to keep the ISO 20022 messages in their native format so that you can gain full efficiency and interoperability. Further, the richness of the ISO 20022 transaction message will spawn an array of new payment products for banks, such as inventory management, payment escrow, product insurance, card management, and identity.

- Collateral: Next to payments, collateral transfer will be the next most significant function in banking that will immediately be impacted by ISO 20022. Securities settlement, cash collateral, receivables, real estate, guarantees, insurance policies, and more will now be categorized and standardized. Suppose your bank is not on the ISO 20022 standard. In that case, you will not be able to take advantage of the details of a particular piece of collateral, such as if it has the subtype of the collateral, the last value date, if it has an IRS lien, the rate index of the security, the jurisdiction of the security or the hundreds of other fields that describe the quality of the collateral. ISO 20022 will almost be mandatory overtime for any bank with a mortgage, wealth, factoring, broker-dealer, or consumer lending focus.

- New Products – In addition to new payment products, a whole host of other products and product extensions will be spawned from the innovation of having a common messaging standard. Embedded finance is an example; as banks embed their treasury management services in commercial customers’ ERP and accounting systems, those systems will likely use the ISO 20022 standard in the next several years. Banks that offer banking-as-a-service or open banking will also need to be early adopters of the ISO standard.

The 5 Steps To An ISO 20022 Conversion Plan

Step one is to determine the criticality of ISO 20022 to your bank. As mentioned above, if you have business lines in critical areas such as payments, trade, collateral, or wealth, your bank will likely need to migrate to the Standard, at least in part, by 2025. If not, your bank likely has more time but movement to ISO 20022 should still be considered for internal efficiency and to future-proof the bank.

Next, take inventory of which of the bank’s partners and systems are converting to ISO 20022, when, and the precise functions that will be converted. All your core, payment, and collateral systems already have a plan, so it is vital to know their roadmap. Some vendors will tell you they will be ISO compliant, but it may not be their full functionality, so it is important to ask questions.

Then, banks need to figure out all the systems that touch these systems, such as customer information systems (CIFs), customer relationship management systems (CRMS), account opening, fraud systems, data platforms, and secondary systems of records for specialty products. The goal is to find out which systems will and will not take native ISO 20022 messages. Many systems say they are “ISO 20022 compliant,” but that might mean they ingest ISO messaging but then transfer the data to your bank in their proprietary format. Here, it is essential to ask questions and push for an option of dealing with the original ISO 20022 messaging format.

Once that is known, banks need to figure out if data translation will be needed to allow these systems to talk. Critical systems will need to be prioritized, and banks need to either push their vendor partners to adopt the standard or find vendors in the future that already have adopted the standard.

Finally, banks need to plan how they will take advantage of the ISO 20022 standard in the future, so the initiative has its own roadmap and goals for revenue and cost savings. This will likely be a five-year plan but a bank that gets ready now will have the advantage when it comes to growth and M&A. Having a common data model and leveraging the growth of data and data analytics will be a competitive factor in the future. Banks still dealing with various proprietary data formats and models will continue to struggle with siloed data and disparate systems.

The ISO 20022 standard is a significant step forward in banking and should be on every bank’s strategic initiative list. While not mandatory for banks, the benefits and the growing adoption of ISO 20022 worldwide will create a variety of new revenue streams and efficiencies that banks will want to take advantage of. Combining ISO 20022 in banking with now standardized communication languages like XML or FDX and banks will be well set up to compete in the future.