The COVID-19 Bank Playbook

When we talk about unforeseen Black Swan events, the COVID-19 virus fits the profile. It has come out of nowhere, taken lives, disrupted public health, altered our daily lives, causing financial market volatility, caused more than five standard deviations of movement in interest rates and likely to have a material impact on credit markets. This isn’t business as usual and for this uncharted territory, you might find this playbook helpful.

The Risk: Obviously, we are not epidemiologists, but we believe no one fully understands the true risk of the COVID-19 virus. At this point, it is not evident how it spreads (for example, can it spread before a person is symptomatic?), the rate of transmission, the risk of recurrence, the long-term impact on lung tissue/capacity or the actual rate of mortality. We also have no known vaccine.

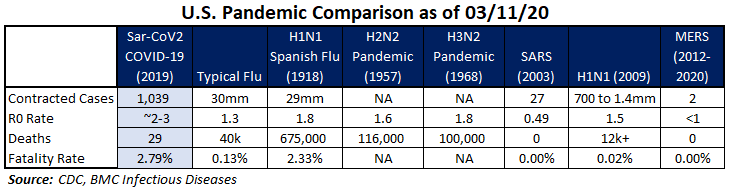

All these items are beginning to come into focus, but the fact is that COVID-19 is transmitted person to person, apparently easily, causes serious illness, and has been reported in multiple countries – this all starts to meet the definition of a pandemic. The rate of transmission is called the “R-nought” factor and the comparison is noted below. A “R0” factor of “two” means that each infected person is likely to infect two other people.

The Lancet shows the COVID-19 spreading faster than the 1918 flu. To dismiss this as “not as bad as the flu” misses the point. We have accurate information on the flu but little information about COVID-19. Because of this uncertainty, this creates a much greater risk profile. In addition, unlike the common flu, the COVID-19 is hitting a population with no past immunities all at once. This has the potential to overwhelm our resources and thereby causing an additional shock to our society and economy.

In short, we know this risk is material we just don’t know if it will abate in a couple of months or not. Thus, logic would dictate we err on the side of caution and build a layer of conservativism into your bank’s response.

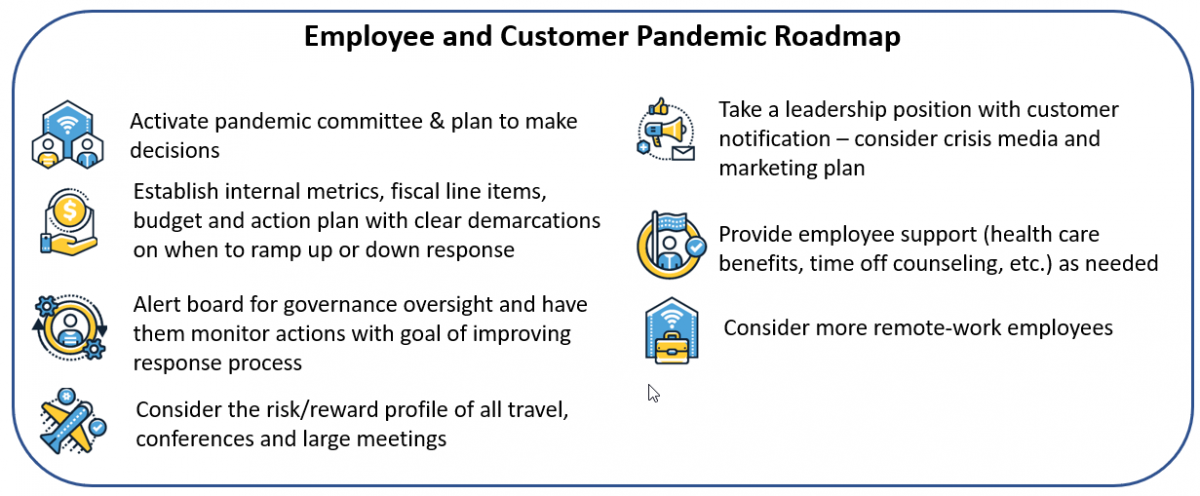

Employees: Some banks have locked down headquarters, sent segments of their employees to work at home and have instituted a travel ban. Conferences are being canceled to avoid large gatherings of people in order to limit the risk of virus transmission.

The root reason for this is that no one knows who a carrier is or the exposure sensitivity of any one person, so public or transportation likely will increase the risk of spreading the virus.

For that reason, we agree that banks may want to consider a travel restriction or at least the cancelation of all “non-essential” travel. While your employees may be all hearty and strong to handle the virus, the long-term impact of COVID-19 is unknown and equally important, unrestricted travel makes it impossible for a bank to determine which employees are caring for or coming in contact with an at-risk family member. Is that meeting or conference worth putting someone’s children or parents at risk?

Every bank also should have implemented its pandemic response, have an actively engaged committee and monitor the risk daily. To this end, you will likely want to start a fiscal controls process so that you can track expenses to assist with insurance, tax and general fiscal monitoring.

Metrics should be established to help the committee quantitatively make decisions. These may include the number of cases in the geography you serve, number of employees traveling or have traveled (and where), number of employees taking sick days, number of employees working from home, the level of cleaning supplies, availability of functioning virtual network portals and any other metric you need to monitor for risk purposes. The objective is to figure out when to ramp up or down your resource allocation and these numbers provide a quantitative basis to do that in addition to other subjective inputs.

Customers: Banks should communicate with customers, as a trusted advisor. In the last two weeks, the world has changed, and your customers likely need some assurance and acknowledgment that your bank is actively managing this risk.

Your response could be nothing more than acknowledgment and assurance or might be a customer letter from your CEO. For that matter, it might be a whole plan of communication to handle all the above and more. There is lots of bad information going around and your bank can help calm the public while providing steady advice.

Branches & mobile: Are you going to be doing any extra branch cleaning, sanitizing your banknotes, increasing your call center hours, promoting mobile/online banking and increasing volunteer hours in the community in related areas? These are all things that some banks are considering helping support their customers and communities.

Credit: Far behind the risk to your employees, customers, and community, credit is your next largest risk. It is too early to tell if COVID-19 will push us into a recession but it will degrade GDP growth. As of today, GDP growth is expected to come in slightly below 1% for 1Q and around 0.25% for 2Q. We assume that COVID-19 transmission will reduce come spring and summer similar to the common flu but the outcome is far from certain as we are unsure of any seasonality trends yet.

Credit spreads across the board have increased in the five to 10 basis point range. Certain industries have already had an economic shock and so it pays to devote more resources to credit risk monitoring and management. Credit spreads have already increased in hospitality (particularly full-service hotels tied to tourism or conventions), energy, amusement, private education, transportation, retail commercial real estate, and tourism credit. In addition, banks need to worry about small businesses that support these impacted industries. Many of these industries took a 30% drop in revenue during the last SARS outbreak and this time the baseline credit shock may be in greater than 50% of revenue.

Of course, more than those industries will be hit. The tricky part is knowing which borrowers, such as those in the manufacturing or retail sectors are at risk for supply chain disruption. If you don’t understand your borrower’s supply chain, then now is the time as many could be poised to experience a credit shock.

Banks need to identify those credit at risk and start to work with them now so that the bank can limit exposure, provide additional liquidity facilities where appropriate and/or assist their clients to get the needed resources to make it through this event. Additional stress testing is now required given the level of credit and interest rate movement.

Finally, there are the unknown unknowns. There are no doubt second derivative effects of this market shock that are impossible to see right now. Companies that have made a directional bet on credit, commodities, interest rates or are overly leveraged will run out of liquidity and be forced into bankruptcy. Banks, at a minimum, need to watch for signs of heightened stress at all companies.

You want to be the first, not the last creditor asking for collateral and new terms. The banks that fared the best during the last downturn where the ones that started to act in the 4Q of 2007. Those that waited to 2008 and 2009 had a much higher probability of failure.

Interest Rate Risk and ALCO: The Federal Reserve did an emergency cut to the Fed Funds target range by 50bp last week, about two weeks ahead of the scheduled March meeting. The market expects another 25bp, or 50bps cut this month at the next Federal Open Market Committee (FOMC) meeting, including dropping the interest on excess reserve rate (IOER). This would not move the Fed to the zero bounds threshold and the Treasury market could move into negative territory similar to Germany and the UK.

Given the severity of margin compression, bank earnings will materially underperform compared to budget.

90%+ of your current unprotected loan portfolio, both retail and commercial, now has a duration close to zero. Banks have not seen this aggressive downward rate move since 2003. Your fixed, floating and adjustable portfolio that doesn’t have a prepay penalty or yield maintenance can be refinanced. An estimated 40% of your current book could run off this year as a result. We have written extensively on how to manage this risk, but customer retention should likely be job one.

Moving customers to loan structures with prepayment penalties, resetting your deposit rates down and staying in touch with your most valuable customers to aid retention are all recommended tactics. Further, the probability of negative rates is no longer in single digits. While we don’t think it is a likely event, the probability is increasing and it is time to start thinking about your systems, marketing message, governance and strategy if you now have to pay the Federal Reserve to keep money overnight and have to pay the Treasury and Agencies a spread to invest your money. Should the 10Y Treasury move to -2% or more, banks would need to start issuing loans at 0% or below. The thought exercise is mind-numbing.

Fee Income: To offset margin compression, more capital should be considered for fee income lines. Treasury management, mortgage, insurance, wealth, credit products, payments and other lines of business should be reviewed to see if they can utilize more resources.

Lending: Once you decide and protect customers, the next move is to get offensive. Most borrowers will at least entertain the notion of saving 1% to 2% in rate so now is the time to increase marketing and sales and build your loan portfolio with customers that you want.

Putting This Into Action

The banks and customers that can adapt the fastest will be the ones that have the best chance of survival. Every bank employee and every customer are aware of COVID-19 and many will wonder how your bank will react. This is the time that makes great leaders.

We do not know how shallow or deep this downturn is going to be but the more banks think through a plan and start to execute to limit their risk, the better off the bank, employees, customers, and your community will be.

The best case, of course, is that the COVID-19 threat starts to resolve, markets return to normal and you have just gained much-needed practice in contingency planning. However, playing the ostrich or having false optimism can put lives at risk and can prevent your bank from executing its contingency plan. We are at an inflection point and while every organization’s risk profile, view, and tolerance are different, now is the time to take decisive action.

Resources:

The page we give out to customers and employees from the CDC

The tracking dashboard we use to monitor from John Hopkins.

The best overview of the Disease we have found from the University of Oxford