The Economy After Coronavirus

Community bankers are busy serving their customers and protecting their balance sheets as we respond to the Coronavirus pandemic and the resulting economic havoc. Just as prudent bankers were strategically planning for the next recession before any signs of this downturn, forward-thinking community bankers will very soon be contemplating their strategy for doing business after the current recession. We cannot pretend to know precisely how the medical development of the virus unfolds, and we cannot predict the pace of the economic recovery. Still, we can safely observe specific, powerful, proactive, and historic, fiscal, and monetary actions currently taking place. These unprecedented actions will shape the future of this country for decades and will undoubtedly affect how community banks do business and the future challenges they may face.

Reaction to Coronavirus

The unprecedented action by the Fed Reserve is not that it lowered interest rates to zero, or has stepped in with a broad array of actions (nine lending programs and multiple other techniques) to limit the economic damage from the pandemic, including up to $2.3 trillion in lending to support households, employers, financial markets, and state and local governments – with much more action to come. The central bank has not only thrown the kitchen sink but the kitchen as well, at the current problem. The real powerful and unprecedented action by the Fed is that as an institution, it has declared to be unhindered by moral hazard. Jerome Powell’s statement included the following words “We should make them [consumers and businesses] whole. They did not cause this.” The goal of making everyone “whole” has resulted in helicopter money and the coordination of efforts by the central bank and Congress.

Helicopter money was coined by Milton Friedman and described his idea of money-financed (as opposed to debt-financed) stimulus. Ben Bernanke made it clear just a few years ago that the probability of helicopter money being used in the United States in the foreseeable future was exceedingly low. Helicopter money involves financing expansionary fiscal policy by a permanent increase in the money supply. For example, Congress approves $2Tn in spending (soon to be $4Tn, or $8Tn or even $20Tn), and the Fed credits the Treasury with $2Tn in a checking account. If the Fed agrees to purchase and hold this new debt indefinitely, the end result is extremely stimulative to inflation. The increase in expected inflation can be permanent if the Fed pledges that the increase in the money supply is not temporary. Unlike debt-financed fiscal programs, helicopter money is a money-financed program and does not increase future tax burdens – but does increase future inflation. Helicopter money is the very essence of printing cash and transferring money from the Fed to the government, thereby devaluing the currency.

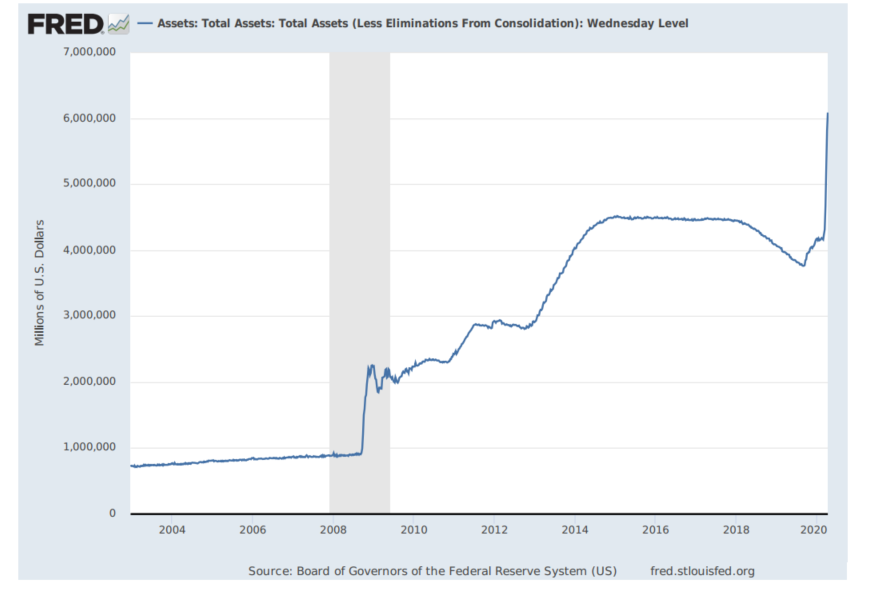

The graph below shows the Fed’s balance sheet. The line going straight up will only increase in the short term – and perhaps with no natural limit because the USD is de facto the world’s reserve currency.

The use of helicopter money may well be a secular source of inflation bias and bring about changes in individual behavior and may trigger waves of future inflation. But monetary-financed debt is crisis response, and we are now in a crisis. Eventually, the Fed will need to land the helicopter, and that is when the fiscal picture becomes frightening.

In January of 2020, the Congressional Budget Office (CBO) released its updated budget projections, showing that the national debt was on an unsustainable path. The CBO’s baseline predictions indicated that debt would reach 98 percent of GDP before 2030, with annual deficits exceeding $1Tn. However, actual deficits and debt are likely to be far higher, taking into account the dramatic economic downturn in the US as a result of the Coronavirus outbreak. When the helicopter money stops, how will Congress agree to fund additional future debt? The answer may be that the market dictates the response by forcing deep cuts to expenditures.

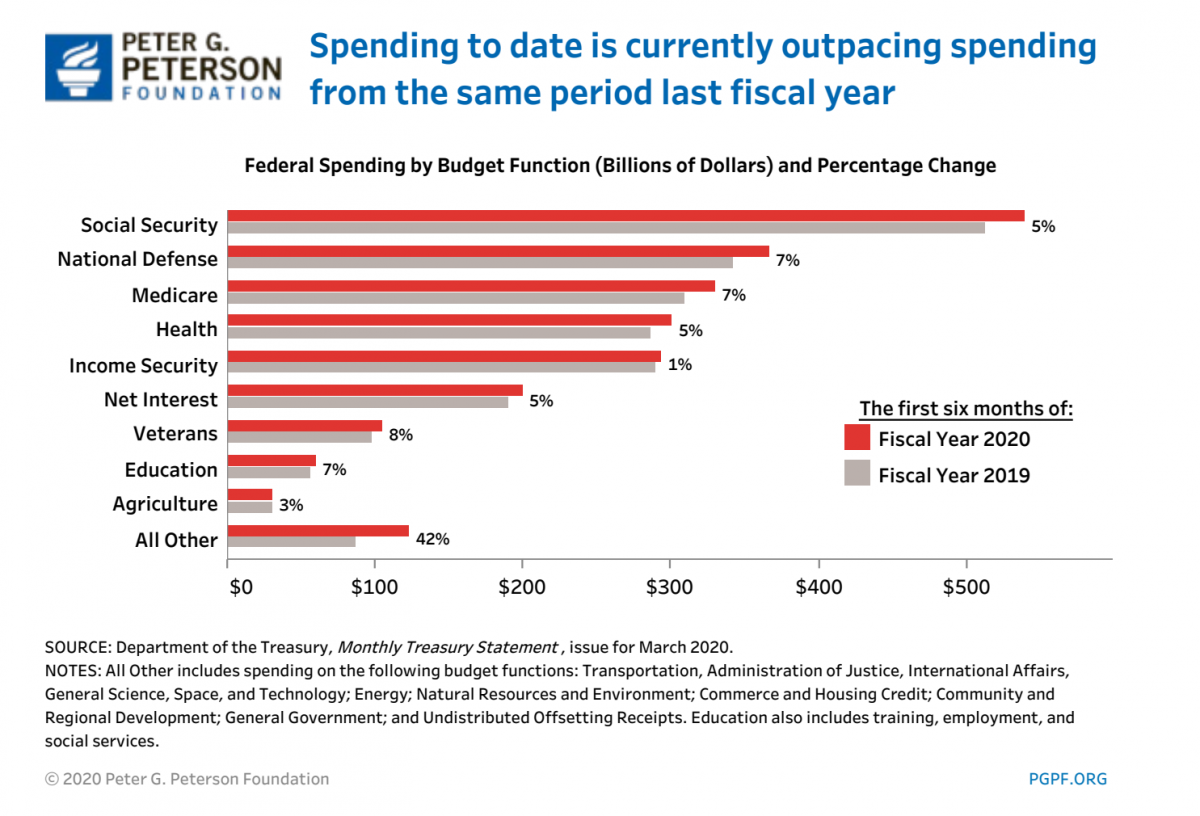

The graph below shows where federal expenditures are allocated among various programs. To bring spending in line with revenue, Congress will be forced to decrease funding for social security, healthcare, or national defense – that may be political suicide, but a mathematical necessity since all other programs do not comprise a meaningful savings opportunity.

To quote the CBO “the irresponsibility, partisanship, and brokenness in Washington has left us weaker and less prepared for a moment like this.” The Social Security trust fund is projected to quickly become insolvent without higher taxes. Medicare’s Hospital Insurance trust fund will face similar insolvency issues, in part because of the cost of coronavirus-related treatments. Therefore, we must expect across-the-board benefit cuts and higher taxes.

At some point, after the economy has fully recovered from the current crisis, the federal government will be forced to tackle the budget’s structural imbalance through a combination of tax increases and benefit changes.

Key Takeaways for Community Banks

These unprecedented times have resulted in unconventional monetary and fiscal responses. These unconventional monetary approaches, along with current fiscal imbalances that are to become much more acute, may lead to bouts of inflation, strong devaluations, balance of payment crises, and downgrade of certain industries (for example, healthcare and defense). While we correctly try to dampen the effects of this emergency with emergency tools, we set out the course for our society for long-term changes that will be difficult to reverse.